This Week:

- Why Isn’t Gold Correcting Like Previous Moves Higher?

- Another Trend Change in Gold’s Favour

- Why NZ Bank Balance sheets and Capital Levels May Not Be the Main Risk

- The Surprising #1 Reason to Buy Gold and Silver

Reminder: Help Us Help You

On Monday we sent out a survey seeking feedback on what else you’d like to learn about and what we could improve on.

It’s only 2 questions long and will take just 30 seconds or so to complete.

You’ll also have the chance to win a pair of nifty inflatable solar lanterns valued at $59.

Here’s the survey link again:

If you’ve already completed it, thank you as we’ve received some useful suggestions so far. The survey closes on Monday and the winner will be notified by Wednesday.

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1855.50 | – $60.45 | – 3.15% |

| USD Gold | $1347.65 | – $16.70 | – 1.22% |

| NZD Silver | $28.05 | – $0.63 | – 2.25% |

| USD Silver | $20.37 | + $0.27 | + 1.34% |

| NZD/USD | 0.7263 | + 0.0142 | + 1.99% |

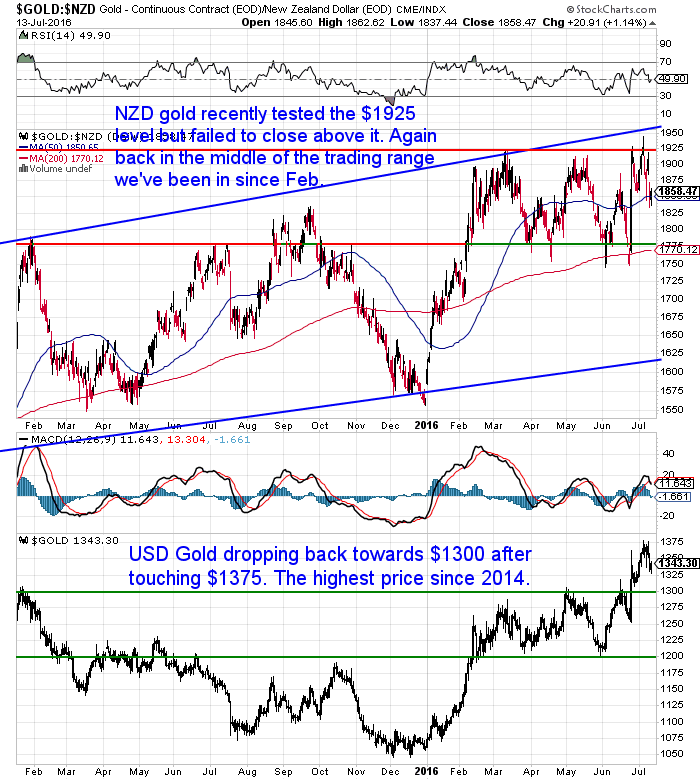

Gold in NZ dollars is down from the highs above $1900 of last week. The higher NZ dollar has had an impact as has a weakening offshore USD gold price.

NZD Gold sits in the middle of the trading range it has been in since February having been unable to close above the $1925 horizontal resistance line. We can see in the chart below that it has been trending steadily higher over the past year though.

This broad consolidation between about $1750 and $1925 won’t last forever. If the “trend is our friend” then we will see higher prices ahead before too long.

