A chuckle is what we often get from reading anything by Stewart Thomson. He has again posted one of his paid newsletters in the clear, so we’ve republished it. Mainly because he has some different views on interest rate rises.

What are they?

Well, he thinks the odds are high the Fed will raise rates in September. We wonder if they are that likely, however he has some interesting points about the impact of this on silver particularly that are worth reading. The charts below also seem to show that the gold miners may well have (finally!) bottomed…

Gold & Silver: Three Green Lights

Graceland Updates

By Stewart Thomson

- The FOMC minutes release tomorrow should bring some short term weakness to global gold prices, but I expect many individual gold and silver stocks to continue their strong rallies.

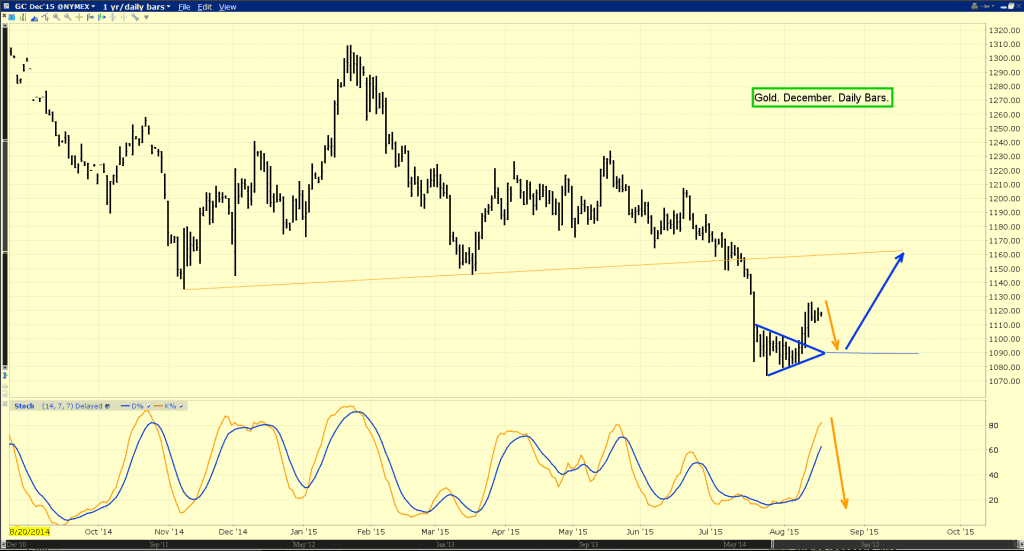

- Please [see below]. That’s the daily gold chart. After bursting upside from a small symmetrical triangle pattern, gold has rallied to about $1122.

- The 14,7,7 series Stochastics oscillator is overbought now. Gold enthusiasts should cheer for higher prices, but be open to the possibility that a small and sharp correction could start now.

- A pullback to the triangle apex in the $1090 area is not just possible but likely, but the longer term charts suggest gold has started a major upside rally.

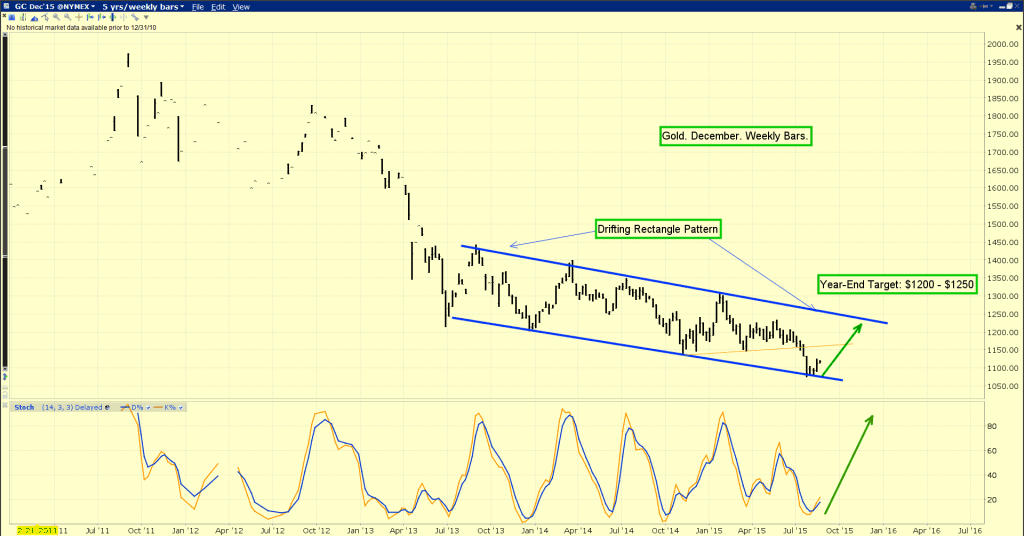

- Please [see below] That’s the weekly gold chart. In the big picture, gold has essentially been in a drifting rectangular pattern, with a slight downside bias.

