While gold has been falling since the US election, Stewart Thomson outlines a number of bullish factors in play currently.

He theorises that gold could pop higher after the expected US Federal Reserve rate hike this week or perhaps more likely after Trump is inaugurated in the New Year…

Dollar Vs Yen: Good News For Gold

Graceland Updates

By Stewart Thomson

- Gold stocks and silver continue to exhibit substantial strength in the face of the decline in the price of gold. Is that strength hinting that a substantial rally will follow a Fed rate hike?

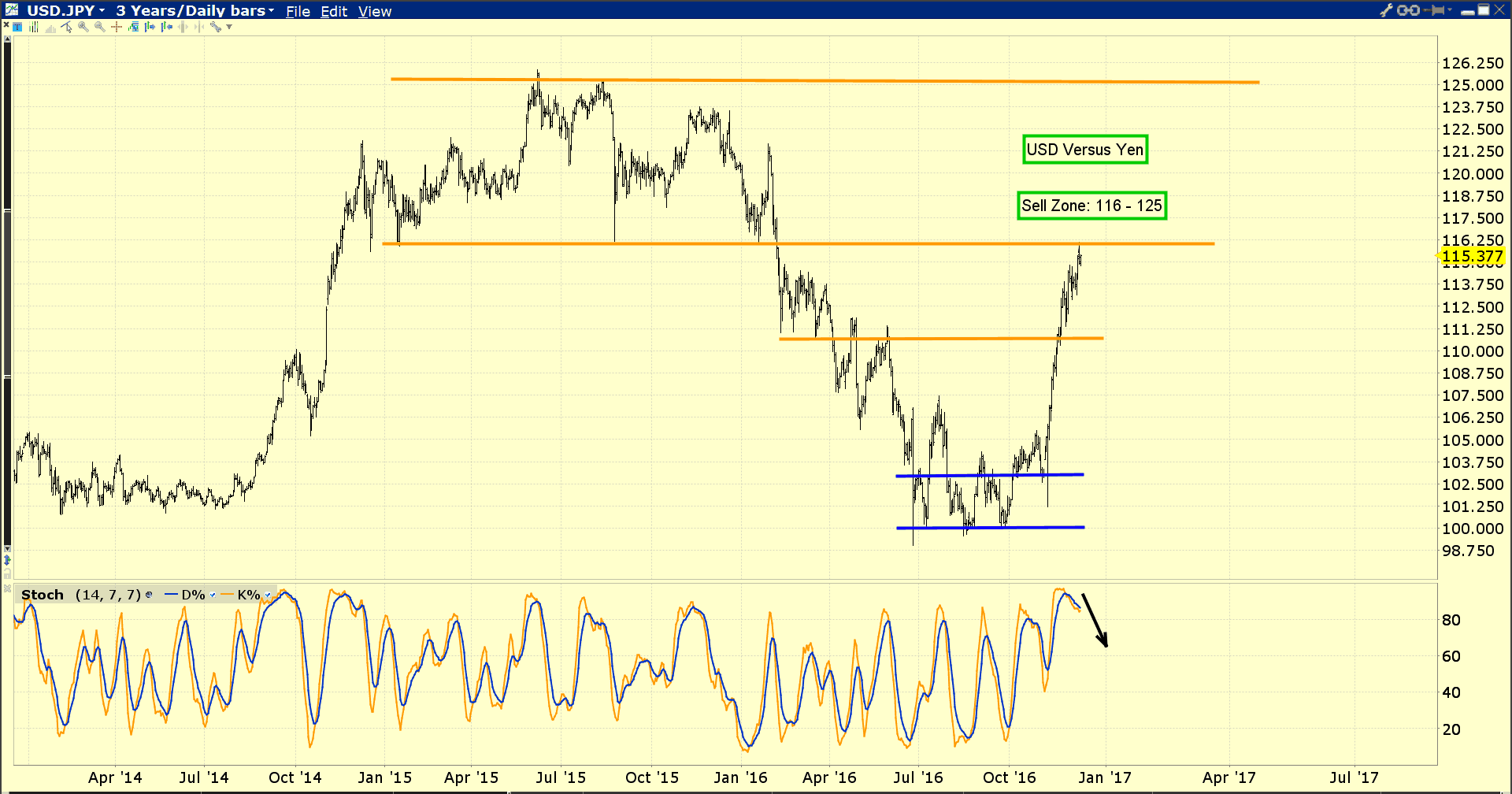

- For some further insight into the matter, please see below now. Double-click to enlarge this key dollar versus yen daily bars chart.

