Feb. 13, 2014

This Week

- Why Has the Gold Price Been Falling?

- Debt ceiling “suspended” but not raised

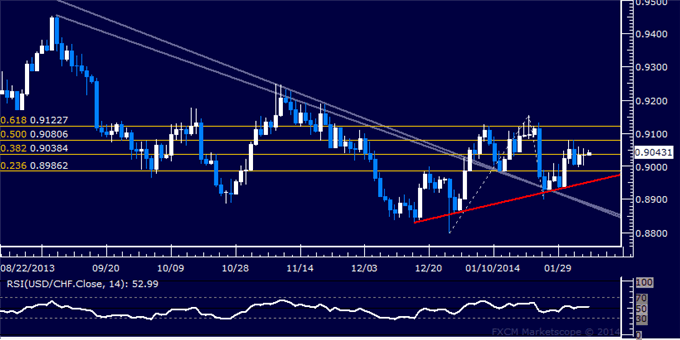

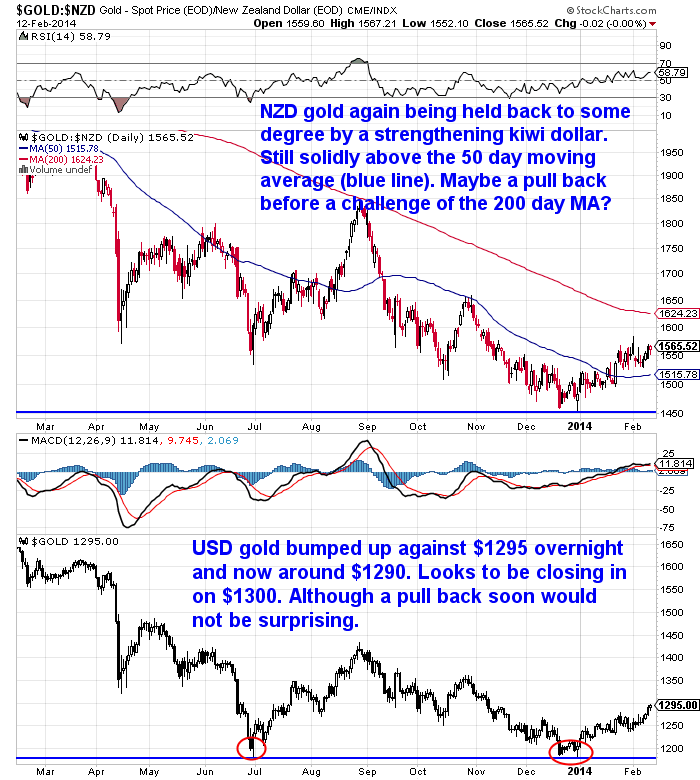

Gold has continued its slow but steady rise over the past week. If you take a look at the chart below, the current rise since the start of the year has not been as sharp as the four bounces that occurred last year in April, June, August and October. So we think this might favour the current run being the start of a longer term uptrend. So far the price has risen pretty quietly and any attention it has received in the mainstream has mainly been of the kind that this is a “dead cat bounce”.

However we did note an article appeared in Tuesdays NZ Herald noting the rise in the gold price over the past month, so perhaps this could be an indicator of a dip to come now?

Overnight in the USA the US dollar gold price reached $1295 so is getting close to the $1300 mark. However most mining shares were actually down this morning, and as we’ve mentioned over the past month they often lead the physical price higher and lower. So another sign we could be due a pull back from here. Although we remain of the opinion that we have more than likely seen a bottom for gold, so reckon odds are the late December lows will hold.

NZ dollar gold is up $24.25 per oz or 1.58% since last Wednesday.

