|

Gold Survival Gold Article Updates:

May. 15, 2014,

This Week:

- Groundhog Day for Gold & Silver

- Is This Another Sign of Big Changes in Gold?

- One Possible Positive for Gold

Groundhog Day for Gold & Silver

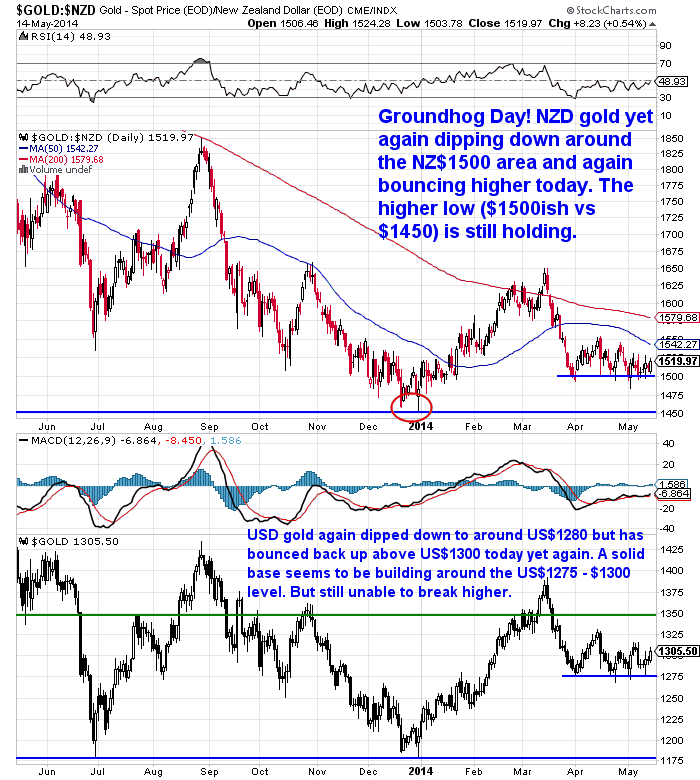

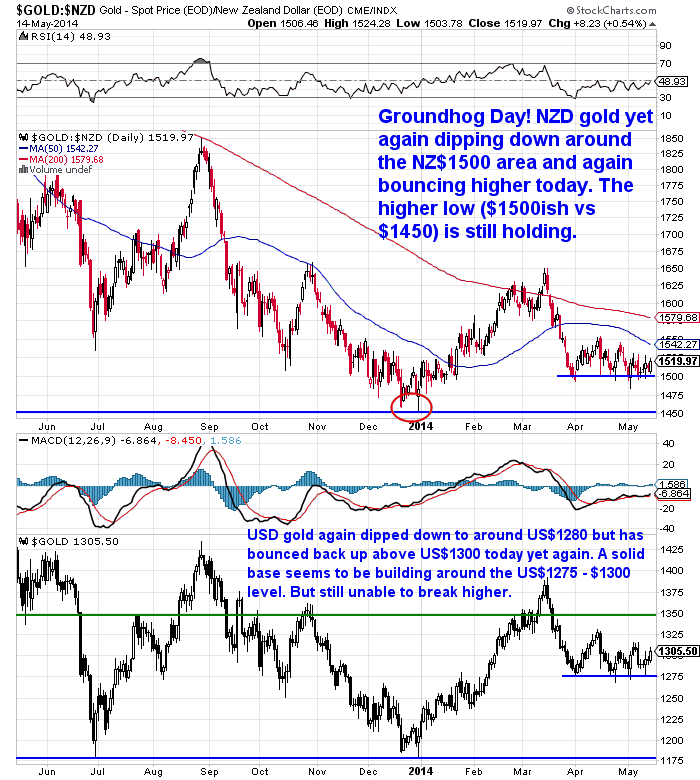

It really is groundhog day in precious metals at the moment with very little volatility. You can see this graphically in todays charts. NZD gold yet again dipped down to the $1500 level this week before bouncing higher today. Since the start of April we have been in a fairly tight range between $1500 and $1550, with fairly strong support around $1500 so a decent base is being built here.