- The dollar has arrived at the major resistance zone of 116 – 125. The yen is the fiat world’s top risk-off currency, and gold is the ultimate risk-off asset.

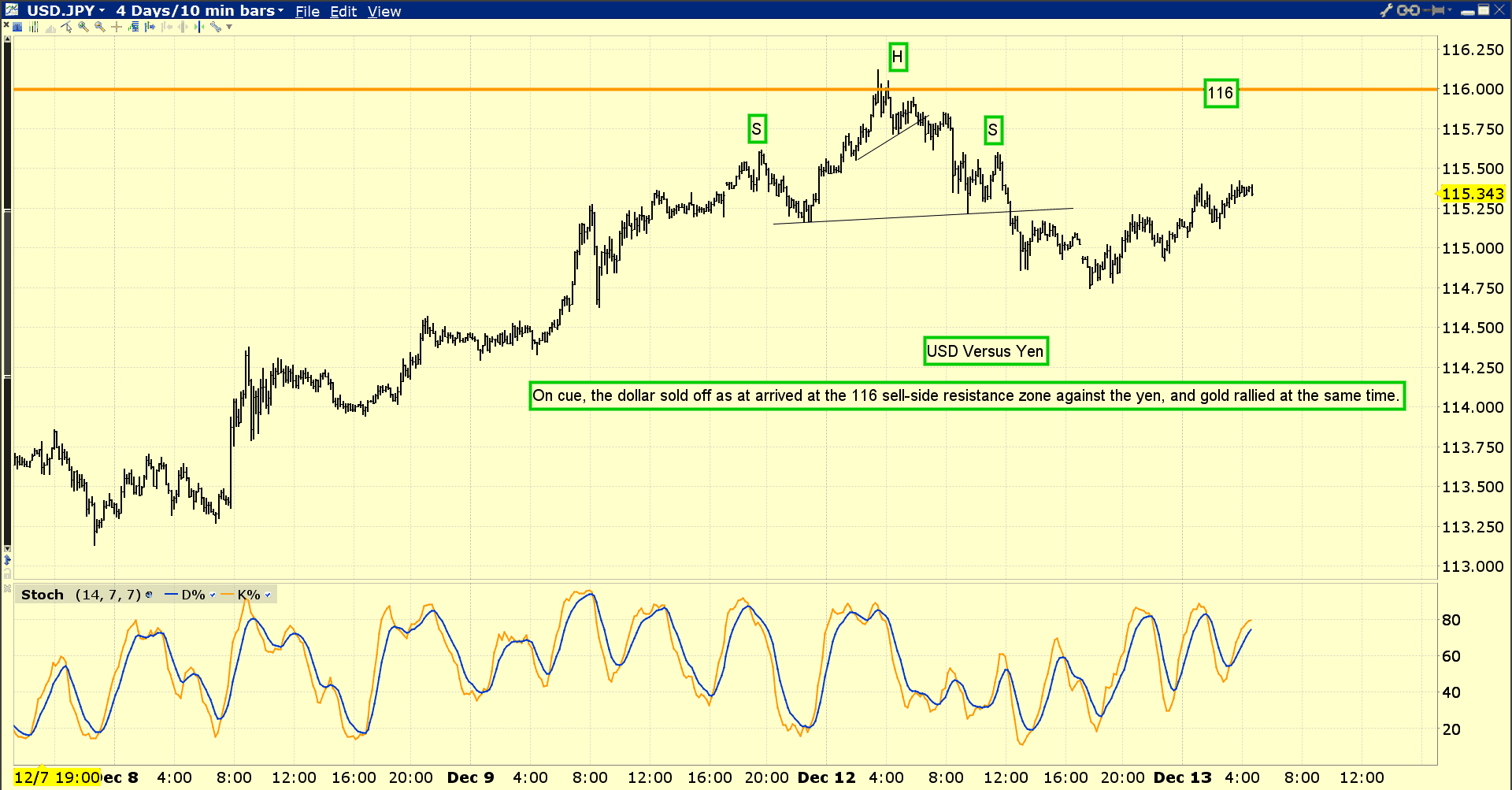

- So, it’s very important for gold bugs to watch the price action of the dollar versus the yen. For a closer look at the action, please see below now. Double-click to enlarge this 10 minute bars chart.

- At about 3:30AM on Monday morning, the dollar reached 116, and sold off from a small head and shoulders top formation.

