This Week:

- Challenges Ahead for NZ Banks Too

- NZ Also Heading into Deflation?

- NZ Housing Costs Raise Poverty

- Central Bank Assets Explode by Most in 8+ Years!

- Recap: Exit Strategies for Gold and Silver

Prices and Charts

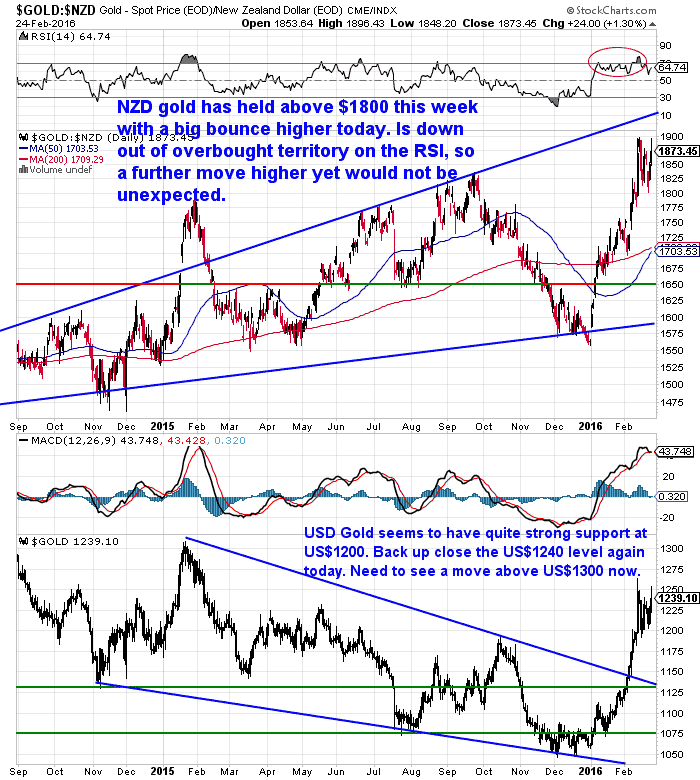

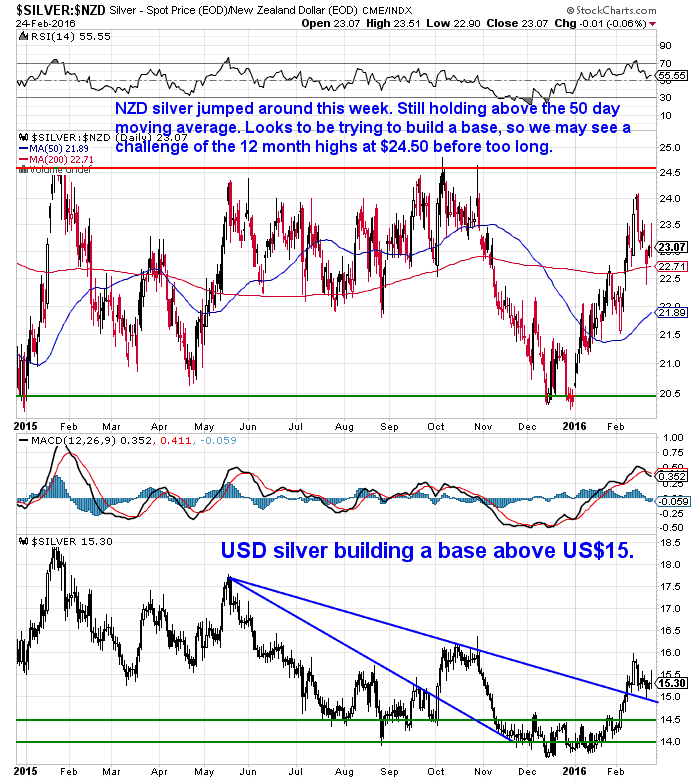

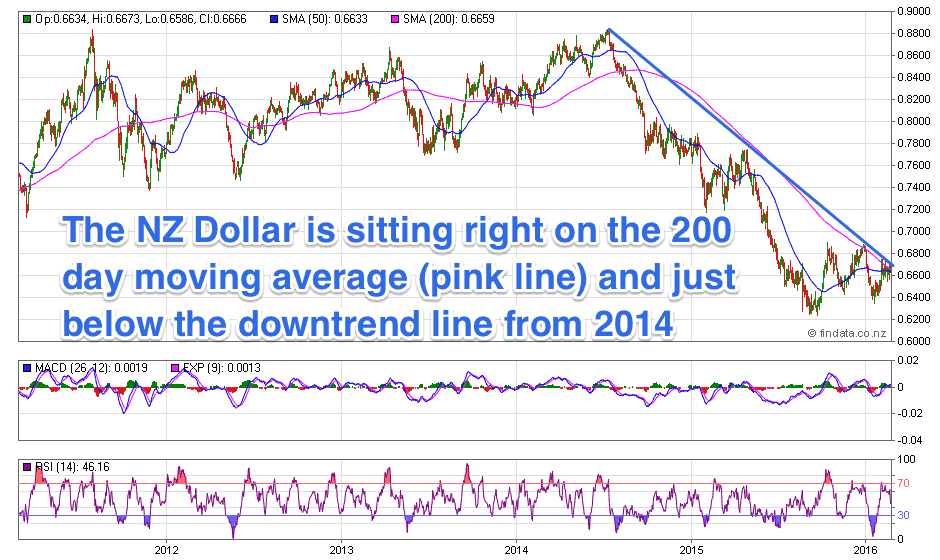

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1847.93 | + $22.35 | + 1.22% |

| USD Gold | $1229.80 | + $20.72 | + 1.71% |

| NZD Silver | $22.92 | – $0.18 | – 0.77% |

| USD Silver | $15.25 | – $0.05 | – 0.32% |

| NZD/USD | 0.6655 | + 0.0032 | + 0.48% |

The super short run down on prices since last week is gold up a bit, silver down a bit, and the NZ dollar up a bit.

NZD gold has managed to stay above the $1800 level this week and could well be building a base before a surprising further run higher.

NZD Silver is just holding above the 200 day moving average and might also be building a base before trying to attack the 2015 high around $25.00

While the Kiwi dollar is sitting right below the downtrend line from the 2014 high and the 200 day moving average. So we will see if it can break out of the downtrend here, or if it will be turned back once again?

The Bad News Continues for Banks

Bix Weir reported this week:

“Banking news is NOT good. HSBC surprised the market yesterday with a huge loss (again) and news of another investigation.

HSBC Posts 4th-Quarter Loss and Comes Under S.E.C. Scrutiny

