Throughout most of the world, the last 7 or 8 years has delivered what appears to be very low levels of what is known as “consumer price inflation”.

Sure house and other asset prices have risen in many parts of the globe. But these get conveniently stripped out of or “substituted” from most government measures of inflation.

But are we beginning to see the very early stages of a switch from these low inflation days?

Ronald Stoeferle of Incrementum’s

chartbook from a month ago featured some thoughts on inflation. The Incrementum team pondered

“Is Consumer Price Inflation in the Offing?”

Their report noted:

Since the Beginning of 2016 the Incrementum Inflation Signal Indicates a Full-fledged Inflation Trend

There is a Lot of Asset Price Inflation That Could Now Spill Over to Consumer Price Inflation

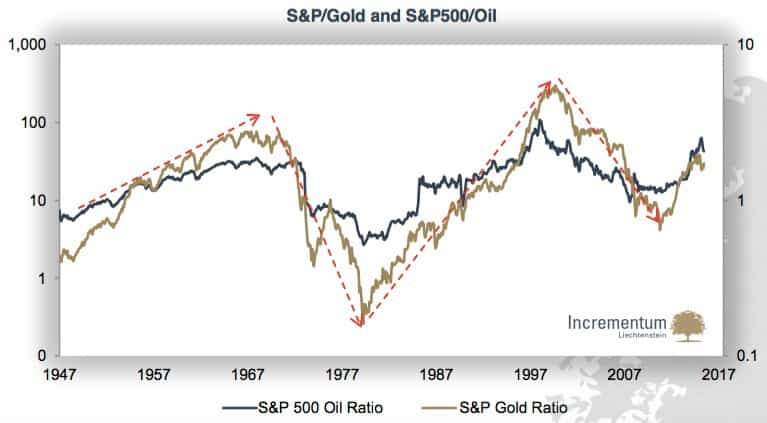

► A commodity price index has been used as a proxy for consumer price inflation (since we are skeptical with respect to the methodology that is commonly used); the S&P 500 has served as a yardstick for asset prices

► Key insight by this ratio: There have been alternating long-term cycles during which either consumer price inflation or asset price inflation predominated

► Similar to the peaks in 1966 and 2000, another change in trend appears to have occurred at the end of 2015

The New Bull Market in Gold Was Accompanied By an Increase in Price Inflation

► A commodity price index has been used as a proxy for consumer price inflation (since we are skeptical with respect to the methodology that is commonly used); the S&P 500 has served as a yardstick for asset prices

► Key insight by this ratio: There have been alternating long-term cycles during which either consumer price inflation or asset price inflation predominated

► Similar to the peaks in 1966 and 2000, another change in trend appears to have occurred at the end of 2015

The New Bull Market in Gold Was Accompanied By an Increase in Price Inflation

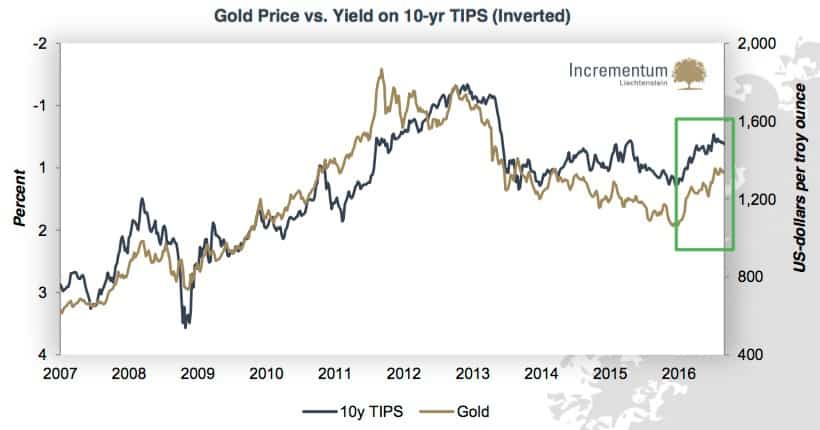

► Strong negative correlation between the yields on inflation-protected bonds and the gold price

The breakout in the gold price was accompanied by an increase in inflation concerns being priced in

► The market appears to have correctly anticipated the change in the inflation trend

Source.

► Strong negative correlation between the yields on inflation-protected bonds and the gold price

The breakout in the gold price was accompanied by an increase in inflation concerns being priced in

► The market appears to have correctly anticipated the change in the inflation trend

Source.

Last month Ronald Stoeferle was quoted on Bloomberg also commenting on inflation:

“Inflation may surprise to the upside and this will be the moment when you want to have some gold in your portfolio,” Stoeferle, 35, said in an interview. “Not the absolute level of inflation, but the momentum and the direction of inflation is the most important driver. In this uncharted territory, with big monetary experiments going on, it just makes sense” to hold bullion, he said.

…Stoeferle’s comments echo Elliott Management Corp.’s Paul Singer who in September said there’s a risk inflation could surprise everyone and that gold was underrepresented in portfolios.”

…Stoeferle manages 32 million Swiss francs in the Austrian Economics Golden Opportunities Fund, which he started in 2014 with partner Mark Valek. The fund uses its own inflation indicator, which has given a strongly rising signal since the beginning of March. This has prompted them to invest in mining stocks, energy equities, commodities and commodity currencies, Stoeferle said.”

Source.

Just this week Jared Dillon in his The 10th Man newsletter makes the argument that regardless of who wins the US election there is one thing you can count on. Inflation will be rising…

“If Donald Trump wins, we will have 35% tariffs on TVs, which will increase in price accordingly. Protectionism sounds great in theory, not so great in practice. The price of all imported goods will rise sharply—especially electronics, where people have become accustomed to prices going down for years.

