Gold is still a long way from the highs it reached back in 2011 of almost US$1900 per ounce.

So there are not too many people outside the gold community that think now is a good time to be buying.

But counterintuitively this probably makes it exactly the time to buy!

Here’s 7 reasons to buy gold today.

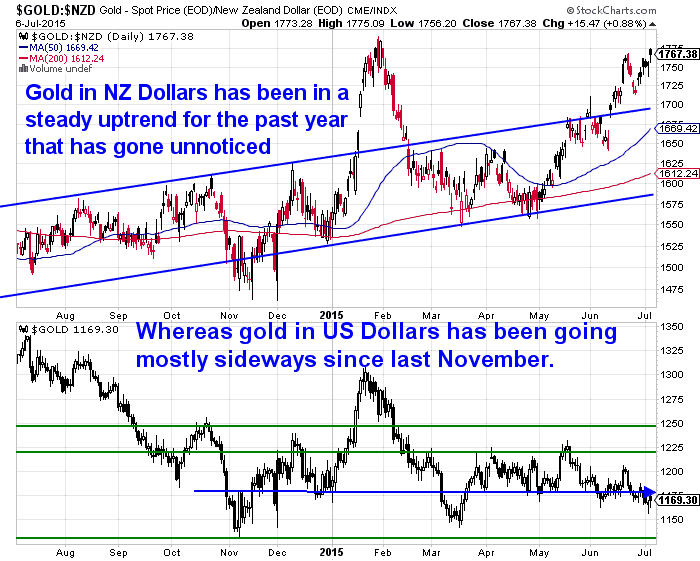

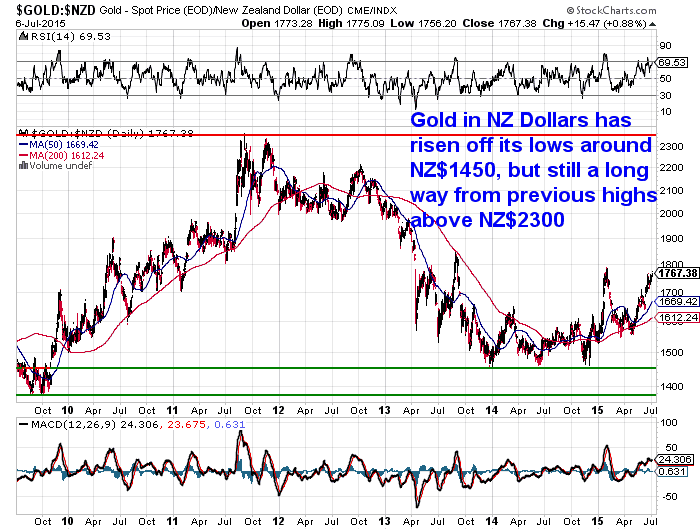

1. Gold Priced in New Zealand Dollars is in an Uptrend

We mentioned that the price of gold in US dollars is still a long way from it’s high of 2011. However with the New Zealand Dollar weakening over the past year, gold priced in NZ Dollars has been quietly trending higher without really being noticed. So it’s likely a good time to buy when in a gently rising uptrend off previous lows.

2. Downside Risk is Low – Upside is High

The downside risk buying now is low.

According to SBCGold…

“It is possible that gold prices could drop close to [US]$1,000, but it is more likely that over the long-run, gold could sell for [US]$2,000 or more. In China and India, demand for gold is on the upswing. We are not mining too much new gold. Central banks have shown increased gold buying lately, which increased demand in the marketplace and is also an indicator of its value.

Don’t buy gold because you are afraid that the price is going to go up and you’ll miss out on the gains (unless you are a short-term investor and are familiar with short trades). In general, you will want to buy gold because you believe the long-term trend is up and you want to have some exposure and protection in your portfolio.”

When buying gold in New Zealand dollars the downside is slightly higher but there is still plenty of upside left. Plus if you manage to buy closer to the NZ$1650 area, it would be an even lower risk entry point.

If you’re looking at buying gold and you’d like to be kept informed of the daily movements in the gold price, then sign up for our daily price alert. Learn More.

3. Get it While You Still Can!

Bloomberg reports how gold sales have ceased in Greece. So even if you had the cash, they’re not selling any…

“Investors are searching for a safe haven after Greece imposed capital controls, closed banks and stopped selling gold coins to the public until at least July 6.”

This emphasises how it’s better to be a year or two early than a day too late. Gold is financial insurance and the time to buy is when things seem pretty rosy, not after it’s all turned to custard.

