Gold Survival Gold Article Updates:

Jan. 16, 2014

This Week:

- NZ Dollar: Rising and Rising Forevermore?

- 10% Wealth Tax on the Cards?

- New Zealand Almost Losing the Race to Debase

- Latest from Ronald Stoeferle

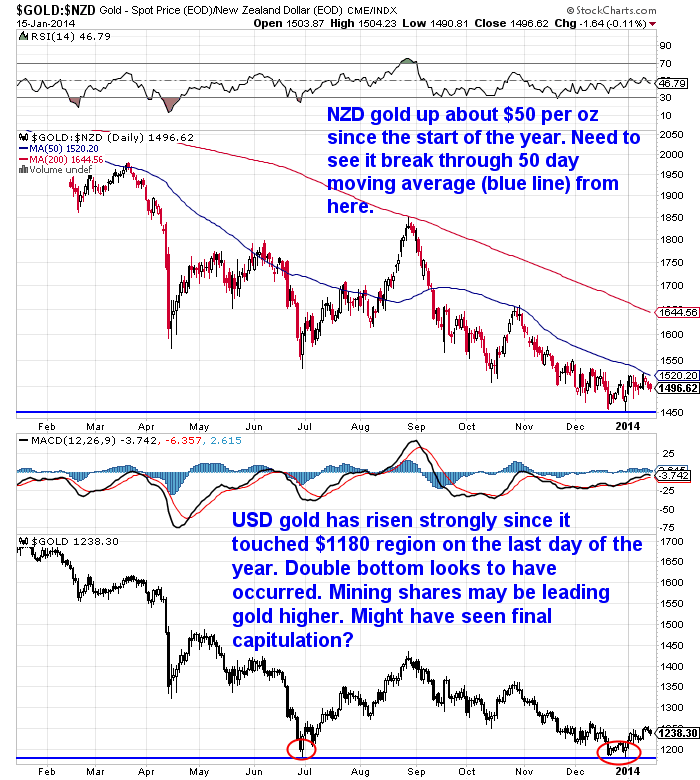

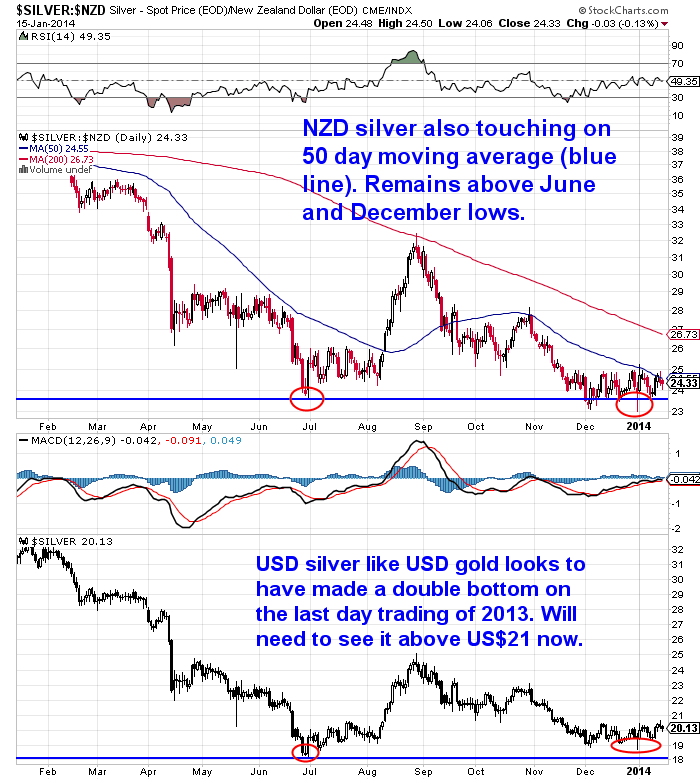

Compared to last week, NZ dollar gold is up $7.26 per ounce or 0.49% to $1488.29. NZ dollar silver is up 61 cents per ounce to $24.19 or 2.59%.

