Gold Survival Gold Article Updates:

Jan. 30, 2014

This Week:

- Bad News (is Finally) Good News For Gold

- Money Still Record Cheap Here in NZ

- Lessons (And a First Hand Report) From Japan

- US Debt Ceiling – Forgotten But Not Gone

Bad News (is Finally) Good News For Gold

This morning we’ve seen announcements from both the US central bank as well as our own here at home.

Across the pacific the Bernank was heading his final FOMC meeting, where they all agreed another $10 billion reduction in money printing was warranted. Not a huge surprise perhaps but the reaction to it probably was. Even though the Taper 2.0 was expected US share prices fell. But the bigger surprise to most was probably that the gold price rose immediately after the announcement after making a higher low. On top of this most mining shares were up around 2%, while the DOW was down 1.19%.

So gold and its miners rising on what has, for the past 6 months (the taper), been seen as gold negative news is a positive to us. We have seen a stealth rise thus far in 2014. We reckon we might see that continue without too much fuss and fanfare. Big Bank analysts are almost universally bearish on gold still, with most predicting the price to fall further in 2014. So if the price continues to tick steadily higher without being noticed by too many that will bode well for the long run.

We doubt it will be so simple for the Fed to just keep reducing $10 billion every month for the rest of the year as is expected. But they undoubtedly have ways to keep the pumps flowing while saying they are reducing. This interesting article we came across reckons the fed actually bought $94 billion last year not $85 billion they said they did. So therefore the first taper would only get them back to the level they were meant to be at for 2013.

Money Still Record Cheap Here in NZ

Meanwhile here at home, down in Wellington, The Reserve Bank of New Zealand (RBNZ) this morning left interest rates at record lows, surprising quite a few economists. Although most expect them to raise rates in March now.

The end of the RBNZ statement read:

—–

“While headline inflation has been moderate, inflationary pressures are expected to increase over the next two years. In this environment, there is a need to return interest rates to more-normal levels. The Bank expects to start this adjustment soon.

The Bank remains committed to increasing the OCR as needed to keep future average inflation near the 2 percent target mid-point. The scale and speed of the rise in the OCR will depend on future economic indicators.”

—–

We also doubt it will be as obvious as just a series of steady raising of interest rates here in NZ. Odds are there will be a hiccup in the next couple of years – most likely one offshore to impact us here like the last one in 2008. So maybe we could see rates rise in the short term before being cut again before too long.

The New Zealand dollar fell almost a cent after the RBNZ rate hold announcement to just under 0.82. Perhaps showing that much of the good news is priced into the NZ economy already as we noted last week in NZ “Rock Star” Economy Already Priced into NZD?

So the local gold price got a double shot today with a stronger US gold price and a weaker kiwi dollar. So it’s up $51.55 per ounce or 3.44% since last Wednesday to $1548.

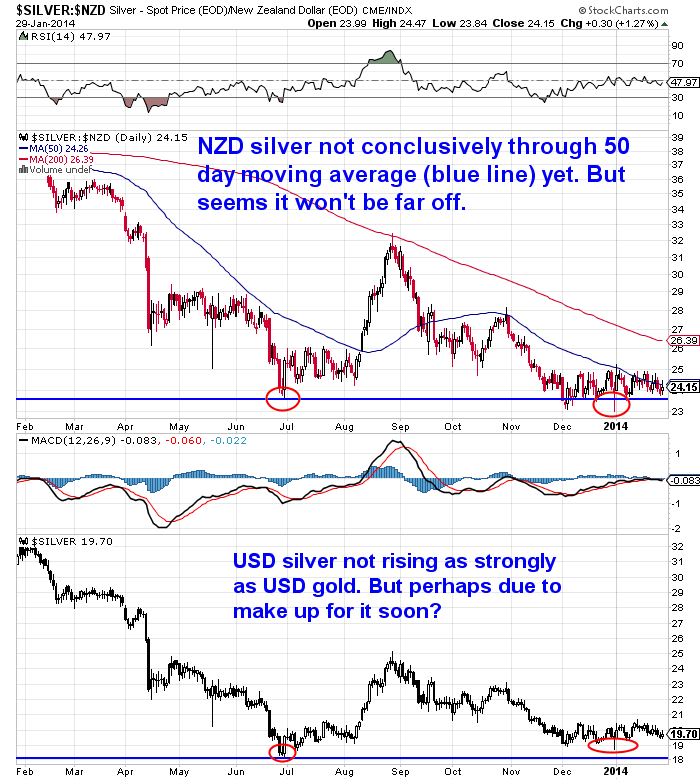

As you can see in the chart below, it is solidly above the 50 day moving average as we guessed it might last week.

