This Week:

- Recommended: See Catherine Austin Fitts In Auckland

- On Auckland Housing Bubble Theories

- Lower Interest Rates Becoming Consensus

- Inflation on the Horizon?

- Gold Digital/Crypto Hybrids Launching

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1615.07 | + $22.81 | + 1.43% |

| USD Gold | $1215.50 | + $22.90 | + 1.92% |

| NZD Silver | $22.81 | + 0.75 | + 3.39% |

| USD Silver | $17.17 | + 0.67 | + 4.06% |

| NZD/USD | 0.7526 | + 0.0036 | + 0.48% |

A big rebound higher in the NZ dollar this morning has dulled the rise for both metals locally.

However overall we’ve still seen continued moves higher this week, especially for silver with 3% and 4% moves higher respectively in NZ dollars and US dollars.

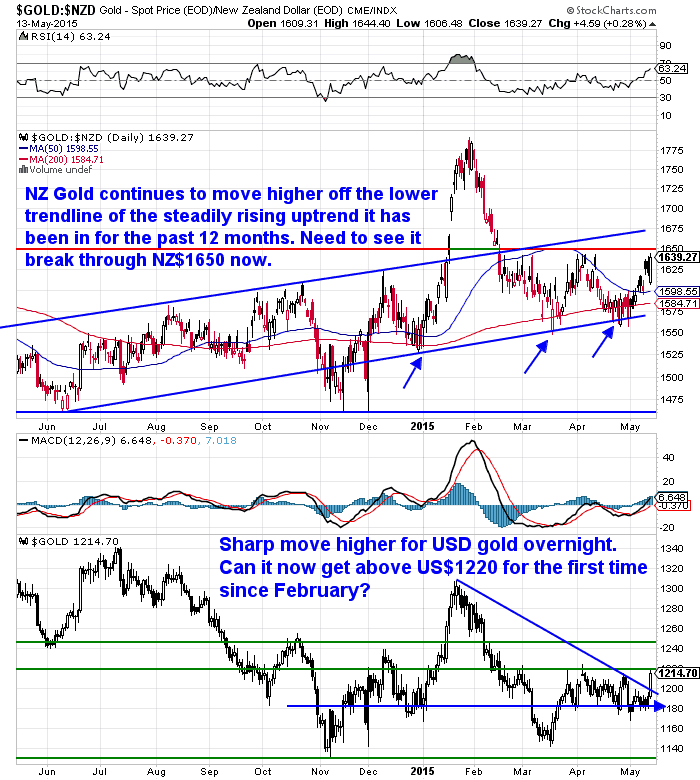

NZD Gold remains in the steady uptrend it has been in for the past year. While USD gold (bottom half of below chart) has actually broken out of the downtrend it has been in since January with a sharp move higher overnight. We’ll now have to wait and see if NZ$1650 and US$1220 can be broken through in the next little while. But our guess is that we could see a run higher from here now.

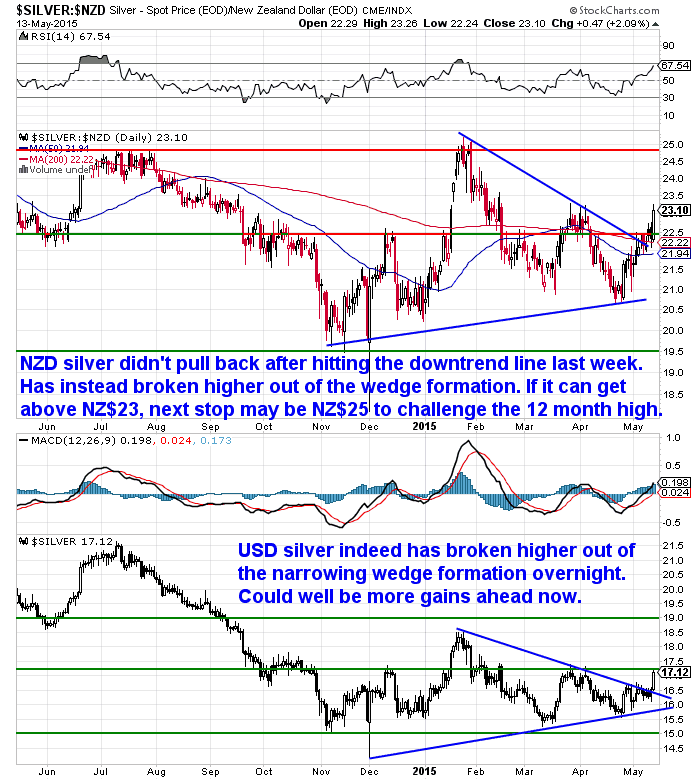

Silver in both local and US currency terms has broken out of the narrowing wedge formation it had been in for most of this year. So we could well see further gains ahead as there is not much resistance between where the price is now and a couple dollars per ounce higher.