- Note the superb position of the 14,3,3 series Stochastics oscillator. Sizable rallies ($150 – $250) often follow set-ups like the one that is currently in play.

- While FOMC-linked short term weakness is likely, the August – December time frame is typically gold’s strongest part of the year, particularly if the monsoon rains in India are good.

- They have been excellent. As a result, farmers appear set to buy sizable amounts of gold in the coming months.

- During gold’s strong season, Indians can buy as much gold as all the world’s investors now hold in the SPDR gold fund.

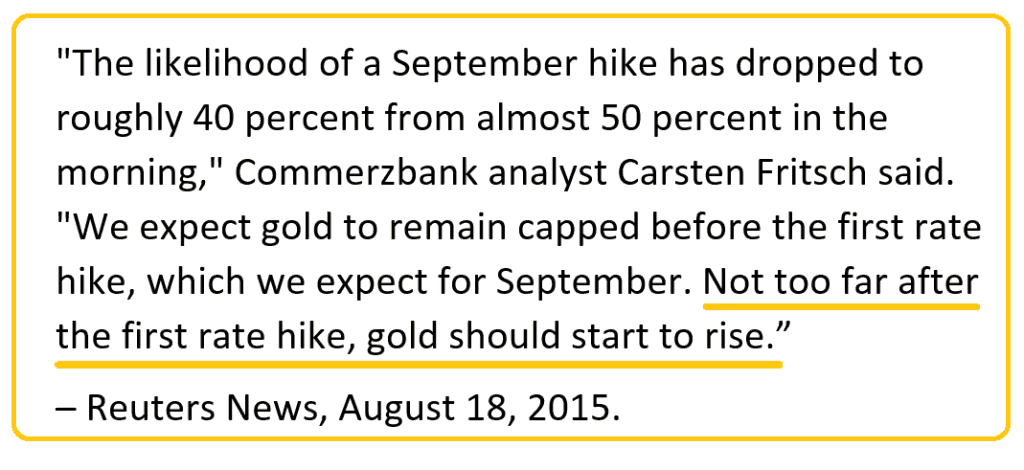

- Most gold community analysts think higher interest rates are negative for gold prices. I strongly disagree, and so do many of the world’s top bank economists.

- On that note, please [see below now]. Clearly, Commerzbank bank’s Carsten Fritsche shares my view on gold and rate hikes.

- I believe the Fed is very concerned about Western government spending, particularly in America. Rate hikes lower T-bond prices. They force institutions to move liquidity flows away from the public sector, and into the private sector. Money parked in T-bonds and wasted in government entitlement programs does not boost money velocity, which is required to boost GDP. I think Janet is preparing to pull the plug on the US government’s multi-decade “spending gone wild” mindset, and she’ll do it with rate hikes.

- Higher rates also give banks tremendous incentive to make more loans. Those loans can significantly boost bank profits, and strengthen the financial system (slightly). For gold investors, the great news is that the loans can reverse declining money supply velocity, and raise the rate of inflation.

