Inflation versus deflation is an ongoing debate or you could say even battle in the online alternative media.

Undoubtedly there has been tremendous expansion in the global monetary base with the reaction of central banks worldwide following the 2008 crisis. However we haven’t (yet anyway) seen widespread inflation as many might have expected.

Inflation Versus Deflation

Mike Maloney gives a good run down of why he believes we are still to see a further deflationary episode before a final even more tremendous reaction from central banks which will finally usher in inflation. He gives 4 reasons for this in the video below.

Top Reasons for Deflation Before Inflation

Via Goldsilver.com

As a side note while many would say that gold is not the asset to hold in a deflationary period, Maloney makes a good argument that it performed very well in the deflationary 1930’s:

Gold Performance In Deflation – Mike Maloney & Harry Dent

“During the Great Depression, America’s last period of real deflation, gold did quite well. It doubled in purchasing power. But back then the dollar was pegged to gold. Its price was fixed. And it still bought you twice as much! If we go through another round of deflation as Harry Dent and Mike Maloney think we will, imagine what could happen. Today, the value and price of gold is determined by the market. Gold’s purchasing power could rise dramatically as the price of everything falls around the world. “

Ronni Stoeferle: Internationally Coordinated Central Bank Reaction to Trigger Stagflation

Ronni Stoeferle and Mark Valek issued a “Chart Book” last month updating and adding to some of the commentary in their 2015 In Gold We Trust report.

They ask:

“Is gold [with the price rising this year] the canary in the coalmine for rising inflationary pressure???”

And ponder not dissimilarly to Maloney:

“In case of a major deflationary event (banking crisis?), a potentially internationally coordinated reaction of central banks could finally be the trigger for the transition from deflation to stagflation.”

Daily Bell: Stagflation

The Daily Bell also believes that inflation or rather stagflation, where we see rising prices in some assets with lagging growth and incomes, is what we should be worrying about in the longer term…

“The larger point is that the Fed and other central banks have printed too much money. Sooner or later that money or part of it begins to circulate and price inflation takes off.

Yellen and the rest of her crowd are certainly aware of this and no doubt it was a motivating factor in getting the first hike done.

But what about the next three? They sound fairly doubtful.

And what about the vaunted US recovery? In our view the whole construct of the US “recovery” was flawed.

The US has been in a recessionary environment since 2001 when the dollar began to move down against gold.

The Fed revved up the printing presses at that time and created a series of asset bubbles, including the great sub-prime bubble that collapsed in 2008.

Looking back we can see there really was no “recovery.” The economy was goosed in the 1990s and again in the early 2000s – and the resultant monetary debasement was so significant that the whole world was plunged into a quasi-depression.

It’s as if they want these serial crises, and perhaps they do. Each crisis brings the economic environment closer to a terminal breakdown.

And no doubt once it reaches that point, we’ll suddenly be exposed to elaborate plans for a more centralized monetary and banking system.

In the meantime, central banks have taken to buying gold and so have many Wall Street types.

What do they know? Obviously that price inflation is on the horizon. It’s the same thing that Janet Yellen knows.

And it’s something that YOU should take into account as well. The economy is not recovering. Deflation, going forward, is surely not going to be an issue.

Conclusion: What we’re looking at, just as in the 1970s, is stagflation. Then gold scaled the heights to $800 an ounce and silver traveled up to $50. Where precious metals could go this time is anyone’s guess. But if you own some, you may be happy to find out.”

So they are doubtful of deflation being much of an issue going forward. They recently penned another article on the stagflation argument too:

“In the West, it has taken an enormous circulation of money to counteract what would otherwise have been a catastrophic descent into a powerful but brief depression.

By printing their tens and hundreds of trillions, central bankers have prolonged the pain and created an ongoing Great Recession that has lasted more than a half decade already.

It is very possible, as we have written, that the upcoming years will see an enormous struggle with “stagflation.” Asset classes will rise and fall against a backdrop of mounting price inflation as tens of trillions begin to circulate with more velocity.

This last happened in the 1970s but the crisis is so much more severe today and the amounts of currency in play are at this point beyond human comprehension.