In the bottom half of both charts above we can see that the USD price ticked up from what looks to have been a double bottom on the last day of the year. We are leaning towards this being the case now for a few reasons:

1. The fact the metals didn’t go any lower than this in the light holiday trading is a positive.

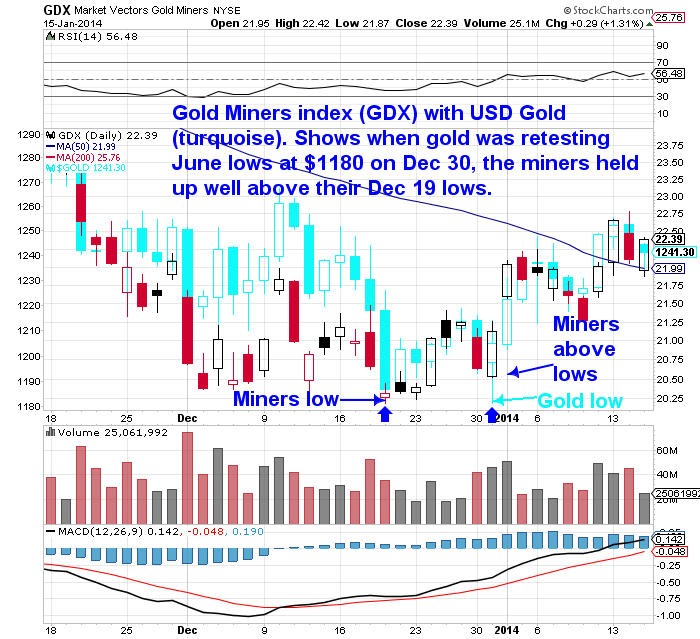

2. That the mining shares held up well. When gold was testing the June lows of $1180 on the last day of 2013, the mining shares were actually already up from their lows which occurred on December 19th. You can see this clearly in the chart below.

The miners often lead the metals higher at important turns, so this is promising.

3. We’ve noticed people we talk to (not followers of precious metals) are aware of how far gold has fallen recently, showing it has been making mainstream headlines.

So it seems perhaps all the sellers have sold and the final capitulation may have occurred. In terms of NZ dollar prices we’d like to see both metals break through the 50 day moving averages now. They haven’t been above these since September of last year. Gold has bumped up against it and silver is right on it currently, so we will see if they can stage a move through them in the next little while.

NZ Dollar: Rising and Rising Forevermore?

The NZ dollar was up sharply on Monday, perhaps on the back of various comments predicting it will reach parity with the Aussie dollar this year. The poor US jobs numbers over the weekend probably helped too.

We’ve read more than a few of these NZ dollar positive stories this week. Heck even we said in our what to expect for 2014 article last week, that the kiwi dollar could likely continue to head higher for now. Although we did temper that by outlining what risks it also faces.

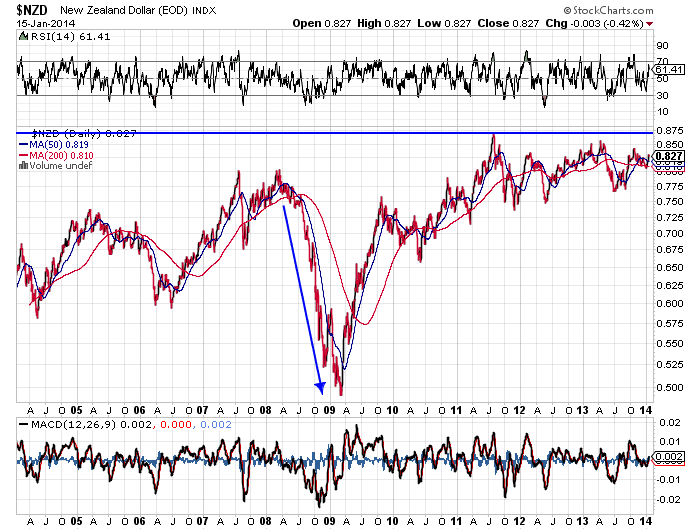

However when everyone is thinking one thing that is usually when the opposite occurs. Who knows if we are at the point of maximum optimism about NZ and the kiwi dollar? Probably not yet but the below NZ dollar long term chart shows we are getting near what has been long term resistance above .8500. But the RSI indicator is still not overbought yet but heading that way.

