This Week:

- NZers: Do You Hold Cash or Gold in the Coming Crisis?

- China Joins the SDR Old Boys Club. What’s the Significance?

- Contrarian Indicator: Gold Money Managers at Record Levels of Bearishness

|

LIMITED QUANTITY GOLD SPECIALS GOLD KIWI 1 oz COIN

1oz NZ Mint 99.99% Gold Kiwi Coins Normally priced at Spot + 5.7% at NZ Mint. Through us: Packaged Gold Kiwis: (Approx $1668) (15 in Stock) ***** PERTH MINT 1 oz GOLD BARS 1oz Perth Mint 99.99% Gold Bars In Green Packaging Approx $1684 (6 green in stock) Ph 0800 888 465 and speak to David or reply to this email. |

Price Chart

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1589.98 | – $40.75 | – 2.49% |

| USD Gold | $1054 | – $16.90 | – 1.03% |

| NZD Silver | $21.19 | – $0.45 | – 2.07% |

| USD Silver | $14.05 | – $0.16 | – 1.12% |

| NZD/USD | 0.6629 | + 0.0062 | + 0.94% |

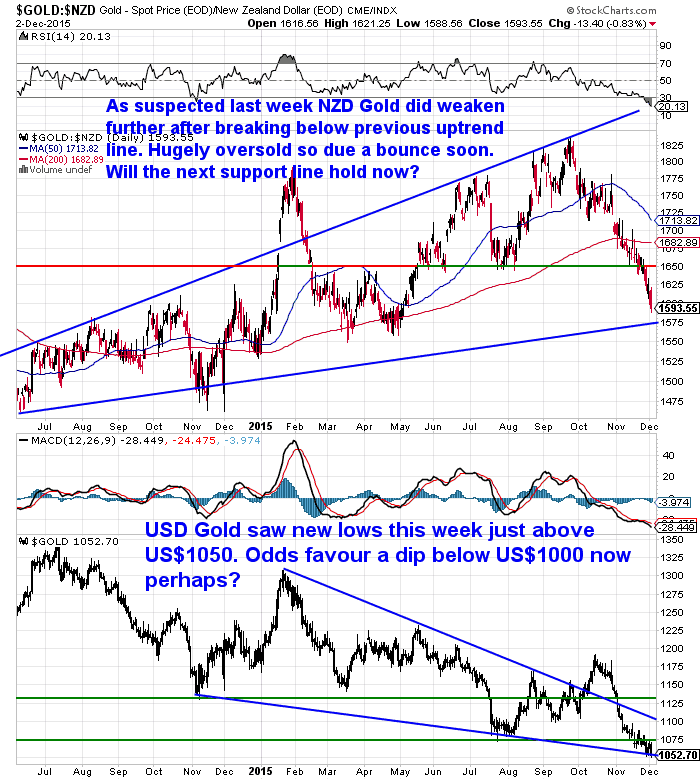

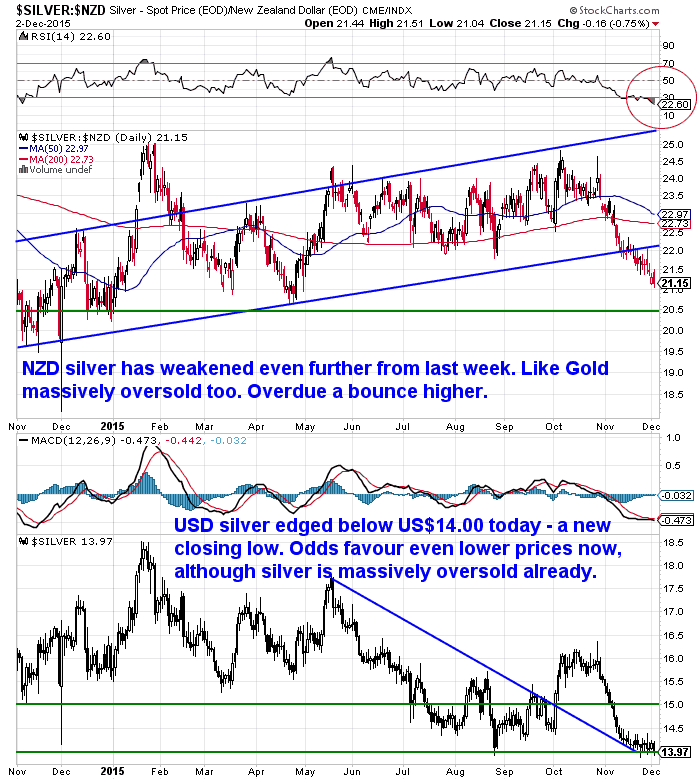

New lows for gold and silver this week in both NZ dollars (multi-month) and US dollars (multi-year).

As you can see in the chart below gold in NZ dollars has extend its fall even further this week after breaking below the previous uptrend line last week. The question now is will this next line of support hold? Gold is very oversold so due a bounce higher soon.

NZD silver has also continued to head lower, but is now even more oversold than it was at its lows last year. So it too is overdue a significant bounce higher from here.

