Gold Survival Gold Article Updates:

12 February 2015

This Week:

- Apologies

- Lots of articles

- All about interest rates

First up, our apologies for the lack of a newsletter last Thursday. And if you receive our daily price alert email, for the lack of that all last week too.

Our email sending company carried out some upgrades. The upshot of which meant we were unable to send any email. Far from ideal, but hopefully all rectified now.

It also means we have a larger than usual number of articles on the website in this weeks newsletter. So have a scan through them at the end of this email and see what interests you.

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1658.34 | – $57.61 | – 3.35% |

| USD Gold | $1221.70 | – $45.20 | – 3.56% |

| NZD Silver | $22.87 | – $0.82 | – 3.46% |

| USD Silver | $16.85 | – $0.64 | – 3.66% |

| NZD/USD | 0.7367 | – 0.0016 | – 0.21% |

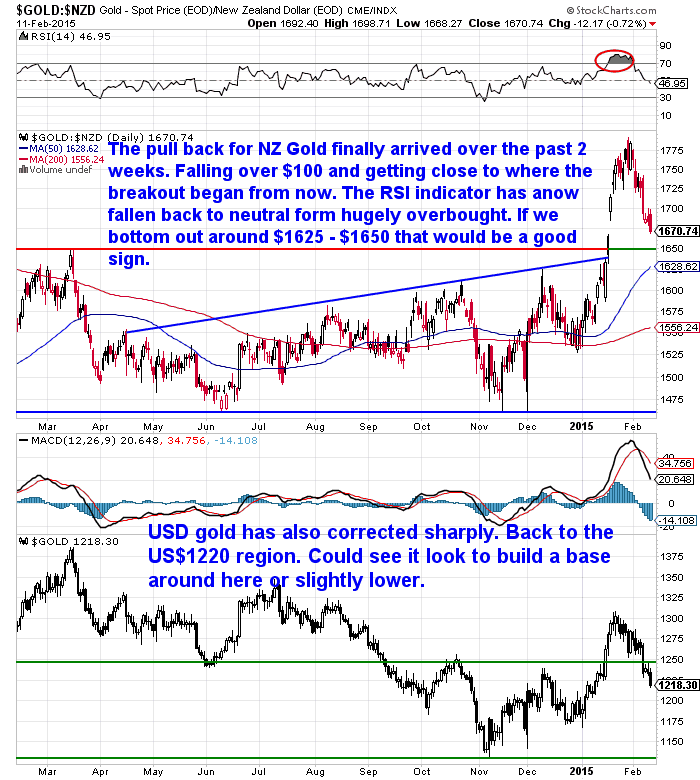

The fall in gold and silver that we had been expecting arrived over the past week and a half. With both metals falling over 3% since last Thursday.

NZD gold has now pulled right back almost to the level where the breakout began from. With it now no longer overbought and in neutral territory around the $1625-1650 level would be a good place for it to start building a base.

NZD Silver has done much the same.

Also in neutral territory on the overbought/oversold indicator and has retraced almost all of the breakout move. It too would be nice to see it build a base around these levels.

The Biggest News NO ONE is Talking About

You’ve likely heard a few news items this past couple of weeks about falling mortgage interest rates here in New Zealand. The reasoning being increased “competition amongst lenders”.

But the really big news that is not being discussed is the real cause of lower rates here and elsewhere are the record low interest rates in US government bonds. This is the key driver of interest rates globally. It affects what banks here pay for their offshore funding which although down from the highs of 2008, still requires a large chunk to come from offshore. Hence they can charge borrowers less for their mortgage.

Friday week ago US 30 year bonds fell to 2.227%. A record low.

10 year NZ Govt bonds also hit record lows last week too. Reaching 3.12%.

They have been trending down for the last 2 decades like just about everywhere else.

What’s been the impact of this multi decade decline in interest rates for New Zealand?

Greg Canavan of the Daily Reckoning Australia summed it up for Australia and we think the same applies to New Zealand:

“–This secular decline in interest rates has produced record debt levels and record high house prices (that’s not a coincidence), a structurally deformed economy and, now, handwringing about its future.