The chart also shows what can happen when the NZ dollar falls as it did in 2008-09. It can plummet.

That is exactly the type of situation that gold and silver insurance protect against.

10% Wealth Tax on the Cards?

In the October 2013 IMF “Fiscal Monitor” report heading “Taxing Times” (a bit of a sickening read – basically how to extract more from the punters) there was an excerpt on Page 49 that stated:

—–

‘The sharp deterioration of the public finances in many countries has revived interest in a “capital levy”- a one-off tax on private wealth-as an exceptional measure to restore debt sustainability. The appeal is that such a tax, if it is implemented before avoidance is possible and there is a belief that it will never be repeated, does not distort behaviour (and may be seen by some as fair). …

‘The conditions for success are strong, but also need to be weighed against the risks of the alternatives, which include repudiating public debt or inflating it away.

The tax rates needed to bring down public debt to pre crisis levels, moreover, are sizable: reducing debt ratios to end-2007 levels would require (for a sample of 15 euro area countries) a tax rate of about 10 percent on households with positive net wealth. ‘

—–

Now a new working paper commissioned by the IMF and written by well known economists Carmen Reinhart and Kenneth Rogoff reaches the same conclusion.

Ambrose Evans Pritchard in the UK Telegraph summarises:

—–

“Much of the Western world will require defaults, a savings tax and higher inflation to clear the way for recovery as debt levels reach a 200-year high…

The IMF working paper said debt burdens in developed nations have become extreme by any historical measure and will require a wave of haircuts, either negotiated 1930s-style write-offs or the standard mix of measures used by the IMF in its “toolkit” for emerging market blow-ups.”

—–

Over on our facebook page (we post various news items on there each day), reader Greg also posted a Zerohedge link on this same topic which is worth a look too.

As it points out, the report by economists Carmen Reinhart and Kenneth Rogoff is “only” commissioned by the IMF, so that gives the IMF some plausible deniability that it is merely the “opinions” of the economists not the IMF. But it is a little unsettling to say the least, that Reinhart and Rogoff reach the same “wealth tax” conclusion that was arrived at in an earlier IMF report in October.

But this would never affect us in NZ!

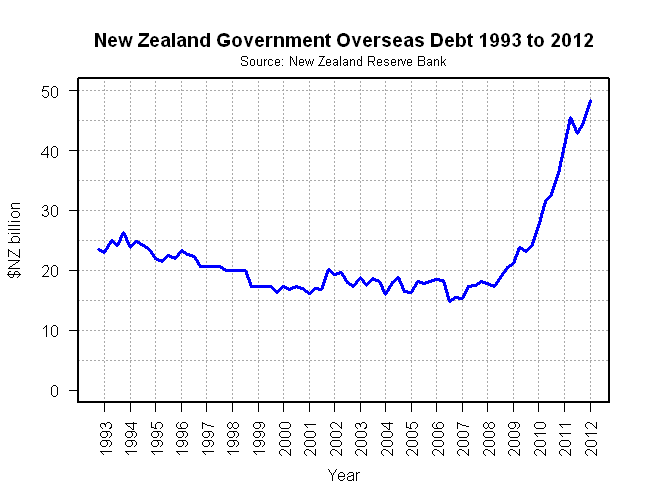

Currently NZ government debt is “low” – well on a global scale anyway, although it has grown at $27 million a day since National came to power and is at $60 Billion now – up from around $10 Billion then.

Source. (Hat tip to Graeme C.)

The below chart is actually a year out of date and another $10 Billion has been added since then.

While NZ Government debt is projected to rise until “only” 2017 that is based upon the somewhat rosy projections of treasury. Reports of 20 year highs for business confidence and likely pay rises for many employees this year would seem to indicate they are accurate.

However we reckon there are surprises looming for the global economy yet and NZ won’t be spared if there is a hiccup, just as we weren’t in 2008. A global shock could put a big whole in government finances here too and see us follow other western nations into ever higher government debt.

We’re already on the way in terms of household debt as you’ll see further on below.

Our old friend Darryl Schoon also thinks that this is merely the “end of the beginning” and there is plenty more to come yet in this monetary crisis in the first of our articles posted on the website this week.

