This Week:

- NZ Dollar Could Fall Further Yet

- Impacts of falling NZ interest rates?

- Bond Prices and Derivatives

- Interest Rates and QE – not what you’d expect

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1681.60 | +$20.30 | + 1.22% |

| USD Gold | $1186.20 | + $0.20 | + 0.01% |

| NZD Silver | $22.78 | – $0.39 | – 1.68% |

| USD Silver | $16.07 | – $0.47 | – 2.84% |

| NZD/USD | 0.7054 | – 0.0085 | – 1.19% |

NZ Dollar Could Fall Further Yet

The “surprise” news today was that the RBNZ cut interest rates 0.25%. We say “surprise” for 2 reasons.

- Because some survey or other said only 40% of respondents thought they would cut in June

- Because the dollar promptly fell almost 2 cents on the announcement. So most currency traders hadn’t expected a cut yet it would seem

If you’ve been receiving our newsletter for a while you’ll recall we’ve been expecting rates to fall, rather than rise for some time now. So we weren’t surprised to see it happen.

Odds are it won’t be the last cut and the RBNZ said as much in their statement too. Taking a leaf out of the US Fed head Janet Yellen’s book and saying it will be “data dependent”:

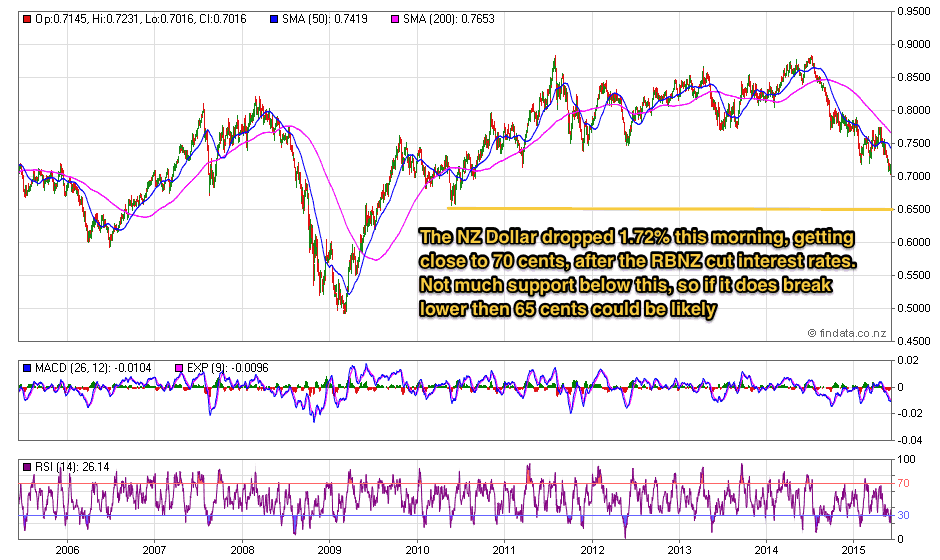

As noted already the rate cut caused the NZ dollar to tumble taking it down to almost touch 70 cents before rebounding slightly. As you can seen in the chart below there is not much support between 70 cents and 65 cents.

So if it breaks below 70 it’s likely watch out below.

It will be interesting to see what happens now. Maybe the next rate cut has been built into the price already?