Silver has been more sedate rising 17 cents or 0.71% to $24.15 since last week. While it is not up much, with 50 day moving average flattening out we reckon it might not be long before it is once again above that important technical indicator.

More on Rising NZ Private Debt

A couple of weeks back we posted a chart from the RBNZ website that showed how private debt levels in New Zealand were heading back to where they were in 2008/09. The latest numbers out on credit card debt back this up.

—–

Credit card debt hits record high

“Figures put out by the Reserve Bank last week showed total credit card balances shot up to just under $6 billion last month – a record high for New Zealand.

Shamubeel Eaqub, principle economist at NZIER, said some of the rise could be attributed to an increasing population but what was of more concern was how much of the borrowing was interest-bearing debt.

Of $5.46 billion credit card debt held on personal cards in November, 66.9 per cent was being charged interest at an average of 17.6 per cent. That was up from 65.9 per cent in November 2012.”

—–

So not only are we as a nation cranking up the mortgages again, but we are also throwing more of our everyday expenses onto credit cards and then just under 70% of those doing this pay interest averaging 17.6%! Sheesh. How/why do people do it? This debt build up almost certainly won’t end well.

Lessons (And a First Hand Report) From Japan

Speaking of not ending well. Japan is an example of this. Their asset price bubble has slowly deflated for the past 2 decades. And while deflation has been the word du jour over that time, the Japanese have continued to accumulate gold but more aggressively of late according to a story on Bloomberg last week.

Gold sales by Japan’s leading bullion dealer Tanaka exceeded their purchases back from the public for the first time since 2004, surging 63% in fact on the previous year.

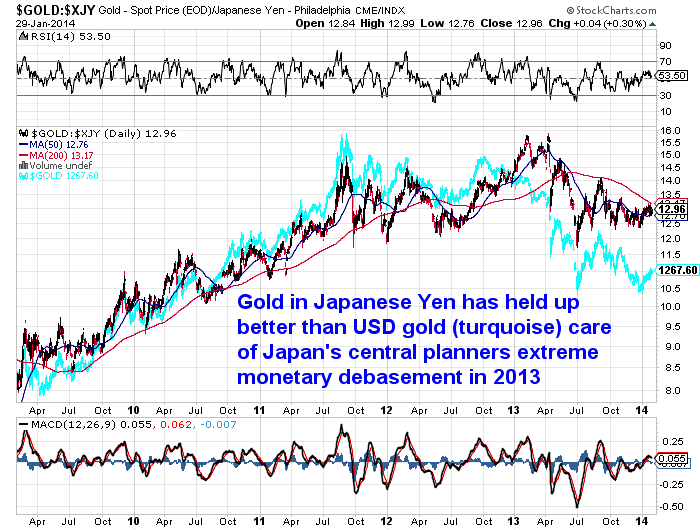

Even with the gold price taking a tumble last year, it seems “Abenomics” has meant more Japanese trying to take shelter from Prime Minister Abe’s massive money printing plan. And it seems they are on the right track as the Yen weakened so much last year that the price of gold in Japan held up rather well compared to most other countries as can be seen in the chart below showing gold in Yen versus US dollars (turquoise line).

An acquaintance of ours who owns a restaurant in Japan gave us his “boots on the ground” perspective this week:

——-

“Yes, there is always a constant stream of people buying and selling [from Tanaka Bullion Dealers]. Up until a year or so ago I could buy gold and silver anonymously, now you have to show proof of identity, name, address etc. And yes, the local price has held up quite well.

I think Abenomics is just a catch phrase for most Japanese, they don’t realise the implications and even if they do there is not much they can do about it.

From my perspective I have no savings in yen hardly at all, I continually buy gold and silver, it makes no sense for me to save in a ZIRP environment on top of monetary debasement.

As a small business owner I feel the effects of the govt. policies, for example it is mandatory for me to contribute [sic] my staffs national pension and social security plan. When I complained that I couldn’t afford it they told me to raise my prices! To think that money will go to buying more govt. debt makes my blood boil!

They want inflation so bad but don’t realise they will destroy business doing it! They have called for small business owners to raise salaries! Since the big boys earnings have gone down they are actively harassing small businesses and particularly foreigners for taxes. They track any money sent overseas for higher yields and then tax you on any profits as well as the usual penalties.

On the ground the average joe sees no noticeable difference I believe, my restaurant business is doing fine although I’m on the bottom end of the scale but most places seem busy. I think it will take quite a big shock to make any difference.