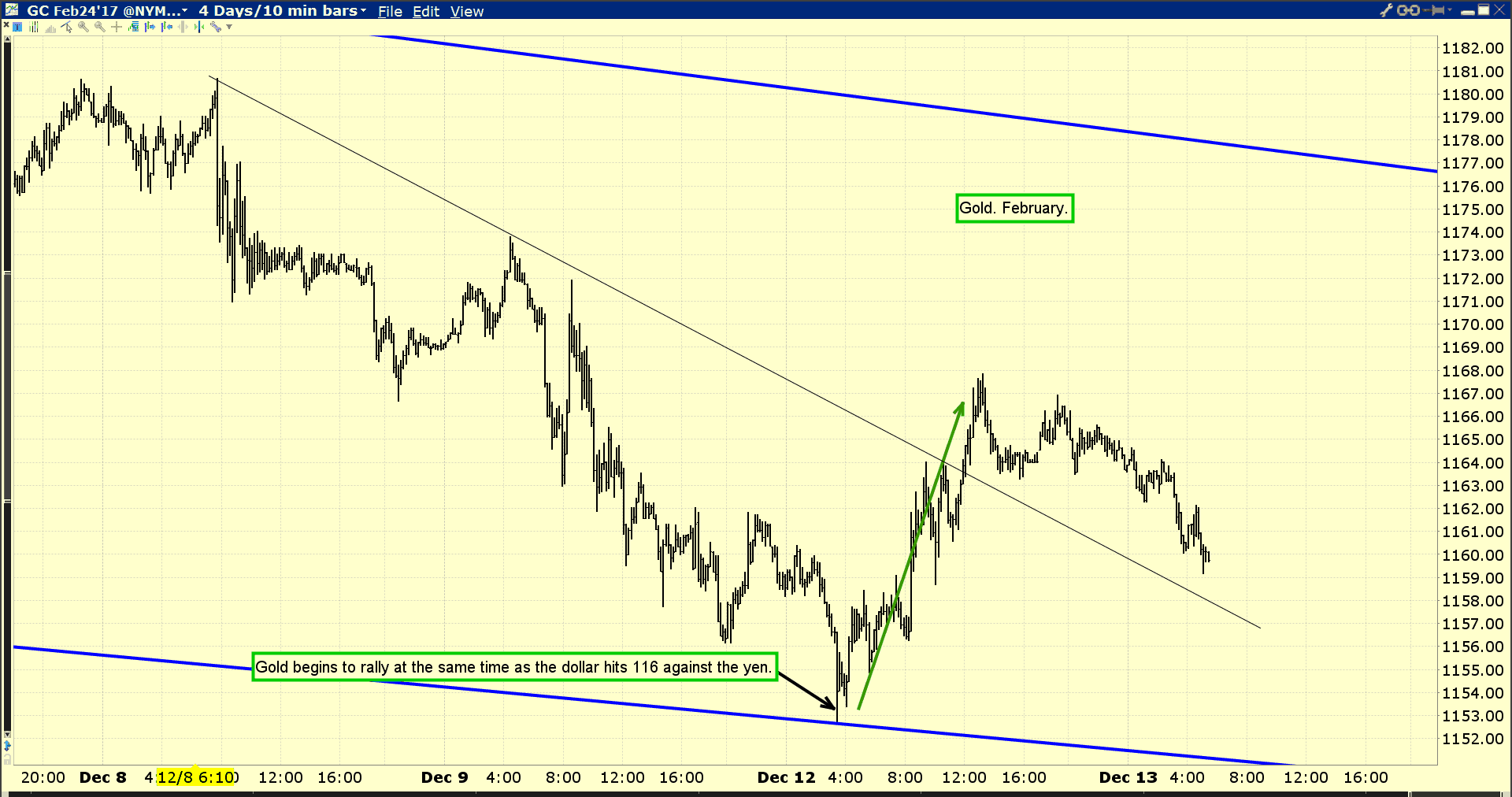

- To view the price action for gold in that same 3:30AM timeframe, please see below now. As the dollar recoiled against the yen, gold began to surge against the dollar.

- Whether 116 marks some kind of final high for the dollar is unknown, but there’s no question that just as gold was vulnerable in the $1320 area going into the US election, the US dollar is now equally vulnerable, going into the Fed meeting tomorrow.