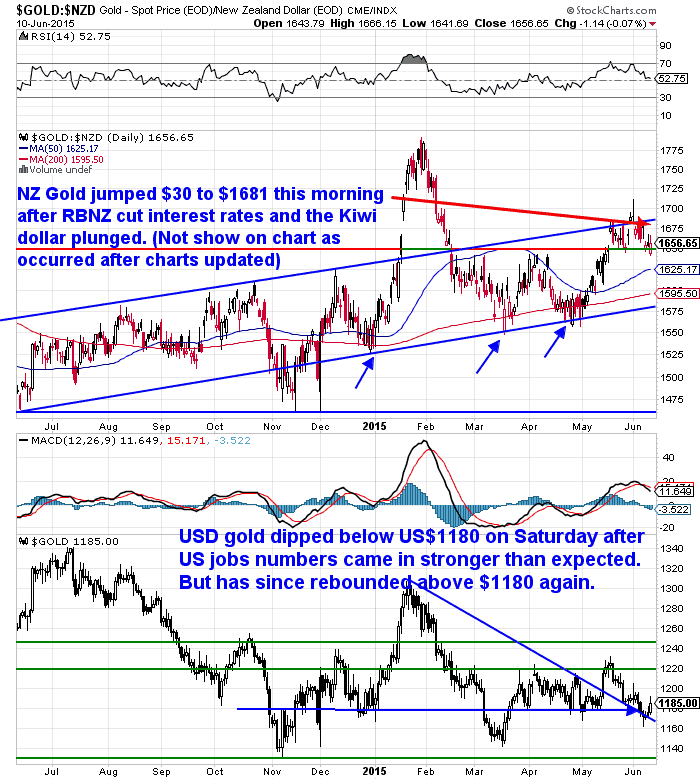

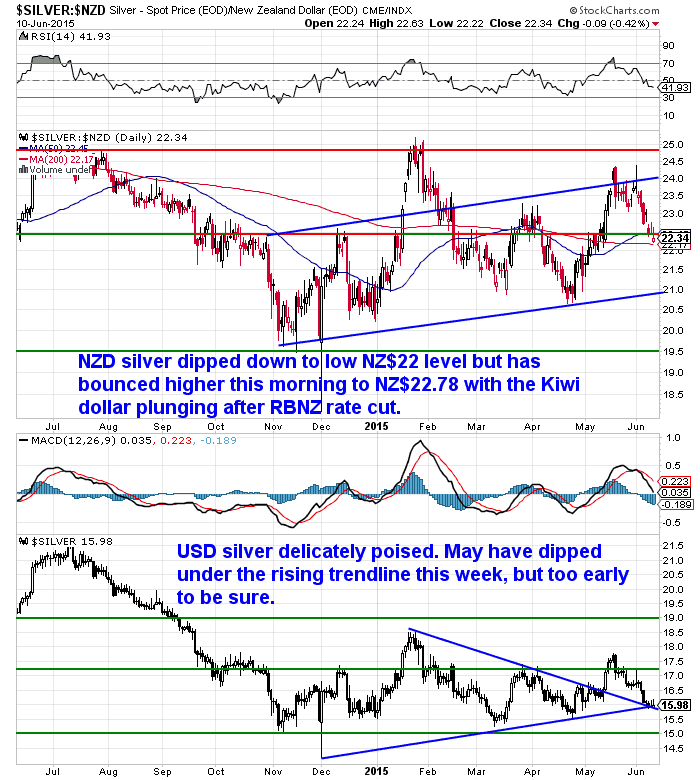

The dollar tumble has of course given local gold and silver prices a good nudge higher this morning.

NZD gold is up 1.18% from a week ago, while NZD silver is down 1.68%

NZD gold again bounced up from the $1650 level. It has been trading in a narrow range between there and $1700 for the last few weeks.

Conversely the US Dollar gold price has struggled this week. Getting knocked down below US$1180 after the release of US jobs numbers which were taken to be pretty rosy on Saturday morning (NZ time). Although it has since moved back up above this level it remains delicately poised and could go either way from here.

NZD silver also still remains in a steady uptrend. Whereas USD silver is poised right on the uptrend resistance line and like USD gold could go either way here.

So overall the weakening NZ dollar is the main factor driving precious metals prices.

What will the impacts of these falling interest rates be?

So back to the RBNZ rate cut and likely cuts.

What will the consequences be for NZ?

As usual – who knows! Likely something unexpected we’d suggest.

The RBNZ argument seems to be that export prices have and are falling further than they thought, inflation is lower than expected, so we need a weaker dollar so we can all pay more for things we import. Yah! Let’s go inflation, Let’s go! We all love paying more for everyday stuff.

They’re pinning their hopes on their proposed new Loan to Value Ratios and the government cracking down on property “speculators” to stop the rate cut from further fanning the flames of Auckland’s rising property prices.

Odds are they won’t.

Although our guess is it will take something offshore to put a handbrake on housing here. Maybe a serious slow down or popping of the Chinese property bubble, and therefore dampening the money arriving in NZ (and many other countries).

At some point there will be a surprise. As we’ve said before, maybe when the local bank economists all expect interest rates to keep falling, we’ll actually see them go in the opposite direction.

We think some thoughts on Australia from Greg Canavan are worth sharing here.

Why?

Because Australia is a little further ahead of us in their slow down and rate cutting. So we may follow a similar path, albeit maybe to a lessening degree. Given we don’t have the same reliance upon hard commodities that they do.

It also ties into some comments of Catherine Austin Fitts in her Auckland Presentation a few weeks ago on the effects of a possible US Dollar bear trap.