“For the three months that ended Dec. 31, HSBC, Britain’s largest by assets, posted a loss of $1.33 billion, compared with a profit of $511 million in the fourth quarter of 2014. In addition to reporting its earnings, HSBC said that it and ‘multiple financial institutions’ were facing an investigation by the Securities and Exchange Commission.”

And today, one of the most EVIL of the Bad Guy banks and a serious player in the rigging of the silver and gold prices in Asia, Standard Chartered Bank, also posted a huge loss and announced more investigations.

Standard Chartered Makes It’s First Annual Loss Since 1989

http://www.theguardian.com/

“Standard Chartered has plunged to its first full-year loss since 1989, axed its final dividend and endured another turbulent day on the stock market, with its shares falling by more than 10% at one stage. Along with its results, the emerging markets focused bank revealed it is still being investigated for potential failings in its defences against financial crime.”

END

Now think to yourself…how could it be that at the end of 2015 EVERYONE was saying things were as good as they get and the banks had never been stronger?

Fast forward less than 2 months and it’s as if the Financial World is the complete opposite…a COMPLETE MESS!!

And they are reporting 2015 results…meaning THEY LIED at the end of last year!

With the new head of the Minneapolis Federal Reserve, Neel Kashkari coming out today trying to explain why the big banks need to be split apart you may wonder just how bad it is behind the scenes.