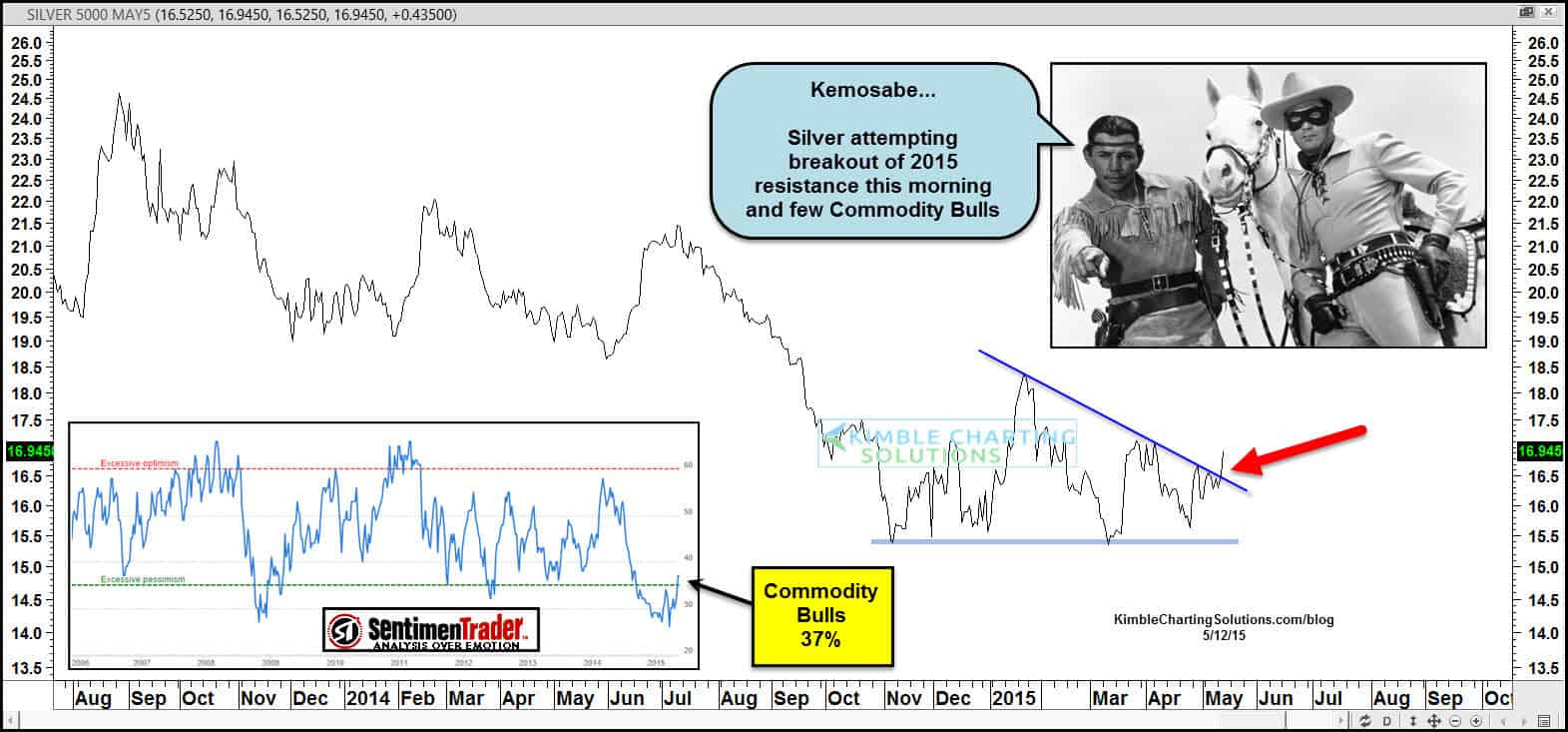

Another positive for silver is this breakout is happening with sentiment still very low as can be seen in the below chart from Kimble Charting Solutions.

Meanwhile a positive for gold is the correlation between it and the European Central Bank (ECB) balance sheet size as outlined by the NIA below:

“Over the last 7 weeks, the European Central Bank (ECB) has increased the total assets on its balance sheet by $401.5 billion or 17.81% to $2.656 trillion. This was its largest 7 week increase in total assets since mid-October 2008, when it responded to the Global Financial Crisis by increasing the total assets on its balance sheet by a record $530.4 billion or 24.95% to $2.656 trillion, which coincidentally was equal to the current size of its balance sheet today.

