This Week:

- Government Destroys National Central Banks to Build Global One

- 10 Steps to Help You Navigate the Challenges Upon Us

- A Reset is Coming

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

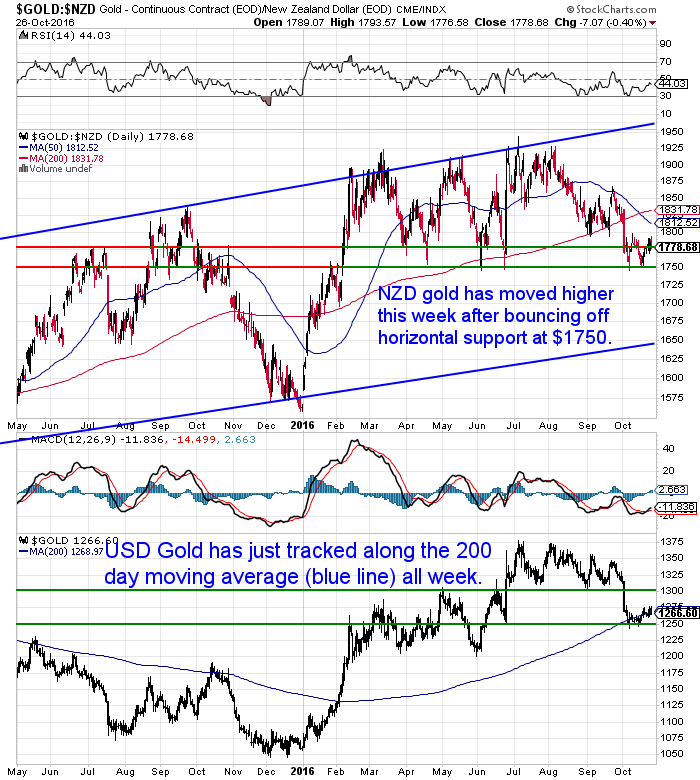

| NZD Gold | $1773.83 | + $15.00 | + 0.85% |

| USD Gold | $1267.05 | – $3.00 | – 0.23% |

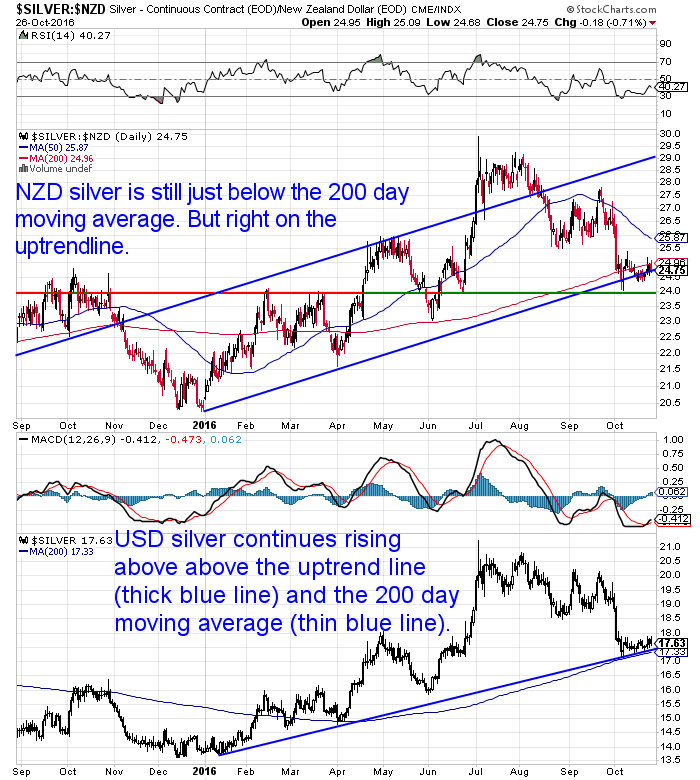

| NZD Silver | $24.73 | + $0.22 | + 0.89% |

| USD Silver | $17.66 | – $0.04 | – 0.22% |

| NZD/USD | 0.7143 | – 0.0078 | – 1.08% |

| Looking to sell your gold and silver?Visit this page for more information | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1704 |

| Buying Back 1kg NZ Silver 999 Purity | $754 |

The New Zealand dollar weakened this week by just over 1% and so that gave local gold and silver prices a boost. The kiwi dollar didn’t manage to get above the 50 day moving average and so drifted lower over the week.

