Gold Survival Gold Article Updates

Nov. 7, 2013

This Week:

- Chris Powell in Auckland: Gold price suppression – why, how, and how long?

- How will it all end? Opinions from Chris Powell, John Butler, Hugo Salinas Price and Dan Denning

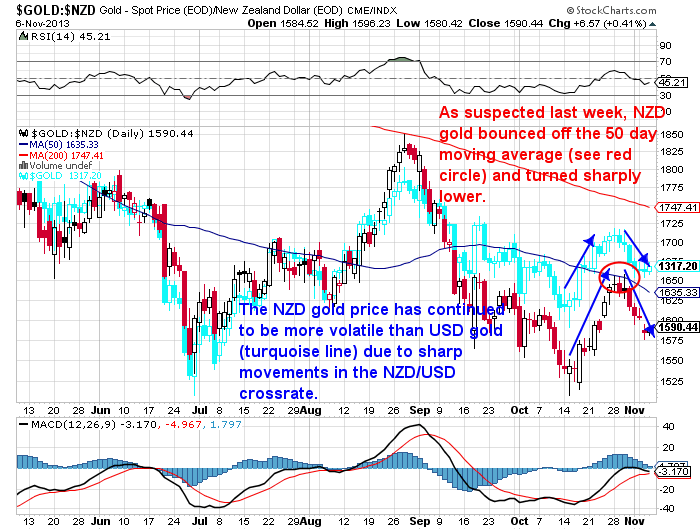

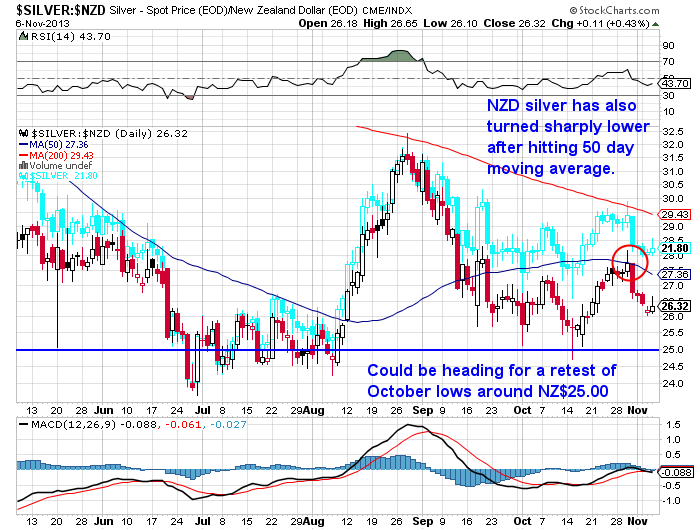

As we suspected they would last week, both metals turned down lower after reaching their 50 day moving averages (blue lines in charts below).

The NZD/USD cross rate continues to be the dominant factor in the local price of gold. With the stronger kiwi amplifying the weakness in USD gold, gold in NZD is down $60.65 per ounce from last week to $1572.85. A significant fall of 3.7%.

You can see in the chart below indicated by the blue arrows, that while NZD gold rose further in mid October it has also fallen further this past week than it’s USD parent.

Silver has also followed but dropped even more sharply, falling $1.57 per ounce or 5.68% since last Thursday to be at $26.06 today. Or in kilos $837.81. Quite a tumble.

Given that indicators are not yet oversold, we could be heading for a retest of last months lows in the not too distant future. And could make the same argument for gold in NZD too.

Chris Powell of GATA’s Auckland Speech and Q&A

Our feature article this week is Chris Powell of the Gold Anti-Trust Action Committee’s speech he gave in Auckland last month. It features the multitude of documents that GATA has collected over the years pointing to the collusion between Central Banks and financial institutions to control the price of gold. We’ve also included our notes of the Q&A sessions from both this Auckland and also his Sydney Gold Symposium presentation. So you get Chris’s thoughts on some fairly searching questions the crowd asked.

Our feature article this week is Chris Powell of the Gold Anti-Trust Action Committee’s speech he gave in Auckland last month. It features the multitude of documents that GATA has collected over the years pointing to the collusion between Central Banks and financial institutions to control the price of gold. We’ve also included our notes of the Q&A sessions from both this Auckland and also his Sydney Gold Symposium presentation. So you get Chris’s thoughts on some fairly searching questions the crowd asked.

It is quite long – it was a 30-40 minute presentation afterall. But it really is a must read if you have any interest at all in what GATA has worked at for more than a decade.