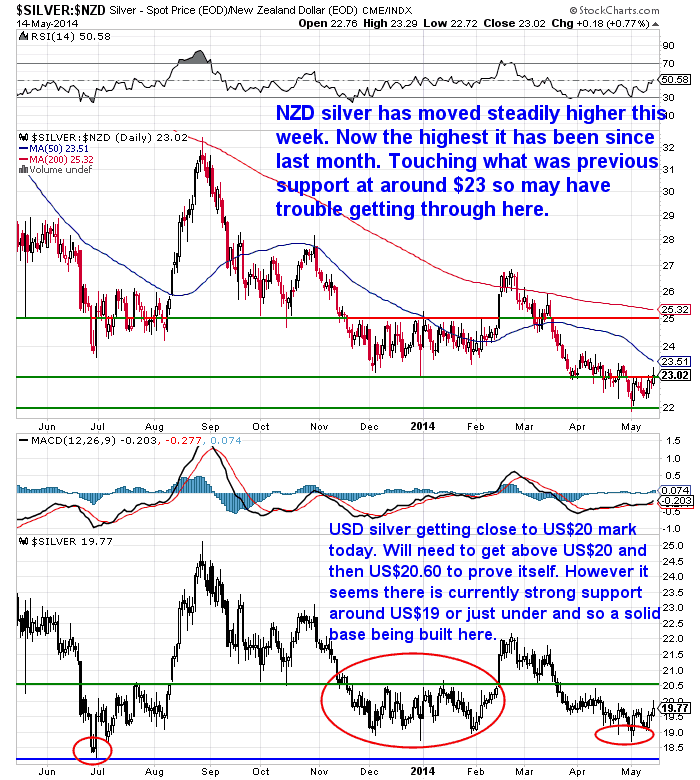

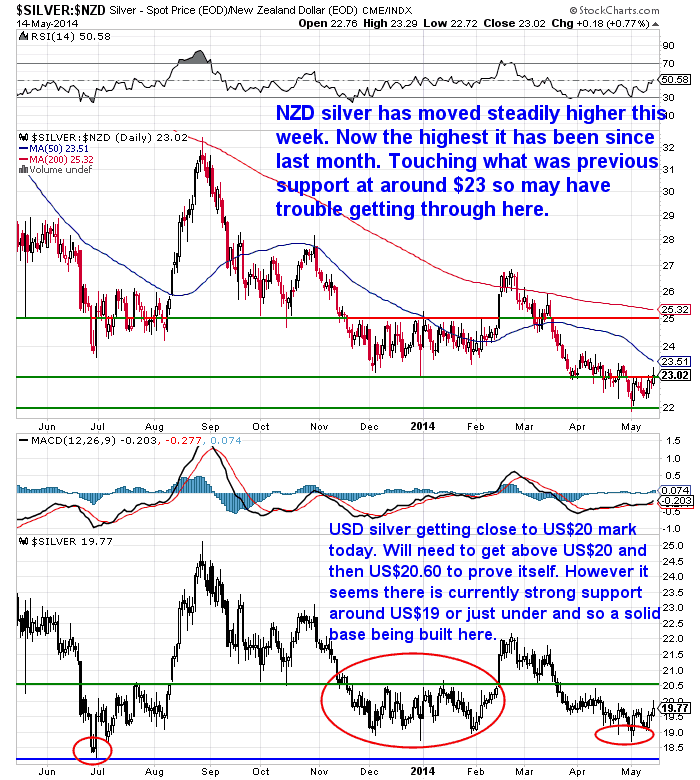

Silver is not too different. Although if anything it has been slightly stronger than gold this week, rising pretty steadily to now be touching $23. This was the previous long term support so it may have trouble moving higher through this level just yet.

The strong kiwi dollar has pushed silver in NZ dollars to new lows recently. However in USD dollars silver has been building a solid base around US$19 for almost 6 months now.

Despite not a great deal of positive news it hasn’t managed to go any lower. So this is a positive sign.