Gold in NZ dollars has edged higher this week after again bouncing off the $1750 horizontal support line. So there certainly seems to be strong support at this level. But unlike the USD gold price, the NZ dollar price remains well under the 200 day moving average (MA). The 50 day MA has also recently dipped below the 200 day MA. So we’d like to see this cross back above the 200 day MA before too long.

While the price remains below the 200 day MA there remains the possibility of further downside and a return to test the lower rising trendline around $1650.

Meanwhile silver has already dropped right back down to the rising trendline. It is sitting just below the 200 day MA which it has been tracking just beneath for most of October.

There has been a marked pull back in the bullishness of traders in the gold and silver futures markets. Steffen Grosshauser reported this week that:

- “Speculative traders in Comex gold futures and options meantime cut their bullish bets, net of bearish bets as a group, to the lowest size since March last week according to data released by regulator the CFTC late Friday.

- The ‘Managed Money’ category cut its net bullish position for the third time running in the week-ending last Tuesday, reducing it to the equivalent of 426 tonnes.

- ‘Managed Money’ accounts ended 2015 with net bearish bets overall, equivalent to 75 tonnes’ worth of derivatives contracts, as prices hit new 6-year lows at $1045 per ounce.

- Their ‘net spec long’ position then hit a record high at 892 tonnes in July, just as gold prices peaked at $1375 per ounce following the UK’s Brexit referendum shock.

- Comex silver speculators meantime cut their betting to April levels, but the giant iShares Silver ETF (NYSEArca:SLV) needed near-record quantities of bullion backing, totalling some 11,395 tonnes.”

- Source.

So given the track record of the “Managed Money” category, this fall in bullishness is a positive for gold and silver. They are usually wrong in their extremes.

But perhaps it still needs to come back a bit further yet before gold and silver can run higher.

Last week we commented on how we had observed a higher incidence of more mainstream reporting on the dangers of central banks.

While at first glance this criticism of central banking may seem like a positive, we should perhaps still be very wary. As the Daily Bell noted this week, this may in fact be part of a larger theme at play.

-

Government Destroys National Central Banks to Build Global One

- “The idea of nationalizing banks is probably part of a continued strategy to destroy local and regional central banks in favor of one that is worldwide.

- …Elite goals have not changed. Centralization of pretty much everything is a longstanding goal. Contrast today’s central banking to yesterday’s and you will see how much the dialogue has changed.

- The mainstream media is critical of central banking in ways it has not been before. And now the political process is changing as well.

- This is surely directed history at work. If we follow these observations to their logical conclusion, we arrive at the observation that central banks will continue to be undermined by those at the very top who likely do not reveal their plans to the “rank and file.”

- What is likely is a major event that will reduce central banks around the world to a kind of economic and political rubble. Then perhaps the International Monetary Fund or some other international organization will step in to offer a single (SDR) currency and perhaps global central bank functions as well.

- In the meantime, central banks will continue to receive considerable criticism – now augmented by political warnings.

- Central bankers and the plethora of economic and sociopolitical interests surrounding them are likely not aware of the fate of local and regional central banks. They may believe they are engaged in an ongoing dialogue about how to make central banks “better” and more efficient.

- Conclusion: But the ultimate plan is to ensure these banks are either extinguished or operate formally under the control of a single entity. And they must be discredited, if not destroyed in order for this to happen.”

- Source.

The Daily Bell expanded on this topic while commenting on the impact of Trump in the US elections and how he has split the Republican party. If the powers that be are indeed aiming for a further centralisation of power than even exists currently, there is at least still some hope…

- “The USA contains a culture of republicanism and freedom even today. But the power resides elsewhere, mostly in London’s City. The goal of the City’s bankers generally is to create a single government ruling over putative, but ineffective states and regions worldwide. There won’t be much difference between these regional and local entities.

- This metamorphosis is ongoing. Look around the world. Almost all countries have a graduated income tax and many supposedly are “democracies” and have “elections.” Most seem to have market systems at local levels, though control of money and industrial power resides at the top.

- Almost all countries have monopoly central banks, either “independent” or government run. The US is similarly organized. The world is not that far away from homogenization.

- But in the meantime, in the 21st century, the candidacies of first Ron Paul and now Donald Trump have offered people a big distinction between what the US has become and the rhetorical portrait of what it is … supposedly.

- The Internet has allowed these candidates and others to spread an alternative viewpoint of how the US is organized and how it ought to be run. Much of this alternative vision is oriented around more vibrant free markets, entrepreneurship and freedom itself.