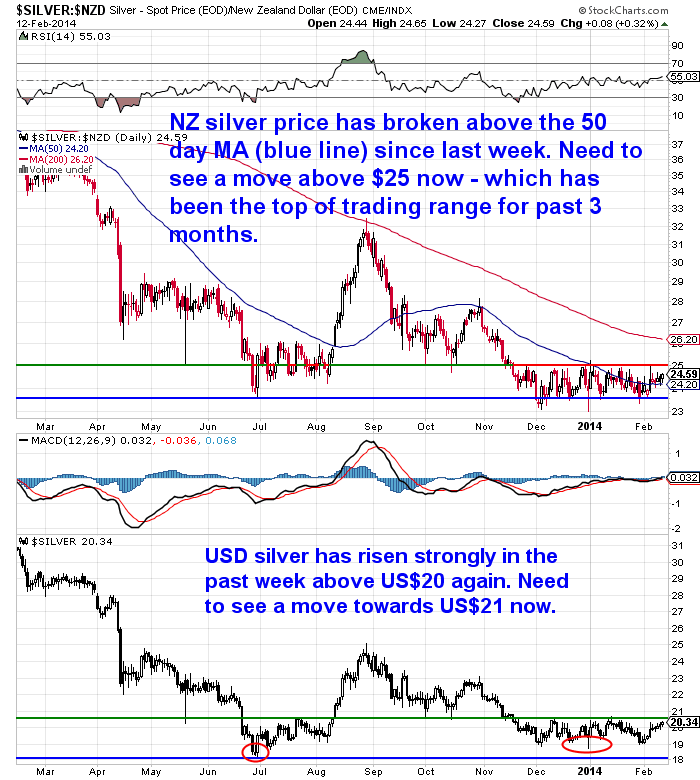

While silver priced in NZ dollars is up 58 cents per ounce or 2.43% from our email a week ago. You can see in the chart below silver remains within the narrow range it has been in since mid November. However over the past week it has moved above the 50 day moving average line, so this might indicate a change in trend. We’ll need to see a move above NZ$25 to confirm this.

Debt ceiling “suspended” but not raised

US lawmakers have overnight “solved” the US debt ceiling problem for another year. By “suspending” the ceiling until 15 March 2015.

CNN reports:

—–

“On Tuesday, the Treasury Department reported that the nation’s borrowing limit automatically reset to roughly $17.2 trillion, after the last suspension expired on Friday.

Here’s why: Suspensions have become lawmakers’ favorite way of “raising” the debt ceiling. They let Treasury borrow as needed to pay the bills and avert default. And when the suspension ends, the debt limit resets to the old cap plus whatever Treasury borrowed during the suspension period.

In other words, a suspension doesn’t technically raise the debt ceiling, but that’s the net effect.

The beauty for Congress is that lawmakers don’t have to go on record as voting for a formal increase by a specific dollar amount.

The reset to $17,211,558,177,668.77 marks the fifth effective increase in the debt ceiling since August 1, 2011, when it was $14.3 trillion.

The debt ceiling suspension approved this week by both the House and Senate will last through March 15, 2015. The Bipartisan Policy Center estimates that between now and then Treasury will have to borrow roughly $1 trillion.”

—–

So the US government gets to keep spending more than it takes in for another year which will probably amount to an extra $1 trillion. Meanwhile the likes of the Chinese are not the buyers of US bonds they once were and new Fed Head Janet Yellen still expects to continue with their taper of QE by years end. Wonder where that extra trillion is going to come from?

Why Has the Gold Price Been Falling?

This week we received a good question from a reader of our ecourse, as to why, with all the trillions that have been printed by central banks over the past few years, has the gold price not been rising but instead falling?

Such a good question prompted us to put together our best guess as to why this has occurred. So if you’ve wondered the same thing then you’ll want to check that out. And be sure to leave us a comment at the end with your own theory on why gold has been falling and if you think this year may be a better one for gold.

Such a good question prompted us to put together our best guess as to why this has occurred. So if you’ve wondered the same thing then you’ll want to check that out. And be sure to leave us a comment at the end with your own theory on why gold has been falling and if you think this year may be a better one for gold.

Why Has the Gold Price Been Falling?

