This week:

– More gold bears than gold bulls

– time to buy?

– Free Aussie Gold Stock pick

More gold bears than gold bulls – time to buy?

A week of great charts for you this week. This first one is of the Bloomberg gold bull/bear sentiment indicator.

It shows that the gold bears outnumber the gold bulls at the moment. So what? Well, this acts as a contrarian indicator. You see, if this chart also plotted the gold price on it – which it unfortunately doesn’t – you’d be able to note that each time the bears yellow line went above the bulls blue line, the gold price soon afterwards broke higher.

“Research from the gold team at Canaccord Genuity found that gold rallied about 10 percent on average during the month following each of these sentiment “cross-overs.” This historical increase means that gold could potentially rally to the “high $1,700’s per ounce,” which Canaccord believes “would breathe some new life into the gold equities.” http://www.usfunds.com/investor-resources/frank-talk/?i=8135

Free Aussie Gold Stock pick

Speaking of gold equities a.k.a. shares, in the reader survey we carried out a couple months ago we did have a number of people say they’d like to see some info on local gold shares. Only problem is there’s not too many options here in NZ. Only 3 listed that we can think of and one of them is only on the NZAX alternative exchange. But across the pond in Aussie it’s a whole other ball game with the problem being too many too choose from and that it can be difficult to sort the wheat from the chaff. That’s where a good investment newsletter can come in handy. We’ve managed to get some exclusive content for our readers from Fat Prophets and one of this weeks articles has some research on one of the gold stocks they have in their portfolio…

Free Aussie Gold Mining Stock Pick It’s easy enough to buy shares on the Aussie exchange too. Most NZ brokers or even online brokers can do it just as easily as NZX shares.

In this weeks other articles we have published our thoughts countering an article a reader sent in, in which the author outlined why gold is in a bubble…

The Gold Bull Market – Is it Over Yet?

And then we have Part 2 of the 9 Gold Myths video (we featured Part 1 a couple weeks ago).

China’s gold imports up tremendously

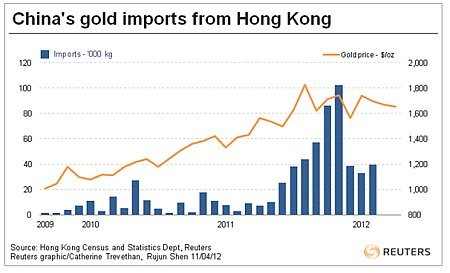

The next chart we came across this week shows China’s gold imports from Hong Kong.

So what’s so interesting about this? Because China doesn’t regularly publish how much gold it’s central bank holds – last time was in 2009 at 1054 tonnes – this import data acts as a proxy for what they might be up to (see How Much Gold Does the Reserve Bank of New Zealand Have? for a list of gold holdings by country).

You can see that in the latter half of last year, China really cranked up it’s gold imports and even though recent purchases are down on the 100 tonne high, at even around 40 tonnes a month there is lot of gold being bought by someone (or many someones) in China. At the current rate China will overtake India as the top gold consumer before very long – probably this year. These monthly imports are really significant when you compare them to China’s gold production from it’s mines. This “only” amounted to “51.005 metric tons of gold in the first two months of the year”.

Whereas China imported around 32 tonnes in January and 40 tonnes in February. So the world’s largest gold producer is importing more gold than it’s producing. And remember none of China’s mined gold is allowed to leave the country. It may only be the first 2 months of the year, but that amounts to around 122 tonnes of gold added to China’s coffers already. Of course much of this will be consumed by the populace, but regardless it’s still a lot of gold.

But China is still a long way from close to matching the likes USA and Germany which is likely what it’s plan is in the long run. China seems to be slowly moving towards internationalising the Renminbi. Of which its announcement this week that they were increasing the band through which it will be allowed to trade from 0.5% to 1%. Can’t remember where we read it but a point was also made that this announcement was made in English not Mandarin which is unusual. You could conclude that this announcement was meant to be more widely heard and fast.

While this change is not significant on its own it is further evidence that China is moving towards a fully fledged international currency. And a whole lotta gold will help – as we said in one of this week’s articles – he who holds the gold makes the rules.

China’s gold reserves only make up a couple of percent of its foreign exchange reserves and as we’ve already said it’s got a long way to go to catch up to the likes of USA, Germany etc. The chart below is a different take on the previous chart. It again plots China’s imports of gold from Hong Kong but also China’s US treasury holdings. The clear take away from the last half of 2011 was Treasury holdings down and gold imports up.

It seems likely that China has been the one “buying the dips” over the past 6 months in gold. China is fast becoming the biggest factor in global demand for gold.

Hands up if you’d like to hear Chris Powell from GATA speak in NZ.

As we mentioned last week a friend is looking at getting Chris Powell from GATA out here to NZ to speak. It’s not definite yet so if you might be interested please just hit reply to this email and let us know as the more who express interest the more likely it will be feasible to get him out here as an extension to his speaking trip to Hong Kong. Possible dates are from 8 June to 13 June. If you’re a possible please let us know.

We haven’t published the gold and silver charts this week as they look very similar to a week ago, so no sense repeating ourselves. Prices for both still look pretty cheap to us, but you have to make your own call on that. As usual give David a call, email, or livechat and he can get you a specific quote for either metal.

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 )

3. or Online order form and full product list

Have a golden week!

Glenn (and David). Founders Gold Survival Guide

This Week’s Articles:

Thumbs up for NZ from the IMF?

2012-04-10 22:54:19-04 This week: – Bernanke The Hero? – The Rain in Spain – This weeks articles – Thumbs up for NZ from the IMF – Interested in hearing Chris Powell from GATA speak here in NZ? – Latest Gold and Silver Charts Bernanke The Hero? Even though it’s been a week, we still can’t help […] read more…

The Gold Bull Market – Is it Over Yet? 2012-04-11 02:34:59-04 There’s plenty of talk around about the gold bull market being over. Mostly from those who also proclaimed it over at $600 an ounce and $800 and $1000. We actually had an email forwarded on from a reader recently which covered much the same ground as always. We thought it might be useful to share […] read more…

Nine Gold Myths Everyone Needs to Understand to Survive this Global Economic Crisis Part 2

2012-04-14 20:19:23-04 A couple of weeks ago we posted the first video from J.S. Kim which exposed numbers 1 to 4 of his 9 gold myths. Below is the 2nd installment with Myths 5 to 9, in which we were surprised to find he was kind enough to also make a mention of us here at GoldSurvivalGuide […] read more…

Free: Aussie Gold Mining Stock Pick 2012-04-14 23:14:32-04 In our subscriber survey a couple months ago a number of readers mentioned how some information on NZ and Australian gold mining shares/stocks would be useful. So in response we’ve managed to negotiate some exclusive free reports from Fat Prophets. Founded by New Zealand born Angus Geddes in 2000, Fat Prophets is an Australian based stock […] read more…

The legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Pingback: Gold in NZD - how much longer at this level? | Gold Prices | Gold Investing Guide