Our old friend Darryl Schoon also thinks that this is merely the “end of the beginning” and there is plenty more to come yet in this monetary crisis in the first of our articles posted on the website this week.

Now obviously we remain bullish on gold and silver. You might say “Of course you are you sell the stuff!” But there are valid reasons for this belief, hopefully some of which we manage to make each week in this email! Here in this article are 23 reasons laid out in a row as to why this bullishness is not misplaced.

Now obviously we remain bullish on gold and silver. You might say “Of course you are you sell the stuff!” But there are valid reasons for this belief, hopefully some of which we manage to make each week in this email! Here in this article are 23 reasons laid out in a row as to why this bullishness is not misplaced.

23 Reasons to Be Bullish on Gold

New Zealand Almost Losing the Race to Debase

As we noted in our feature article last week reviewing gold and silver for 2013, gold in New Zealand dollars is up 169% since the year 2000. Last week GoldSilver.com in their yearly “Race to Debase” looked at how gold and silver have fared against 120 fiat currencies over this same period.

The New Zealand dollar has actually been one of the better performers globally over this period against gold (that is the NZD lost less value against gold than most others on the planet). We counted only 4 other currencies that had done better:

4. Lithuanian Litas 164%

3. Swiss Franc 135%

2. Czech Koruna 133%

1. Somali Shilling 101%

We’d be a bit dubious about the Somali Shilling being in top spot but we’ll take their word for it. Maybe the pirates know how to elect a more solid government and central bank than most?!

Anyway at first glance the fact that the NZ dollar has held up better than many others to date against gold might have you think that is a good reason not to bother to own any gold here.

However that is still 13% a year that gold in NZD has risen over that time and bear in mind this is measured after 2 years of falling gold prices.

Also the fact that the NZ dollar has been doing better than most is no guarantee that it will continue like this forever. Gold offers protection from sharp moves in currency that could follow a banking crisis.

A banking crisis – here in NZ – surely not?

Well our reserve bank did receive a pile of money from the US Federal Reserve in 2008. A US$9 billion pile in currency swaps to be exact. This emergency funding and government bank guarantees that rolled out likely stopped the global financial system from imploding. We think we’ve shown this video before but here it is of Bernanke getting quizzed on the $9 Bil. for we Kiwis.

Private debt levels here are growing again and as we wrote about last week we are not alone with rising house prices. So could we be, along with much of the globe, in the fabled “Crack Up Boom” phase that Austrian Economist Mises wrote cannot be escaped after an inflation in the money supply?

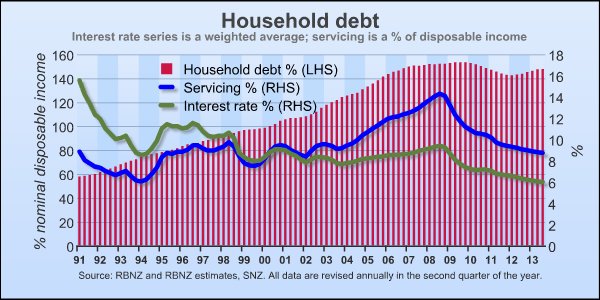

This chart from the RBNZ website shows that after falling for a couple of years, household debt as a percentage of disposable income, has been rising again since early 2012. We are again not too far from the 150% level of 2009/10. With record low interest rates it could well keep rising for a bit yet too.

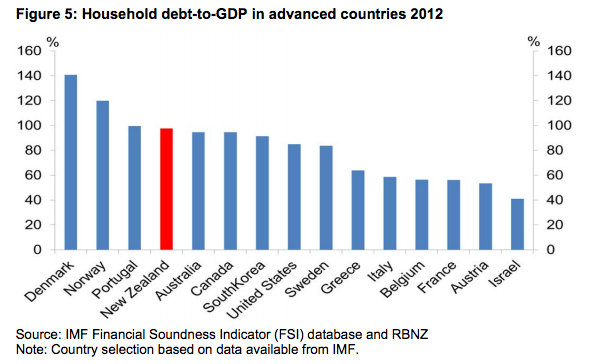

In a report they released last year on Loan to Value Ratios (LVR) the Reserve Bank also had the following chart showing how NZ compares internationally to other advanced economies in terms of household debt to GDP. At around 100% we came in 4th based upon 2012 figures.

