Gold Survival Gold Article Updates

September 05,2013

This Week:

- Gold and Silver Charts

- Does War Affect the Gold Price?

- Another Approaching Day of Reckoning

- Could NZ Take a Pounding Like Emerging Market Currencies?

Free Ticket to See Ronald Stoeferle live in Auckland

First up a reminder in case you missed last week’s email, that Ronald Stoeferle, writer of the widely read and much respected In Gold We Trust report will be in New Zealand “for one night only” in just over a week.

First up a reminder in case you missed last week’s email, that Ronald Stoeferle, writer of the widely read and much respected In Gold We Trust report will be in New Zealand “for one night only” in just over a week.

Thanks to sponsorship his presentation on Saturday September 14th is free to attend. So if you have yet to do so you should head over to the post linked below for the full details on how to get yourself a free ticket.

See Ronald Stoeferle live in Auckland

There’s also plenty of information on there and a copy of Ronald Stoeferle’s latest report. He is sure to be of interest regardless of whether you are new to the world of precious metals or an old hand. Take advantage of the chance to hear what he has to say for merely the cost of getting yourself to Parnell, Auckland. Also Mr Stoeferle’s company Incrementum has just released a fantastic pdf of 50 charts entitled: Gold Bull and Debt Bear

Gold and Silver Charts

As expected both gold and silver have come off their highs of last week slightly. They were due a rest after such a strong run higher since the start of August.

With the kiwi dollar a cent stronger than yesterday and gold in US dollars off slightly, local gold is down at $1764. It did edge as high as $1845 during the week, touching the 200 day moving average before backing off. $1850 was also the area that had been long term support that the April plummet began from so this will be major resistance to overcome.

Importantly the RSI has also come back down from oversold levels above 70. So we look to be building for a second assault on the $1850 level. But for now after a run higher of $300 since July, NZD gold is taking a well deserved break. Some support levels to look for if thinking of making a purchase would be NZ$1750 and NZ$1700.

NZ dollar silver is not in a dissimilar position. Today it sits at $29.73 per ounce, down from $31.54 last week. Or if you prefer metrics, $956 per kg today versus $1013 a week ago.

NZD silver faces stiff resistance at $32. Like NZD gold this level coincides not only with the 200 day moving average but also where the April pummeling began from. If you’re looking to buy you may get a chance at around the $27 to $28.50 zone. Again like gold we are already back down below overbought levels in the RSI so could see another crack at the $32 level before too long.

We thought it was worth taking a look at both metals in US dollar terms as well. We don’t do it too often, since after all it is in NZ dollars that we buy gold and silver here in New Zealand so that’s what counts when tracking their movements.

However gold and silver in US dollar terms are approaching some key zones that could tell us a bit about where they head in the medium term.

Unlike here in NZ they have not yet retraced the losses they suffered in April in US dollars. Gold faces a key battle in the US$1480 to $1550 zone. It wouldn’t be surprising to see it head down to the US$1350 mark which would get the RSI back to neutral, before mounting another attack up towards the US$1450 – $1500 area.

While silver has a gap to fill between US$24.80 and $26.80 to get its head back above where the April plunge began from.

So once we see these levels regained and bettered we would feel somewhat more confident that the bottoms for both are in.

Key Dates to Watch in September

Zerohedge reported that September could be explosive for gold with a number of key dates:

- Sept. 5: BoE, ECB announce monetary policy decisions

- Sept. 6: U.S. Aug. change in nonfarm payrolls

- Sept. 9: Italy Senate committee to start debate on Berlusconi’s expulsion after his tax-fraud conviction

- Sept. 13: Euro-area finance ministers meet

- Sept. 16: Portugal EU/IMF aid review mission starts

- Sept. 18: FOMC meeting with rate decision and economic projections being released

- Sept. 22: Germany holds federal elections

- Sept. 29: Portugal holds municipal elections

The US Non farm payrolls and of course the Fed meeting are likely to be key dates to watch. And then combine these with warmongering regarding Syria and there are plenty of reasons to expect some action this month in gold (and silver).

Interestingly war may only have a short term impact on gold. As Jan Skoyles points out in the past couple of decades talk of war has often caused the price to rise in the short run but then retrace those gains once the fighting actually starts.

Does War Affect the Gold Price?

“Talk of war and the act of war clearly affects the gold price. The price of the yellow metal obviously continued to climb after each of the three examples we provide. But in truth very little happens when the talk of war turns into action.

This brief look at a small selection of wars suggests that the gold price peaks prior to and at the beginning of military action, before returning to levels seen not long before. It then, of course goes on to extend its bull run. But how much of it was to do with wars that happen in the Middle East?