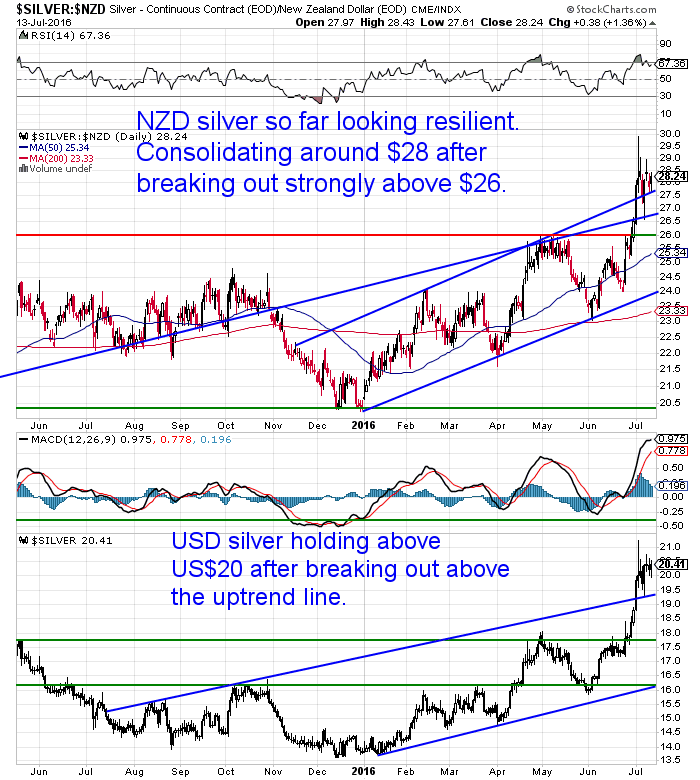

After the massive post-Brexit run up in silver, so far it has given up very little of those gains.

Sitting above $28 still, having clearly broken higher above the uptrend line from the start of 2016.

Now we will see what silver does. Will it pull back sharply and retrace a good part of these recent gains?

Or will it perhaps follow what gold has done?

That is after gold rose sharply at the start of the year it has consolidated sideways for the past few months at these much higher levels. Perhaps silver will do the same from here? Say between maybe $26 and $29?

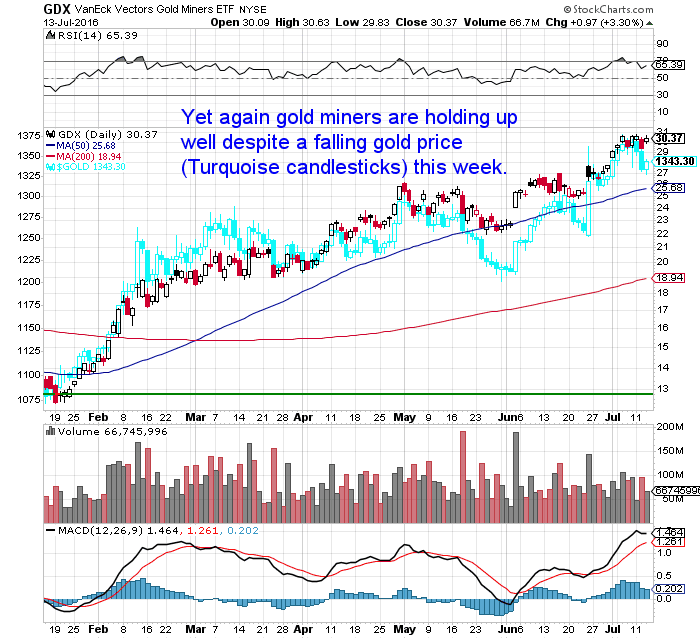

A recurring positive indicator for gold this year has been the performance of the gold miners.

The chart below is of the GDX gold miners index (black and red candlesticks) versus the gold price (turquoise).

Yet again while gold has fallen the miners are remaining remarkably resilient. Just as they did in May and again in June when the price of gold dipped.

The Kiwi dollar remains in the uptrend it has been in all year. It has risen sharply this week by 2% and is back to the pre-Brexit high.

Why Isn’t Gold Correcting Like Previous Moves Higher?

So why is it that gold (and silver) don’t seem to be undergoing the periodic corrections that most expect?

This was a great question we received from a reader this week.

Our feature article has a crack at answering it. We offer 5 possible factors as to why gold hasn’t corrected much so far this year.

Why Isn’t Gold Correcting Like Previous Moves Higher?

Another Trend Change in Gold’s Favour

Greg Canavan in the Daily Reckoning Australia pointed out this week another technical indicator trend change that is about to occur in gold’s favour.

—–

“The chart below shows an important trend change for gold. It’s a weekly chart, which is less volatile than the daily chart, giving you a better idea of the longer term trend. Moving averages are good representations of a trend. The blue and red lines in the chart below represent the 50 and 100-day moving averages.

As you can see in the chart, the blue line is just about to cross above the red line, which is an indication that the longer term trend is turning bullish. The last time this happened was in January 2002. It was the start of a multi-year bull market.

So, in my view, this is not just another bear market rally, like you saw in mid-2013, and in early 2014 and 2015. There is an important change of trend taking place.

That doesn’t mean gold won’t fall from here. It’s had a big run. A correction back down to US$1,300 or below wouldn’t be surprising. But you have to respect the fact that the market is telling you that a change of long term trend is underway.”