I’m a big fan of Martin Armstrong and can see what he’s talking about when he says govt. will come after you with everything they’ve got and how deflationary that is even though they’re trying to create inflation.”

—–

We thanked him for letting us use his comments and said “Thanks for the detailed response. It might give us a glimpse as to where most western nations are heading perhaps?”

He replied:

—–

“I think that’s where we’re all heading but the Japanese are a lot more docile than most other populations. They have just announced the biggest trade deficit ever but that doesn’t mean anything to the guy in the street…yet.”

—–

So maybe we will all be turning Japanese? Watch out for the government here and in most places to be looking to extract more from the average guy in the street. Eventually we’ll also have to collect ID etc when selling gold and silver here as well. That is on the cards under Anti Money Laundering laws being implemented in stages here in NZ. But from what we know will still be a couple of years away. But consider yourself warned.

This Weeks Articles:

This weeks articles have a definite focus on gold shares. WIth the first 2 both specifically on this topic.

This weeks articles have a definite focus on gold shares. WIth the first 2 both specifically on this topic.

Two Gold Stocks You’ll Wish You Owned in 2013… and Should Still Buy Now

This next one at the end gives a chance to watch an upcoming webcast featuring a whole bunch of well known names.

This next one at the end gives a chance to watch an upcoming webcast featuring a whole bunch of well known names.

Doug Casey: “Gold Stocks Are About to Create a Whole New Class of Millionaires”

Even if you don’t get time to read the article then at least consider signing up for the live event.

We know patience is one of the hardest traits to come by as an investor, so one of the most frequently asked questions is, “But WHEN will the gold market rise again?”

Doug Casey and his good friend, Rick Rule—two of the smartest people in the natural resource sector—think they have the answer. They are now convinced that a turnaround in the beaten-down gold sector may be imminent.

The signs of an upturn are unmistakable, they say. And now you’re invited to join them for their free video event, “Upturn Millionaires,” on February 5, at 2 PM Eastern, to find out what you need to do NOW to profit from the turning tides in the gold market.

Watch and get the answers to questions like…

* What ARE those distinct signs of an imminent upturn, and how do I know it has started?

* What exactly should I do NOW to take full advantage of this fortune-making opportunity?

* When do you think the actual MANIA PHASE in gold will set in, and how do I recognize it?

* And much more

Register today to watch the all-star cast—including Doug, Rick, self-made billionaire and mining magnate Frank Giustra, New York Times best-selling author John Mauldin, and Porter Stansberry, founder of one the top investment research firms in the US—make the case for the turnaround.

Click here to save your seat now. (Even if you can’t make it on February 5, if you sign up, you’ll be able to watch a recording later.)

Once the mining sector turns around, say the Casey folks, there’s a good chance that it could go vertical… so don’t miss this once-in-a-generation opportunity to get in on the ground floor.

We also have another article from our favourite billionaire – Mexico’s Hugo Salinas Price. A somewhat philosophical read, but we check his website regularly for whatever he has written.

We also have another article from our favourite billionaire – Mexico’s Hugo Salinas Price. A somewhat philosophical read, but we check his website regularly for whatever he has written.

Hugo Salinas Price: When Reality Overthrows Imagination

Then finally we have this piece from Grant WIlliams. In our newsletter last week we discussed the goings on with the London gold “Fix”, with the German financial regulator looking into it at the same time as Deutsche Bank announced it would be resigning it’s seat on the Fix. If you find these activities even slightly interesting then you’ll love the parallels drawn between them and what occurred in the late 90′s in this Grant Williams piece from last week. As usual he manages to draw a number of seemingly disparate points together to reach an interesting conclusion…

Then finally we have this piece from Grant WIlliams. In our newsletter last week we discussed the goings on with the London gold “Fix”, with the German financial regulator looking into it at the same time as Deutsche Bank announced it would be resigning it’s seat on the Fix. If you find these activities even slightly interesting then you’ll love the parallels drawn between them and what occurred in the late 90′s in this Grant Williams piece from last week. As usual he manages to draw a number of seemingly disparate points together to reach an interesting conclusion…

Things That Make You Go Hmmm: That Was The Weak That Worked: Part 3

US Debt Ceiling – Forgotten But Not Gone

We have seen little mention of the US debt ceiling lately. Recall the US Poli’s agreed to fob it off for a couple months towards the end of last year. But they will be running out of borrowing room again by late February according to this report.

—–

Lew Warns Congress of Late-February Debt Deadline

“Treasury Secretary Jacob Lew has told Congress that by late February he will run out of steps he can take to avoid a first-ever default on U.S. debt.