That is if the US Fed does finally raise interest rates, this could send the US dollar flying even higher. At the time we said this could increase the cost of borrowing here in NZ.

So the impacts on NZ could be similar to those Greg mentions below for Australia [our notes are in bold]:

–So expect bigger fiscal deficits and more interest rate cuts to come. Anything to help keep our head in the sand for just a little bit longer — or until the next election.

–But for Australia, the day of reckoning will come. Our net foreign debt levels will go close to hitting $1 trillion this year. While the economy slows and national income growth grinds to a halt, we’re maintaining our standard of living by borrowing more and more [GSG Note: Likely New Zealand will too].

–In the global search for yield and complete ignorance of risk, our creditors keep lending to us, mainly via the banking sector. The funds then go to the household sector, which bids up the price of housing and clocks the gains up as ‘wealth’. [GSG Note: Same for NZ]

–But as Greece knows only too well, when you’re a debtor you don’t hold too many cards when the proverbial hits the fan.

–In Australia’s case, if our creditors decide to reassess the risk of ‘buying Australia’, two things will happen. Our dollar will be the first to adjust lower. That’s already happening. But it’s happening too slowly. [GSG Note: Another tick – same for the NZ dollar]

–The dollar adjusts lower when the supply of funds coming into Australia doesn’t meet the demand. A lower dollar is the price mechanism to balance the market. It allows foreigners to get more bang for their buck, euro or yen.

–The other adjustment mechanism is market interest rates. A sharply lower dollar will pretty quickly feed through to higher inflation. [GSG Note: As we mentioned earlier today, this is what the RBNZ is wanting too] If the RBA ignores this and keeps cutting interest rates anyway, foreigners might decide to demand higher compensation (higher interest rates) for lending to a country that appears to be losing the plot. [GSG Note: Similar to the US dollar bear trap we mentioned earlier]

–Loss of faith in a central bank or confidence in a currency means the cost to hedge any cross border investment becomes too great — it no longer compensates for the interest rate on offer. So the creditor asks for a higher interest rate as well.

–When that happens, it’s game over for our highly leveraged economy. That’s probably still a year or so away. In the meantime expect more interest rate cuts.

Source.

Sheesh. That sounds bad. We’re not so sure NZ is quite so close to the tipping point as that. Our government finances are in better shape than our Aussie brethren. Although the private sector is in debt to a pretty similar level.

Anyhow Greg’s comments are food for thought. The RBNZ clearly thinks the NZ economy is slowing up at a faster rate of knots than any of the central planners had expected. Heck it was only months ago that all the economists were talking interest rate rises!

The question now is will this produce a real “two speed” economy with Auckland housing continuing up while everything else slows down?

One thing’s for certain. Central planning the “price of money” (i.e. interest rates) is not the way the system should work.

This won’t go the way the central planners hope.

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $285 you can have 1 months long life emergency food supply.

Learn More.

—–

Bond Prices and Derivatives

There are plenty of issues bubbling away at the moment.

Greece defaulting and exiting the Eurozone has been on the boiler for months now.

Bond prices plunging (interest rates rising) in the likes of Germany and Austria is a more recent occurrence.

From Biller Bonners Daily email, by Tim Price in London:

“Meanwhile, the price of German sovereign bonds, regarded as among the safest credits in the world, have been falling hard. Colleague Tim Price, in London, has the story:

Our favorite “risk-free” reference rate is the yield on the German government 2.5% bond maturing in August 2046. Since mid-April, the yield of this bond has risen by just over 1 percentage point, from 0.46% to 1.54% at the end of last week.

Sounds relatively innocuous, no?

That rise in yield equates to a fall in price of roughly 36%. In just over a month. We thought the collapse in Bund prices was grisly, until we spotted the carnage unfolding in the Austrian government bond market.

Ladies and gentlemen, we give you the Austrian government 3.8% bond maturing in January 2062. The price of this “risk-free” asset has fallen from roughly 220 to 162 as of the end of last week. That is a fall in price of nearly 60%.

If euro zone government bonds are collapsing, can U.S. Treasurys be far behind?”

Strange goings on in derivatives and Deutsche Bank CEO’s being fired is the other thing of note this week.

This article is worth reading. While speculative it does offer some insights into goings on in the past few weeks in “derivatives land”.

http://

[But if you have trouble getting your head around derivatives then check out this article of ours:

[But if you have trouble getting your head around derivatives then check out this article of ours:

Derivatives – a Beginner’s Guide to “Financial Weapons of Mass Destruction”]

It also looks at what derivatives the NZ government may have to contend with some day.