Chris Powell in Auckland: Gold price suppression – why, how, and how long?

Bit of a common theme here this week, how will it all play out in the end? Hugo Salinas Price also comments on this, looking at the only way he believes the global debt burden can possibly be resolved.

Bit of a common theme here this week, how will it all play out in the end? Hugo Salinas Price also comments on this, looking at the only way he believes the global debt burden can possibly be resolved.

Then finally we have some useful advice for anyone who has or is looking at investing in gold mining shares.

Then finally we have some useful advice for anyone who has or is looking at investing in gold mining shares.

What NOT to Do When Investing in Miners

How will it all end?

How will it all end is a common question those following gold often ask both themselves and others. We’ve heard many different theories ourselves (for that is of course what they all are – theories).

In Chris Powell’s recent speech he actually covered 4 ways this current monetary system may end. So if you don’t get round to reading all of Chris Powell’s presentation (this weeks feature article above) then we’ll summarise them for you now as his options cover most bases.

According to Chris Powell

As Chris points out it will likely be down to what happens in world politics at the highest levels. He outlined how the powers that be could take a number of different roads.

1. “The system may end at the insistence of the developing world with an official worldwide revaluation of gold and gold’s formal restoration to the international monetary system.”

2. “Or the system may end when one country pulls the plug on it, exchanging U.S. government bonds for more gold than is available.” [China would be an obvious candidate for this eventually we’d say.]

3. “Or the system may end as part of a plan by central banks to avert the catastrophic debt deflation that now threatens the world.

For example, a 2006 study by the Scottish economist Peter Millar concluded that to avert such a catastrophic debt deflation, central banks would need to raise the gold price by a factor of seven to 20 times in order to reliquefy themselves and devalue their currencies and society’s debts generally:

4. Or the system may end chaotically as the London Gold Pool ended in 1968 when the gold the Western central banks were prepared to lose simply ran out even as those central banks were not yet ready with an alternative gold price control system.”

In the answer to a question from an audience member in Sydney, Chris outlined what seemed to be his most likely outcome. Namely option 3 above – that it will resolve as it has throughout history.

Central Banks will retreat with gold to a higher level and maintain the gold price suppression at a level that doesn’t result in such an off take of their gold reserves.

Most likely we will go to bed on Sunday and wake up on a Monday morning and read in the papers that there is new Bretton Woods or Plaza Accord agreement, with new exchange rates and major central banks have agreed to tender for gold at a much higher price to regain all the gold they lost through swaps and leasing.

So effectively they will resume gold price suppression at a much more practicable level.

According to John Butler

As it happens all these options could also play out under John Butler’s theory. That is according to mathematician John Nash’s equilibrium game theory the few major players in the world holding the majority of US dollars will eventually be forced to have a full return to gold backed money – at least as an international money for solving balance of payment transactions.

As it happens all these options could also play out under John Butler’s theory. That is according to mathematician John Nash’s equilibrium game theory the few major players in the world holding the majority of US dollars will eventually be forced to have a full return to gold backed money – at least as an international money for solving balance of payment transactions.

That is, they won’t actually want to do this, as what government doesn’t want to be able to inflate. However, as no single currency will be trusted to replace the dollar as reserve currency they will be forced to place gold at the centre of the system.

If you didn’t read this last week it is a must John Butler in Auckland: “Remonetisation of gold is inevitable”

According to Dan Denning

Our notes from the Gold Symposium have just reminded us that Dan Denning of the Daily Reckoning Australia also reached a similar conclusion to the likes of Chris Powell and John Butler. That there is likely to be an overnight revaluation of gold at some point, otherwise we would see a complete collapse of civilisation. Given the powers that be have too much riding on it to allow a complete collapse to occur, the out for Central Banks is to remonetise gold at a much higher price. That is the end game.

Our notes from the Gold Symposium have just reminded us that Dan Denning of the Daily Reckoning Australia also reached a similar conclusion to the likes of Chris Powell and John Butler. That there is likely to be an overnight revaluation of gold at some point, otherwise we would see a complete collapse of civilisation. Given the powers that be have too much riding on it to allow a complete collapse to occur, the out for Central Banks is to remonetise gold at a much higher price. That is the end game.

So while any of the above outcomes should be of benefit to holders of gold, in the long run each scenario would still see the money masters in control overall. As Chris Powell outlined they would still look to keep the price of gold down and this would let them continue with a degree of monetary base inflation.