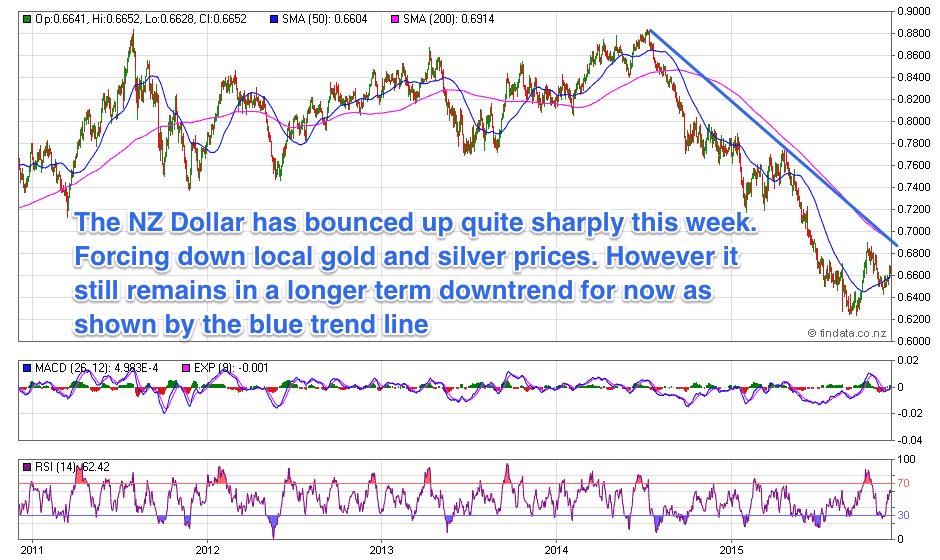

It has been the NZ dollar that has done most of the damage to local precious metals prices as it strengthened quite sharply this week. However of note is that the Kiwi dollar is still well within the confines of the downtrend it has been in for the past 18 months. So it may well struggle to get through the downtrend line in the chart below. Particularly while the expectation remains that US interest rates are about to be lifted.

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $265 you can have 1 months long life emergency food supply.

Learn More.

—–

China Joins the SDR

Big but not surprising news this week was the IMF announcing the Chinese Renminbi would join the basket of currencies that make up its Special Drawing Rights (SDR).

We have a feature article on the website. It includes:

- A summary of the changes to the SDR.

- Thoughts on what this means from the mainstream media.

- Along with some views from other not so mainstream commentators.

- Finally we give our take on the significance of this announcement and what might lie ahead.

China Joins the SDR Old Boys Club. What’s the Significance?

We also have another feature article this week on the website.

It considers the opinion of Daily Reckoning Australia writer Vern Gowdie, that Australians are better off holding cash than gold in the lead up to the next financial crisis.

We give our thoughts on what New Zealanders might want to consider before taking this approach. As there are some major differences compared to Australia.

NZ’ers: Do You Hold Cash or Gold in the Coming Crisis?

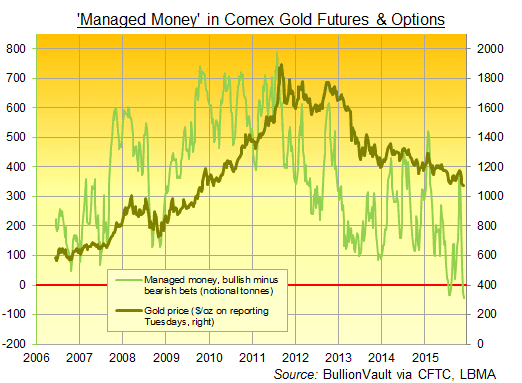

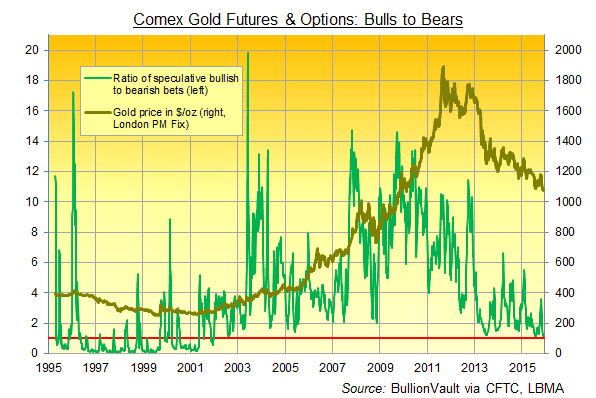

Contrarian Indicator: Gold Money Managers at Record Levels of Bearishness

Given those two articles have plenty of reading we won’t add too much else this week – especially as we are very late hitting send!

However it is worth pointing out that the “Money Managers” category in gold futures are more bearish in their bets than at any time in 10 years before the last weeks drop to new 6 year lows.

On top of this reports Adrian Ash, “the net long position…of bullish minus bearish bets…across all “non-commercial” traders (basically anyone outside the miners, refiners and bullion banks) is now near its lowest point since 2002 as a proportion of all outstanding contracts.

It peaked at 42% in autumn 2009. Last Tuesday it equalled less than 4% of all Comex gold futures and options that were live.

In fact, looking at the ratio of bullish to bearish bets, the speculative side of the market in Comex futures and options hasn’t been this close to negative overall on gold since December 2001.”

Historically these “money managers” are generally wrong at the extremes. This is certainly an extreme. We think the odds favour a broad bottoming in precious metals is underway. US Dollar prices may still head lower from here, but the fact that the mining indexes haven’t hit new lows is a positive.

If you are yet to take a position now might be as good a time as any with a bounce likely due very soon. The fact we have very little interest from buyers currently is also a positive contrarian indicator.

Free delivery anywhere in New Zealand

Free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $13,540 and delivery is now about 3 weeks away.

— Prepared for Power Cuts? —

[New] Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

This Weeks Articles:

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|