The derivatives market alone is estimated to be in the area of one thousand trillion dollars.

Conclusion: Don’t fall into the trap of believing in a “recovery” in the US or the West. It’s just more mainstream (central banking) propaganda. Expect prices to climb, perhaps aggressively, and people to continue to struggle – perhaps to just survive. Please plan accordingly.”

Read more: Could Stagflation Happen Again?

So What Comes Next?

In the email we received from Ronni Stoeferle accompanying his latest Chart Book he finished up with:

“Take warning, the upcoming recession could play out differently than the last ones. We do hope you find the presented material helpful and interesting!”

So what might we see this time that is different from the last 2008 recession and crisis?

Credit Crisis or Currency Crisis?

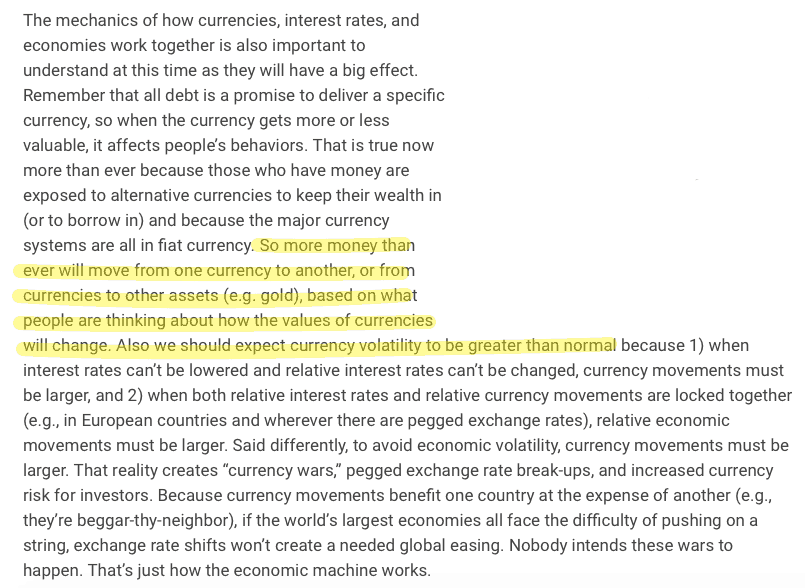

Greg Canavan recently made a good argument that perhaps instead of a credit crisis like in 2008 we’ll see a currency crisis this time around?

“This is the definition of a credit crunch. An event happens and credit values get ‘crunched’. This damages bank balance sheets and restricts their ability to lend; that is, create more credit.

This is what happened in late 2008. But central banks quickly moved to stem the damage. They started buying mortgage bonds and Treasury bonds in exchange for cash. That is, they satisfied the massive demand for cash by increasing the supply of it.

This eventually stabilised the crisis. The problem was that the central banks never pulled back their support. They kept buying assets, which soon resulted in too much cash sloshing around the system.

The point to understand is that there remains a huge amount of cash in the system! This makes a genuine credit crisis difficult, if not impossible, to play out. Why? Because when people panic and sell to move into cash, there is plenty of cash already there waiting….

…What if, instead of a credit crisis — like everyone expects — we end up with a currency crisis?

What does a currency crisis look like?

In short, it has the opposite effect of a credit crisis. That is, in a credit crisis, the value of cash increases relative to stocks. But in a currency crisis the value of stocks increases relative to cash.

That’s because, in the lead up to a currency crisis, global central banks pump so much cash into the system that the supply overwhelms demand.

They’ve already been doing this for years, of course. But what makes you think they won’t continue to do so, or up the ante to even more absurd levels if conditions warrant it?

That’s why I think the prospect of another major credit crisis is slim, and that you shouldn’t let this fear stop you from buying into good opportunities as they present themselves.

Further economic deterioration will result in ever greater attempts at money printing and currency devaluation. At some point in the future, that could result in a wholesale flight out of cash and currencies, and into assets.

That is, stocks could eventually go much higher than what you think is possible…not because things are good, but because it will reflect a world in the throes of a currency crisis.

