This week:

-

Gold and Silver in an Interesting Place

-

Gold Symposium Sydney

-

Inflation vs Deflation vs Stagflation

We’re making a habit of this – being late that is sorry. And we will likely be late next week too as we’ll be in Sydney. Read on to see why…

Gold and Silver: An Interesting Place

As suspected both metals have backed off from their highs in the past week or so. However we do sit in an interesting place currently. In the futures markets where the spot prices that you see quoted are created, the tables have turned from 2 or 3 months ago. We now have the commercial traders or smart money (those who are actually trying to hedge their production and usage of the metals) with net short rather than net long positions and record sizes too. (See comments here from “Trader Dan” Norcini ). So we could have further to fall still.

Looking at the NZD gold chart below there are a couple of levels that potentially we could see the price find support at from here. First down at the lower line of the channel formation that it is trading in currently – say just above NZ$2100 (top green arrow). We’ve had this channel on our daily price alert for a couple of weeks at least now.

Then below this would be the 200 day moving average (MA) (red line) which is currently at NZ$2073. It hasn’t taken too many days in October to get down out of the overbought region it was in for a lot of September (see green circle at top of chart), so good buying opportunities not far off perhaps.

Likewise with the NZD silver chart the RSI has turned down sharply from the overbought region it has been in since August. (see green circle in the chart) And it is actually getting pretty close to oversold even more so than gold (i.e. 30 and below).

There’s a few areas of support to look out for in silver too – see the green arrows. We’re very close to the 50 day MA (blue line). Below that is the 200 day MA at NZ$38.50, then at NZ$37.50 is where silver broke out of long term downtrend it had been in since August 2011. After breakouts like this it’s not uncommon to see price return to the breakout level or even back to touch the downtrend line (bottom green arrow).

So there are a few buying zones possibly about to come into play.

One angle (which we’ve mentioned more than once before) is to split whatever funds you’re looking at using to purchase some bullion into a few tranches and aim to buy a slice at each level if it gets there.

Gold Symposium Sydney

Labour weekend is coming but we do not rest here at GoldSurvivalGuide! Ever on the hunt for the latest happenings in the gold markets, on Monday of the long weekend we’ll be in Sydney once again for the Gold Symposium.

Featuring the likes of Currency Wars author James Rickards and back again from last year Egon Von Greyerz of Matterhorn Asset Management. The symposium also runs on Tuesday, so just a heads up that we will be working from Australia so if we’re ever so slightly slower to respond on Tuesday that will be why.

Speaking of speakers at the symposium. Another speaker is Frédéric Panizzutti of Swiss gold trading and refining company MKS. We stumbled across this article the other day where he was quoted.

We knew Switzerland refined a lot of gold but learned just how staggering the volume of gold that is refined there is. Last year 2600 metric tons of raw gold were imported. A phenomenal figure considering that the US Geological Survey reported the total mined gold in the world for 2011 was 2700 metric tons. Panizzutti was quoted as saying that the Swiss refine 70% of the worlds gold (taking into account illegal mining and scrap gold too).

So it will be interesting to see what else he has to say when we hear him on Monday at the symposium.

Odds are we’ll learn a thing or two and we’re happy to share. We’ll have some reports from the many speakers to share with you in the coming weeks.

To give you an idea, here’s a few of the articles we wrote after last year’s symposium:

Eric Sprott: Mania, Manipulation, Meltdown

Egon von Greyerz Apocalypse Soon

Panel Discussion featuring Eric Sprott, John Embry, Egon von Greyerz and Ben Davies

This weeks articles:

We have another video featuring a presentation by the author of one of our favourite books G Edward Griffin. He comments that the US Federal Reserve is actually doing a great job… “THE FED’S SOLE PURPOSE: KEEPING THE BANKS AFLOAT” – G. EDWARD GRIFFIN

We have another video featuring a presentation by the author of one of our favourite books G Edward Griffin. He comments that the US Federal Reserve is actually doing a great job… “THE FED’S SOLE PURPOSE: KEEPING THE BANKS AFLOAT” – G. EDWARD GRIFFIN

Here’s a dangerous statement to make, not only a gold price prediction but also the date it will come about. A fools errand no doubt, but the chart in this short article is worth seeing on it’s own. WHAT WILL THE PRICE OF GOLD BE IN JANUARY 2014?

Here’s a dangerous statement to make, not only a gold price prediction but also the date it will come about. A fools errand no doubt, but the chart in this short article is worth seeing on it’s own. WHAT WILL THE PRICE OF GOLD BE IN JANUARY 2014?