–It should be clear to anyone that lower interest rates are not the answer. Yet it is the answer because that’s the system of finance we’re all trapped in.

–This is how it works: Reduce interest rates to increase demand and asset prices (‘wealth’), which after a time results in increased pressure on household finances, the solution to which is lower interest rates. And so it keeps on going.

–This is a global problem, not just unique to Australia [or New Zealand]. And it will result in a global crisis far worse than 2008 because no one wants to do anything about it.”

Who knows when though?

Probably something out of left field will kick it off.

Greg’s Colleague, Tim Dohrmann, at Money Morning Australia also commented on the falling rates and the divergence between the 10 year Aussie Government Bond rate and the overnight cash rate…

“Yesterday, the yields on Aussie bonds hit a new all-time low. But you could have told as early as Thursday last week that something funny was afoot. That’s when the yield on 10-year government debt dropped through the overnight cash rate.

That means you can earn less annualised interest by lending money to the government for 10 years than by lending it for one night. If this seems crazy to you, you’re right — it is.

This market action flies in the face of the time value of money. It’s another milestone on the unique economic experiment that central bankers have run for several years now.

It’s not just Australia’s policymakers playing this dangerous game. It’s a ballooning global phenomenon — and if anything, the RBA is late to the party…

Inverted world

Yes, we’ve been forecasting low interest rates for a good while. But the forecast is rapidly becoming a global reality.

For example, three weeks ago, for the first time ever, the Japanese government paid no interest on its five-year bonds. No, the Japanese didn’t default on their debts…that was simply the interest rate on a five-year government bond in Japan.

Yes, it was zero. No, we’re not kidding.

But it’s not just Japan. If you live in Switzerland, you’d be lucky to earn zero interest. Swiss bonds out to 13 years in length have negative yields.

Even worse, the Swiss National Bank has cut its short-term interest rate to negative 0.75%. That means you’d have to pay them interest to keep your money in the bank!

Here in Australia, we think earning a ‘safe’ 2% to 3% on our savings is terrible. But even after yesterday’s action from the RBA, Australia is still the outlier. Slowly but surely, we’re joining the race to rock-bottom rates. But if rates can go and stay negative…who even knows what rock-bottom means anymore? Answers on the back of a postcard, please…”

Comparing this to New Zealand, we are also in the same boat.

The Overnight Cash Rate (OCR) is 3.50%. While the 10 year government bond rate got as low as 3.12% almost 2 weeks ago but is still only 3.33%.

So just like Australia the rates here mean getting more interest to lend for one night than you’d get for 10 years. Just the opposite of what it should be. There should be far more risk in lending out to 10 years so you should receive a higher rate of interest for it.

So where are interest rates heading?

We still think they may go down further before they go up. And that the Federal Reserve’s talk of raising rates this year may prove to be just that – talk.

With the data across the globe from China to Europe pointing to a slowing world economy the Fed will likely be afraid to raise rates for fear of damaging the US “recovery”.

Could the opposite happen and they in fact cut them further?

Jeff Gundlach is known as the “King of Bonds” having one of the best performing bond funds of the previous decade.

So what does he think?

He reckons that US interest rates will continue heading lower…

“The 10-year [US] Treasury could join the Europeans and go to 1 percent. Why not? The European rates are at 1 percent. France is below 1 percent right now.”

Dr. Steve Sjuggerud in his Daily Wealth believes:

“Governments around the world will keep interest rates lower than you can imagine for longer than you can imagine. And that will cause stock prices and real estate prices to go higher than you can imagine.

So far, my script has been so right that’s it’s actually approaching the point of ridiculousness…

For example, earlier this month, for the first time ever, the Japanese government wasn’t paying any interest on five-year Japanese government bonds.

No, the Japanese government didn’t default on its debts… That was simply the interest rate on a five-year bond in Japan. Yes, it was zero. No, I am not kidding.

It’s not just Japan… You are welcome to lend your money to the German government for the next five years for no interest. Heck, if you live in Switzerland, you’d consider yourself lucky to earn 0% interest. Five-year bonds in Switzerland have a negative interest rate.

Even worse, the Swiss government’s short-term interest rate is now set at negative 0.75% – meaning that YOU have to pay THEM interest to keep your money in the bank!”