This next article has a great run down on just who has been buying gold during 2013. While all the focus in the mainstream has been on the falling price, confoundingly 2013 saw many records broken in demand across the globe. (Our feature article above touches on this topic too – i.e. why record demand could result in a falling price). This article shows there was more evidence the Japanese have been buying more gold. The latest numbers on Japanese gold imports show…

This next article has a great run down on just who has been buying gold during 2013. While all the focus in the mainstream has been on the falling price, confoundingly 2013 saw many records broken in demand across the globe. (Our feature article above touches on this topic too – i.e. why record demand could result in a falling price). This article shows there was more evidence the Japanese have been buying more gold. The latest numbers on Japanese gold imports show…

—–

“Japan was a net importer of gold in December, the first time in almost four years. Net purchases totaled 1,885 kilograms (60,604 ounces). It was only the tenth time Japan was a net monthly buyer since the end of 2005. There are reports that Japan’s pension funds, which hold the world’s second-largest pool of retirement assets, are buying gold.”

—–

This follows on from our on the ground report from Japan a couple weeks back that showed how Japan’s biggest gold dealer actually sold more gold than it bought back for the first time since 2004.

International Gold Buying & Your Shot at 1,000% Gains

Next up, the always entertaining Darryl Schoon is back with his latest article. Contained within it is his latest video. If you’re not up with the play in terms of your distant (as in centuries ago) monetary history then that is worth a watch too.

Next up, the always entertaining Darryl Schoon is back with his latest article. Contained within it is his latest video. If you’re not up with the play in terms of your distant (as in centuries ago) monetary history then that is worth a watch too.

Darryl uses a number of charts from Ronald Stoeferle of Incrementum’s latest chartbook to outline just what the problem is with Quantitative Easing. So check that out to see why Darryl believes a currency crisis is what we are still heading for…

QUANTITATIVE EASING: THE KILLER SOLUTION

Our final article for this week is an old interview with Doug Casey on gold stocks. Something which he reckons are incredibly undervalued currently.

Our final article for this week is an old interview with Doug Casey on gold stocks. Something which he reckons are incredibly undervalued currently.

Speaking of an interview with Doug, he was on Max Keisers show this week too, touching on Argentina, the dollar, art and gold. Worth a look.

A Couple of Other Items

We don’t have too much else to add this week, other than to share a couple of other interesting items we’ve come across in the past few days.

Have a look at this interesting and somewhat against the grain article from a New Zealand Mortgage broker John Bolton.

The Economic Risks That Lurk Beneath

Here’s a brief excerpt:

—–

“At the moment we are being told that New Zealand is the new economic success story. Buoyed by growth, we are told that interest rates will increase by at least 2.00% over the next two years. Then, somewhere along the line, the media translates this into mortgage rates rising to over 8.00%. I’ll touch on mortgage rates later, and in much more detail in this post (Mortgage Rate Strategies for 2014)

What makes me uncomfortable with the sole focus on domestic news is that none of the structural problems that led to the GFC have been solved. All major economies have done, is kick the can further down the road. We all know that if you ignore problems, they get BIGGER.”

—–

Interestingly he doesn’t think interest rates will rise like most in the mainstream do. But that we will be in for “a long period of relatively low interest rates”. Anyhow it was a somewhat alternative viewpoint from someone within the property industry and we reckon worth a glance.

Jim Rickards Interview

Finally we read a great interview of Jim Rickards by – of all places – the Epoch Times. (We remember the Epoch Times being handed out on Campus back in our Uni days).

They managed to cover a large amount of ground in a very small number of words including how a new monetary system is not the end of the world and nor will it be a big surprise. Interestingly his gold price prediction is for $7000 to $9000 an ounce and within 3 to 5 years. Worth a quick skim.