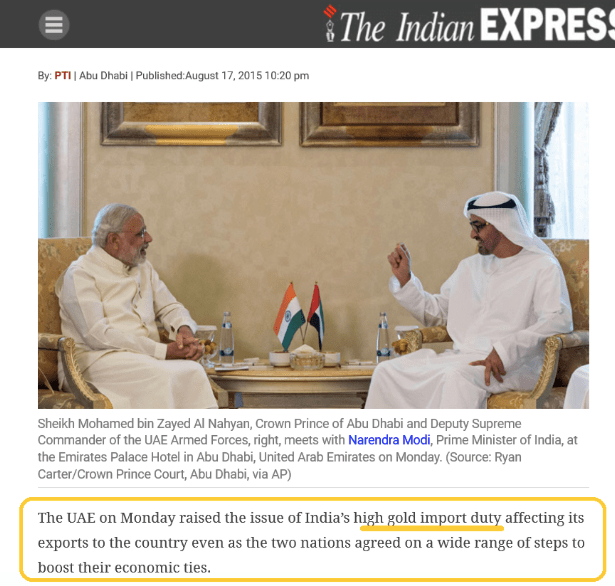

- I think Janet Yellen should raise rates in September, but whether she hikes in September or December doesn’t really matter. Also, please [see below now]. India’s Prime Minister wants the UAE to invest USD $1 trillion into India. The UAE wants India to cut the gold duties, and a cut looks more and more likely in the coming months. In addition, Shanghai appears to be ready to launch a gold fix by the end of the year. These three key “traffic lights” for gold (US rate hikes, Indian duties, Shanghai gold market infrastructure) seem ready to turn bright green!

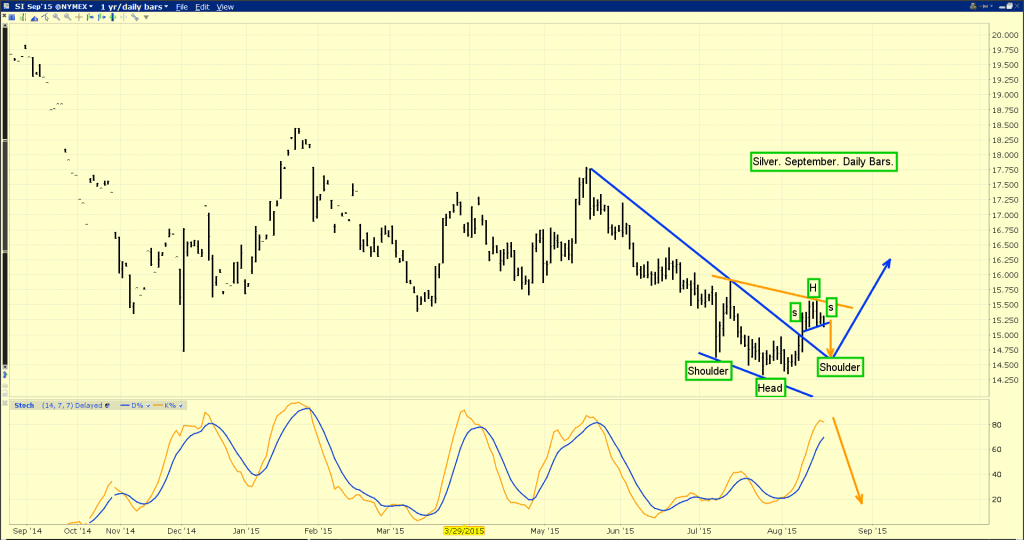

- Please [see below now]. That’s the daily silver chart. Rate hikes that ramp up money supply velocity could be one of game changers that silver investors have been patiently waiting for.

- A decent inverse head & shoulders pattern is forming, and a rate hike would likely be the catalyst to activate an upside breakout.