Before You Buy Gold or Silver You Need to Read This…

“19 Nuggets of Knowledge on Buying Gold in New Zealand”

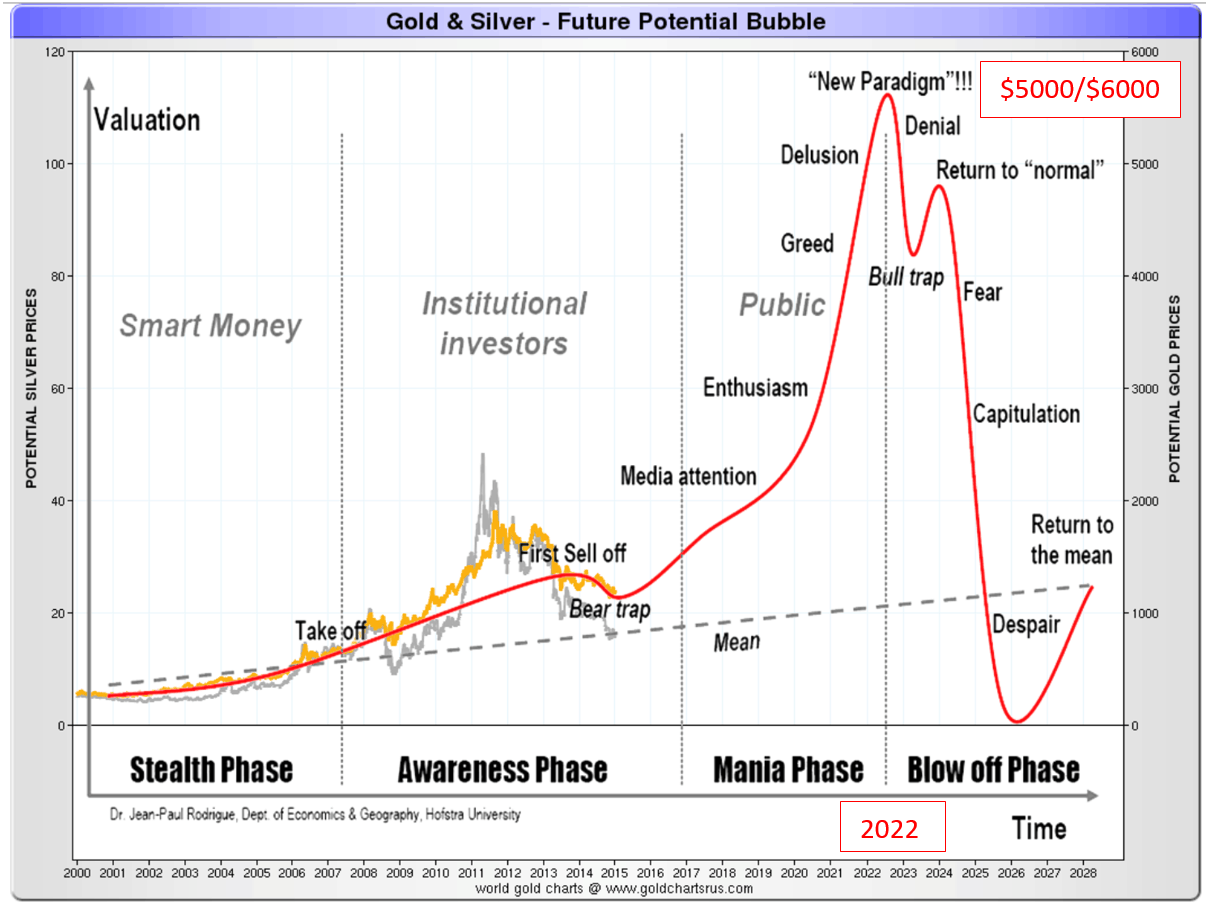

4. The Mania Phase is Still to Come

Dan Popescu believes the mania or bubble phase is still to come for gold:

“I still believe the most probable path is that the next bubble phase of this major secular bull market in gold and silver would begin in 2015 to 2017 and would end at the latest by 2022. Those dates are approximations with a big margin of error. I don’t expect a progressive move but a quantum leap with at least $500/day moves, as we have seen in the ‘70s when gold moved from $100 to $850. We have been, in my opinion, in a bear trap similar to the one shown in the graph below. The main cause of this mania phase is the collapse of the present dollar-based international monetary system, which will end also the present currency wars with a reset.”

