Darryl Schoon is back with a follow on from last weeks SMART MONEY, DUMB MONEY & YOUR MONEY. This week looking at inflation, including how inflation figures are “massaged”, and how food and fuel prices head up first. While we may currently be shielded from some of the price rises here in New Zealand by the strengthening kiwi dollar, we shouldn’t bet on this lasting forever. So this is worth reading. (By the way, from what we’ve seen it seems New Zealand government inflation figures shouldn’t really be trusted either. See this article for more: Here’s Why Not to Believe the NZ Government’s Inflation Statistics)

INFLATION: HIGHER AND HIGHER WE GO

In the end game, truth is found only at the margins

In Time of the Vulture: How to Survive the Crisis and Prosper in the Process(2007, 2012 3rd edition), I wrote about inflation and its root cause:

In a credit-money system, over time the constant infusion of increasing amounts of credit will inevitably lead to higher and higher rates of inflation. Because common knowledge of this fact is not in the best interests of those benefiting from the system, it is hidden away. And in the US, hiding the real rate of inflation is done the old-fashioned way, by lying about it.

Prior to the 1990s, the cost of a basket of standard goods and services was compiled. This was called the consumer price index, the CPI, and any rate of increase was considered to be the actual rate of inflation. However, in the early 1990s, this began to change.

Perhaps the old method of tracking inflation seemed outdated or quaint, much like the Geneva Accords [which outlawed torture], to Alan Greenspan and Michael Boskin, the chief economist under President Bush Sr., and a newer way of calculating the CPI was needed.

What was needed was a way that would show a slower rate of increase rather than the actual rate, a way that would save the US government money by lowering social security payments and Medicare benefits tied to the CPI, a way that would convey to global investors that all was well in America, that inflation was under control.

Irrespective of what the newly reconstituted CPI says about inflation, its effects cannot be hidden. Remember Motel 6? A low cost motel chain started in Santa Barbara, California in 1962 whose advertised price was a part of its name, $6.00 per night for accommodations.

I recently checked the prices Motel 6 charges, forty-four years later. The current room rates of Motel 6 at three different locations in Santa Barbara are:

1962 2006

Motel 6 location #1 $6.00 $105.99 an increase of 1,767 %

Motel 6 location #2 $6.00 $82.99 an increase of 1,383 %

Motel 6 location #3 $6.00 $61.99 an increase of 1,033 %

Home prices are also higher as advertised in Morris County New Jersey.

1966 2006

Three bedroom home $15,900.00 $399,900.00 an increase of 2,515 %

Four bedroom home $19,000.00 $624,900.00 an increase of 3,289 %

Marijuana also shows a similar increase in price since the 1960s.

1966 2006

One lid of pot $10.00 $250.00 an increase of 2,500 %

The cost of attending college at the University of Minnesota also rose.

1968 2004

Cost per unit $8.25 $183.00 an increase of 2,218 %

THE DIFFERENCE IN PRICES

BETWEEN THEN AND NOW

IS DUE TO INFLATION

INFLATION IS THE INCREASING COST

OF GOODS AND SERVICES CAUSED

BY THE CONSTANTLY DECLINING

VALUE OF PAPER MONEY OVER TIME

THE MORE MONEY YOU PRINT

THE LESS IT’S WORTH

ECONOMICS – SHILL OR SCIENCE

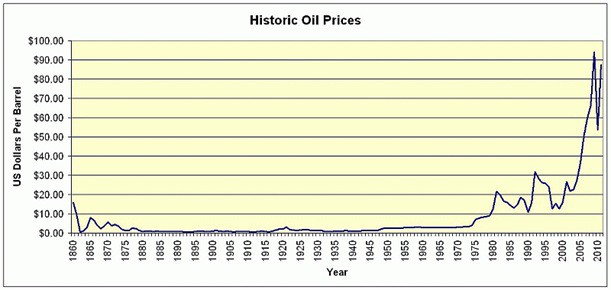

On May 30, 2014, in a talk at the Federal Reserve Bank of Cleveland’s conference on ‘Inflation, Monetary Policy and the Public’, Michael F. Bryan, Vice President and Senior Economist of the Federal Reserve Bank of Atlanta, shed light on how the Fed distorts the rate of inflation; a process that actually began shortly after gold was removed from the international monetary system in 1971.