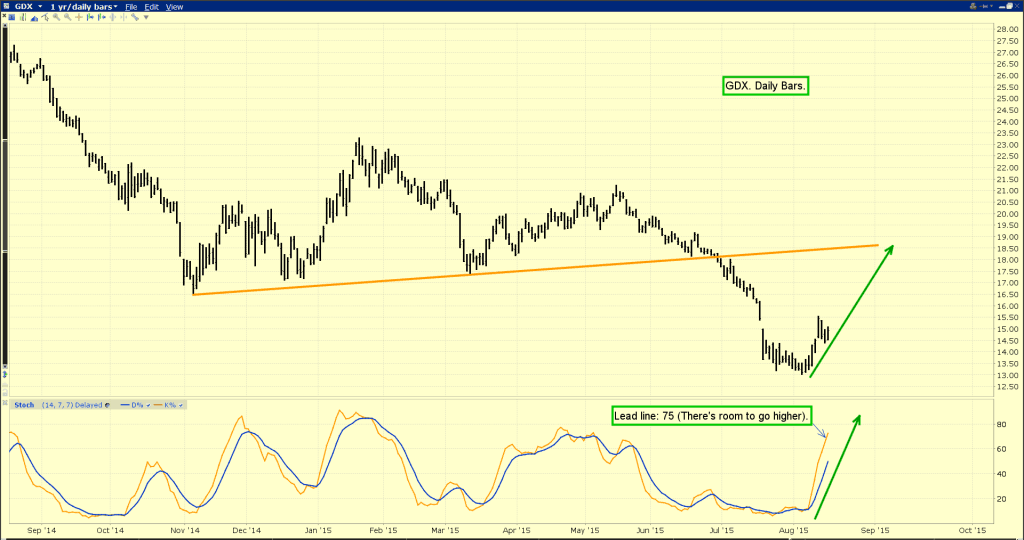

- Please [see below now]. That’s the GDX daily chart. It’s not as overbought as the gold and silver bullion charts. There’s room for the rally continue, even if bullion swoons a bit.

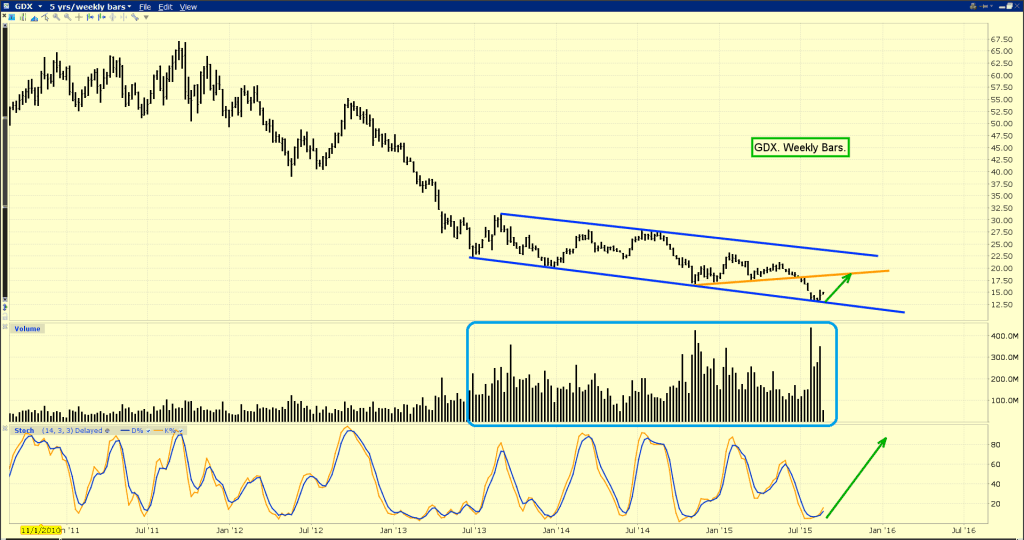

- Please [see below now]. That’s the GDX weekly chart. Note the “epic” rise in trading volume that has occurred since July of 2013.

- The 14,3,3 series Stochastics oscillator has crossed to a buy signal, and has yet to rise above the 20 line. That implies tremendous potential for higher prices.

- Since gold stocks began declining in 2011, I’ve used my unique pyramid generator to systematically and methodically double my overall gold stocks position, both for myself and the funds I manage.

- In contrast, most gold stock fund managers have liquidated massive amounts of stock over the past two years. They may have given bullish forecasts and tried to keep a stiff upper lip, but their liquidity flows tell a horrific story of liquidation and capitulation.

- Their selling probably magnified the decline.

- As with bullion, the overall GDX price action since 2013 has taken the form of a drifting rectangle. This has been accompanied, ironically, by what I consider to be very emotionally charged statements from gold stock analysts. Predictions for wildly higher and dramatically lower prices have not played out.

- That’s because gold is an asset in “flux”. US financial system risk is declining (but not gone). Deflation is ending, and inflationary road signs are clearly appearing. Rate hikes, a duty cut in India, and a Chinese gold fix are imminent. The downside bias of the drifting rectangle in gold, silver, and related stocks is ending, because the fundamental drivers of it are changing quite dramatically. All hands now need to be on the accumulation deck, of the good ship called…. gold!

Special Offer For Website Readers: Please send me an Email to freereports4@gracelandupdates.com and I’ll send you my free “GDXJ Hot Rods!” report. I cover ten of the hottest GDXJ component stocks, with key buy and sell points for each of them. Send me an email today, and I’ll send you the report tomorrow!

Thanks!

Cheers

st

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email: stewart@gracelandupdates.com

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?