Kashkari Wants to Break Up The Big Banks

http://www.cnbc.com/2016/02/

One of the articles we’ve posted this week shows how bank stocks are already trading like a financial crisis has begun.

One of the articles we’ve posted this week shows how bank stocks are already trading like a financial crisis has begun.

These Important Stocks are Trading Like a Financial Crisis Has Begun.

Challenges Ahead for NZ Banks Too

The latest financial results for NZ banks show they had record returns in 2015. But there are challenges ahead.

“[KPMG’s John Kensington] said the dairy industry’s situation was not yet “dire”, but would become more serious if prices remained low for a sustained period.

“[Were you] to have two more years of sustained low dairy prices, with no relief in any other areas [such as increased production or a lower Kiwi dollar] … then I think you would see banks starting to make provisions against loans and having to make special arrangements with farmers on potentially … a wide proportion of their books,” Kensington said.”…

“The risk of a sharp correction in house prices is therefore still a concern given the banking sector’s significant exposure to the property market,” the report said.

KPMG’s comments echo those of ratings agency Standard & Poor’s, which said this week that rising house prices and the dairy slump posed a threat to New Zealand’s banks.”

“Meanwhile, global fears about credit risks are increasing the cost of credit default swaps, essentially insurance policies against debt default.

Last week, the cost of protecting the bonds issued by Australia’s big four banks – ANZ, Westpac, National Australia Bank and Commonwealth Bank – rose to 29 basis points more than the average for the four biggest US banks, the widest gap on record in credit default swap prices going back to 2004, Bloomberg reported.

Kensington said funding markets had been favourable for local banks last year, but the situation had taken a turn for the worse in early 2016.

“I think banks that are now looking to refinance will be doing so at rates that are less favourable than they were previously,” he said. “As banks start to feel the impact of higher pricing, they will be forced to raise their mortgage rates slightly.”

This reinforces what we wrote last week on the topic of interest rates. That while Central Banks will likely continue to cut their short term interest rates further, it is markets that will control longer term interest rates.

So many could get a surprise in the future when longer term bond interest rates rise. And with them mortgage rates.

On a side note, if you don’t know anyone with a dairy farm, here’s an opinion piece from a dairy farmer showing just how tough things have gotten for them. As she says it is the sharp rise and sharp fall in such a constrained period of time that has hit them.

Opinion – Lyn Webster: Dairy experts not needed to realise the impact of low milk prices

Of course this volatility is a function of our current monetary system! Where demand for many products has been artificially boosted by very cheap money. And accordingly production capacity has also been increased via cheap lending.

Tony Sagami noted this same phenomenon in global shipping capacity after results from A.P. Moller Maersk (AMKBY), one of the largest container shipping companies in the world. They just reported awful results—a $2.51 billion loss for the quarter.

“Maersk CEO Nils S. Andersen didn’t mince his words: “Maersk has been hit by the perfect storm, with the low energy prices dealing a serious blow to the oil unit and minimal benefits for the container business.”

“It is worse than in 2008,” said Andersen. “The oil price is as low as its lowest point in 2008-09 and has stayed there for a long time and doesn’t look like going up soon. Freight rates are lower. The external conditions are much worse.”

Maersk also warned that 2016 profits will be “significantly below” what it made in 2015.

It is the same problem I’ve been talking about for months: overcapacity. The global container fleet grew by around 8% last year, but container demand was basically unchanged for the year.”

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $265 you can have 1 months long life emergency food supply.

Learn More.

—–

NZ Also Heading into Deflation?

You’ve no doubt recall we’ve talked a lot about the negative interest rates spreading across the planet. And how these are introduced as a supposed elixir to “cure” deflation.

Well were seeing more reports of even lower inflation in New Zealand now too:

“NZ Inflation expectations are likely to fall still further over the next year, making it even harder for the RBNZ in its “uphill battle” to generate a sustained lift in inflation, according to Westpac economists.”