- ….Our thought, …is that changes embodied by [Ron] Paul and Trump extend far beyond the men themselves. They will persist and expand much as similar changes did after the advent of the Gutenberg Press. The kind of consolidation that elites currently seek was tried in Sumer, Babylon and Rome. It didn’t work in Venice, either, and it won’t work today.

- Conclusion: The more pressure put on people, the more they will investigate history and explore alternatives. Yin inevitably is confronted by Yang and the world turns. Of course … too bad for you, if you have to live through it. Take steps to prepare. Explore the world for yourself and trust your own eyes, not the vision of anyone else, not, even Donald Trump.

- Source.

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

We’ve been reading a bit of Catherine Austin Fitts work this part week. She has many wise words to share as those of us lucky enough to hear her speak here in Auckland last year could attest.

Here’s a short note from her for anyone that feels “out of sorts – that your perceptions of the world are out of step given what you are seeing and hearing in the media and the polls – have no fear. You are not out of step. What you are observing is complete fiction.”

- I have never seen the entrainment, subliminal programming and lies this invasive and this thick. While the digital systems may be designed to seduce you into insanity, you have the power to turn most of them off.

- Believe your own eyes, ears and instincts. You are sane. That is the source of unending irritation to the folks trying to get you to obey and consume. Ain’t nothing they can do about it but ramp the volume higher until it fails completely.”

- Source.

10 Steps to Help You Navigate the Challenges Upon Us

So what can I do about it?

You might be wondering what you can do to improve your life given the forces at work in the world today. The answer would seem to be, “Quite a lot!”

This blog post from Catherine should give you plenty of ideas

10 Steps to Help You Navigate the Challenges Upon Us

We’d especially recommend checking out Coming Clean. A process for improving your energy in 23 areas of your life.

And if you think “I’m only one person, what difference can I make?”, then be sure to read Appendix A. But . . . I’m Only One Person!

There’s a wealth of ideas in there to consider. Maybe just try 1 a week? It could have a big impact on your family’s life down the track.

A Reset is Coming

If you checked out our presentation 2 weeks ago, Gold & Silver: Wealth Insurance with Upside, you’ll recall we outlined how historically the growth in monetary supply has been balanced out by the value of global gold holdings.

Or put another way the gold price rises to balance out the amount of currency that is created. At the end of the 1970’s we could have actually gone back onto a gold standard due to the rise in the price of gold throughout the decade.

This methodology is the same one that Jim Rickards (and others) uses to arrive at his $10,000 gold forecast.

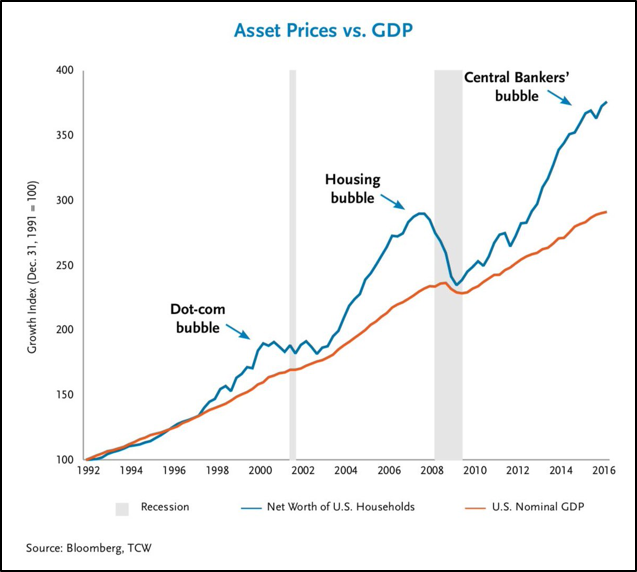

This week we stumbled across a chart that also shows how out of whack we are currently. But how historically the net worth of US citizens eventually comes back into balance with US GDP.

It was from the interesting Ben Hunt of Salient Partners who writes Episilon Theory:

- “…a reset — both in markets and in politics — is coming whether we like it or not. We can either prepare for the reset … we can shape the reset as best we can … or we can let the reset shape us.

- Here’s the most impactful chart I know. It can’t be fudged. It’s a measure of US household net worth over time, compared to US nominal GDP. Is it possible for the growth of household wealth to outstrip the growth of our entire economy? In short bursts or to a limited extent, sure. But it can’t diverge by a lot and for a long time. We can’t be a lot richer than our economy can grow.