We believe very little, whilst geopolitical instability clearly is a driver for the gold price, it does not obviously have a long-term impact on the price of bullion. It may be interesting however to look at how the economic impact of wars go on to affect the price.

For instance, what many appear to forget when they discuss Syria, tapering and gold in the same breath, is that a war means money printing will have to happen regardless of what you call it.”

Debt Ceiling – Another Approaching Day of Reckoning

Another approaching day of reckoning for the USA that will likely have an impact on gold and silver is the US debt “ceiling”. The ceiling that is forever being raised.

MarketWatch.com reports that the limit is likely to be reached a month earlier than expected in mid October and unless Congress votes to lift it the US will be unable to borrow to pay its bills.

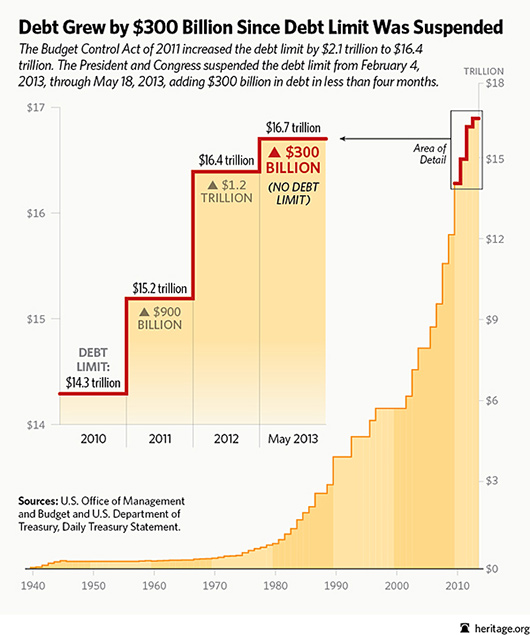

The below infographic from www.heritage.org shows the continuing rise in US debt and how in just 4 months earlier this year it went up $300 billion! And this was despite budget cuts and the “sequester”.

So we may be heading for some repeated fireworks in October when the debate returns. Odds are they will extend it yet again, but this will likely draw some attention back to this area.

Could NZ Take a Pounding Like Emerging Market Currencies?

Lately we’ve read plenty about how emerging markets have been taking a pounding both in terms of the their currencies and stock markets falling.

The Wall Street Journal reports on the impacts on the likes of Indian and Indonesian companies.

—–

“Plunging Currencies Crimp Asian Companies

Companies across Asia are facing a debt-repayment crunch as plunging local currencies make it more costly to repay foreign loans, a situation that is exacerbating stresses on the region’s economies.

Asian companies took out sizable foreign loans in recent years as the U.S. Federal Reserve kept interest rates low and printed money. For firms in nations like India and Indonesia, rates on U.S. denominated debt were more attractive than local borrowing costs.

But the current exodus of capital from emerging markets, amid expectations the Fed will end its period of extraordinary monetary stimulus later this year, has changed that equation.

Foreign funds are pulling out of Asian bonds and other assets amid expectations U.S. rates will rise further. That is pushing currencies in Asia sharply lower and raising the cost of repaying U.S.-denominated borrowings….

…Few observers expect a re-run of the 1997-98 Asian crisis, when companies and banks across the region folded as they were unable to repay foreign loans amid a currency crisis.

A higher portion of Asia’s corporate debt is in local currencies today than back then. HSBC estimates that Indonesia’s public and private external debt was 45% of gross domestic product in 2012, much lower than 90% before the Asian crisis.

Asia’s central banks also have much larger stockpiles of foreign reserves, which they can use to defend currencies.

Still, there are worrying signs of stress. Many Asian countries are running current-account deficits, meaning they import more than they export….”

—–

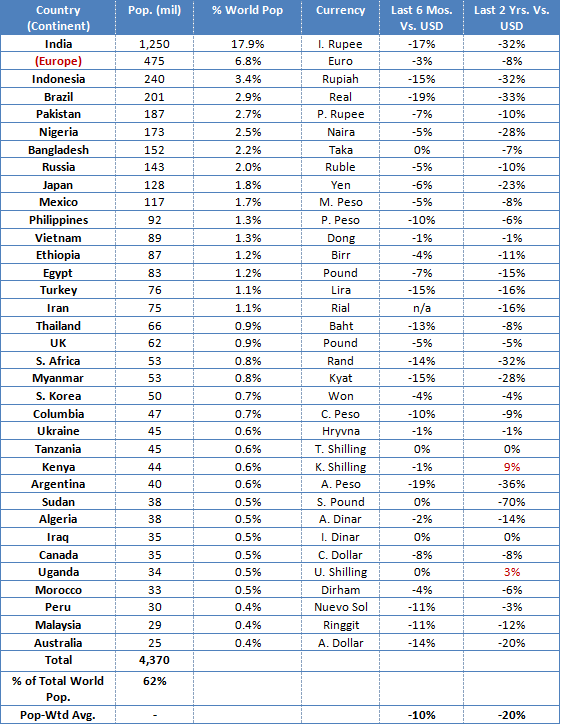

Then a Miles Franklin blog post shows just how widespread the depreciation against the USD has been over the past 2 years care of this excellent table:

The talk of winding back on the money printing is what has really set this off with the Indian and Brazilian currencies really plummeting since the “taper” talk began.

