This week:

- Kiwi takes a dive and helps out precious metals

- Real Interest Rates in New Zealand: What can they tell us about when to buy gold

- Gerald Celente in Trends Journal – NZ a good place to escape to.

- Shanghai Futures Exchange starts silver futures trading

- Good time to buy Gold and Silver in NZ?

- How a Silver bar quote is put together

Kiwi takes a dive and helps out precious metals

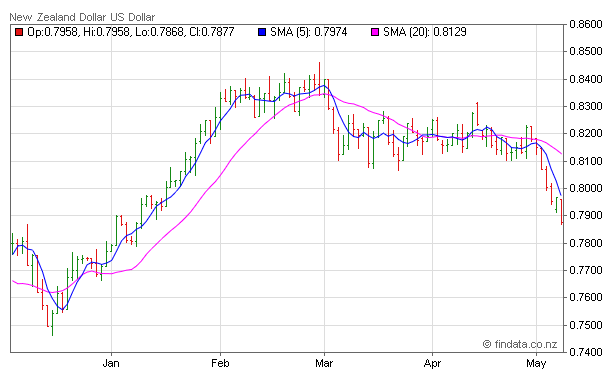

Maybe Guv Bollards comments last week on the possibility of more monetary policy intervention did the trick. As in the last few days the kiwi dollar is down quite significantly and under 80c for the first time in 3 months – see the chart below. (Or perhaps it is just following in the footsteps of big brother Aussie dollar which has fallen sharply after their 0.5% interest rate cut last week and the (not surprising) troubles of Europe being back in the headlines).

Either way this is helping out the gold price in NZ dollar terms. Even though gold in USD has dropped right down to $1604 overnight (after bouncing off $1598), gold in NZD is only down to $2036. So still well above the support line (green line in chart below) of the last 9 months at $2000.

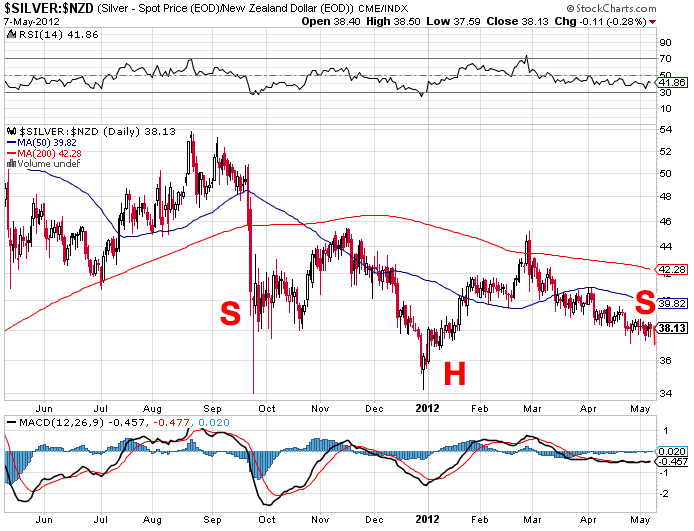

Meanwhile silver in USD has been as low as $29.16 (now $29.40), while in NZD terms it’s at $37.30 after bouncing off $37.06NZ. To us silver looks a bit more uncertain at the moment. From the chart below you could make an argument for an inverse head and shoulders pattern. When this occurs the price then moves up markedly higher from the right shoulder where it sits currently.

But you could also make an argument for it heading down to the previous low of around $35-35 NZD dollars. And in these days of Central Bank manipulation in interest rates and foreign exchange markets and for that matter in just about every other market it seems, only time will tell.

Real Interest Rates in New Zealand: What can they tell us about when to buy gold

And speaking of the good Dr Bollard, as we discussed last week there is the possibility of further interest rate cuts which got us to thinking about one of our favourite gold buying indicators – Real Interest Rates. So this week we’ve put together a feature article on Real Interest Rates in New Zealand and what they can tell you about when to buy gold.

Also this week we’ve posted the 2nd part of The Big Silver Picture video: The Silver Door is Closing. Part 1 last week covered the past 600 years of silver history, Part 2 focuses on just the past 80 years.

And following on from the European elections of France and Greece is this interesting piece on the problems the governments of the world face and their likely reactions to these problems. Is an Economic Deluge Nigh?

As an interesting aside and to share a bit of culture, we were forwarded this YouTube video of a song written by reader Andrew with a monetary message of the metallic variety. A Time Soon Coming

He said to say that if you think it’s a bit “lo-fi”, musically speaking – it was more important to them to get this message out there than polish it up too much.

Gerald Celente in Trends Journal – NZ a good place to escape to

As we mentioned a few months back, while things may not be perfect here in NZ, we still seem to be fairly attractive to wealthy foreigners such as the likes of James Cameron of Avatar fame.

And thanks to the last issue of Gerald Celente’s Trends Journal, we could end up with a few more looking to join the ranks. The nation managed to make the shortlist of “Safe Haven” destinations to escape to and did come in ahead of Australia too…

“High on the list as a Long Farewell safe haven is New Zealand. The island nation of forests and volcanoes has such livable, prosperous cities as Wellington, Auckland, and Christchurch, all with a mild maritime climate. English is spoken by 98 percent of the people, and it’s a place where folks can’t help – literally – to be sunny, since it has 2,000 hours of sunshine per year. It is, however, earthquake prone. Christchurch suffered an estimated $30 billion in damage, and some 200 deaths, from a series of strong quakes over the past year and a half.