—–

Why NZ Bank Balance sheets and Capital Levels May Not Be the Main Risk

A RBNZ press release this week referred to a speech that the central bank deputy governor made about you guessed it the “housing crisis”. He discussed what could be done and how these measures may “further bolster bank balance sheets against fallout from a housing market downturn”. Here’s an excerpt:

—-

“Mr Spencer said a broad range of initiatives is necessary to increase the long-term housing supply response, particularly in Auckland, and to help ensure housing demand is kept in line with supply capacity.

“The Reserve Bank has no direct influence over supply, but can influence housing demand through the credit channel. In this regard, we see the Reserve Bank as part of a team effort.

“A dominant feature of the housing resurgence has been an increase in investor activity, which increases the risk inherent in the current housing cycle.

“The Reserve Bank is considering tightening Loan-to-Value Ratios (LVRs) further to counter the growing influence of investor demand in Auckland and other regions, and to further bolster bank balance sheets against fallout from a housing market downturn. Such a measure could potentially be introduced by the end of the year.

“Limits on Debt-to-Income ratios (DTIs) might also have a role to play but would be a new instrument that would have to be agreed by the Minister of Finance under the Memorandum of Understanding on Macro-prudential policy. Further investigation of this option will be undertaken.”

—–

However Bank Balance sheets and capital levels may not actually be the main risk to the NZ and every other banking system.

We were reminded of something we read last month by Chris Whalen of the Kroll Bond Rating Agency entitled:

Large Bank Risk: Liquidity Not Capital Is the Issue

Here was the summary of that report:

—–

• “Kroll Bond Rating Agency (KBRA) notes that since the 2008 financial crisis and the passage of the Dodd-Frank legislation two years later, global financial regulators have been pushing a deliberate agenda to increase the capitalization of large banks. Despite the fact that the 2008 financial crisis was not caused by a lack of capital inside major financial institutions, raising capital levels has become the primary policy response among many of the G-20 nations.

• KBRA believes that using higher capital to change bank profitability and, indirectly, corporate behavior is a rather blunt tool for the task of ensuring the stability of financial markets. Part of the problem with using capital as a broad prescription for avoiding rescues for large financial institutions, aka “too big to fail” or TBTF, is that this approach explicitly avoids addressing the actual cause of the problem, namely errors and omissions by major banks that undermined investor confidence.

• One of the key fallacies embraced by regulators and policy makers is the notion that higher capital levels will help TBTF banks avoid failure and, even in the event, the failure of a large bank will not require public support. KBRA believes that there is no evidence that higher levels of capital would have prevented the “run on liquidity” which caused a number of depositories and non-banks to fail starting in 2007.”

—–

Our reading of this is that simply requiring the banks to hold more capital in case of a large bank failure would not stop a repeat of 2008 and the near total systemic failure.

The problem then was a lack of liquidity. Once the trust breaks down and banks stop lending to each other the liquidity can dry up almost immediately. This hasn’t changed at all since 2008.

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have 4 weeks emergency food supply.

For just $190 you can have 4 weeks emergency food supply.

The Zeitgeist is Changing

We read a thought provoking piece from John Mauldin this week. He talked about the the zeitgeist seems to be changing.

—–

“Everywhere I go, everyone I talk to seems to have the sense that there is a deep cultural shift coming. Everywhere we look, there are causes for concern. Ben Hunt says this shift will come because of a failure of narrative, an idea that we will discuss. Neil Howe, whose work we discussed a few weeks ago, says the shift is a natural feature of an 80-year cycle of generational change; and, lucky us, we are now entering the most volatile and critical period of that cycle, one that often produces crisis and catharsis. These global cyclical events don’t happen in days but play out over months and years. As Lenin is supposed to have said, “There are decades where nothing happens; and there are weeks where decades happen.”

Ben [Hunt] talks about the power of the Common Narrative, the things that we all know and believe. Much of this is what we learned growing up about our countries or religions. These narratives (and there are more than a few of them) shape our prejudices and our actions.

- What I care deeply about, however, is how the Narrative around these events is being shaped and reshaped, because that Narrative will determine the path and outcome of every election and every market on Earth. And what I can tell you is that I am shocked by the diminishing half-life of status quo protecting Narratives, by the inability of Big Institutions and Big Money and Big Media and Big War and Big Academia to lock down an effective story that protects the State, even when their competition is primarily comprised of clowns… There’s a … tiredness … to the status quo Narratives, a Marie Antoinette-ish world weariness that sighs and pouts about those darn peasants all the way to the guillotine….

