|

Gold Survival Gold Article Updates:

Jul. 3, 2014

This Week:

- Gold and silver remain near last weeks prices

- NZ Dollar close to all time highs

- Loan to Income Ratios or Loan to Value Ratios Won’t “Fix” the Problem

- Smart Money, Dumb Money & Your Money

Just a short email this week as we are putting the finishing touches on two articles in answer to a couple of reader questions which we thought we would have ready for todays newsletter. But they’re not quite done yet. So these will have to wait until next week now. The questions were:

Reader Question 1: What would happen to the NZ Dollar when the US Dollar collapses?

Reader Question 2: Why bother with technical analysis?

Our answer to the first one is perhaps slightly counter intuitive so stay tuned for that next week or check out the (new and improved website in the next couple of days when it should be posted.

Gold and silver remain near last weeks prices

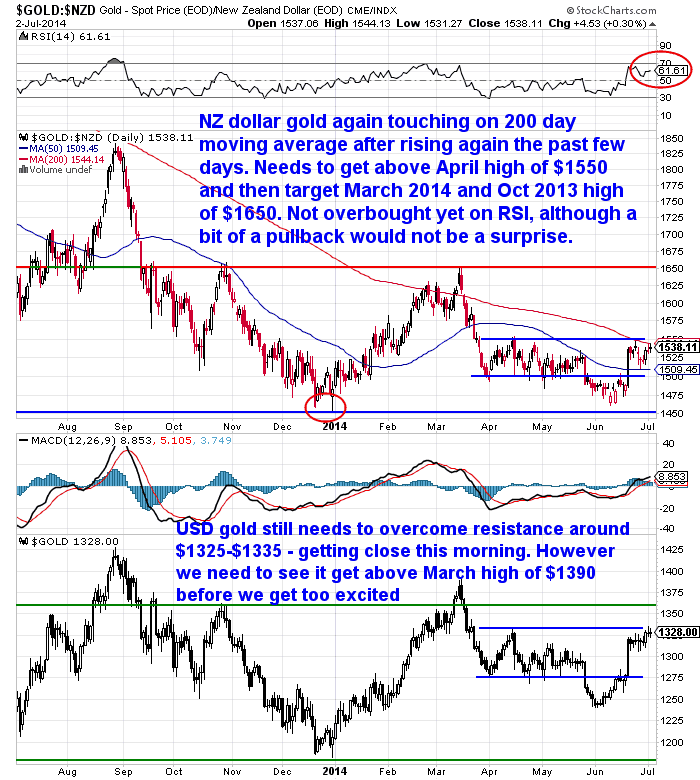

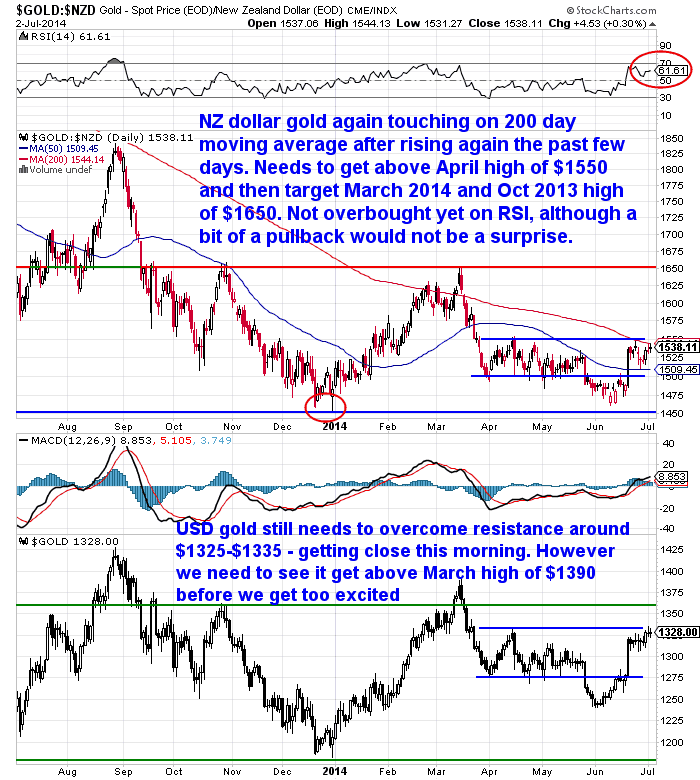

Not much change from a week ago in either metal. Gold in NZ dollars is up $3.50 per ounce or 0.23% from last week to NZ$1515.07.