This Bank for International Settlements (BIS) report indicated that around 85% for household debt is where it becomes “a drag on growth”. So we, like the majority, are above that – although currently it doesn’t seem to be slowing “NZ Inc” down too much.

Latest from Ronald Stoeferle of In Gold We Trust Fame

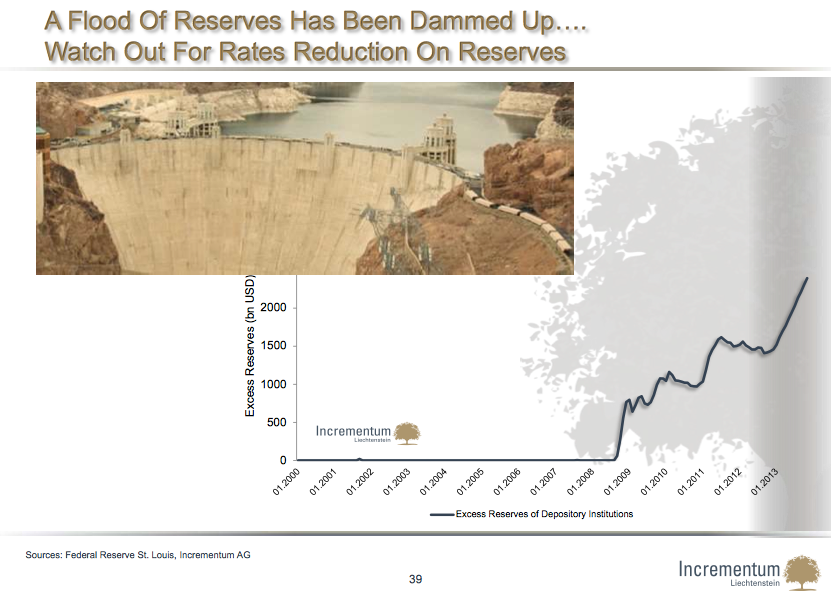

Ronald Stoeferle who some of us were lucky enough to hear at his presentation in Auckland last year (Our summary of that excellent presentation can be found here) has released a new series of charts this week. As usual there are some excellent visual representations of the problems the planet faces monetarily in the coming years. Mainly it discusses the battle raging currently between deflation and inflation and draws a few conclusions as to what central bank moves may be in the future. These include:

- ‘Strengthening guidance’(Via a change of the definition/threshold of unemployment or a change of the inflation threshold)

- More direct Measures (e.g. Funding for Lending Program; Helicopter Money) More QE (if ‘required’)

- Changing Interest Rates on Reserves

The last point is key and is something we’ve mentioned a few times in recent months. This refers to the interest rate that the US Fed pays banks for keeping “excess reserves” with the Fed. Currently at 0.25% this could be reduced further. This rate is what is keeping the massive monetary base that the Fed has created from really getting loose into the global economy, as it is the commercial banks that are the “money multipliers” in the fractional reserve banking system.

So reducing this rate could be one method of getting some of these “excess reserves” out into the wider economy. And as Ronnies chart shows these are substantial.

Banks have been making noises they would charge depositors to keep money with them if the Fed enacted this. So this would further encourage money to leave banks and find other homes where they might make a return or at least hold purchasing power.

Bernanke actually specifically referenced this possibility in the press conference after the last Fed meeting. Youtube link here.

Go forward to 22:34 where he says they are still concerned about low inflation and will take “appropriate action” if necessary. Then answering a question on “alternative measures” they could implement in case of a stumble he mentions:

- Forward guidance,

- and at 24:22, Changing the Interest rate on reserves.

He explains how they looked at something similar to the British funding for lending programme if the banks show they have increased their funding to households or businesses. But unlike their European counterparts, US banks are “flush with liquidity” so the Fed didn’t think there would be any uptake on this.

So a reduction in interest rates seems like the most likely option to us. It will likely take a while yet but that is how these new moves are often rolled out. With quiet noises here and there initially.