Albeit at a much lesser rate than we have seen for the past 40 years. So we would likely see a somewhat better society but one still controlled by an elite few. Fair to say far from ideal still.

Our Thoughts

Our preferred option would be for a free market in money. A very foreign concept for the average person, where money does not bear a government seal and the words legal tender upon it. Rather money is whatever the people prefer to use. This old article of ours discusses this concept further looking at a government mandated gold standard versus a free market in money: The Gold Standard: What Do We Think About it?

If you’ve watched any of Chris Duane’s (of Silver Bullet Silver Shield) videos you’ll have seen him discussing the problem of a new gold standard bringing rise to new financial oligarchs. He even wonders whether Mr Gold himself Jim Sinclair is in fact one of these in a recent video.

So he believes silver is a better option than gold. One, because on an historic basis it is more undervalued than gold. And two, because from a consciousness or moral perspective he believes it is a better choice than gold. The theory being that since a government mandated gold standard will likely be something instituted and managed by the same elite running things now, extracting your resources from the system and turning them into silver will help bring about the end of the current monetary system.

Chris Duane also believes we need a complete collapse and reset in order to build something better.

Unfortunately as Hugo Salinas Price outlines in one of this weeks articles mentioned earlier, The Coming New Barbarism, it is dictatorship that often rises out of collapse. So a clean slate may not guarantee a better monetary construct to follow, although perhaps with the internet today that may up the odds a bit.

Personally we’d rather have a bit of both silver and gold. Just in case. We can understand Duanes argument for holding silver rather than gold from a “take down” perspective. But if we “only” get a government instigated gold standard redu, then it would seem wise to hold a chunk of the yellow metal as well.

Of course if the system is still controlled by the elite under a government mandated gold standard, then gold will be dominant but that doesn’t mean silver doesn’t still have the ability to gain much more value than gold.

Whether you want the yellow stuff or the white stuff let us know. As always any questions just hit reply to this email or:

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| Update: Who Pays Tax in NZ? |

2013-10-30 22:26:04-04 2013-10-30 22:26:04-04 |

Gold Survival Gold Article Updates: Oct. 31, 2013 This Week: Update: Who Pays Tax in NZ? Tax and inflation More on PAMP and Chinese Gold Imports John Butler in Auckland: “Remonetisation of gold is inevitable” The big factor in the past week has been the falling NZ dollar. Dropping from just over .8500 last […]

| Chris Powell in Auckland: Gold price suppression – why, how, and how long? |

2013-11-04 01:51:39-05 2013-11-04 01:51:39-05 |

As we’d promoted back in September and October, Chris Powell of the Gold Anti Trust Action Committee (GATA) was in New Zealand on Sunday 13th October, before then heading to Australia to also speak at the Gold Symposium in Sydney. For those that consider GATA simply as a conspiracy theory website, it is worth knowing […]

| What NOT to Do When Investing in Miners |

2013-11-05 15:40:15-05 2013-11-05 15:40:15-05 |

Whether you have invested in gold and silver mining companies in the past or are thinking about it now, here is some great advice on a methodology to use in choosing which companies to buy into or which to hold onto if you already have some. It will help you avoid following the herd and […]

| The Coming New Barbarism |

2013-11-05 16:50:06-05 2013-11-05 16:50:06-05 |

Here’s the latest from our favourite billionaire – Hugo Salinas Price. He looks at how the massive global debt burden will be addressed and what the outcome of this will be for society. He paints a somewhat gloomy picture but (not surprisingly for the head of the Mexican Civic Association Pro Silver ) has an answer to offer […]

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1572.85/oz | US $1318.21 / oz |

| Spot Silver | |

| NZ $26.06/ ozNZ $837.81/ kg | US $21.84/ ozUS $702.17/ kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

(price is per kilo for orders of 1-4 kgs)

$910.26

(price is per kilo only for orders of 5 kgs or more)

(Fully insured and delivered)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

Copyright © 2011 Gold Survival Guide. All Rights Reserved.

Pingback: The Siren-song of Welfare State | Gold Prices | Gold Investing Guide

Pingback: – The Siren-song of Welfare State

Pingback: More Weakness Ahead for Gold and Silver? | Gold Prices | Gold Investing Guide

Pingback: Gold Prices | Gold Investing Guide Top 17 Reasons To Own Gold Right Now

Pingback: Gold Prices | Gold Investing Guide Watch Chindia