So perhaps NZ is also heading to where much of Europe is with prices actually falling?

Bernard Hickey wrote about why he believes inflation expectations falling towards 0% and below is a problem for everyone and why the Reserve Bank should care and act:

“Everyone agrees that deflationary expectations are a bad thing, which is why our Reserve Bank watches inflationary expectations very closely for any signs they are losing their moorings and starting to fall towards zero, or lower. This week the Reserve Bank’s own survey found one year ahead expectations fell this year to a record low of 1.09% from 1.51% and two year ahead expectations fell to a 22 year low of 1.63% from 1.85%.

This is why the drums are beating again for the Reserve Bank to cut interest rates again as early as March 10. The Reserve Bank cannot afford to let expectations about inflation fall and it’s not surprising they have fallen. The prices of goods in the shops have been falling for three years and the most prominent price in people’s minds — the price of petrol — is falling too.

Just as for any shop, falling prices make sense for a short while to clear stock and bring people through the door for the first time, but continually falling prices are a dangerous thing for everyone.”

However falling prices are only a bad thing in a world with massively high debt levels.

Falling prices should be good for consumers. While you may have a flat or falling income, falling prices for everyday goods mean you can still buy and save more – i.e. your purchasing power increases.

But if you’re loaded up on debt, this makes it much much harder to repay your loans. Debt servicing becomes a larger proportion of your income. So it is only because of our debt based money system that deflation is seen as the arch nemesis.

There are studies that show in the late 1800’s and early 1900’s prices fell for decades. But this was a time when there was actually tremendous expansion globally. Prices should fall due to technological advances.

But while the current monetary system exists expect central bankers everywhere to do all they can to avoid deflation. The negative interest rates we have been reporting on for months is just one example of this.

NZ Housing Costs Raise Poverty

Here’s evidence of another problem caused by the current debt based monetary system…

Think-tank says today’s Kiwis better off than past generation — until housing factored in.

“New Zealand would have less poverty today than a generation ago if it weren’t for higher housing costs, a business think-tank says. The NZ Initiative, a think-tank supported by 45 corporate chief executives, says in a new report that the number of Kiwis earning below a fixed poverty line of 60 per cent of the 1998 median income fell from 12 per cent in 1982 to 8 per cent in 2014 before allowing for housing costs.

But the numbers falling below that line after housing costs were factored in rose from 8 per cent to 13 per cent.

“In short, housing costs have risen markedly relative to disposable incomes during this period,” it says.

Higher housing costs mean that, going by Ministry of Social Development research quoted in the report, the real incomes of low-income households in 2013 were still “around the same as they were in the 1980s”.

So we’ll keep hearing calls that the government “must do something” about the level of poverty. Much like they “do something” about the “housing shortage”. But these are all just symptoms of a monetary system that requires more and more debt to keep functioning. And this ever increasing debt increases asset prices. While wages stagnate.

Of course there will be a limit to how much debt can be created. It’s just that no one knows when exactly this will be reached?

Central Bank Assets Explode by Most in 8+ Years!

Hugo Salinas Price recently reported how global central bank currency reserves have fallen to 11.03 trillion. A significant development given they have been growing exponentially since 1971. See this week’s featured video for more on this.

Hugo Salinas Price recently reported how global central bank currency reserves have fallen to 11.03 trillion. A significant development given they have been growing exponentially since 1971. See this week’s featured video for more on this.

Hugo Salinas Price – Gold Repriced at End of Contraction Phase

In contrast the NIA this week showed how the balance sheets of the big four central banks reached a new all time high of $15.983 trillion.

The difference is that currency reserves are the result of balance of trade. If you sell more than you buy, you get more reserves.

Whereas total balance sheet assets includes everything such as the monetary expansion created by quantitative easing/money printing of recent years.

“In January 2016, the total balance sheet assets of the big four central banks: the Federal Reserve, European Central Bank (ECB), Bank of Japan (BOJ), and People’s Bank of China (PBOC) exploded by $471 billion to a new all-time high of $15.983 trillion – the largest increase in a single month in over eight years! The only two larger monthly increases over the past decade occurred in October 2008 and December 2008 – during the financial crisis! See for yourself by clicking here!