And there’s even more interest rate craziness in Denmark where negative rate mortgages now exist!

Via Bullionvault:

“SO NEGATIVE RATE mortgages are now a thing.

Yes, you can borrow to buy a home for less than nothing in Denmark, reported Finans.dk in Copenhagen on Friday.

Nordea Kredit has begun repaying money to customers of its F1 mortgage product. Because the floating interest-rate on those accounts has gone negative…meaning the lender must pay the borrower.

Remember that phrase: The lender is paying the borrower. Repeated so often in history, it’s the way of the future. Starting right now.

Some 20% of the €7 trillion owed by Eurozone governments to the bond market is now yielding less than zero, according to analysts. German Bund yields are negative on all debt maturing before 2020, says the Bundesbank. This chart shows you the cost to investors of buying top-rated Eurozone debt today.

Why? Negative central-bank interest rates are one reason. Trying to force banks to lend…and investors to invest…the European Central Bank has joined its Swiss neighbours in charging depositors for the pleasure of looking after their cash.

Denmark is there too, and Sweden started the whole thing back in 2009, moving from the “zero interest rate policy” long applied by Japan (ZIRP) to a “negative interest rate policy” (NIRP) to try and force savers to keep spending instead.

Money managers today have meantime got so much money to park, not even soaring Eurozone stock markets can absorb it all. Not now the European Central Bank is spewing out money as well…an extra €60 billion per month.

And besides, with so much money waiting to be repaid by less trusted borrowers, why not pay a few basis-points for Berlin, Paris or the Hague to “look after” your clients’ savings? They’re so good for the money, in fact, lending to Germany, France or the Netherlands is safer than cash.

Not everyone, however, thinks sub-zero bonds are 100% safe. A small but growing number of money managers also piled into gold suddenly last month.

A lump of dead metal pays you nothing of course. Gold does so little, in fact, it can’t even rust. But even nothing is better than sub-zero. And the ECB, remember, is now printing money as well.

So the giant GLD exchange-traded trust took in $1.9 billion last month…the biggest rise since October 2012. In gold futures and options too, the “hot money” hasn’t been this bullish on gold since November 2012.

Gold was then trading at $1750 per ounce. It has dropped over 25% since. That loss badly hurt many smaller investors.

So while a fast-growing handful of money managers think gold is now worth buying again, the US Mint just reported its weakest January for gold coin sales since 2008.”

So what to make of all this?

Perhaps the weakest month for US Mint gold coin sales could well be a contrarian indicator.

Here for us it’s also been deathly quiet in terms of people buying but we have had the odd person looking to sell. Perhaps due to a decent run up in prices over the past month or so and they are looking to cut their losses?

Given that most people do exactly the right thing, but at exactly the wrong time, our guess is that the bottom is in for gold (and hopefully silver). And that more sellers is an indicator of this.

These falling interest rates and in particular negative yields will likely lead more people across the globe to consider gold and silver.

Because if you’re going to earn nothing in the bank you’re better off to own the only financial asset that at the same time is no one else’s liability.

And if you’re earning nothing or next to nothing in the bank then why take the risk of a bank failure? Especially here in New Zealand where there is no deposit insurance whatsoever in case of a failed bank.

Odds are we are slowly joining the rest of the world in edging towards negative rates.

It would be a good idea to have some financial insurance before we get there…

Free delivery anywhere in New Zealand and Australia

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $13,750 and delivery is now about 7-10 business days.

This Weeks Articles:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| Today’s Spot PricesSpot Gold | |

| NZ $ 1658.34 / oz | US $ 1221.70 / oz |

| Spot Silver | |

| NZ $ 22.87 / ozNZ $ 735.34 / kg | US $ 16.85 / ozUS $ 541.72 / kg |

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuideToday’s Prices to Buy |

Note:

|

|

Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

|

Our Mission

|

| We look forward to hearing from you soon.Have a golden week!David (and Glenn)

Ph: 0800 888 465 From outside NZ: +64 9 281 3898 |

|

|

|

The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

|

Copyright © 2013 Gold Survival Guide. All Rights Reserved. |