In our subscriber survey a couple months ago a number of readers mentioned how some information on NZ and Australian gold mining shares/stocks would be useful. So in response we’ve managed to negotiate some exclusive free reports from Fat Prophets.

Founded by New Zealand born Angus Geddes in 2000, Fat Prophets is an Australian based stock market research house providing insightful reports, recommendations, and investment / wealth management services. They have also recently opened a New Zealand office and you can hear their N.Z. Chief Greg Smith regularly featured on 1ZB.

Fat Prophets have been bullish on Gold since 2002 and their Australasian share portfolio is heavily weighted to precious metals mining shares. In this exclusive excerpt from their latest stock report they profile an Australian mid-tier gold producer. Keep your eyes peeled for more free reports from Fat Prophets in the coming weeks…

Evolution Mining

Will be an Australian mid-tier leader

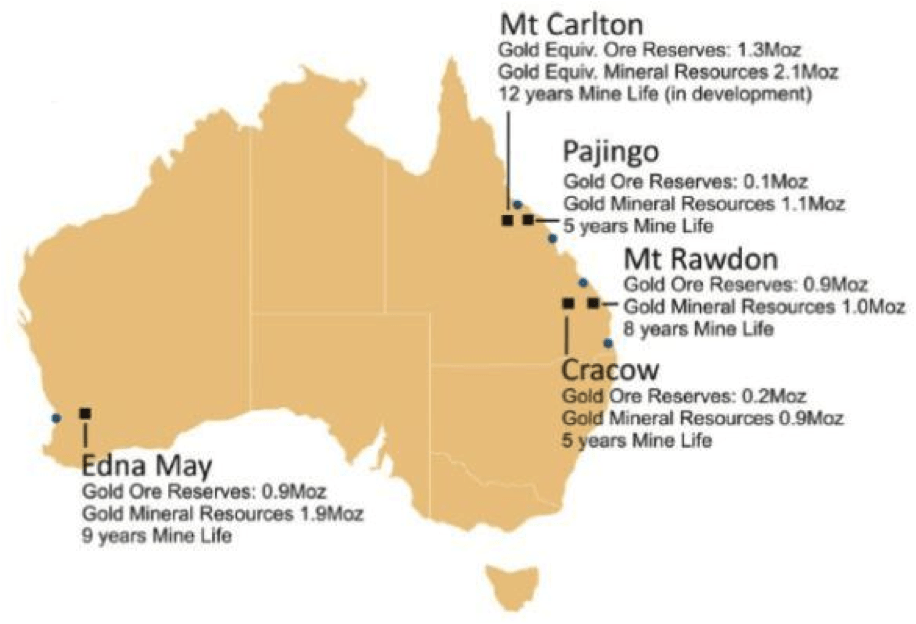

We continue to be encouraged by the progress being made across the project portfolio at Evolution Mining (EVN). Evolution currently operates four gold mines in Australia and is currently developing a fifth in Queensland. EVN is targeting 335-375k oz of production in the current financial year, moving to 410-465k oz of gold equivalent production in FY13. If these targets are achieved this will place EVN as the 3rd largest Australian gold producer behind both Newcrest and Alacer gold.

Evolution was formed by the merger of Catalpa and Conquest last year, and since the deal we have seen some very significant management and board changes. The most important being the appointment of Jake Klein who has taken on the role of Executive Chairman and MD of the group. The MD was formerly the head of Catalpa, Bruce McFadzean. Jake Klein has a an impressive track record particularly with Sino Gold which he took from being a junior miner into a multi-billion dollar market cap company which was subsequently taken over by global gold major Eldorado Gold.

Financials

Evolution Mining released its maiden First Half 2012 result in February, reporting a headline net loss of A$17.9 million for the half. The result was primarily driven by a A$29.4 million charge arising from the merger, in late 2011, between Catalpa Resources and Conquest Mining to form Evolution Mining. However underlying profit of A$20.2 million better reflects the performance of underlying operations.

The company reiterated gold production guidance for the 2012 year, to be in the range 335,000 to 375,000 ounce and 410,000 to 465,000 ounces for 2013.

Evolution also has substantial financial flexibility with which to support core assets. The company has cash of A$167.4 million and bullion of A$40.6 million. Debt stands at A$43.9 million. Excluding bullion the company is in a net cash position.

Asset Portfolio

Critical to the progress of whole portfolio here is not just about reaching these production targets; but also demonstrating reasonable cost control across the assets overall as these assets develop and reach steady state production.

Edna May

Edna May operates an open cut mine which is low grade, high cost. There is also the underground development that has been progressing in the background. EVN recently announced that the underground resource had been upgraded by some 70%. Albeit, off a low base, we now have an underground resource that complements the open pit resource of 270k oz grading around 7 grams per tonne. This compares to the open pit currently grading 1.1 grams per tonne.

