This Week:

- Gold Gets Shellacked Again

- 3 Reasons Why Gold is Falling Again… And Our Thoughts on Each of Them

- How Much Further Might Gold Fall – What About in NZ Dollars?

- Forget Housing Bubble, NZ in a Major Bond Bubble?

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1652.43 | – $93.81 | – 5.37% |

| USD Gold | $1094.90 | – $55 | – 4.78% |

| NZD Silver | $22.41 | – $0.58 | – 2.52% |

| USD Silver | $14.85 | – $0.29 | – 1.91% |

| NZD/USD | 0.6626 | + 0.0041 | + 0.62% |

Gold Gets Shellacked Again

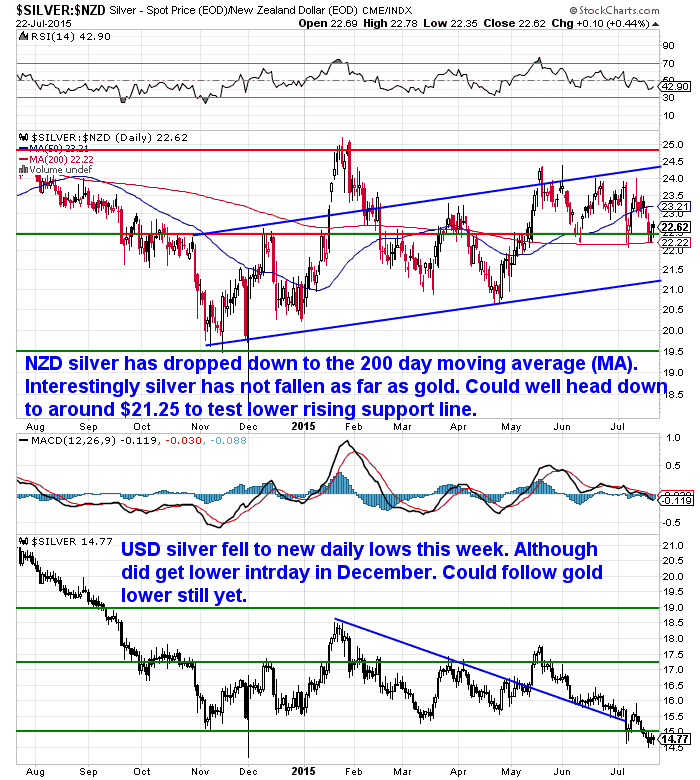

Another (perhaps) stomach wrenching plunge for gold this past week. In USD terms it is now at record lows as can be seen in the bottom half of the chart below.

What was the reason for this fall?

Who knows for sure, but we hazard a few guesses in one of our articles this week.

Who knows for sure, but we hazard a few guesses in one of our articles this week.

3 Reasons Why Gold is Falling Again… And Our Thoughts on Each of Them

Interestingly silver didn’t fall as much in percentage terms, but is still at new lows in US dollars too.

However as you can see in the charts above in NZ dollar terms (top half of charts) both metals are still well above their lows, just as they are in most other currencies across the globe.

So what does the current fall mean for holders (or buyers) of gold and silver in New Zealand?

We take a look at this question in our other article this week:

We take a look at this question in our other article this week:

How Much Further Might Gold Fall – What About in NZ Dollars?

It also covers how silver hasn’t really followed gold lower yet. And how you might need to take rising premiums into account when considering buying.

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $395 you can have 60 days long life emergency food supply.

Learn More.

—–

“Young Guns of Gold” Roundtable

We’re part way through watching this roundtable discussion between a number of knowledgeable gold experts from Australia and Europe that you might want to check out too.

It features Jordan Eliseo of ABC Bullion in Sydney, Bron Suchecki of the Perth Mint and Ron Stoeferle of Incrementum and Mark O’Byrne of GoldCore.

We’ve met the first 3 and have enjoyed hearing what they have to say over the years. So we guess you might too.

They cover Greece, China, manipulation, interest rates and the outlook for precious metals.

https://www.youtube.com/watch?

Or there’s a brief overview of what they cover on this page.

Forget Housing Bubble, NZ in a Major Bond Bubble?

We’ve kept an eye on bond prices in New Zealand over the years. Record low interest rates mean record high bond prices (Bond prices are inversely correlated to interest rates).

So it was with interest that we noted some stats from the National Inflation Association on bubbles brewing around the world. For all the talk of housing bubbles in Auckland, we haven’t seen NZ’s bond market with the B word after it until now.

Based on historical data New Zealand came in at number 6 globally in bond bubble size.

They “calculated the price of each country’s 10-year bond as a percentile of their historical daily 10-year bond prices going back to 1980. 16 countries have 10-year bond percentiles of above 90% and are experiencing major bond bubbles: Sweden, Norway, Japan, France, Switzerland, Italy, New Zealand, the Netherlands, Spain, Canada, Germany, Australia, Ireland, South Korea, the United States, and Hungary.”

Click here to see their complete global 10-year bond asset bubble percentile data.

So what does a Bond Bubble mean?

Well at some point these overpriced bonds will take a turn down. This means interest rates will rise.

Maybe those nations with the highest bond prices might correct the most, meaning interest rates will rise significantly. This will likely come as a nasty shock to people after years of low rates.

But, for now in NZ the trend still seems to be falling interest rates. All the bank analysts seem to expect at least another two 0.25% interest rate cuts this year.

Actually we forgot to mention the RBNZ did cut rates this morning by 0.25%. The NZ dollar rose back up on the news, so it seems like lower rates may be priced in already now. So the Kiwi could strengthen a bit from here too.

Final Thoughts

There certainly has been plenty happening this past week.

Odds are we’ve got a bit of volatility coming yet. If you’re thinking of buying gold or silver here’s something to consider…

There’s a good chance of further downside ahead, but odds favour this being close to a bottom.

So you may want to consider how much of your paper wealth you want to convert into tangible assets with no counterparty risk. Then break this up into chunks of say 4 or 5 and buy over a number of weeks or months.

It’s going to be hard to pick the bottom so this way you should get a decent entry price overall.

Just a thought. As always, conduct your own research and make up your own mind. But if you have any questions, we’re here to answer them via phone, email, or live chat.

Free delivery anywhere in New Zealand and Australia

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $13,875 and delivery is now about 7-10 business days.

** Urgent Message for All Car Owners **

A compact, revolutionary tool can save your life.

We believe everyone who drives or rides in a vehicle must carry this tool.

The Keychain Car Escape Tool can save lives.

For less than the price of 2 movie tickets you can get 2 of these. One for each car in your family or give one to someone you care about.

This Weeks Articles:

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|