- Why are the status quo protecting Narratives faltering so badly? I think it’s because status quo political and economic institutions – particularly Central Banks – have failed to protect incomes and have pushed income and wealth inequality past a political breaking point. They made a big bet: we’re going to bail-out/paper-over the banks to prevent massive losses in the financial sector, we’re going to inflate the stock market so that the household sector feels wealthier, and we’re going to make vast sums of money available for the corporate and government sectors to borrow really cheaply….

We all know what happened when the narrative surrounding the price of housing and subprime debt collapsed in 2008. You don’t have to be much of a historian to come up with many examples of collapsing narratives. War in Europe is impossible, we were told as late as 1913. And more recently, the British wouldn’t actually vote to leave the EU.

Central banks around the world have pushed the limits of what their credibility can actually deliver. I truly worry what will happen when we enter the next recession and everybody realizes that the Federal Reserve, the ECB, the BOE, and the BOJ are shooting blanks and the emperor has no clothes. Given the mood in countries all over the world and the frustration of the Unprotected class with the seemingly impervious Protected class (which will be compounded if we have another protracted income recession), the level of uncertainty regarding future events is at least as high as it has been at any time in my life.

The next recession, whenever it comes, will result in a completely different type of global crisis than we have seen in the experience of those alive today. Oh, there will certainly be some things that rhyme with history, but I think we would have to go back to the ’30s to find a period roiled with this much social upheaval.”

—–

There seems to be a lot of evidence surfacing lately for this changing zeitgeist or “narrative” as Ben Hunt put it. From the Brexit vote, to the rise of Trump and Sanders. To similar “populist” movements in Austria, Italy, France and many more European nations.

To quote a guy named Bob “The times they are a-changing”.

Fed: Helicopter Money a Possibility

Speaking earlier this week in Australia at a conference US Federal Reserve board member Loretta Mester said:

—–

“We’re always assessing tools that we could use,” Dr Mester said in response to a question from the ABC about the potential use of helicopter money.

However, Dr Mester signalled that in the event of another shock or economic downturn that most likely option would be more quantitative easing-style money printing.

“In the US we’ve done quantitative easing and I think that’s proven to be useful,” she observed.

So it’s my view that would be sort of the next step if we ever found ourselves in a situation where we wanted to be more accommodative.

Dr Mester’s cautious response to the helicopter money option follows recent comments from the Federal Reserve chair Janet Yellen that the measure could be used in “extreme situations”.

Helicopter money is where stimulus is directly pumped into the real economy, not through the banking system, and discussion of it is increasing amid expectations that the Bank of Japan is poised to unleash a major fiscal stimulus package of at least 10 trillion yen ($130 billion) to kickstart its flat-lining economy.”

—–

But Rickards Says Helicopter Money is Already a Done Deal

—–

“But these elites are actually beyond the stage of calling for helicopter money. That’s already been decided. They’re now debating what they should spend the helicopter money on. They looking for the best way to reassure the public — meaning lie to the public — about what they’re actually up to.

A few months ago, I wrote about how the climate agreement reached this spring may have really just been a disguised helicopter money scheme. Spending on emission reduction programs and infrastructure could total about $6 trillion per year, which would be carried out by the IMF through the issue of special drawing rights (SDRs).

That’s one way the elites could sell their plans to the public. It’s inflation masquerading as “saving the planet,” “climate justice,” or what have you.

The bottom line is that helicopter money is coming. I think inflation is too, either through helicopter money or increasing the gold price — or a combination of both. It may not happen overnight, but governments will ultimately get it if they’re determined enough.

It’s true, inflation is low right now. The Fed says it wants 2%. But it secretly wants 3%, which is really not so secret. Troy Evans is the president of the Chicago branch of the Federal Reserve. And he told me recently he wouldn’t mind seeing 3% to 3.5% inflation. His theory is that, if the target is 2% and it’s been running at 1%, you need 3% to average the two. And mathematically that’s right.

But the economy isn’t a fine Swiss watch you can tinker with to produce desired outcomes.

Deflation has held the upper hand in many ways since the 2008 crisis. But once inflation takes hold, it can’t easily be put back in the bottle.

Think of the forces of deflation and inflation as two teams battling in a tug of war. Eventually, one side wins. If the elites win the tug of war with deflation, they will eventually get more inflation than they expect. Maybe a lot more. This is one of the shocks that investors have to look out for.