In a letter to congressional leaders Wednesday, Lew said he thinks he will exhaust the bookkeeping maneuvers he can make to avoid breaching the federal borrowing limit sooner than previously thought. He had estimated in December that he could avoid a default until late February or early March.

Under an agreement that ended the partial government shutdown in October, Congress suspended the debt limit until Feb. 7. After that, Lew would start using the bookkeeping maneuvers.

He urged Congress to raise the limit before Feb. 7.”

—–

So on top of the ongoing worry for financial markets of the Fed Taper this could be another catalyst for some bumpier times ahead. And maybe some more fuel to keep gold quietly moving higher? If you’d like to get some (perhaps ahead of further price rises) then get in touch:

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| NZ “Rock Star” Economy Already Priced into NZD? |

2014-01-22 05:36:15-05Gold Survival Gold Article Updates: Jan 21, 2014 This week: More Positives from Gold and Silver Miners Big gold news this week – all about Germany NZ “Rock Star” Economy Already Priced into NZD? We’re a day early today as we thought we might struggle to get this email out tomorrow due to […] 2014-01-22 05:36:15-05Gold Survival Gold Article Updates: Jan 21, 2014 This week: More Positives from Gold and Silver Miners Big gold news this week – all about Germany NZ “Rock Star” Economy Already Priced into NZD? We’re a day early today as we thought we might struggle to get this email out tomorrow due to […]

|

| Two Gold Stocks You’ll Wish You Owned in 2013… and Should Still Buy Now |

2014-01-26 21:56:40-05It’s fair to say this is a sales piece and being straight up it doesn’t actually name the 2 stocks. However it does show that even in a year when gold took a beating and gold mining shares took an absolute pounding, it was still possible to find the odd winner in the sector… Two […] 2014-01-26 21:56:40-05It’s fair to say this is a sales piece and being straight up it doesn’t actually name the 2 stocks. However it does show that even in a year when gold took a beating and gold mining shares took an absolute pounding, it was still possible to find the odd winner in the sector… Two […]

|

| Doug Casey: “Gold Stocks Are About to Create a Whole New Class of Millionaires” |

2014-01-27 19:31:20-05A couple of weeks ago we mentioned in our weekly email (and showed via a chart) how gold and silver mining shares seemed to be leading the prices of gold and silver themselves higher. Since then mining shares have continued to move higher and so has the gold price. To follow are a few comments that […] 2014-01-27 19:31:20-05A couple of weeks ago we mentioned in our weekly email (and showed via a chart) how gold and silver mining shares seemed to be leading the prices of gold and silver themselves higher. Since then mining shares have continued to move higher and so has the gold price. To follow are a few comments that […]

|

| Hugo Salinas Price: When Reality Overthrows Imagination |

2014-01-28 00:44:08-05Here’s the latest – and somewhat philosophical – piece from our favourite billionaire, Mexico’s Hugo Salinas Price. Being somewhat “old school” he is not a big fan of Bitcoin, but while the title might make it sound like Bitcoin is his main focus, he only really makes passing comment on that topic. Rather he gives an interesting […] 2014-01-28 00:44:08-05Here’s the latest – and somewhat philosophical – piece from our favourite billionaire, Mexico’s Hugo Salinas Price. Being somewhat “old school” he is not a big fan of Bitcoin, but while the title might make it sound like Bitcoin is his main focus, he only really makes passing comment on that topic. Rather he gives an interesting […]

|

| Things That Make You Go Hmmm: That Was The Weak That Worked: Part 3 |

2014-01-28 16:09:31-05In our newsletter last week we discussed the goings on with the London gold “Fix”, with the German financial regulator looking into it at the same time as Deutsche Bank announced it would be resigning it’s seat on the Fix. If you find these activities even slightly interesting then you’ll love the parallels drawn between them and […] 2014-01-28 16:09:31-05In our newsletter last week we discussed the goings on with the London gold “Fix”, with the German financial regulator looking into it at the same time as Deutsche Bank announced it would be resigning it’s seat on the Fix. If you find these activities even slightly interesting then you’ll love the parallels drawn between them and […]

|

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1548 / oz | US $1267.19 / oz |

| Spot Silver | |

| NZ $24.15/ ozNZ $776.50/ kg | US $19.77/ ozUS $635.64/ kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

(price is per kilo for orders of 1-4 kgs)

$844.66

(price is per kilo only for orders of 5 kgs or more)

(Fully insured and delivered)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

Copyright © 2011 Gold Survival Guide. All Rights Reserved.

Pingback: Why Has the Gold Price Been Falling? | Gold Prices | Gold Investing Guide

Pingback: Why is Silver Lagging Gold? -