The rising gold price is perhaps an early indicator of this trend. If the market views gold as a currency, what better currency to own than one that central banks cannot devalue?

I want to stress that a ‘currency crisis’ is not a near term prediction. Depending on central bank actions, this could take a while to play out. But it is important to be flexible in how you think about the future.

Don’t lock yourself into a certain way of thinking. The popular line of thinking right now is to be on the lookout for another 2008-type event. But markets NEVER do what you expect. Something unexpected always pops up.

This currency crisis idea is backed up by Ray Dalio – head of the worlds largest hedge fund – in a note he sent out to clients in February:

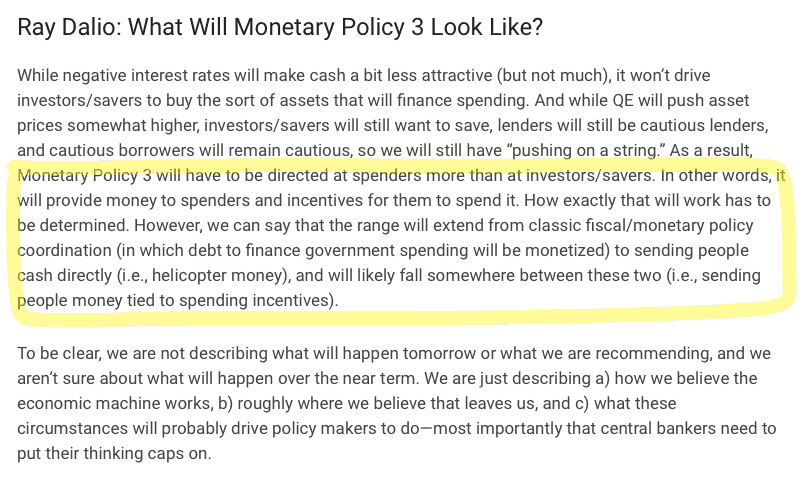

Dalio also has a definite opinion on what will be coming next from central bankers.

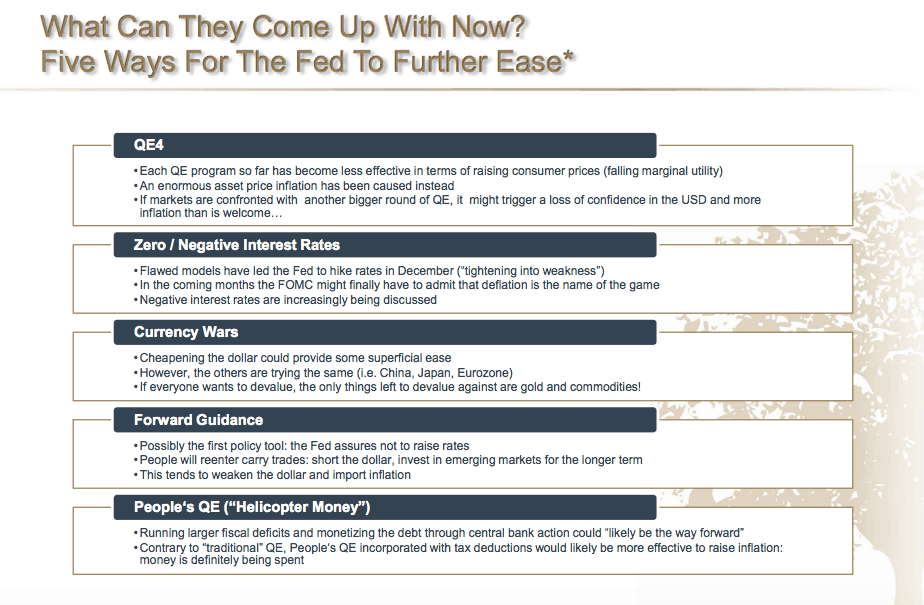

The Federal Reserve’s ability to stimulate the economy with interest rates and QE is weaker than ever before. He explains why it hasn’t worked. Plus what we can expect next from the Fed:

Ronni Stoeferle is also thinking Central Banks will have to go down a similar route. He and Mark Valek outline what options the US Federal Reserve have to react to what they believe is a coming recession. Like Dalio one of these options is “helicopter money” or “Peoples QE”.