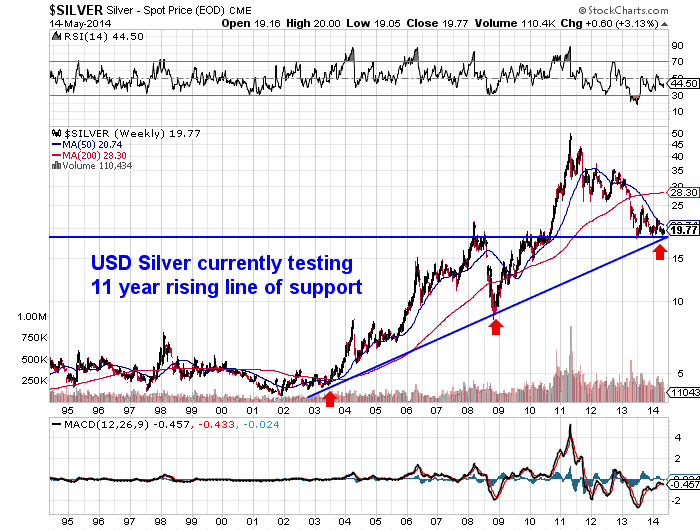

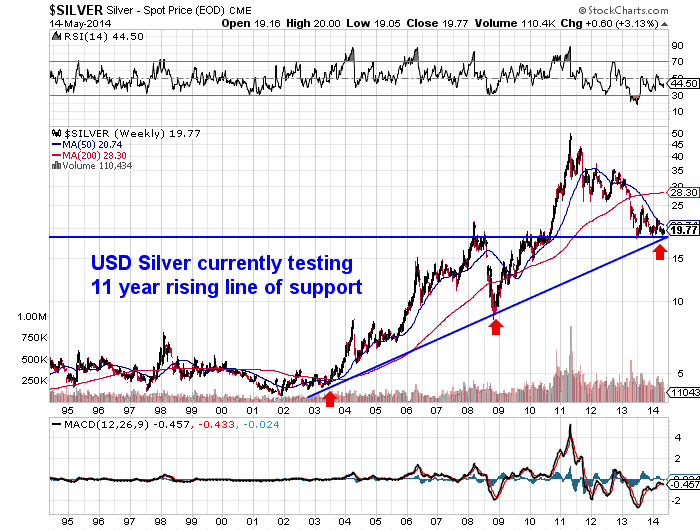

This US$19 level is also a key level in the long term weekly chart of silver below (meaning a chart of the closing price of silver in US$ every Friday). The price is currently around the 11 year rising trend line of support so if it continue to hold above this level that would prove a very positive factor.

We’ve mentioned many times that the price of silver (and gold) in NZ dollars is what’s most important to watch if you’re buying here in New Zealand.

So why do we still feature the USD prices and charts?

Well, for one many people still like to follow the USD price. So we give the people what they want. And two, even though the NZ dollar has been rising for many years against the US dollar, it has been the (USD) gold and silver price that has been the dominant factor. So we still keep an eye on what the US price is doing.

Is This Another Sign of Big Changes in Gold?

Chinese demand has supposedly slackened off a bit the past month or 2 according to some reports we’ve seen. Although this piece has an angle for why this may have occurred.

—–

“IS THIS ANOTHER SIGN OF BIG CHANGES IN GOLD?

Reports from Hong Kong show that gold imports here have dropped considerably. With shipments during March falling 24%, to 85.1 tonnes. Down from 112.3 tonnes in February.

That’s a big drop. Representing a fourth-month low.

The interesting question is: why?

Analysts attributed the decline to a weaker yuan. Which has made gold less attractive to Chinese buyers of bullion.

But it’s interesting that the fall in Hong Kong shipments coincides with another event. The announced opening of official gold imports through Beijing–the first time foreign bullion sales will be allowed directly through the capital.

Up until now, Hong Kong has been the preferred channel for China’s gold imports. But authorities are reportedly uneasy about Hong Kong’s extensive reporting on trade. Seeking instead to import gold more discreetly, by using Beijing as a “top secret” receiving point.

Speculation is this will allow China’s banks to build a big position in physical gold. Without global buyers realizing the accumulation is taking place.

The fall in Hong Kong gold trade jives with such a shift in buying. If Chinese purchasers really are moving to more-secretive sales through Beijing, we may see a permanent decrease in the amount of trade conducted through other cities.”

Source.

—–

Koos Jansen on his In Gold We Trust site uses Shanghai Gold Exchange (SGE) numbers instead of imports via Hong Kong. He reports that demand year to date is on par with last year reaching 694 tonnes as of April end. Annualised this would be over 2000 tonnes so in line with what his estimation was in 2013.

So perhaps Jansens numbers would give some credence to the above theory that imports haven’t actually dropped, they are just now even more opaque? That is, that the SGE demand has actually remained pretty strong in the face of supposedly weaker imports.

One Possible Positive for Gold

As we said earlier, there hasn’t been a great deal of precious metals positive news of late. Most we read is in fact just the opposite. Probably a good sign of being somewhere near the bottom, when there is not a lot of positive news but the price doesn’t head any lower.

However one possible very positive note for the metals is what is shaping up to be the likely election of Narendra Modi in the Indian elections.

We featured an article on this last year: On India: The Modi Man & Gold Tonnage

The key points were:

“Mr. Modi oversees the state of Gujarat. It has a population of 60 million, a 1% unemployment rate, a 10% GDP growth rate, a standard of living equal to Germany, and equity analysts in India have labelled the current Indian stock market price surge, the “the Modi rally”. They believe he will win the national election.His home state of Gujarat is recognized as one of only two states in India where government corruption has been virtually eliminated.

Many Indians believe that Mr. Modi is a devout Hindu who views gold as a sacred metal. Regardless, if elected, the “Modi Man” has promised to dramatically reduce government corruption, which could open the door to an epic increase in foreign investment. That should eliminate India’s current account deficit surprisingly quickly.”

You might recall that India’s current account deficit was the main reason given for the draconian import restrictions placed on gold into India last year. There has also been talk that Modi pro-gold and might well lift these restrictions pretty smartly. So his election could be positive for gold on a couple of fronts.