Two main domains of this mineralisation include;

a) High grade quartz reef mineralisation – 490,000 tonnes at 8.8g/t for 140,000 gold ounces; and

b) Halo mineralisation – 720,000 tonnes at 5.8g/t for 130,000 gold ounces

As Jake Klein recently commented, ‘This is an encouraging addition to our efforts to maximise the value of Edna May. Our focus at the operation over the next 12 months remains on improving the reliability and performance of the plant, but underground development represents an option for adding value to the long term future at Edna May.’

Mt Carlton

Mt Carlton is currently at development stage and on track to be commissioned by year end. This asset will provide a significant boost to Evolution’s growth profile in the coming years. The deposit is expected to produce 95k oz of gold equivalent at an average cash of $600 per oz of gold equiv. This will have effect of lowering cash costs overall. Mt Carlton will produce gold, silver and copper.

Ex – Newcrest assets…

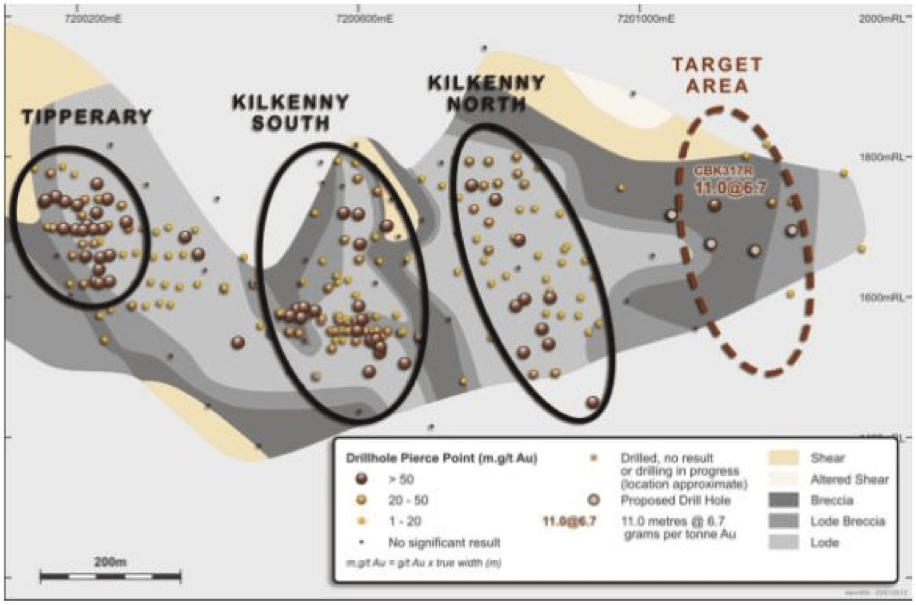

Cracow and Mt Rawdon which were acquired as part of the formation of EVN were an insignificant part of Newcrest’s Mining portfolio (approximately 3%). As such they demanded little management attention relative to others and suffered as a result. Under EVN’s ownership these assets represent over a quarter of the asset base of EVN and as such will be a key focus of management attention. In our view they are likely to be better managed and as a result see more value extracted in terms of both current operations and exploration.

This is already evident at Cracow with new targets area already identified along strike from Kilkenny North.

Drill results here include;

a) 2.03m grading 7.59g/t Au

b) 11.02m grading 6.76g/t Au

c) 1.74m grading 5.47g/t Au

We await quarterly results for further details on the progress on the production front. We believe that 80-85k oz for the March quarter remains feasible. Over the next few years EVN will in our view reach steady state production of 500,000 per annum from 5 key assets. Once this milestone production level is reached, Evolution will warrant a premium to valuation.

We believe that Jake Klein and his management team have the ability to meet this production target. The exploration upside in each of these assets is also significant and is now being given due management focus. We should not underestimate the knowledge and information available from EVN’s relationship with Newcrest which has a significant shareholding of 33%. Assets that may be immaterial to Newcrest may be a source of future acquisitions for Evolution. These are likely to be highly accretive.

Fat Prophets continue to believe that gold prices will go ever higher in the years ahead, further underpinning the Evolution growth story. As such we recommend the shares as a buy.

Interested in further research from Fat Prophets?

Email richard.kellow@fatprophets.com.au or call their Auckland office on (09) 306 8934 and say Gold Survival Guide sent you.

Are these free reports useful? Please leave a comment below if you’d like to see more of these…

Pingback: China’s gold imports up tremendously: What does it mean? | Gold Prices | Gold Investing Guide

Pingback: Australian Gold Miner Newcrest Still a Buy - Free Report | Gold Prices | Gold Investing Guide