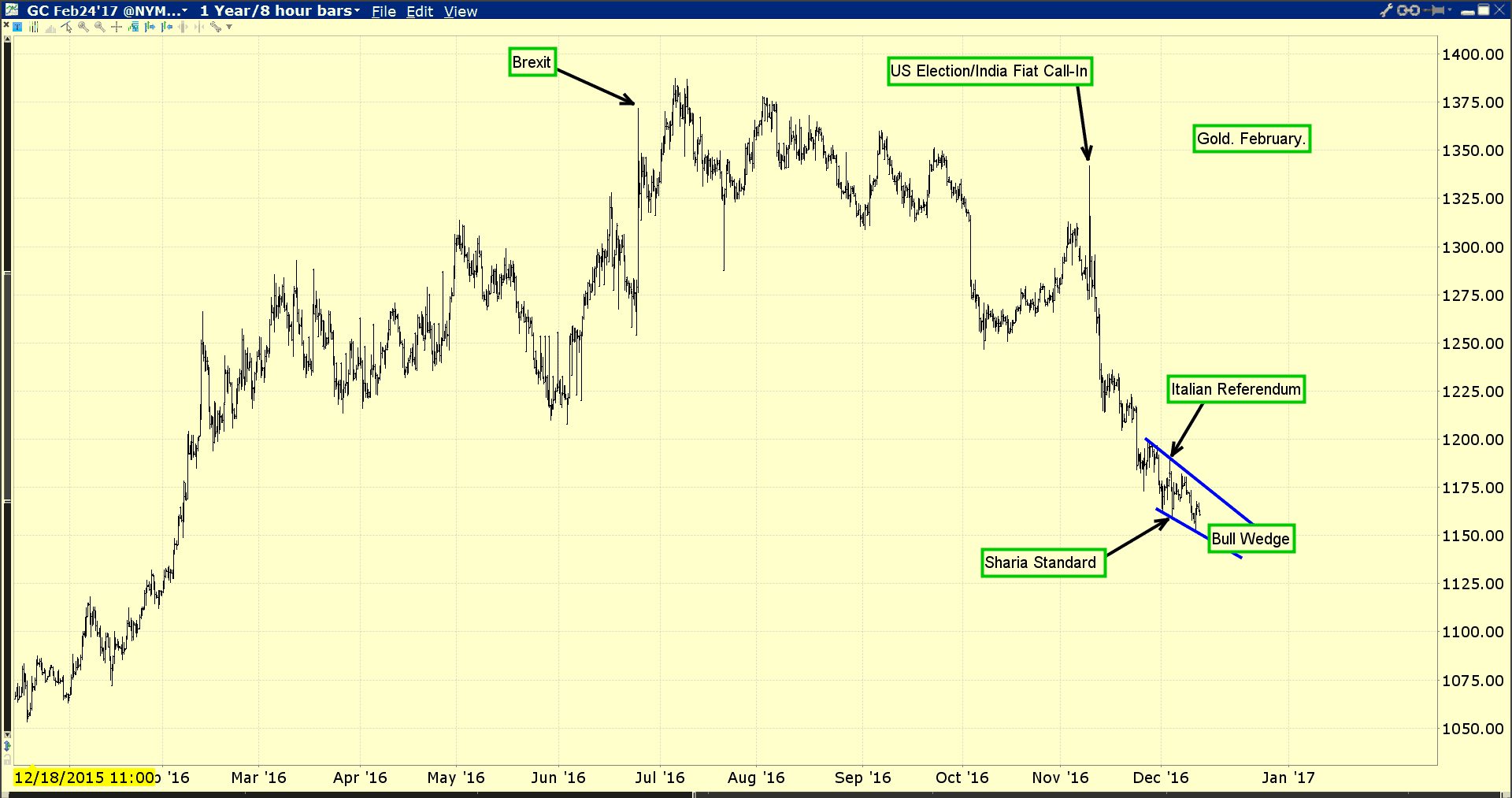

- Please see below now. Double-click to enlarge this daily bars gold chart.

- There’s a bull wedge pattern in play. Both technically and fundamentally, there are some great similarities between the current timeframe and last year, in terms of a potential rate hike and a gold price rally that follows.

- Unfortunately, there are also some important differences. There are rumours that Chinese capital controls are coming, and the government is restricting gold imports.

- That restriction is raising the gold price in China, but to raise the global price Chinese citizen demand must be allowed to be fulfilled.

- Janet Yellen has clearly stated that she seeks a “high pressure economy”, which is an economy where inflation is allowed to run higher.

- If she forcefully reiterates that view this week, the dollar could fall hard against the yen, and against gold.

- Also, banks are incentivized by rate hikes to make more loans, and a rise in loan activity is needed to increase velocity of the money supply.

- Regardless, my suggestion to gold bugs is to cheer for a post Fed meeting rally in gold, but be open to the idea that nothing too exciting happens until Trump gets inaugurated in January.

- Trump’s protectionist agenda is highly inflationary, and his tax cuts would help move money away from government, where it has no real velocity.

- In the private economy and fractional reserve banking system, it would get substantial velocity.

- For more good news on inflation, please see below now. While the fiat call-in in India may be responsible for a lot of the latest surge in oil demand, there’s no question that oil demand in India is growing at a very rapid rate.

- On the supply side, Iran and Russia appear to be ready to put a ceiling on supply. Against the background of inflationary rate hikes and “Trumpflation”, oil is extremely well-supported now, and poised to move higher.