If you like the sound of Jim’s prediction and would like to add to your stack or begin it, then get in touch:

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| Why is Silver Lagging Gold? |

2014-02-04 21:22:58-05Gold Survival Gold Article Updates: Feb. 5, 2014 This Week: NZ Bank Failure “Bail In” Scheme Gold and USD both rising together Why is Silver Lagging Gold? Not Convinced of Rising Interest Rate Story Yet Our weekly email is a day early today with Waitangi Day tomorrow. So we’ll try and […] 2014-02-04 21:22:58-05Gold Survival Gold Article Updates: Feb. 5, 2014 This Week: NZ Bank Failure “Bail In” Scheme Gold and USD both rising together Why is Silver Lagging Gold? Not Convinced of Rising Interest Rate Story Yet Our weekly email is a day early today with Waitangi Day tomorrow. So we’ll try and […]

|

| Doug Casey on Gold Stocks |

2014-02-06 21:09:30-05Doug Casey on Gold Stocks By Doug Casey, Chairman The following is an excerpt from famous contrarian speculator and libertarian freethinker Doug Casey’s latest book, Right on the Money. The interview with Casey Research Chief Metals & Mining Analyst Louis James took place on September 30, 2009, when gold stocks were clearly rebounding from their […] 2014-02-06 21:09:30-05Doug Casey on Gold Stocks By Doug Casey, Chairman The following is an excerpt from famous contrarian speculator and libertarian freethinker Doug Casey’s latest book, Right on the Money. The interview with Casey Research Chief Metals & Mining Analyst Louis James took place on September 30, 2009, when gold stocks were clearly rebounding from their […]

|

| International Gold Buying & Your Shot at 1,000% Gains |

2014-02-10 16:39:00-05We’d say a gold investor in New Zealand, would feel much the same way as the description below of a North American gold investor. Like our Northern Hemisphere brethren we remain pariahs too. However this article offers some definite glimmers of hope. It outlines why now is likely to be a good time to buy physical gold […] 2014-02-10 16:39:00-05We’d say a gold investor in New Zealand, would feel much the same way as the description below of a North American gold investor. Like our Northern Hemisphere brethren we remain pariahs too. However this article offers some definite glimmers of hope. It outlines why now is likely to be a good time to buy physical gold […]

|

| QUANTITATIVE EASING: THE KILLER SOLUTION |

2014-02-10 17:32:45-05Darryl Schoon uses a number of charts from Ronald Stoeferle of Incrementum’s latest chartbook in this piece of his to outline just what the problem is with Quantitative Easing. (Over the last month we’ve also featured a number of Charts from Ronald Stoeferle’s excellent chart book on Inflation vs Deflation. See Inflation versus Deflation and Latest from […] 2014-02-10 17:32:45-05Darryl Schoon uses a number of charts from Ronald Stoeferle of Incrementum’s latest chartbook in this piece of his to outline just what the problem is with Quantitative Easing. (Over the last month we’ve also featured a number of Charts from Ronald Stoeferle’s excellent chart book on Inflation vs Deflation. See Inflation versus Deflation and Latest from […]

|

| Why Has the Gold Price Been Falling? |

2014-02-12 15:42:21-05We recently received a comment from a reader that said: “I have gone through your Gold survival course, and most of what you say makes very good sense. But I have one thing that seriously puzzles me, and nobody can give me a plausible answer: Logically when the currencies are printed to the levels they […] 2014-02-12 15:42:21-05We recently received a comment from a reader that said: “I have gone through your Gold survival course, and most of what you say makes very good sense. But I have one thing that seriously puzzles me, and nobody can give me a plausible answer: Logically when the currencies are printed to the levels they […]

|

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1555.98/ oz | US $1292.55/ oz |

| Spot Silver | |

| NZ $24.40/ ozNZ $784.50/ kg | US $20.27/ ozUS $651.68/ kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

(price is per kilo for orders of 1-4 kgs)

$853.22

(price is per kilo only for orders of 5 kgs or more)

(Fully insured and delivered)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

Copyright © 2011 Gold Survival Guide. All Rights Reserved.

Pingback: Gold Prices | Gold Investing Guide What' s driving the gold & silver price up now?