The ECB’s balance sheet expressed in USD has had an extremely strong correlation with gold dating all the way back to 1999 of 97.1%. The decline in the ECB balance sheet from its 2012 peak of $4 trillion, was primarily responsible for weak gold prices in recent years. On NIA’s chart matching up the ECB’s balance sheet in USD to gold, the ECB’s balance sheet has now surpassed gold for the first time in 11 months. More importantly, the ECB balance sheet now has tremendous upward momentum for the first time in 3 years – and is expected to rise back to its record high of $4 trillion by year-end 2016. Therefore, as the ECB’s balance sheet rises by $1.344 trillion or 50.6% to $4 trillion over the next 20 months – for an average monthly increase of $67.2 billion – look for gold to rise by $602 or 50.6% to $1,792 per ounce, for an average monthly increase of $30.10 per ounce!”

On Auckland Housing Bubble Theories

An interesting article by Gareth Morgan and Geoff Simmons of the Morgan Foundation last week. They say:

Tax change the right pin to pop Auckland’s housing bubble

“Auckland’s housing market is now almost certainly in bubble territory, the most certain sign being the irrational reaction to the Reserve Bank Deputy Governor’s comments two weeks ago. Bank economists and politicians alike have been flailing, claiming that taxing housing isn’t the answer but unable to provide any viable alternatives.

The Reserve Bank is late to the party with its call for changing the tax treatment of housing, but right. These changes should have been done before Brash, before Bollard – that means more than 25 years ago.

These problems caused by tax loopholes and favouring of mortgage lending continue to build a massive misallocation of investment in New Zealand. This undermines our growth, because we do what the tax system tells us to do and invest in housing rather than businesses. The resulting growth in house prices is also the largest driver behind increasing inequality in the Western world.”

Source.

We’d agree that the “growth in house prices is also the largest driver behind increasing inequality in the Western world.”

However we think they fail to look deep enough as to the cause. They believe the tax system and favouring of mortgage lending encourages us to invest in housing, which it likely does.

But would taxation changes necessarily change this?

Our contention would be that a monetary system, where money is debt and that requires ever expanding debt to continue will inevitably lead to assets such as housing to be highly leveraged.

Sure, rules that didn’t so favour lending against residential property may dent this rise in asset prices.

As we mentioned last week, the structure of the banking system in Germany certainly seems to have led to less speculation in housing and more investment in business.

But at the end of the day, we still maintain that it is money that is debt is the chief problem.

Of course this doesn’t stop the Central Planners from trying to “improve” things. You’ve no doubt heard the headlines that the Reserve Bank has announced new LVR restrictions on Auckland housing.

They’re taking aim at property investors as if they are the sole cause of the ever rising house prices. No doubt these will have some unintended consequences and investors will find ways around rules as creative people always do.

Lower Interest Rates Becoming Consensus

Meanwhile there are even more people over on our “side of the ship” expecting lower interest rates in NZ ahead.

Source.

They even reckon there’ll be one cut in June and another in July.

To be honest it starts to feel a little uncomfortable when the bank economists are agreeing with us! The difficult thing to predict now is when there are too many on this side of the ship and when it’s time to take the other side and expect higher rates. Might be too early for that yet as the cuts haven’t started yet.

Easy money continuing the world over looks likely with China cutting rates last week.

A China Daily headline reckons:

So we have China, Europe, Japan, Australia just to name some, all turning up the easy money tap in recent months and weeks. NZ may soon follow too.

Globally very low inflation is becoming expected now too.

But at some stage people may get a surprise as things flip in the other direction.

We read an interesting note from Bill Bonners daily letter this morning highlighting what most wouldn’t expect:

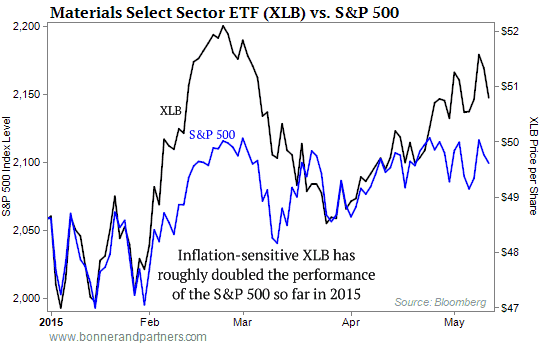

by Chris Hunter, Editor-in-Chief, Bonner & Partners“If you think inflation is gone for good, take a look at today’s chart…

It tracks the performance of the Materials Select Sector SPDR ETF (NYSE:XLB)against the SPDR S&P 500 ETF Trust (NYSE:SPY).