- But that’s exactly what’s happened. Again. Like the Housing Bubble of 2004–2007, we’ve gotten a lot richer than our economy has grown. But unlike the Housing Bubble, the riches of this latest bubble haven’t been as widely distributed. This latest bubble blown by our central bankers has been in the form of a stock market triple and bond prices at record highs, it’s been almost entirely in the form of financial assets, not real assets like houses. In 2007, everyone who owned a house was rich. That’s a lot of people. In 2016, the rich are the people who owned stocks and bonds in 2009. That’s a lot fewer people. If you don’t see the pernicious impact on our politics from this distributional difference in the bubbles, you’re just not paying attention.”

- Source.

Here in New Zealand it seems we have a housing bubble still being blown ever larger. But we have our doubts whether this means “everyone who owns a house is rich”. Perhaps they might feel richer at least we guess?

But a reset of some kind seem inevitable. Be sure to have some financial insurance in place well before the reset comes.

Get in touch if you have any questions about the buying process. David is happy to answer them.

** Urgent Message for All Car Owners **A compact, revolutionary tool can save your life.

We believe everyone who drives or rides in a vehicle must carry this tool.

The Keychain Car Escape Tool can save lives.

The Keychain Car Escape Tool can save lives.

For less than the price of 2 movie tickets you can get 2 of these.

One for each car in your family or give one to someone you care about.

—–

This Weeks Articles:

The Elimination of ReasonWed, 26 Oct 2016 2:43 PM NZST  If you have children in any levels of education, then this article is worth taking into consideration in deciding how you can ensure they retain the ability of critical reasoning… The Elimination of Reason By Jeff Thomas Recently, I paid for an item with the exact amount requested, including 89 cents in change. The salesgirl […] If you have children in any levels of education, then this article is worth taking into consideration in deciding how you can ensure they retain the ability of critical reasoning… The Elimination of Reason By Jeff Thomas Recently, I paid for an item with the exact amount requested, including 89 cents in change. The salesgirl […]

|

Gold And Central Bank ConfidenceWed, 26 Oct 2016 2:23 PM NZST  See why Stewart Thomson thinks regardless of whether Clinton or Trump wins the US election, the outcome will be a positive one for gold… Graceland Updates By Stewart Thomson The US election is now only about two weeks away. The winner of this election is likely to be… gold. Here’s why: Both candidates are eager […] See why Stewart Thomson thinks regardless of whether Clinton or Trump wins the US election, the outcome will be a positive one for gold… Graceland Updates By Stewart Thomson The US election is now only about two weeks away. The winner of this election is likely to be… gold. Here’s why: Both candidates are eager […]

|

The Father of the Euro: The Currency “Will Collapse”Wed, 26 Oct 2016 1:59 PM NZST  Following the Brexit leave vote we published a number of articles that supported the notion that it might not actually be so bad for Britain. And that it could well be just the first step in the end of the EU. Of course these were definitely not mainstream opinions. But this week we’ve seen the […] Following the Brexit leave vote we published a number of articles that supported the notion that it might not actually be so bad for Britain. And that it could well be just the first step in the end of the EU. Of course these were definitely not mainstream opinions. But this week we’ve seen the […]

|

The Last Time This Happened, Gold Tripled…Here’s How to ProfitWed, 26 Oct 2016 1:35 PM NZST  If you’ve read Ronald Stoerferle’s In Gold We Trust report you’ll know they believe the most likely outcome is that of stagflation (see the report here: In Gold We Trust 2016). The following takes a similar position and outlines why we could well see something of a repeat of the 1970’s… Weekend Edition: The Last Time […] If you’ve read Ronald Stoerferle’s In Gold We Trust report you’ll know they believe the most likely outcome is that of stagflation (see the report here: In Gold We Trust 2016). The following takes a similar position and outlines why we could well see something of a repeat of the 1970’s… Weekend Edition: The Last Time […]

|

Gold Price Forecast 2016/2017 – Gold Bull Market Still Intact, But…Thu, 20 Oct 2016 7:05 PM NZST  This Week: Gold Price Forecast 2016/2017: Gold Bull Market Still Intact, But… Why This Gold Correction is Normal Dangers of Central Banks Going Mainstream? Former Goldman Insider Says Price of Gold Could Double Janet, Government, And The Woodshed Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1758.83 […] This Week: Gold Price Forecast 2016/2017: Gold Bull Market Still Intact, But… Why This Gold Correction is Normal Dangers of Central Banks Going Mainstream? Former Goldman Insider Says Price of Gold Could Double Janet, Government, And The Woodshed Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1758.83 […]

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2016 Gold Survival Guide. All Rights Reserved. |