Ambrose Evans-Pritchard neatly sums up the problems the Fed now faces:

—–

(UK Daily Telegraph): “The Fed has a duty of care to emerging markets, since its own hands are hardly clean. Zero rates and quantitative easing were the cause of dollar liquidity flooding these countries. It was the biggest reason why net capitals flows into emerging markets doubled from $4 trillion to $8 trillion after 2008, much of it wasted in a late cycle blow-off.

Yes, China, Brazil, India and others handled the liquidity bath badly. They ramped up credit without generating much worthwhile growth. In China’s case the economic return on loan growth has collapsed from a ratio of 0.85 to 0.17. The diminishing returns have shrunk to almost nothing.

The credit boom disguised the underlying rot as the BRICS club lost labour competitiveness. Every case is different but nowhere was myth so divorced from reality as in Brazil. The country is languishing at 130th place in the World Bank’s rankings for ease of doing business, industrial output is still 3pc below pre-Lehman levels and it has lost its way with dependence on iron ore and commodity exports.

As Matt King from Citigroup says in a pithy note, tourists have discovered that “reality is less good than the brochure” in emerging markets and now they are pining for home. “Don’t all come home at once. The exits are small,” he warned.

One cannot blame the US for the failings of these countries, yet Ben Bernanke and his successor will still have to live with the consequences. Globalisation has entrapped the Fed. Like it or not, the Fed is the world’s monetary superpower.

The exodus of money from emerging markets that we have seen so far is nothing compared with what could happen if this episode is mishandled. The rapid escalation towards a Western missile strike on Syria is bringing matters to a head fast, with talk of a spike in crude oil prices to $150 a barrel setting off its own chain reaction.

If the Fed really thinks that the rest of the world will have to “adjust to us” as it insists on draining global liquidity come what may, it may have a very rude surprise, yet again.”

—–

A rude surprise indeed! The Fed is in an impossible situation. Stopping the free money leads to trouble for the entire emerging world, which as Ambrose also mentions in the full article is big enough to drag down the rest of the planet with it nowadays too. And of course higher interest rates (the likely impact of winding back on money printing) won’t mix well with the USA’s wee debt situation mentionedearlier either. Jim Rogers commented in an interview this week “when this artificial sea of liquidity ends we’re gonna see panic in a lot of markets, including in the US, including in West developed markets.

I mean…, this is the first time in recorded history that all major central banks have been flooding the market with artificial money printing at the same time. They’ve all been trying to debase their currencies at the same time.

This has never happened in recorded history. When this ends its gonna be a huge mess.“

On the other hand, history proves ongoing money printing leads to a sticky end as well. Rock meet hard place.

As many of these emerging nations are finding out it’s a case of be careful what you wish for. As when you run down the list in the table above, you see a good many nations who were not so long ago complaining about having currencies that were too strong and hurting their export sector. Now as the WSJ article explains they are suffering under the dual weights of higher prices of everyday goods due to a much weaker currency, along with facing repaying offshore loans in also much weaker currencies as the free money rapidly leaves their shores.

So far the fall for the NZ dollar has been comparatively small even compared to our neighbours across the ditch. NZ is too small to gain a mention in the table but in the past 6 months the kiwi dollar is only down about 6% against the USD. But perhaps we too should be careful what we wish for. A markedly weaker kiwi dollar might mean cheaper exports but it also would mean higher prices for all the goods we import. Which number more than our exports like most of the western world. And it would also make our external debt more expensive to foot as well just as India and Indonesia are finding. But unlike many of these emerging nations we don’t have significant foreign reserves to use to shore up our currency if the need arose.

Brian Fallow made the point in the NZ Herald yesterday that with emerging markets currencies taking a pounding perhaps we shouldn’t be too smug thinking that we are immune to such an outcome here.

—–

“In recent months, as financial markets have priced in the prospect the US Federal Reserve will taper off its quantitative easing and US bond yields have climbed, the flood tide of money which had flowed into emerging markets has turned.

Among the effects have been double-digit percentage declines in the exchange rates of India and Brazil.

As the rupee hits new lows it seems to be one of those cases where billionaire businessman Warren Buffett’s aphorism applies: that it is when the tide goes out that you discover who has been swimming with no togs on.