The materials sector includes companies operating in the chemicals, mining, forestry, and construction industries. And along with the energy sector, it is one of the most inflation-sensitive sectors in the S&P 500.

That’s because, like energy, demand rises for basic materials as growth – and inflation along with it – picks up.

As you can see, so far in 2015, investors in the materials sector have enjoyed roughly double the returns of the S&P 500. XLB has returned 4.5% year to date versus a gain of just over 2.1% for the S&P 500.

That, plus the rise in Treasury yields I flagged yesterday, should give pause to investors betting on a continued deflationary outlook.”

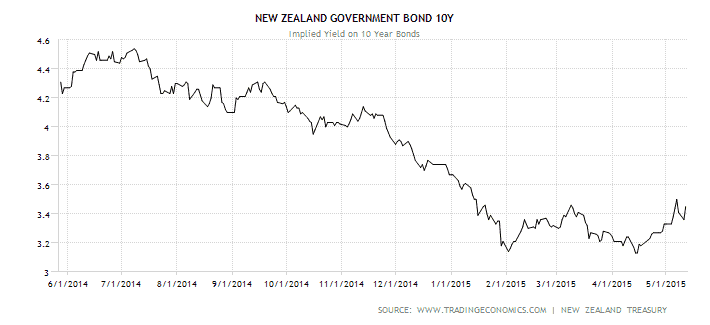

As noted above by Chris Hunter Government Bond Yields across the planet have bounced up sharply since last month, including those in the US, Germany and here in NZ too – as per the chart below of 10 year NZ Government bonds.

Some have called this as likely to be the end of the multi decade bull market in bonds (remember Bond prices rise as interest rates fall, so this is another way of saying interest rates are rising). Although it might be too soon to make that call we’d say, but at some point rates will have to rise. But maybe not just yet.

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $395 you can have a 60 day long life emergency food supply.

Learn More.

—–

Gold Digital/Crypto Hybrids Launching

We’ve seen a couple of headlines this week announcing new Gold digital/cryptocurrency hybrids being launched.

It will be interesting to see what the uptake of these are. We’ll be keeping a close eye on them for sure although think we’ll stay on the sidelines for now.

It seems there is a battle looming between the current big, global and top down monetary system and a bottom up, decentralised, local and free market monetary system.

This was well summarised in this Daily Bell article where they discussed a couple of these new developments and concluded:

Source.

See Catherine Austin Fitts (of the Solari Report) Live in Auckland

Last week we mentioned Catherine Austin Fitts will be speaking in Auckland on Saturday May 23. We’ve posted full details of this on the website along with a recent interview she did with Greg Hunter of USAWatchDog.

Last week we mentioned Catherine Austin Fitts will be speaking in Auckland on Saturday May 23. We’ve posted full details of this on the website along with a recent interview she did with Greg Hunter of USAWatchDog.

So check that out if you haven’t heard of Catherine and want a taste of what she might cover next weekend.

As it happens in that interview she also touches on this battle between more globalisation and centralisation (think global IMF SDR currency) and the decentralisation being brought about by technology. An interesting interview and worth watching even if you can’t make it next weekend.

See Catherine Austin Fitts (Solari Report) Live in Auckland

Our theory is that holding gold in your possession hopefully offers protection regardless of the outcome. If the elite win out and we get an even more centralised global currency, it appears likely this may have some gold backing.

If freedom wins (here’s hoping that the Daily Bell is right and it does!) we will likely see money of a free market variety with various competing currencies, possibly like the hybrid forms mentioned earlier. History says if people are given the choice gold (and silver) will likely rise to the top of the list.

With both metals appearing to be building a solid base currently, this offers a good chance to get some of this protection. Get in touch if you’d like help getting some.

Free delivery anywhere in New Zealand and Australia

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $13,720 and delivery is now about 7-10 business days.

This Weeks Articles:

|

|

|

|

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| Today’s Spot Prices Spot Gold |

|

| NZ $ 1615.07 / oz | US $ 1215.50 / oz |

| Spot Silver | |

| NZ $ 22.81 / oz NZ $ 733.34 / kg |

US $ 17.17 / oz US $ 551.91 / kg |

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon. Have a golden week! David (and Glenn) GoldSurvivalGuide.co.nz Ph: 0800 888 465 From outside NZ: +64 9 281 3898 email: orders@goldsurvivalguide.co.nz |

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2013 Gold Survival Guide. All Rights Reserved. |