CME Mulls Daily Price Limits & London Silver Fix to End

As we said earlier it really is Groundhog Day for gold & silver currently. Both trading in fairly tight ranges with close to record low volatility. It is interesting then to have had the US futures exchange CME Group only now looking at introducing daily limits on price moves in gold and silver.

Coincidence that this is happening with the metals now at lows? Maybe a method to try and keep them there?

Other news overnight was that the London Silver Fix is being ended as of 14 August. You’ll recall that there has been discussion and an initial investigation by German financial regulators into the London Gold Fix. So who knows if this is in response to that or not. The press release gives no reason as to why the Silver Fix is being ended.

Adrian Ash of Bullionvault noted this morning:

“So the LONDON SILVER FIX is set to end after 117 years.

Congratulations to all concerned. The hucksters must be very pleased with their work. They have deprived the physical market of its benchmark price without proposing or arranging any replacement, and cost all participants the deep liquidity it brought.

Job well done. Barring World War 2, the London Silver Fix has been a formal event each day since 1897 (and very likely running before that, too). But August 14th this year will mark its end. Higher costs for buyers and sellers in the wholesale market look the certain result.

Because with Deutsche Bank jumping at its own shadow, the two remaining members (Scotia and HSBC) have also decided to quit finding that one single price which clears the greatest volume of orders via this quaint, apparently “out-dated” process at 12 noon. ”

However we’re unsure if we’d totally agree. Having a bunch of men sit around a table and agree on a price and have advance knowledge of this price doesn’t seem to be ideal. In this day and age we would have thought there was a way to reach a price in a more transparent manner.

It will be interesting to see what if anything replaces it and also what happens with the London Gold Fix.

Meantime gold and silver continue to just churn sideways. Likely discouraging more and more who bought in the past few years. At some point this sideways action will end. Who knows whether up or down but we think we are far closer to a bottom in both here than a top.

That would make any purchases around these levels a good long term entry point. If you’ve bought at higher prices it will give you a lower overall price. And if you’re yet to buy you’re in luck that you get a second bite of the cherry than many didn’t expect to have. Either way we’re happy to help out and answer any questions you have. Just hit reply to this email.

This Weeks Articles:

| Why Central Bankers Still Rule the World |

2014-05-08 00:52:59-04Gold Survival Gold Article Updates May. 8, 2014 This Week: – Central Bankers Still Rule the World – Time to Admit That Gold Peaked in 2011? Just one article for you this week, but an interesting one if you’ve come across the meme that gold reached its “inflation adjusted” high in 2011 and has already peaked. See the link below for that. 2014-05-08 00:52:59-04Gold Survival Gold Article Updates May. 8, 2014 This Week: – Central Bankers Still Rule the World – Time to Admit That Gold Peaked in 2011? Just one article for you this week, but an interesting one if you’ve come across the meme that gold reached its “inflation adjusted” high in 2011 and has already peaked. See the link below for that.

Gold Discovery of the Decade, On Sale

|

2014-05-14 18:37:55-04A rare treat today. Usually in these editorials we get some excellent generalised research about gold and silver. Or the mention of a promising company without the details of which specific company it is. However today we get the name and ticker symbol of the company who has made the biggest, richest gold discovery this decade. Read on for the full details. 2014-05-14 18:37:55-04A rare treat today. Usually in these editorials we get some excellent generalised research about gold and silver. Or the mention of a promising company without the details of which specific company it is. However today we get the name and ticker symbol of the company who has made the biggest, richest gold discovery this decade. Read on for the full details. |

|

2014-05-08 00:52:59-04Gold Survival Gold Article Updates May. 8, 2014 This Week: – Central Bankers Still Rule the World – Time to Admit That Gold Peaked in 2011? Just one article for you this week, but an interesting one if you’ve come across the meme that gold reached its “inflation adjusted” high in 2011 and has already peaked. See the link below for that.

2014-05-08 00:52:59-04Gold Survival Gold Article Updates May. 8, 2014 This Week: – Central Bankers Still Rule the World – Time to Admit That Gold Peaked in 2011? Just one article for you this week, but an interesting one if you’ve come across the meme that gold reached its “inflation adjusted” high in 2011 and has already peaked. See the link below for that.

2014-05-14 18:37:55-04A rare treat today. Usually in these editorials we get some excellent generalised research about gold and silver. Or the mention of a promising company without the details of which specific company it is. However today we get the name and ticker symbol of the company who has made the biggest, richest gold discovery this decade. Read on for the full details.

2014-05-14 18:37:55-04A rare treat today. Usually in these editorials we get some excellent generalised research about gold and silver. Or the mention of a promising company without the details of which specific company it is. However today we get the name and ticker symbol of the company who has made the biggest, richest gold discovery this decade. Read on for the full details.