We often get asked, “Is now a good time to buy gold in NZ dollars?” Back in November I read a great interview from Chris Weber, who we pay close attention to, as he did well in the 1970’s bull market and always writes insightfully. It’s hard to argue with the answer that he gave in this interview on this very question of “Do you recommend buying now?” An excerpt from the interview is included below… (We read the original interview via a Daily Crux email subscription but the whole interview has been reposted here and is worth a read)

I’ve actually been getting this question a lot lately. You know, I’ve been talking about how competitive devaluations are going to raise the gold and silver prices since early ’01, and I get the sense that some people are just now starting to believe that. It actually had to happen for them to see it… What they’re calling the “currency wars” in the financial news is competitive devaluation in action. To try to answer it simply… I don’t think it’s too late to buy. Especially with the events of the past couple of weeks… Both gold and silver have gone past the levels where I would say, “Hold off to see if they fall.” But it really depends on the individual here. For me, I’ve probably got about 25% of my assets in cash right now… mostly U.S. dollars. The rest is predominantly in gold and silver, which I view as alternative currencies. Now I didn’t set out to have 70% or 75% in precious metals, but since I bought them quite a few years ago, they’ve gone up so much they make up the majority of my assets. I could sell and rebalance, but there’s nothing else I’d rather own right now. At the same time, I think if you have 75% of your portfolio in any asset class like I do, it would be pretty stupid to add to it. If you own no gold or silver – or less than 5% of your net worth – you’re in a very different situation. But as far as whether this is the best time to buy or not, I would say I’m pretty much over-trying to pick entry points. Just bite the bullet and buy some. And then continue to add regularly until you own as much as you feel comfortable holding. Of course, the metals aren’t as cheap as they were a few years ago, but that seems to be the way of the world. People don’t seem to want things so much when they’re very inexpensive. But when they start going up every day, everyone wants to buy them. We’ve just seen what can happen when an item, in this case silver, starts to go up by 3%, 4%, even 5% per day. People start to jump in and it really increases the volatility. In just the past couple weeks we’ve seen some huge moves. We saw silver jump over $29 one day, then plummet 10% within a few hours, only to rally back up again. That’s the kind of thing that happens. What we’ve seen recently is, I believe, just a taste of what’s going to happen down the road… at far higher prices. Could it still correct before heading higher? Of course. This recent rally began in August, when silver was $18. And by the time it got to $29, it had almost increased 60% in just a few months. So it’s definitely entitled to back off to rest. But you can’t count on it. On the other hand, you’ve also got to be prepared for the possibility that we could just as easily see silver fall to $15. In fact, I would be willing to bet we’ll see silver drop 50% or more again in a short period of time. If that were to happen, it’d actually be a great buying opportunity. But it very well could happen from a much higher level, where the low point is actually higher than it is today. Ideally, I’d like to see gold and silver hang out in their current neighborhood – around $1,400 for gold and $27.50 for silver for the next few months. Now obviously, I don’t mean exactly those levels… I’m talking around those levels, give or take 10% or 15% either way. To me, that would be the most bullish scenario possible, setting them up for a new lunge upwards at some point. For silver especially, if it can hold above the 50% retracement level it would be extremely bullish. But we just can’t know for sure. So your best bet is to be prepared for either scenario. Again, what that means will be different depending on the person. But the idea is, you want to own a comfortable amount of gold and silver, and hold enough cash to see you through any major corrections.

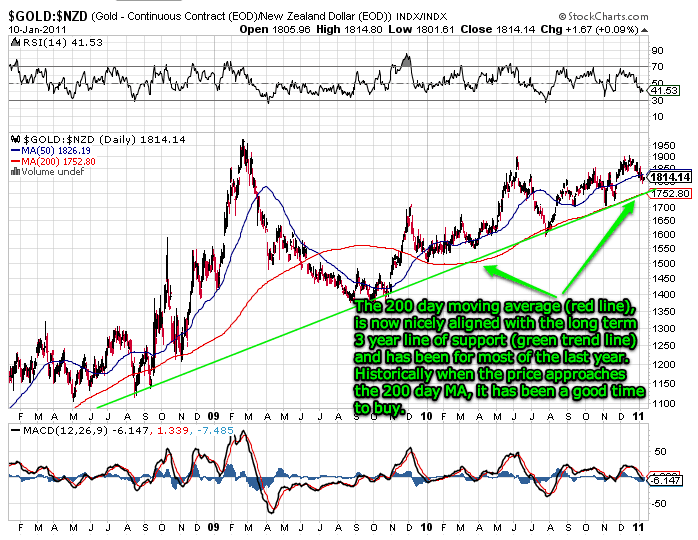

Judging by the recent movements, it may well be that the monetary metals are holding around those levels he mentioned. Probably the reason we like to read Chris Weber is because our approach mirrors his. Buy regularly and you’ll get a good price overall. But we also like to buy more when the gold price dips. How do we do this? We’ve commented on this somewhat before but one of our favourite measures to watch is the 200 day MA (moving average) in the New Zealand dollar price of gold. Why is that? Well check out the chart below for the reason. It’s a 3 year chart of the gold price in New Zealand dollars.

>> Read an update on this topic: Is Now a Good Time to Buy Gold in New Zealand?

The 200 day MA is the red line and as you can see, history shows that in the last 3 years buying when the price is close to the 200 day moving average has worked out well. During this period, it was only in the middle of 2009 that the gold price dropped significantly below the 200 day MA. And even then the bull market remained intact and in 6 months the gold price was back above the 200 day moving average line. You’ll also note that the 200 day MA line is currently nicely aligned with the long term line of support (the green trend line we have drawn in). The current price of $1814 is getting pretty close to the 200 day MA and so we could well currently be in a good zone to buy gold in NZ dollars for the long term. Again we don’t recommend trying to time the market but in the long run buying the dips in the NZD gold price should see you right!

>> Learn More: When to Buy Gold or Silver: The Ultimate Guide

Pingback: Buy gold in New Zealand - Is now a good time? | Gold Prices | Gold Investing Guide

Pingback: A longer term view of NZD silver | Gold Prices | Gold Investing Guide

Pingback: Buying Precious Metals: Common Questions from First Time Buyers | Gold Prices | Gold Investing Guide

Pingback: Gold Bullion in New Zealand dollars hits record high – Time to buy or sell? | Gold Prices | Gold Investing Guide