In his talk, Torturing CPI Date Until They Confess: Observation on Alternative Measures of Inflation, Bryan made the following revelatory remarks:

… Stephen Roach [later Managing Director of Morgan Stanley]..in the 1970s worked for the Federal Reserve under Chairman Arthur Burns. Roach remembers that when oil prices surged around 1973, Burns asked Federal Reserve Board economists to strip those prices out of the CPI “to get a less distorted measure”. When food prices then rose sharply, they stripped those out too—followed by used cars, children’s toys, jewelry, housing and so on, until around half of the CPI basket was excluded because it was supposedly ‘distorted'” by forces outside the control of the central bank. The story goes on to say that, at least in part because of these actions, the Fed failed to spot the breadth of the inflationary threat of the 1970s.

http://www.frbatlanta.org/news/speeches/140530_speech_bryan.cfm?d=1&s=blogmb

In the 1970s, not only did the Fed fail to spot the breadth of the inflationary threat of the 1970s (which rose from 3.3% in 1971 to 14.4% in 1980, a 436% increase); but in September 2008, economists at the Fed also failed to predict the cataclysmic crisis that was to occur later that month.

The failure to predict the crisis and collapse of Wall Street banks in 2008 is not unique to the Fed, it is ubiquitous to economists everywhere; as economists around the world failed to predict the greatest financial crisis since the Great Depression even as it was about to happen.

In his article in FT Magazine, An Astonishing Record – Of Complete Failure (May 30, 2014) Tim Harford noted that although 49 countries were to fall into recession in 2009: …Economists – as reflected in the averages published in a report called Consensus Forecasts – had not called a single one of these recessions by April 2008.

Today’s abysmal state of economics is due to the fact that modern economics is confined to the behavior of the bankers’ parasitic ponzi-scheme of credit and debt whose purpose bankers and powerful elites, e.g. governments, corporations, etc., don’t want known.

Economists, prohibited by academic orthodoxy from any serious examination of that which they purport to study, have devolved into little-more-than philosophising actuaries whose role is to provide a patina of truth, i.e. ‘truthiness’, to the bankers’ ponzi-scheme of credit and debt; the foundation of which is the bankers’ paper banknotes which, although not money per se, possess a ‘moneyness’ which allows them to be used as chips in the bankers’ global casinos, i.e. capital markets, where the house has an insurmountable advantage.

In the West, all attempts to examine the flawed foundations of the bankers’ parasitic scheme from another perspective are marginalized, whether that perspective is the Austrian School of Economics Marxism, communism or common sense.

The study of modern economics is like the study of religion in a time of idolatry

In the end game, self-induced blindness is fatal.

INFLATION AND THE GREAT WAVE

Among the best explanations of today’s economic crisis comes not from an economist, but from an economic historian, David Hackett Fischer. In his seminal book, The Great Wave: Price Revolutions and the Rhythm of History, Fischer offers an historical perspective that provides reasons and explanations assiduously avoided by economists.

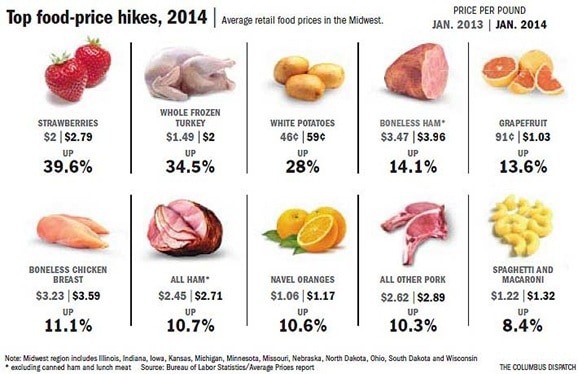

Fischer’s The Great Wave describes the economic, cultural and social collapse of historical epochs brought about by inflationary waves of rising prices. In the last stage of such waves, food and fuel lead the upward surge just prior to societal collapse. Today, according to Fischer, the last stage’s upward surge is now in motion.

Note: On July 7,2014, the Wall Street Journal reported As Food Prices Rise, the Fed Keeps a Watchful Eye – Central Bank Officials Sometimes Look Past Food Cost Increases. The inexplicably sanguine attitude of the Fed regarding food inflation is based upon its deeply-held belief that if food prices soar too high, the Fed can always print more pork, beef, fruit or vegetables to bring prices back down in line with its mandated inflation target.

Regarding the recurrent waves of inflation that culminate in the collapse of historical epochs, Fischer noted that in each wave:

..Food and fuel led the upward movement. Manufactured goods and services lagged behind. These patterns indicated that the prime mover was excess aggregate demand, generated by an acceleration of population growth, or by rising living standards, or both.

… prices went higher, and became increasingly unstable. They began to surge and decline in movements of increasing volatility. Severe price-shocks were felt in commodity movements. The money supply was alternately expanded and contracted. Financial markets became unstable. Government spending grew faster than revenue, and public debt increased at a rapid rate. In every price-revolution, the strongest nation-states suffered severely from fiscal stresses: Spain in the 16th century, France in the 18th century, and the United States in the 20th century.