The full chartbook is not that long and so we’d encourage you to download it and check them out at the Incrementum website.

Incrementum remain focused on their core competencies including, Austrian Investing, precious metals, absolute return and bottom up fundamental research. We can’t help you with absolute returns but if you’d like to start or add to your precious metals holdings then get in touch. With the NZ dollar getting close to long term highs and US dollar gold price possibly making a double bottom this could be an opportune time to purchase.

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| Coming Housing Bottom for Canada? (And Similarities to New Zealand) |

2014-01-08 21:56:51-05This Week: This week… NZ’s gold miner hedging 2013 in Review and Some Predictions on 2014 NZ’s largest Gold miner announces hedging in place until Dec 2015 China Also Cranking Out the Money Coming Housing Bottom for Canada? And Similarities to New Zealand First up Happy New Year! Here’s hoping that this year is […]read more… 2014-01-08 21:56:51-05This Week: This week… NZ’s gold miner hedging 2013 in Review and Some Predictions on 2014 NZ’s largest Gold miner announces hedging in place until Dec 2015 China Also Cranking Out the Money Coming Housing Bottom for Canada? And Similarities to New Zealand First up Happy New Year! Here’s hoping that this year is […]read more… |

| 23 Reasons to Be Bullish on Gold |

2014-01-09 16:54:48-05With so much negativity surrounding gold and silver currently it’s useful to hear the other side of the argument. Here’s some very big reasons as to why precious metals will still shine again before too long… 23 Reasons to Be Bullish on Gold By Laurynas Vegys, Research Analyst It’s been one of the worst years for gold […]read more… 2014-01-09 16:54:48-05With so much negativity surrounding gold and silver currently it’s useful to hear the other side of the argument. Here’s some very big reasons as to why precious metals will still shine again before too long… 23 Reasons to Be Bullish on Gold By Laurynas Vegys, Research Analyst It’s been one of the worst years for gold […]read more… |

| 2014 THE END OF THE BEGINNING |

2014-01-09 18:50:31-05Darryl Schoon gives his thoughts as to how we have seen the end of the beginning of this financial and monetary crisis but how the worst is still to come. However he remains ever optimistic about what will follow. In our discussions with him a few years back he outlined how he has been heavily influenced by […]read more… 2014-01-09 18:50:31-05Darryl Schoon gives his thoughts as to how we have seen the end of the beginning of this financial and monetary crisis but how the worst is still to come. However he remains ever optimistic about what will follow. In our discussions with him a few years back he outlined how he has been heavily influenced by […]read more… |

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1488.29/ oz | US $1239.30/ oz |

| Spot Silver | |

| NZ $24.19/ ozNZ $777.59/ kg | US $20.14/ ozUS $647.50/ kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

(price is per kilo for orders of 1-4 kgs)

$842.82

(price is per kilo only for orders of 5 kgs or more)

(Fully insured and delivered)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

Copyright © 2011 Gold Survival Guide. All Rights Reserved.

Pingback: Contrarians’ Wildest Dream Coming True | Gold Prices | Gold Investing Guide

Pingback: NZ “Rock Star” Economy Already Priced into NZD? | Gold Prices | Gold Investing Guide

Pingback: Doug Casey: “Gold Stocks Are About to Create a Whole New Class of Millionaires” | Gold Prices | Gold Investing Guide

Pingback: 2014 Bad News (is Finally) Good News For Gold | Gold Prices | Gold Investing Guide

Pingback: Why is Silver Lagging Gold? | Gold Prices | Gold Investing Guide

Pingback: What’ s driving the gold & silver price up now? | Gold Prices | Gold Investing Guide

Pingback: Gold Prices | Gold Investing Guide Good News? Hedge Funds Betting Against Silver Reaches Record High - Gold Prices | Gold Investing Guide

Pingback: Gold Prices | Gold Investing Guide Silver Price NZ Dollars

Pingback: Gold Prices | Gold Investing Guide QUANTITATIVE EASING: THE KILLER SOLUTION

Pingback: Will Your Bank Survive the Coming Financial Crisis? - Gold Survival Guide - Gold Survival Guide

interesting thanks alot!

Thanks for taking the time to comment.