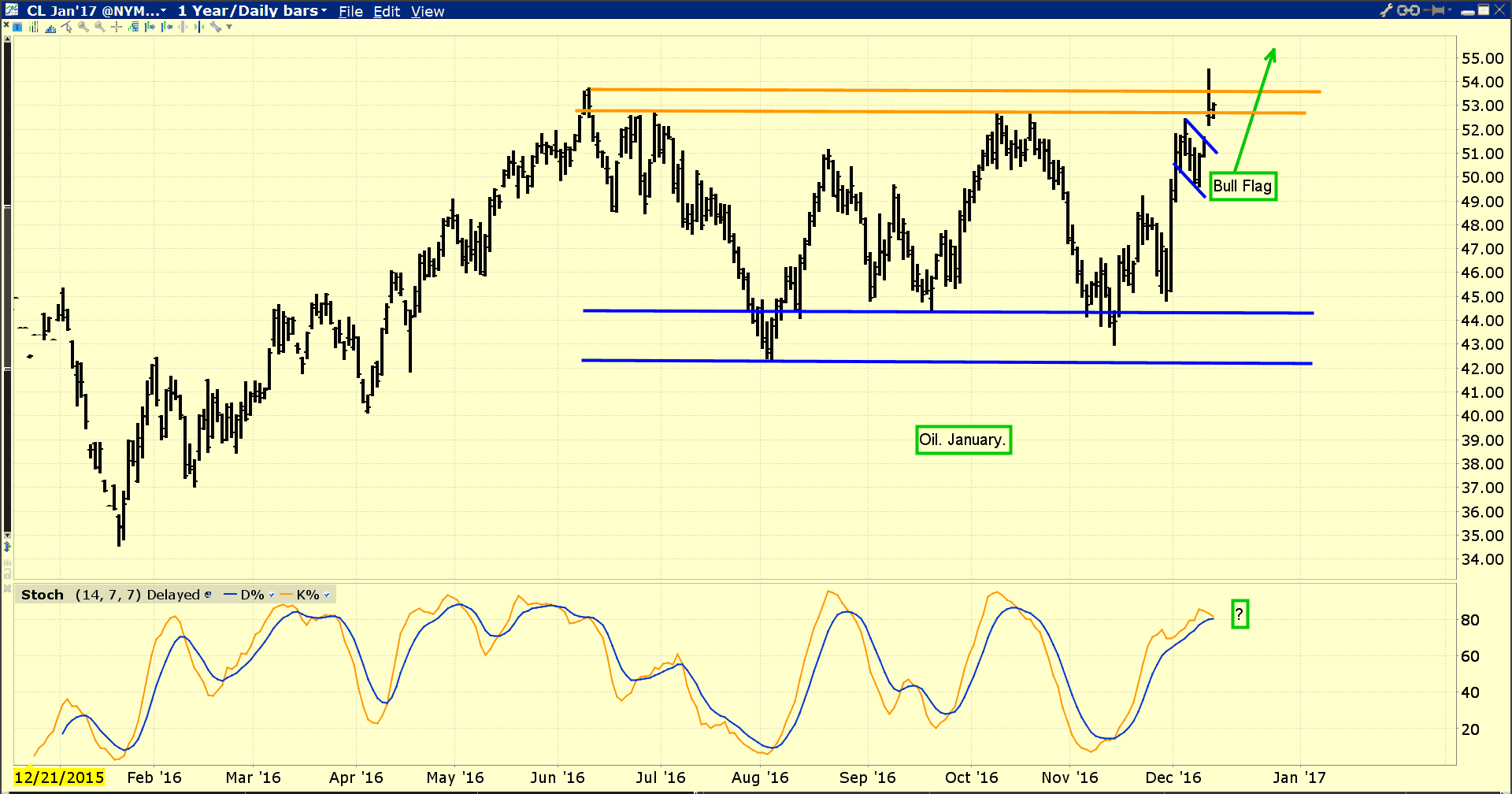

- Please see below now. Double-click to enlarge. Technically, oil also looks superb. There’s a bull flag in play. Oil appears set to burst upside from a sizable rectangle formation, with my target being the $63 area!