India’s currency crisis – rather like New Zealand’s in 1984 – has focused minds on underlying structural weaknesses, with a lot of commentary from within India about policy paralysis, cronyism and corruption, and so on. Is that fair? From this distance, who can say.

What is beyond dispute is the close correlation between the rise in US benchmark interest rates since May and the depreciation of the rupee. A chart in the New Zealand Institute of Economic Research’s latest Quarterly Predictions, released Tuesday, makes that very clear.

And if US monetary policy can have that impact on the third largest economy in Asia it is vain to imagine that little old New Zealand can shield itself from these sorts of forces.”

He finished up by commenting that:

“NZIER’s principal economist Shamubeel Eaqub warns that if the latest emerging market scare becomes more serious “it will almost surely result in a recession in New Zealand”.

“A full-blown capital account crisis like the 1997/98 Asian financial crisis is not yet likely,” he says. “But it is possible and should be on the watch list.”

—–

So maybe it will be Asia’s turn to set off the next round of the global monetary meltdown? The US and Europe have each had a decent bout and some suffering even if there could well be more to come for them down the line yet.

If we’ve learnt anything over the past 6 or 7 years it has been to expect the unexpected. The benefit of hindsight makes the initial GFC in 2008 look very obvious now, as it does for the Euro crisis. Neither of which were seen coming by too many. These sharp moves of one currency versus another are of course symptoms of the slow but steady break down of the global monetary system.

So while the NZ dollar remains comparatively high and the price of gold and silver comparatively low, this would make now a pretty decent time to hedge for the unexpected. Please get in touch if you need a hand.

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week! Glenn (and David) goldsurvivalguide.co.nz Ph: 0800 888 465 From outside NZ: +64 9 281 3898 email: orders@goldsurvivalguide.co.nz

| Free Ticket to Live Gold Event in Auckland with Ronald Stoferle – In Gold We Trust |

2013-08-27 22:32:27-04

As mentioned a couple of weeks ago there are a number of high profile speakers being brought to New Zealand by our friend Louis Boulanger in the next couple of months. We can now confirm details for the first event featuring Ronald-Peter Stöferle – writer of the “In Gold We Trust Report” and how to get yourself a free ticket! When: 4pm […]

read more… 2013-08-27 22:32:27-04

As mentioned a couple of weeks ago there are a number of high profile speakers being brought to New Zealand by our friend Louis Boulanger in the next couple of months. We can now confirm details for the first event featuring Ronald-Peter Stöferle – writer of the “In Gold We Trust Report” and how to get yourself a free ticket! When: 4pm […]

read more… |

| Gold and Silver Almost Recoup April Losses |

2013-08-29 01:31:53-04

Gold Survival Gold Article Updates August 29,2013 This Week: Gold and Silver Almost Recoup April Losses Here’s how to see Ronald Stöferle (Writer of “In GoldWe Trust” Report) Live in Auckland for FREE! A Changing Gold Market The East Remains Key Gold and Silver Almost Recoup April Losses Yet again big moves over the […]

read more… 2013-08-29 01:31:53-04

Gold Survival Gold Article Updates August 29,2013 This Week: Gold and Silver Almost Recoup April Losses Here’s how to see Ronald Stöferle (Writer of “In GoldWe Trust” Report) Live in Auckland for FREE! A Changing Gold Market The East Remains Key Gold and Silver Almost Recoup April Losses Yet again big moves over the […]

read more… |

| Gold Stock Write-Downs: Death Sentence or Opportunity? |

2013-09-02 20:26:59-04

The plummeting gold price in April to June of this year had a dramatic impact on all gold producing companies. Here’s some thoughts on what the impact of these write downs may be, including what will happen to them if the gold price goes back up again and whether you should sell your shares in […]

read more… 2013-09-02 20:26:59-04

The plummeting gold price in April to June of this year had a dramatic impact on all gold producing companies. Here’s some thoughts on what the impact of these write downs may be, including what will happen to them if the gold price goes back up again and whether you should sell your shares in […]

read more… |

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

| Spot Gold | |

| NZ $1764 / oz | US $1391.97/ oz |

| Spot Silver | |

| NZ $29.73 / oz NZ $956/ kg | US $23.46/ oz US $754.38/ kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

Note: – Prices are excluding delivery – 1 Troy ounce = 31.1 grams – 1 Kg = 32.15 Troy ounces – Request special pricing for larger orders such as monster box of Canadian maple silver coins – Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more. – Foreign currency options available so you can purchase from USD, AUD, EURO, GBP – Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

Copyright © 2011 Gold Survival Guide. All Rights Reserved.

Pingback: Gold Wins Regardless | Gold Prices | Gold Investing Guide