The total nominal GDP of the U.S., Euro Area, Japan, and China is currently $43.695 trillion – down from a peak in July 2014 of $45.962 trillion. Total balance sheet assets of the big four central banks as a percentage of GDP, reached a new all-time high in January 2016 of 36.58%! This compares to a one decade median of 26.57%! See for yourself by clicking here!

The PBOC has resumed balance sheet expansion, leaving the Fed alone as the only major central bank not creating massive monetary inflation. Look for new Fed quantitative easing (QE) to be launched this year – along with a negative Fed Funds Rate. Before the Fed acts, we expect the stock market to resume its crash – only at a much faster pace than we have seen year-to-date!”

It would make sense that Central Bank Balance Sheets are expanding at the same time as currency reserves are falling. They are simply printing money to make up for the falling reserves caused by falling exports.

Recap: Exit Strategies for Gold and Silver

We recently received the following question from a reader on our exit strategy for gold and silver:

“Hello there. My partner and myself want to buy gold and silver but are unsure if we should. We have been on Mike Maloney’s website and have watched a few of his videos. He has an exit strategy for the “insiders” customers, but to become an insider a purchase of 100 oz of silver or 10 oz of gold needs to be made on his website. Here’s my question are you going to follow the same exit strategy or do you have your own?”

And our answer:

“Thanks for your question.

I believe Mike Maloney’s “insider” club just means he will let these people know when he is exiting precious metals and what he is buying instead. Or what he is swapping into.

We’ve actually answered this previously in an article we wrote 2 years ago.

Exit Strategies For When the Time Comes to Sell Gold and Silver

Exit Strategies For When the Time Comes to Sell Gold and Silver

As we outline in that, you can’t really have an exit strategy completely pre built as we don’t know exactly how the future with play out. So we keep a track of the various measures to see when precious metals are nearing full valuation.

Hopefully that answers your question? Please let us know if it doesn’t or if you have any others.”

They had a couple more questions as follow ups though:

“Thanks for the quick reply. I suppose the exit strategy depends on timing and how to turn the gold/silver into another commodity to increase value and make a great return. It’s going to interesting to see what happens when trying to trade these precious metals for real estate or stocks. In times of an economic collapse who and where will we have to go to trade the gold/silver for say real estate? Maybe the banks since they will own the property?

Thanks again.”

Our final reply:

“Yes indeed it is about timing. That article and the others linked to it discuss various methods for valuing gold and silver and they show the levels these measures reached in previous precious metals bull markets like 1970-80.

So we can use this as an indicator of possible times to move out of PM’s and into other cheaper asset classes.

In terms of how to trade precious metals for real estate, stocks etc, well that depends on what happens to the monetary system between now and then.

If you are talking about a complete collapse and people don’t want to use government fiat money/cash then you might well just use gold and silver itself as money to trade for other goods and assets.

If it is more like 1980, then cash may still be accepted and used so you could “sell” gold and silver for that and then buy another undervalued asset. There are various possibilities which we’ve actually written about before too. Check out this article from 2014:

If it is more like 1980, then cash may still be accepted and used so you could “sell” gold and silver for that and then buy another undervalued asset. There are various possibilities which we’ve actually written about before too. Check out this article from 2014:

If/When the US Dollar Collapses, What Will Gold be Priced in?”

Of course before you have an exit strategy, you’ve got to have an entry strategy!

If you’re looking to buy there could be some good entry points coming up for gold and silver if we get a pull back after that sharp rise at the start of the year. So consider signing up for our daily price alerts if you haven’t already so you’ll know if these dips occur.

Free delivery anywhere in New Zealand

Free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $14,185 and delivery is now about 7-10 days.

— Prepared for Power Cuts? —

[New] Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

This Weeks Articles: |

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

Unsubscribe | Report Abuse

|