Addison Wiggin discussed how much these derivatives have grown in the Daily Reckoning a few weeks back:

“According to the Bank for International Settlements (BIS), on the eve of disaster at LTCM in June 1998, there were about $70 trillion in total world derivatives.

In June 2007, prior to the meltdown of Bear Stearns and the ultimate demise of Lehman Bros. a year later, there were roughly $510 trillion in derivatives outstanding — up 628% from the risky decade before.

By June of last year, by one estimate, total world derivatives were $1.5 quadrillion — that’s 14 zeros — an increase of 294%. What will happen the next time these geniuses fail?”

The key point on derivatives is that the vast majority of them are all linked to interest rates. So any unexpected movement in them could send the dominoes toppling.

Interest Rates and QE – not what you’d expect

One thing unexpected about interest rates that Jim Rickards point out this week was how interest rates counter intuitively have actually risen during bouts of QE, and fallen when there’s been no QE.

“One fascinating indicator of the past seven years is the direction of interest rates during periods of quantitative easing. The Fed has conducted three programs of quantitative easing since 2008, known as QE1, QE2 and QE3.

The stated purpose of each QE program is to lower interest rates, especially on intermediate-term securities. The idea is to make the yield so low that investors channel funds into other asset classes, such as stocks and real estate.

The higher prices on stocks and real estate are supposed to create a “wealth effect” that causes people to spend more. More spending will then result in higher money velocity and higher nominal GDP. Everything about this theory is flawed, but the Fed believes it, so we need to pay attention if we want to understand Fed policy.

The chart below shows the path of interest rates on 10-year Treasury notes over the past seven years. The shaded areas are the periods of quantitative easing. The red arrows show what happened to 10-year note yields during the QE periods.

Incredibly, note yields did not decline during QE. They rose all three times! There was some volatility along the way, and there were short periods when rates did decline, but the overall impact of QE was to increase rates, not decrease them.

The shaded areas in this chart are periods of quantitative easing, or “QE,” by the Fed. The red arrows show that interest rates on 10-year Treasury notes actually rose during periods of Fed easing.

Equally important for present purposes is that rates declined when the Fed was not doing QE. This is also apparent from a glance at the chart.

Why do rates rise when the Fed is easing and fall when the Fed is not easing? The answer has to do with investor expectations. The Fed may believe the economy is getting stronger, but investors and everyday Americans know better — the fundamentals are weak and getting weaker.

When the Fed prints money (that’s what QE is), investors expect inflation, and therefore rates rise. When the Fed stops printing money, investors expect deflation, and therefore rates fall.”

He also believes…

“It is difficult to see how the Fed can raise rates in 2015 without sinking markets and the economy completely; therefore, a rate increase should not be expected. The only things that will change this outlook are if the Fed blinks and admits it cannot raise rates or if it starts to talk about QE4. We’ll be watching closely for indications and warnings on both of those events.

How can investors benefit from the huge gap between what the Fed expects and what markets expect? This is a good time to take another look at gold, especially high-quality gold mining stocks.

Gold has two ways to win. If low rates persist, gold becomes more attractive because costs of carry and opportunity costs of holding an asset without yield decline. Conversely, if rates go up, that means inflation is on the way, and the gold price benefits from that also.

Gold mining stocks have been beaten down to the point where stock prices will either go up or the miner will go out of business. That’s why it’s important to stick to the high-quality names in the major indexes.”

Source.

We also read in a separate piece of his what he learnt from a recent meeting with a new think tank called the Center on Sanctions and Illicit Finance, (CSIF):

It seems to us that slowly but surely we are creeping closer to the next “unexpected” financial event. Have you prepared accordingly and have some of your wealth in “nondigital form”?

Free delivery anywhere in New Zealand and Australia

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $13,795 and delivery is now about 7-10 business days.

This Weeks Articles:

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| Today’s Spot Prices Spot Gold |

|

| NZ $ 1681.60 / oz | US $ 1186.20 / oz |

| Spot Silver | |

| NZ $ 22.78 / oz NZ $ 732.37 / kg |

US $ 16.07 / oz US $ 516.61 / kg |

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon. Have a golden week! David (and Glenn) GoldSurvivalGuide.co.nz Ph: 0800 888 465 From outside NZ: +64 9 281 3898 email: orders@goldsurvivalguide.co.nz |

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2013 Gold Survival Guide. All Rights Reserved. |