This week: – Gold Confiscation – Could it happen in NZ?– China’s gold imports from Hong Kong surge– Big buyer in Hong Kong– India back buying too– Chart of the week First up our feature article this week is in response to a reader question… Gold Confiscation – Could it happen In New Zealand? We discuss the history of confiscation and then our thoughts on the likelihood of it happening in NZ and what options there may be to consider. As usual links to all 3 of this weeks articles are at the end of this email. As we mentioned last week, Obama has now officially asked the US Congress to raise the USA debt ceiling by $1.2 Trillion (or as we read somewhere a more appropriate term would be “debt target” since it seems the aim is to breach it!). Seems it is a formality and as expected it has had very little mention in the mainstream.

China’s gold imports from Hong Kong Surge

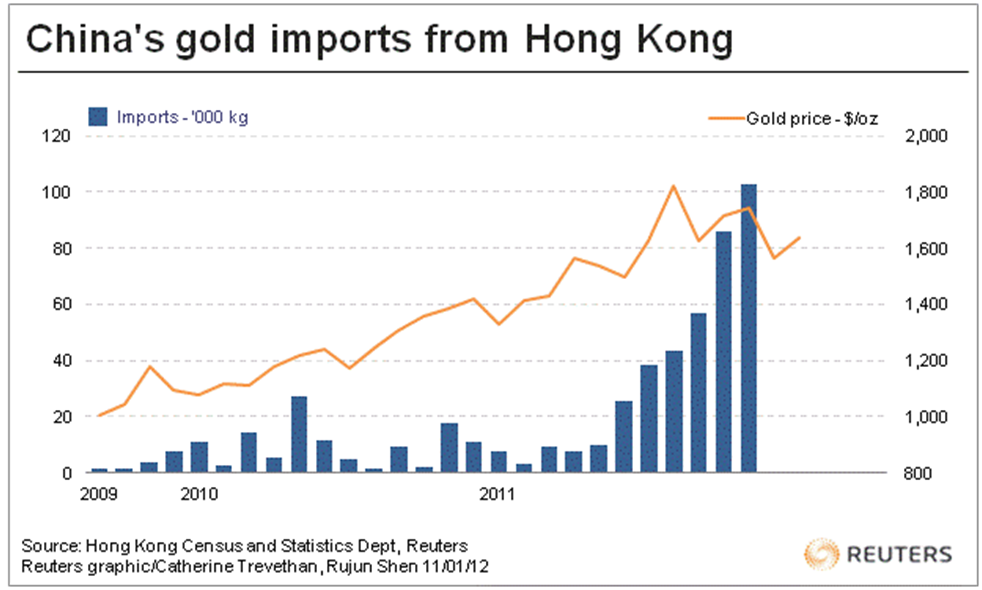

But the really big news this week we think was the report that China’s gold imports from Hong Kong have surged to their highest ever level. “Mainland China’s imports from Hong Kong surged to 102,779kg/oz from 86,299kg/oz in October. This is a 20% increase from the already high number seen in October and a 483% y/y increase.” And this Reuters chart shows visually this staggering rise over the past year…

Along with Chinese consumers and investors buying gold in response to rising inflation and falling share and property markets, the report speculates that both Chinese commercial banks and the Peoples Bank of China (Chinese Central Bank) were likely buyers in this period. Another telling statistic was that China also recently passed India to be the largest market for gold jewellery. But what is also very significant about this data is the fact that it is illegal to export gold from China. So if they are importing large amounts it shows that gold bullion is in strong hands in China.

Big buyer in Hong Kong

As anecdotal evidence of this huge buying in the East, last night we were reading one of our favourite investment newsletters we subscribe to, The Weber Global Opportunities Report. One of Mr Weber’s subscribers from Hong Kong had written in to report he had just been in to pick up an order for gold and silver. The person in the metals shop told him he was lucky to have bought when he did because a day later a customer had come in and bought their entire inventory of large gold and silver products. The dealer said the man had spent 8 figures (Hong Kong Dollars) which in US dollar terms would be somewhere between 1 and 10 million dollars! The dealer would have no more metal until February! So it would seem that the “strong hands” are replacing the late comers at the current prices in gold and silver.

Indians back buying too

While China may have taken over India in the Jewellery buying department, India remains a big player in the global gold market. And in one of this weeks articles (Why has gold been down?), we briefly mention that Indian buyers are returning to the gold markets too. The Indians and Chinese are usually the more astute buyers preferring to buy generally on price dips rather than close to highs. So more proof strong hands coming in to the market buying when there is more value.

Chart of the week

Also from the above mentioned article is the following “chart of the week” which speaks for itself we’d say (the green writing on the chart also helps!)

If you agree that Gold may have recently found a bottom and so think now’s a good time to buy then give us a call for a quote… 0800 888 GOLD ( 0800 888 465 )orders@goldsurvivalguide.co.nz If you’re a first time buyer we’re always happy to answer any questions you may have (actually we’ll even answer you questions if you’re not a first time buyer for that matter!). Have a golden week!

Glenn (and David). Founders Gold Survival Guide

This weeks articles…

Was 2011 a Dud or a Springboard for Gold?

2012-01-10 03:27:40-05 We’ve just completed our own 2011 review of gold and silver in NZ dollar terms. In the following article Jeff Clark shows us that surprisingly US treasuries were the best performing sector of 2011. So is this the place for our money in 2012 or does gold still look strong from a fundamental point of […] read more…

Why Has Gold Been Down?

2012-01-12 19:39:04-05 Outlined in this article are some of the reason as to why gold has been falling in recent months. (On top of these someone a bit closer to home, Bron Suchecki of the Perth Mint, has outlined how Indian demand has been a big factor too.) So, has the bull market in gold finished? Well […] read more…

Gold Confiscation – Could it happen in New Zealand?

2012-01-16 23:50:45-05 We recently received a question from reader J.M… “I just wanted to know if you had any info on if the NZ Government has the ability to ‘confiscate’ investors gold & silver. I have read some articles about this happening in the USA in the thirties and wonder if our govt. has the power/laws to […] read more…