But Hillary Clinton is also good for inflation. Regulation increases the cost of everything. This is known as “inflation by fiat.” There are a million examples of it. Those costs of compliance feed into everything we buy. The regulatory state has expanded massively in the last eight years, and it will continue to expand under a Clinton administration.

One thing is for sure—inflation is not going down. The only question is, how fast will it go up?

It is starting to get priced into the TIPS [Treasury Inflation Protected Securities] market:

Which is something the Fed watches closely.

You can look at this any way you want. The Fed is either hiking rates preemptively, because of inflation, or belatedly, because of unemployment, but barring any complete collapse in a major economic indicator (like nonfarm payrolls), I fully expect the Fed to hike interest rates in December.”

Source.

Which is something the Fed watches closely.

You can look at this any way you want. The Fed is either hiking rates preemptively, because of inflation, or belatedly, because of unemployment, but barring any complete collapse in a major economic indicator (like nonfarm payrolls), I fully expect the Fed to hike interest rates in December.”

Source.

Here in New Zealand we also have seen inflation expectations rise recently. Albeit by a very low amount. But still, maybe we are seeing a change in the tide after years of very low price inflation (well by official measures anyway)?

“Inflation expectations show modest uplift in next two years.

New Zealand inflation expectations for the next two years have increased, a Reserve Bank survey shows, in an economy that respondents believe will pick up pace.”

Expectations for inflation one year out rose to 1.29% compared to 1.26% in the Reserve Bank’s previous survey of expectation three months ago. The two-year ahead figure edged up to 1.68% from 1.65%, although this was little changed for a third straight quarter.”

Source: www.nbr.co.nz

While an error at Statistics NZ has meant that the latest inflation figures have been adjusted up slightly.

“The consumers price index rose 0.3% in the three months ended September 30, above the 0.2% pace originally reported on October 18, which was itself above Reserve Bank expectations for a 0.1% increase.”

Source:www.nbr.co.nz

These levels are very low still. But as Ronald Stoeferle noted above it is

…“the momentum and the direction of inflation [that] is the most important driver”.

Then today “The Maestro” also points out that the early stages of inflation may be appearing.

“Former Federal Reserve Chairman Alan Greenspan sees longer-term market interest rates increasing as inflation takes hold in the U.S.

“If the early stages of inflation, which are now developing, would take hold, you could get — fairly soon — a fairly major shift away from these extraordinarily low yields on 10-year notes, for example,” Greenspan said in an interview on Bloomberg Television on Monday. “I think up in the area of 3 to 4, or 5 percent, eventually. That’s what it’s been historically.”

The target range for the Fed’s main policy rate is 0.25 percent to 0.5 percent, and the yield on 10-year Treasuries remains below 2 percent. Greenspan reiterated his often-repeated point that such low rates are unsustainable in the longer run, and said that he sees nascent inflation as the possible end to the bond bull market.

“We’re moving into the very early stages of inflation acceleration,” Greenspan said. “That could be the trigger.”

…Challenges lie ahead as longer-term rates adjust upward toward a more historically normal level, Greenspan warned.

“It’s a problem, as in going from where we are now to 4 or 5 percent,” he said. “There’s a whole structure of adjustments which have taken place, basically since 2008, which have to be unwound, and that’s not going to be done without a problem.”

Source.

So what to make of all this inflation talk?

We’ll turn back to Incrementum’s chart book again.

“While all other currencies used to be firmly tied to gold as well, they are nowadays tied to the US dollar, which is drifting like a buoy in a continually changing swell

► In this role the dollar‘s relative value vs. gold, respectively a broad basket of commodities, plays a decisive role for global inflation trends

► If the dollar depreciates against gold and commodities, all other commodities implicitly depreciate as well and global price inflation will tend to rise”

To us it makes sense that the majority will once again be taken by surprise.

After years of low inflation, we may well see a surprise lift in inflation rates. This will perhaps take hold in the US first before spreading elsewhere.

People who have been looking for yield by buying longer term government bonds will be hit hard.

Those with large debt positions, who haven’t done their sums on the impact of higher interest rates, would also take this change in trend squarely on the chin.

We’ve written a number of times before

how rising interest rates can actually be positive for gold.

Are we perhaps heading for an eventual repeat of the stagflation of the 70’s? Low growth, higher inflation and interest rates (but lower real (after inflation) interest rates, and higher gold and silver prices?

► A commodity price index has been used as a proxy for consumer price inflation (since we are skeptical with respect to the methodology that is commonly used); the S&P 500 has served as a yardstick for asset prices ► Key insight by this ratio: There have been alternating long-term cycles during which either consumer price inflation or asset price inflation predominated ► Similar to the peaks in 1966 and 2000, another change in trend appears to have occurred at the end of 2015 The New Bull Market in Gold Was Accompanied By an Increase in Price Inflation

► Strong negative correlation between the yields on inflation-protected bonds and the gold price The breakout in the gold price was accompanied by an increase in inflation concerns being priced in ► The market appears to have correctly anticipated the change in the inflation trend Source.

Which is something the Fed watches closely. You can look at this any way you want. The Fed is either hiking rates preemptively, because of inflation, or belatedly, because of unemployment, but barring any complete collapse in a major economic indicator (like nonfarm payrolls), I fully expect the Fed to hike interest rates in December.” Source.

Pingback: The 35-Year Bull Market in Bonds Comes to an End - Gold Survival Guide

Pingback: What's “Changing”: Interbank Lending, Interest Rates and Inflation? - Gold Survival Guide