The average kiwi doesn’t invest in government bonds and certainly not US Treasuries, but you may have noticed just how incredibly low the yields on government bonds the world over are. In this article Darryl Schoon shows the yields don’t have much left to fall, and how with the risk of deflation now back, those holding government bonds are not in the safe haven they think they are. He also goes into how gold protects us from not just inflation but also deflation too. GOLD AND THE DISAPPEARING YIELD

The average kiwi doesn’t invest in government bonds and certainly not US Treasuries, but you may have noticed just how incredibly low the yields on government bonds the world over are. In this article Darryl Schoon shows the yields don’t have much left to fall, and how with the risk of deflation now back, those holding government bonds are not in the safe haven they think they are. He also goes into how gold protects us from not just inflation but also deflation too. GOLD AND THE DISAPPEARING YIELD

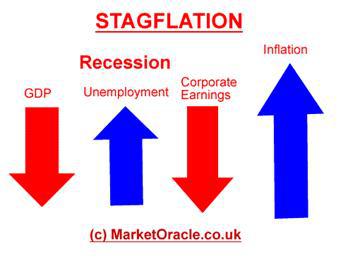

Inflation vs Deflation vs Stagflation

Speaking of inflation and deflation. Last week we were at a gathering of a few like minded friends. “Comrades in Gold Arms” as Jim Sinclair would say. We got on to the topic of what people see coming down the track in the future. Chiefly will it be deflation or inflation? Opinions were quite varied. Many thought we would still see a deflationary collapse followed by inflation or even hyper-inflation.

What’s our take?

We’re leaning toward stagflation for the medium term. Much like the 1970’s we could see very low to no growth, ongoing higher unemployment levels, but rising living costs such as food and fuel. As the name suggests a stagnant economy but rising prices of basic goods. How can prices rise in a stagnant economy with high unemployment? We saw it most simply explained recently by Nickolai Hubble of the Daily Reckoning Australia. He was discussing why more money printing by Bernanke won’t solve the unemployment problem:

“The problem is that unemployment and money printing aren’t related to each other in the way central bankers expect. They learned this back in the 70s when many countries experienced high inflation and high unemployment at the same time.

It was supposed to be impossible. How can prices rise if there are lots of unemployed people? Well, those unemployed people aren’t producing anything, so you have more money chasing fewer goods. The result is higher prices.” Source.

Learn more: Could Stagflation Happen Again?

Ongoing money printing by central banks globally may serve to cancel out the deflationary forces at play for a while yet.

How long will this last?

Who knows? Simply until it can’t anymore. Perhaps at some point more and more of all the extra currency created will find it’s way into real assets forcing their prices to rise. And unlike 1979 the major governments of the world have incredibly high debt levels so the central banks won’t be able to raise interest rates to rein in inflation as that would bankrupt many governments. So we could end up with very high inflation that can’t be contained and a complete loss of faith in fiat currency.

We hope for an eventual return to freely exchanged gold and silver as money, (see here for out thoughts on how this might work) not controlled by governments or banks, but who knows if we’ll get it?

In the meantime we continue to turn some monopoly money into physical gold and silver on a regular basis. Are you?

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

Silver and Gold in NZD: Performance Year to Date 2012

2012-10-11 00:57:28-04

Better late than never! Sorry for the delay… This Week: • The Golden Cross Has Occurred • Silver and Gold in NZD Performance Year to Date • Everyone Else is Printing Why Shouldn’t We? • Speaking of Mexican Billionaires The Golden Cross Has Occurred 3 weeks ago we mentioned a significant technical indicator was about to […] read more…

“The Fed’s sole purpose: keeping the banks afloat” – G. Edward Griffin

2012-10-11 19:11:02-04

This makes it 2 in a row for G Edward Griffin, author of one of our favourite books. Following on from the previous video of an interview with him, this one is part of his presentation at the recent Casey Research Summit… Is the Federal Reserve really doing such a bad job… or does it actually […] read more…

GOLD AND THE DISAPPEARING YIELD

2012-10-15 19:33:39-04

Darryl Schoon writes how bond yields have almost no where left to fall to, how risk is once again back in town in the form of deflation and how gold is the ultimate hedge against not only inflation but also deflation too… GOLD AND THE DISAPPEARING YIELD We asked for signs, the signs were sent […] read more…

What Will the Price of Gold Be in January 2014?

2012-10-16 18:14:43-04

An often cited argument for holding gold is to protect ones purchasing power against an ever growing money supply. Well, here’s a great visual representation of the the relationship between the gold price and monetary base and how the correlation between the two can be used to project the gold price at a given point in […] read more…

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Pingback: Jim Rickards: Buy Gold While it’s on Sale | Gold Prices | Gold Investing Guide

Pingback: Housing Un-affordability: It’s Not Supply, It’s the Debt Stupid! | Gold Prices | Gold Investing Guide