Gold rises strongly

We have said many times before that the precious metals markets are notoriously difficult to time. This morning is pretty good confirmation of that. Gold is doing the complete opposite of what many predicted post a debt ceiling agreement (we won’t even get into that as I’m sure you know how phony the agreement is already), rising strongly instead of correcting. And even with the kiwi dollar not far off the record highs against the USD from earlier in the week, gold in NZD terms is up strongly today too – over $50 in fact. Back above the $1900 where it hasn’t been since early July.

It’s the debt stupid!

So this could be somewhat unexpected for most. Many people ask about gold and silver being at record highs. They wonder if it can go any higher after rising so much since the early 2000’s.

Chart of the week:

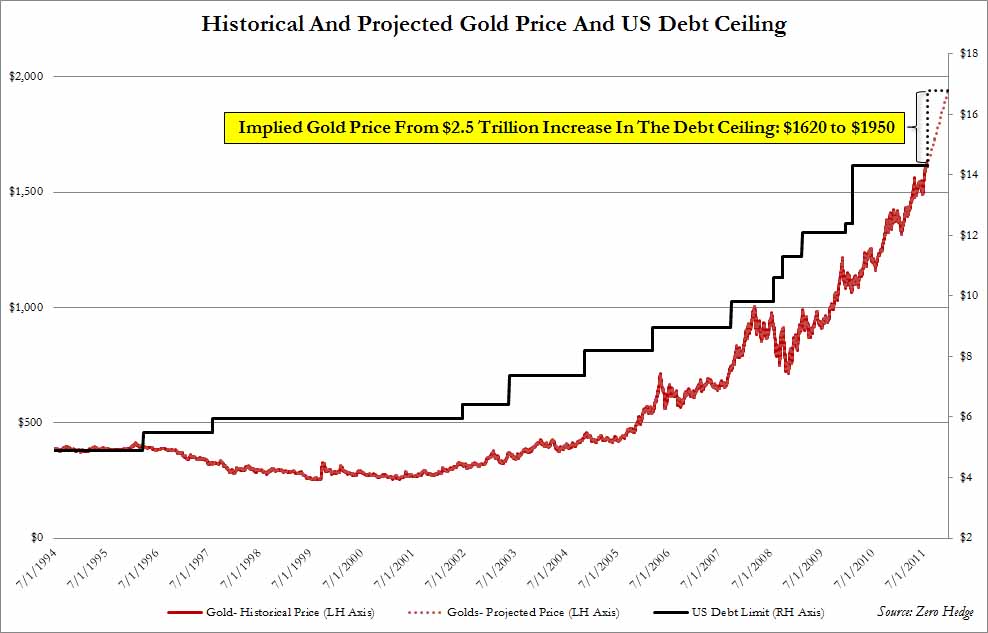

This morning we just saw a great chart that reflects this perfectly on Zero Hedge.

The chart shows that over the past decade gold has been closely correlated to the US debt ceiling, rising proportionately every time the “ceiling” was increased. But Tyler Durden of Zero Hedge goes further and extrapolates this out to project a gold price of $1950 by years end! Crikey!

Regardless of whether this comes to pass, the chart is clear in demonstrating that gold is rising in proportion to the debt and currency debasement going on. While the debt keeps being added to it seems fair to assume gold will continue to rise as well. As always that’s just our opinion anyway!

This week we have 2 articles and 1 video for you: Bud Conrad of Casey Research on the Economic Crisis in the USA.

Check out the short article that is “A Thousand Pictures Is Worth One Word“. It shows you all the paper currencies to have failed over the years – there’s many more than you’d think and a lot of them failed in recent years too.

Gold and silver in NZ Dollars are still both off their highs from earlier in the year so if you’d like a quote just phone David on 0800 888 465 or email him at orders@goldsurvivalguide.co.nz.

Pingback: Schizophrenic markets and why the US may be the last to fall | Gold Prices | Gold Investing Guide

Pingback: Another Bite of the Gold and Silver Cherry Presents Itself | Gold Prices | Gold Investing Guide

Pingback: Is Gold ready for a fall? | Gold Prices | Gold Investing Guide

Pingback: Gold Prices | Gold Investing Guide RBNZ Jawboning But May Follow Through