Jim Rickards has a very similar view too:

“A new global consensus is emerging from elite voices such as Adair Turner, Larry Summers, Joe Biden and Christine Lagarde. The consensus is that the only solution to stagnation is expanded government spending on critical infrastructure, health care, technology, renewable energy and education. (In a Republican administration, more defense spending could be added to the list.)

If citizens won’t borrow and spend, the government will! It’s the basic Keynesian idea from the 1930s without the monetarist gloss.

More government spending means more government debt. Who will buy these added government bonds? How will the Treasury keep interest rates low enough so that a death spiral of higher deficits and higher rates doesn’t push the Treasury bond market to the point of collapse?

The answer is that the Fed and Treasury will reach a new secret accord, just as they did in 1941 [to fund the WWII]. Under this new accord, the U.S. government could run larger deficits to finance stimulus-type spending.

The Fed will then cap interest rates to keep deficits under control. Capping rates will have the added benefit of producing negative real rates if inflation emerges as the Fed expects.

The Fed can use open market operations in the form of bond buying to achieve the rate caps. This means the Fed would not only give up control of interest rates, it would give up control of its balance sheet. A rate cap requires a “whatever it takes” approach to Treasury note purchases.

The popular name for rate caps, and Fed bond buying to support government spending, is “helicopter money.” The technical names are fiscal dominance and financial repression.”

What About in New Zealand?

Surely all this talk of helicopter money and central banks monetising debt to fund larger government deficits can’t apply to little old New Zealand?

Well, today the Reserve Bank of New Zealand surprised many by cutting their lending rate by 0.25%. That rate now stands at 2.25% so some way off 0% yet. Now we have a little way to go before we catch up to the major central banks running 0% or negative interest rates. But with inflation rates dipping below zero in the last quarter of 2015, odds are even lower interest rates are ahead.

Bernard Hickey actually outlined the argument for “QE for the people” just this week:

Now that zero interest rates, Quantitative Easing and negative interest rates have failed, should the world’s central banks start printing money and handing it over to real people? Bernard Hickey takes a look

“So here we are at the ultimate last resort — printing money out of thin air and giving it to real people to spend on real goods and services, rather than just buying assets and putting the proceeds in the bank.

Late last year the former chairman of Britain’s Financial Services Authority, Adair Turner, recommended something similar. He suggested monetary financing of Government deficits, which means the central bank prints money to lend to the Government to spend on new infrastructure or tax cuts or whatever it feels like. This is more like the Russel Norman suggestion.

The other one is that the central bank simply pay the freshly invented money into everyone’s accounts. This is classic helicopter money without the actual helicopters. It would be fair and have an immediate effect because much more of it would go to poorer spenders, rather than richer savers. Central banks also don’t have to get elected so could do it without the pesky political issues of who deserves the money and who doesn’t. Anyway, many argue the world is in such an economic mess because politicians could not get their political act together to reform their economies and fix their broken infrastructures with Government spending. So why not give the job to a bunch of technocrats.

No one is suggesting this is appropriate for New Zealand any time soon. Our Reserve Bank still has another 2.5% of interest rate cuts to go, and is expected to signal a few as early as this Thursday.

But Helicopter Money is now being actively discussed in the Northern Hemisphere and as we’ve seen over the last decade, where they go, we often follow.”

So keep your eyes peeled. It may be a way off yet, but here in New Zealand we are at least peering down the rabbit hole if not actually going down it yet.

What to do about it?

Maybe take heed from Ray Dalio?

Last year he gave his perspective on gold. Interestingly he was speaking to the Council on Foreign Relations (a well known elitist think tank) where he said to some stifled laughter:

“If you dont own gold…there is no sensible reason other than you dont know history or you dont know the economics of it”.

If You Don’t Own Gold, You Know Neither History or Economics

Pingback: What Will the Impacts of the COVID19 Lockdown be on the Global and New Zealand Economy? - Gold Survival Guide

Pingback: Is Inflation Coming? If So, What Kind? - Gold Survival Guide