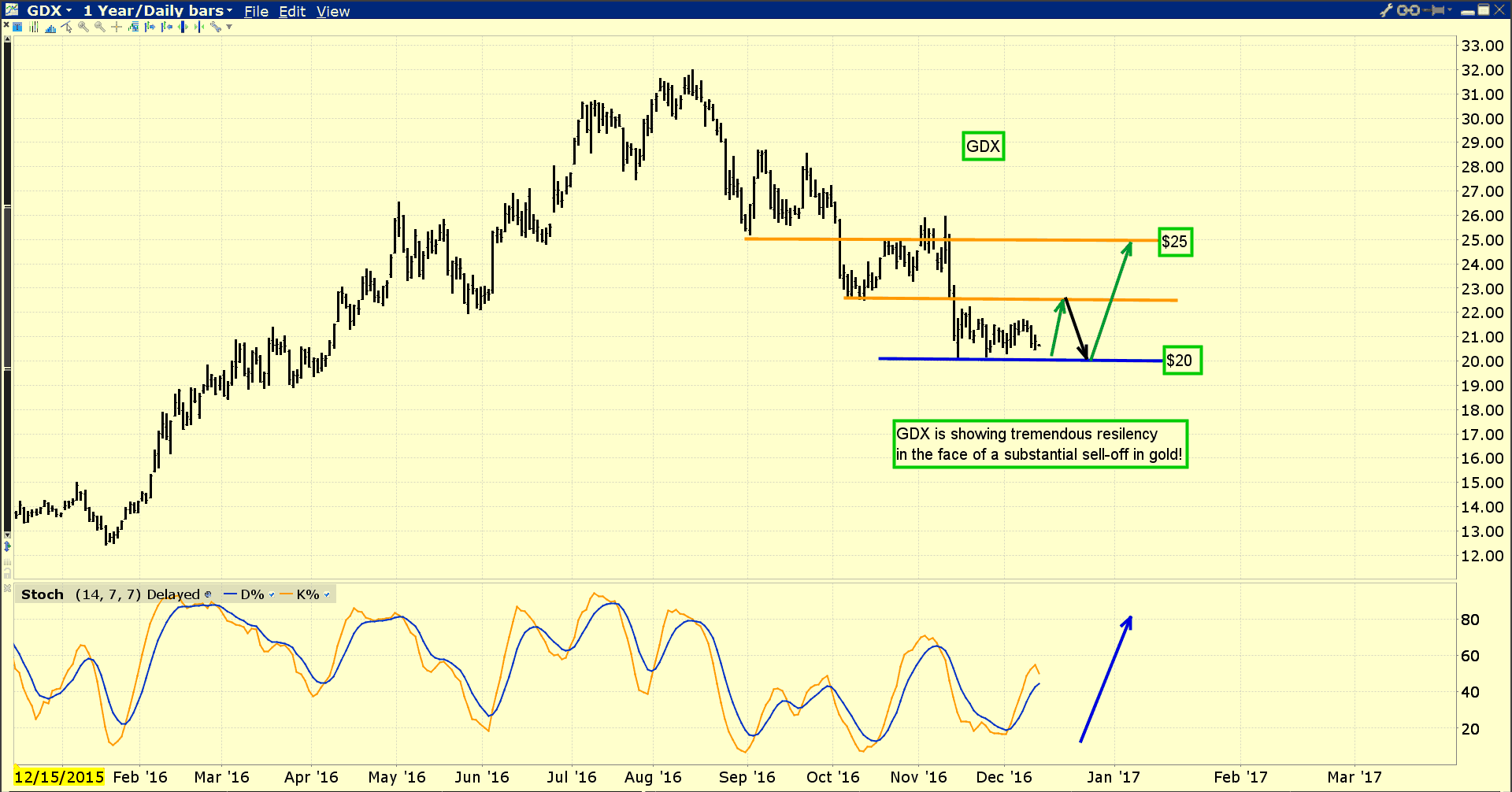

- Please see below now. Double-click to enlarge this GDX chart. As noted, gold stocks are showing phenomenal resiliency over the past month, in the face of what is roughly an $80 an ounce decline in the price of bullion!

- GDX is essentially unchanged in price, while gold gets hammered. In a deflationary environment centred on system risk, gold bullion dramatically outperforms gold stocks. In an inflationary setting, which appears to now be imminent, gold stocks absolutely destroy bullion, in terms of upside performance. GDX could trade as low as $18 before a major rally starts, but it’s starting to look like $20 is the floor.

- It’s quite possible, even likely, that Janet Yellen does not want to upset her new boss, Donald Trump. Trump wants inflation, and he likely knows the only “solution” to US government debt is serious inflation that helps debtors and damages creditors.

- Janet Yellen is likely to help Trump get that job done. Mainstream analysts are seriously underestimating the amount of inflationary pressure that Janet Yellen is willing to tolerate once Donald “The Golden Trumpster” Trumpbecomes America’s most powerful man, on inauguration day!

Thanks!

Cheers

St

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

https://www.gracelandupdates.com

Email:

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?