This policy is coming sooner than you may think… Now is the time to buy gold.”

—–

Rickards has been on the ball lately with many of his calls. He pointed out that the Brexit “remain” vote was far from a given and was proven correct.

He also recently noted that China had slowed up in its buying of gold but that was likely to change soon. If Western purchases continued and China joined back in this would boost price further. (See this article of ours from last month.)

Gold has indeed been moving higher since then.

If you’ve like to follow Rickards advice then please get in touch for a quote or to have any questions you have about the buying process answered.

Wanting some small denomination silver?

We have free shipping on boxes of 500 x 1oz Canadian 9999 purity Silver Maples delivered to your door via UPS, fully insured until you sign for them.

Price today is $16,400.

Delivery in approx 7-10 business days.

We wouldn’t be surprised to see the wait times increase for these soon and quite likely the premiums too.

— Prepared for Power Cuts? —[New] Inflatable Solar Air Lantern

Check out this cool new survival gadget.

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

This Weeks Articles:

How to Escape the World’s Biggest Ponzi SchemeWed, 13 Jul 2016 5:45 PM NZST  We don’t have negative interest rates in New Zealand (although never say never!), but in this article you’ll see how why negative rates are a threat to your wealth no matter where you live in the world. Given the rate of growth in negative yielding debt globally this is likely to affect us even more […] We don’t have negative interest rates in New Zealand (although never say never!), but in this article you’ll see how why negative rates are a threat to your wealth no matter where you live in the world. Given the rate of growth in negative yielding debt globally this is likely to affect us even more […]

|

Alan “Bubbles” Greenspan Returns to GoldWed, 13 Jul 2016 4:59 PM NZST  Witty, dry and insightful, but always entertaining. Bill Bonner is one of our favourite financial writers. He always comes at topics from a slightly different angle. In this piece he discusses Alan Greenspan and his views on gold of which he has been very outspoken on lately. Perhaps he is a “scalawag” as Bonner says. Perhaps (as […] Witty, dry and insightful, but always entertaining. Bill Bonner is one of our favourite financial writers. He always comes at topics from a slightly different angle. In this piece he discusses Alan Greenspan and his views on gold of which he has been very outspoken on lately. Perhaps he is a “scalawag” as Bonner says. Perhaps (as […]

|

The #1 Reason to Buy Gold and Silver Surprisingly is NOT What You Think It IsWed, 13 Jul 2016 1:29 PM NZST  In the aftermath of the Brexit surprise and the sudden and severe impact on the Pound Sterling, this article is quite timely. It looks at recent devaluations of a number of other currencies. We’re not just talking struggling third world developing nations here either. So if you don’t think this can happen in the west […] In the aftermath of the Brexit surprise and the sudden and severe impact on the Pound Sterling, this article is quite timely. It looks at recent devaluations of a number of other currencies. We’re not just talking struggling third world developing nations here either. So if you don’t think this can happen in the west […]

|

Why Isn’t Gold Correcting Like Previous Moves Higher?Tue, 12 Jul 2016 11:15 AM NZST  Knowledgable readers are what we seem to have in spades here at Gold Survival Guide. We get some great insightful questions. Here is one received this week that we thought worth sharing: “In your opinion, why isn’t gold making the periodic corrections that it did the last time it rose to about $1950.00 per ounce […] Knowledgable readers are what we seem to have in spades here at Gold Survival Guide. We get some great insightful questions. Here is one received this week that we thought worth sharing: “In your opinion, why isn’t gold making the periodic corrections that it did the last time it rose to about $1950.00 per ounce […]

|

Silver Rockets HigherMon, 11 Jul 2016 4:51 PM NZST  This Week: Silver Fireworks! Gold and Silver ChartFest – Update for 2016 In Gold We Trust 2016 – Out Now! Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1915.95 + $60.39 + 3.25% USD Gold $1364.35 + $45.60 + 3.45% NZD Silver $28.23 + $2.47 + 9.58% […] This Week: Silver Fireworks! Gold and Silver ChartFest – Update for 2016 In Gold We Trust 2016 – Out Now! Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1915.95 + $60.39 + 3.25% USD Gold $1364.35 + $45.60 + 3.45% NZD Silver $28.23 + $2.47 + 9.58% […]

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2016 Gold Survival Guide. All Rights Reserved. |

Pingback: Grant Williams: The Rising Danger Of A Bidless Market - Gold Survival Guide - Gold Survival Guide