…Wages, which had at first kept up with prices, now lagged behind. Returns to labor declined while returns to land and capital increased. The rich grew richer. Inequalities of wealth and income increased. So did hunger, homelessness, crime, violence, drink, drugs, and family disruption.

pp. 237-238, David Hackett Fischer, The Great Wave: Price Revolutions and the Rhythm of History, Oxford University Press, 1996

Published in 1996, David Hackett Fischer wrote about our present dilemma:

… inflation was declining, but far from dead. Anti-inflationary policies added to the miseries that inflation itself had caused. The consequences continued in the 1990s: falling real wages, rising inequality, diminished economic growth, and increasing instability in political and social systems.

All that was happening in the Spring of 1996, when this book went to press. The end of the story has not been written. It could end in many ways. So fragile were the major trends that contingencies of various kinds threatened to disrupt them. A major war in the Middle East or eastern Europe or some other trouble spot could reignite inflation. A collapse of overvalued security markets could cause panic, depression and deep deflation.

In a time of crisis, when so many possibilities were hanging in the narrow balance, much depended on the wisdom of our choices. Wise choices in turn required intelligent leaders and informed electorates. But intelligence and wisdom and even the information that we needed most were not much in evidence in the national capitals throughout the world.

As the great wave of the 20th century approached its climax…The ship of state raced onward through high seas and heavy weather…several parties of myopic navigators squinted dimly at the dark clouds behind them…The first-class passengers amused themselves in their opulent cabins, knowing little of the suffering in steerage, and nothing of the dangers that surrounded them. On deck amidships, a lone bookish traveler turned his collar against the wind, leaned precariously across the lee rail, and tried to read the signs in the sky.

For those interested in an unbiased, i.e. non-ideological, explanation of our accelerating predicament and malaise, David Hackett Fischer’s The Great Wave: Price Revolutions and the Rhythm of History offers a unique and informative tableau against which to view today’s events.

The Great Wave, the present inflationary wave of rising prices is now cresting and about to bring the present era to an end. A new and better world is coming; but, first, the banker’s towering edifice of credit and debt—mammon’s legendary Tower of Babel—must collapse.

GOLD IN THE END GAME

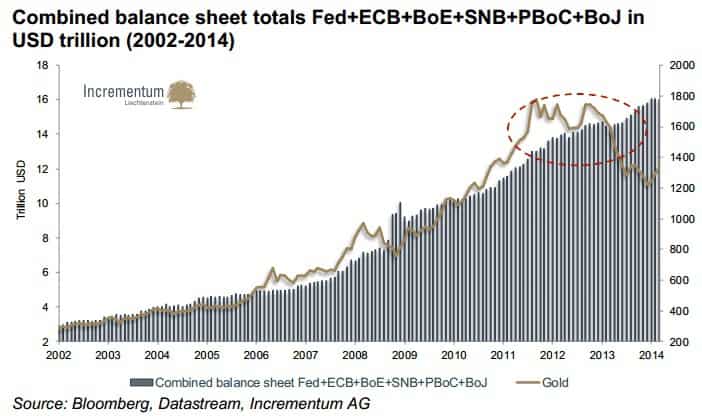

Gold, the ultimate thermometer of systemic monetary distress, accurately tracked the exponential growth of the central banks’ debt-based Tower of Babel until September 2011; when gold’s 27% rise in two months, forced the bankers’ paper money cartel to manipulate the gold price lower no matter what the cost in paper money.

In Gold’s Coming Rise, I explained how the paper money cartel forced down the price of gold from is $1920 high in September 2011. The intervention occurred when bullion banks flooded markets with leased gold shortly after gold moved above $1900 per ounce; giving banks a premium to borrow gold then sell it in the marketplace, temporarily increasing its supply and artificially driving down its price.

But the central bankers’ desperate measures won’t work forever. The fact they chose to intervene at $1900 showed how far the end game had progressed. When gold makes its final ascent, it will be because central banks will be powerless to stop its advance as their paper markets will then be in complete disarray.

Lowering the price of gold by iceing the thermometer will only work for so long; and the longer it works, the less it will do so in the future.

US FIGHTS INFLATION

DRS, Time of the Vulture (2007, 2012 3rd edition)

In my current youtube video, Capitalism and the Age of Aquarius, I discuss my use of the word ‘capitalism’ and how the confusion around the word arose. I also explain how I predicted the economic crisis in March 2007 when economists had not, http://youtu.be/p2g0nGYKhx8 .

[youtube url=”https://www.youtube.com/watch?v=p2g0nGYKhx8″ width=”560″ height=”315″]Buy gold, buy silver, have faith.

Darryl Robert Schoon