Lower on the down-under Long Farewell list is Australia, primarily for the same reasons that make Canada less attractive: its close military and foreign policy ties to the United States. But even with the downside, there is a tremendous vitality and a can-do, pioneering spirit to Aussie life. “

Shanghai Futures Exchange starts silver futures trading

We’ve recently reported how statistics are showing massive increases in gold imports into China. Well, the big event for the week is the opening of the Shanghai Silver Futures Exchange. The Australian reports that it will be interesting to see if the same demand now builds for silver and silver mining companies from within China: (Full article taken from GATA)

“Silver and China are coming full circle. In the mid-1930s the academic journal Foreign Affairs noted how “the world was startled by the news that China had abandoned the silver standard” after foreign miners began dumping surplus metal into China.

Seventy-eight years later, this coming Thursday, the Shanghai Futures Exchange begins trading silver contracts. China Daily noted there had been an absence of silver trading ability in China and — significantly — it would make the market more liquid.

The silver buffs jumped on that one, predicting the end of big Western speculators manipulating the price, which so many of them believe has been occurring.

However, silver still tends to behave as it did more than 80 years ago. That Foreign Affairs article noted “the ups and downs of silver have been more marked than those of any other commodity.” Same now. China Daily noted “the price of silver has long been volatile,” recalling last year it dropped 13 per cent in a single session.

Chinese commentators expect the silver contract to do well as most retail investors there prefer that metal to gold, because its minimum purchase value is lower. But silver is also imbedded in the Chinese psyche: It was long the basis of China’s currency and in 1935 the Shanghai-based biweekly Finance and Commerce reported personal hoards of the metal in China were estimated at 1.27 billion ounces.

China is not only the world’s largest gold producer but is becoming the biggest importer too. We will wait and see whether the same import demand builds for silver.

Shanghai futures trading could mean additional investment demand for silver, just as we have seen Chinese retail investors stock up on gold.But, more importantly, we might see Chinese corporates looking to pick up silver projects (and companies) abroad, just as they have begun doing with gold deposits and producers.

If Standard Bank’s bullion strategist was right in February, China has very large stockpiles of silver, estimated as being sufficient for 15 months’ fabrication demand. So China does not need physical silver today — but buying foreign silver assets is about demand in the years ahead.It seems all the gold and silver roads are leading to China.”

Good time to buy Gold and Silver in NZ?

A falling NZ dollar and a US dollar gold and silver price that has been consolidating for 6-9 months could make this a pretty decent time to buy for Kiwi’s. Especially if the Kiwi continued to fall for a bit and gold in USD rose at the same time.

If you think so then give David a call, email or live chat and he can get you a specific quote for either metal.

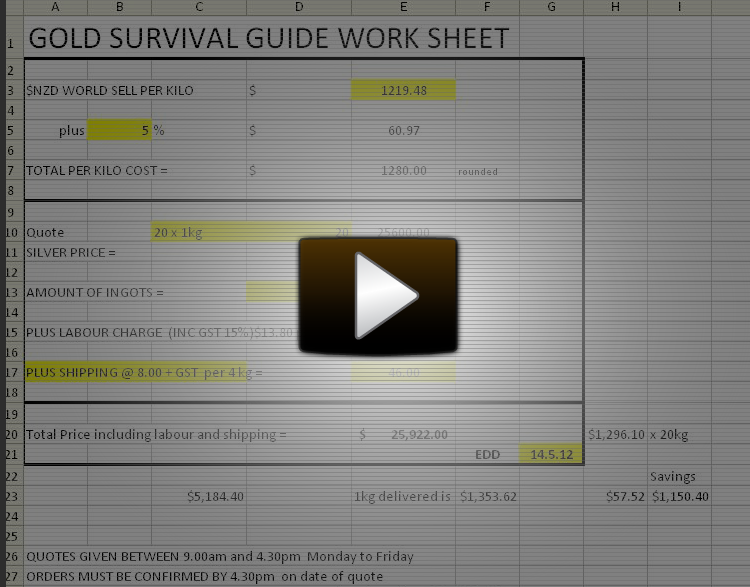

How a Silver bar quote is put together

Here’s short video David just made which shows how a quote for silver bars is put together and outlines the savings on buying 5kgs or more.

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 )

3. or Online order form and full product list

Have a golden week!

Glenn (and David).

Founders

Gold Survival Guide

High NZ dollar? We need more intervention!

2012-05-01 19:04:01-04

This Week: – NZ Interest rates – RBNZ cut on the horizon? – Low Inflation in NZ – Boo! – High NZ dollar? We need more intervention! – The start of an awakening? – Another Free Aussie Gold Miner Share Report Interest rates – RBNZ cut on the horizon? Interest rates seem to be the […]read more…

Real interest rates in New Zealand: What can they tell us about when to buy gold?

2012-05-07 21:32:29-04

Last Wednesday we commented on Reserve Bank Govenor Bollards recent announcement to hold NZ interest rates as they are. And his comment that “Should the exchange rate remain strong without anything else changing, the bank would need to reassess the outlook for monetary policy settings.” What will the Reserve Bank of New Zealand do in […] read more…

The Silver Door is Closing

2012-05-07 22:28:33-04

Here’s is part 2 of The Big Silver Picture video from Chris Duane who has been publishing some great videos. In this instalment Chris covers: The Kondratieff cycle and the 80 year seasonal nature of our society When in the seasonal cycle to be in Paper Assets versus Real Tangible Assets The Silver bear market […]read more…

Is an Economic Deluge Nigh?

2012-05-07 22:47:06-04

This article was written before the weekends elections in France and Greece and so David was surprisingly accurate in what he predicted would occur in the markets as a result of a change of leadership. Read on to see if you agree with the rest of his predictions as to how Governments are likely to […]read more…

The legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.