5. The Makings of a Massive Global Meltdown Are Still in Place

Jim Rickards believes the global financial system is in an even more precarious state than it was in 2007:

“Both [Greece and China] have the potential to ignite a global systemic meltdown. The world is even more fragile than it was in 2007. The big banks are bigger. Aggregate bank assets are concentrated in fewer hands. The bank derivatives books are much larger. Market liquidity is worse…

The makings of a massive global meltdown are still in place. The official warnings are correct. The crack-up will not come from the things we can see – like Chinese stock bubbles, and Greek debt defaults — but from something none of us has factored in.

That’s the essence of complex systems. They are characterized by “emergent properties.” That means system behavior that cannot be inferred from perfect knowledge of all the parts of the system. The event that causes the crack-up will come like a thief in the night. Yet it will come.

A healthy allocation to hard assets such as gold, silver, land, and fine art is still recommended. Cash should have a place in every portfolio in such uncertain times. The lines at Chinese brokerage firms, and Greek ATMs should remind us that the time to protect your portfolio is not when the panic begins, but while there is still time to act. What are you waiting for?”

6. Your Bank Account Remains at Risk – Yes Even in NZ!

The financial times reports:

Greek banks prepare plan to raid deposits to avert collapse

http://www.ft.com/cms/s/0/9963b74c-219c-11e5-aa5a-398b2169cf79.html#ixzz3f4VvEh48

Greek banks are preparing contingency plans for a possible “bail-in” of depositors amid fears the country is heading for financial collapse, bankers and businesspeople with knowledge of the measures said on Friday.

The plans, which call for a “haircut” of at least 30 per cent on deposits above €8,000, sketch out an increasingly likely scenario for at least one bank, the sources said.

A Greek bail-in could resemble the rescue plan agreed by Cyprus in 2013, when customers’ funds were seized to shore up the banks, with a haircut imposed on uninsured deposits over €100,000.

It would be implemented as part of a recapitalisation of Greek banks that would be agreed with the country’s creditors — the European Commission, International Monetary Fund and European Central Bank.”

It might be easy to think “no such risk here in New Zealand”. But we actually have similar rules in place here. In fact we were the first country in the world to do so! When you deposit money into a bank you become a creditor of the bank. It it fails you may take “haircut” on your deposit. Think it can’t happen here? Remember, the BNZ was bailed out back in the 1980’s. Gold is the only financial asset with no counter-party risk.

To learn more about this check out this video and article:

RBNZ Bank “Bail In” Scheme for Bank Failures: The Open Bank Resolution (OBR)

7. All Fiat (Unbacked) Monetary Systems Fail – This Current One is Overdue

Mike Maloney summarises a lot of history into a few paragraphs that are worth repeating in full…

“I am a firm believer that everything happens in waves and cycles. So when I started writing my book back in 2005 I entered every financial crisis that I could identify into a spreadsheet, starting from the beginning of the USA, looking for a cycle, and something very dramatic stuck out at me. I had discovered that every 30-40 years the world has an entirely new monetary system.

From that day till now I have been telling as many people as I could that before the end of this decade (before 2020) there will be an emergency meeting of the G-20 finance ministers (or something like that) to hash out a new world monetary system. It’s normal. No man made monetary system can possibly account for all of the forces in the free market. They get old… they develop stress cracks… then they implode.

We have had four different monetary systems in the past 100-years. The system we are on today is the U.S. dollar standard. It is an ageing system that is way overdue for its own demise. It is now developing stress cracks, and will one day implode. Like I said, it’s normal.

But what is different this time around is that the last three transitions were baby-steps from full gold backing, to partial gold backing, to less gold backing, to no gold backing. In each of these transitions the system we were transitioning from had a component that could never fail… gold. This time we will be transitioning from a system based on something that always fails… fiat currencies. The key component to this transition from the U.S. dollar standard to some new standard is of course the U.S. dollar. By the time the emergency meeting takes place the U.S. dollar will be in the final stages of the terminal condition known as fiat failure.

But the U.S. dollar represents more than half of the value of all the world’s currency. A dollar crisis would cast doubts on all fiat currencies, and the cascading effect of loss of faith could cause the rest of them to fall like dominos. The central bankers will try everything they can think of to keep the fiat game going, but when everything they try fails they’ll look around and say, “What worked before.” And once again the pendulum will swing back to quality money.

The only beneficiaries of this event will be gold and silver, and those who own them.”

So there you go, 7 current reasons to buy gold.

Think of any more? Share them with us and other readers in the comments below!

For more on this topic see:

I completely agree with why you should invest in gold rather than just regular stock. I think gold is a great long term investment with strong stability and low risk. I am still learning about gold investing and have been using a great gold investors guide that you should definitely checkout.

Pingback: When to Buy Gold or Silver: The Ultimate Guide (Updated) - Gold Survival Guide