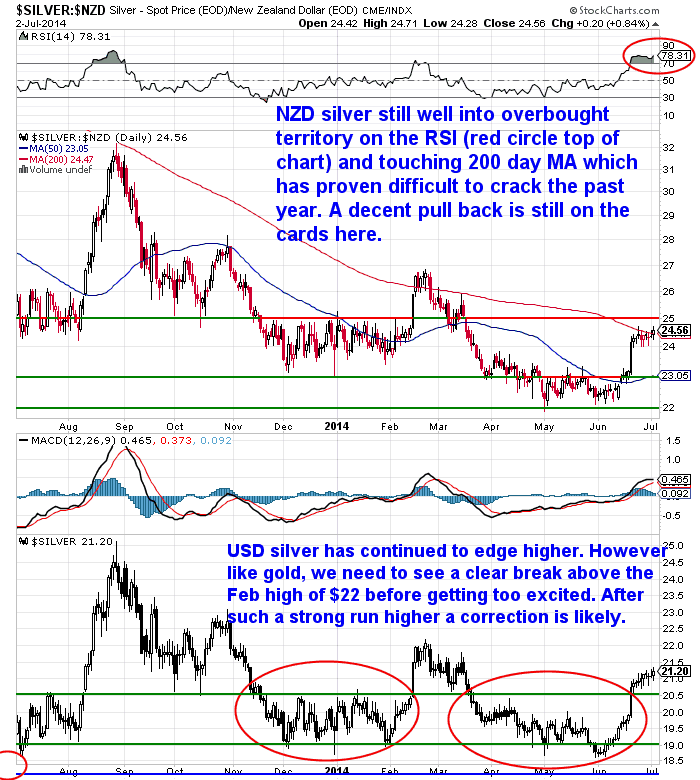

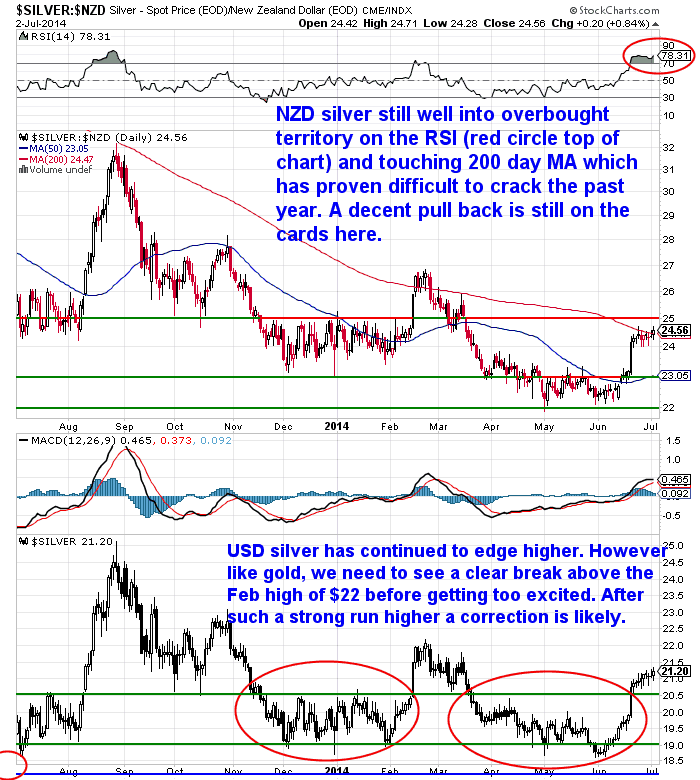

NZ dollar silver likewise has just edged up slightly from a week ago by 5 cents per ounce or 0.21% to $24.17. Silver remains very overbought so a decent pull back soon is really to be expected.

There has been some big movement in the commitments of trader data on the COMEX futures market the past couple of weeks. The previously very short speculators/managed money have now moved to the other side of the boat and gone long and the commercials (those that actually use and sell the metal and are actively hedging) have now gone short.

The commercials are the “smart money” and so are generally right at extremes and this proved to be the case recently. However the extreme has now passed us by so it is less certain who will be right in the shorter term. Gene Arensburg at Got Gold Report makes a good argument that the Managed Money group likely now believe that higher – not lower – gold prices are ahead, “Otherwise, why the hurry to cover their shorts?”

(Speaking of Smart Money check out this weeks feature article below entitled SMART MONEY, DUMB MONEY & YOUR MONEY which looks at various indicators that demonstrate things may not be as they seem in the current financial system. Including share trading volumes falling while prices rise, what institutional investors are doing versus private/retail investors, and bond market illiquidity).

Loan to Income ratios or Loan to Value Ratios Won’t “Fix” the Problem

This week “think tank”, the NZIER, commented that they believe the Bank of England’s new tool to manage financial instability is better than the RBNZ’s high Loan to Value restrictions. They said:

—–

“Restrictions on high loan to income mortgages directly address the risk that the Bank of England is worried about: that very high household debt could cause a sharp economic correction in the future. High LVR [Loan to Value] mortgages only tell you that house purchases are made without much collateral. But LVR restrictions do not take into account households’ long-term ability to service debt,” said Lees.

He said the Bank of England has a policy solution for a well-defined problem being stopping soaring household debt that sits at the heart of financial stability risks.

“Controlling house prices is not part of the Bank of England’s problem,” said Lees.

In contrast LVR restrictions will constrain risky lending, but the gains look to be limited and the policy carries unintended consequences.

“We should look at LTI [Loan to Income] restrictions, as they are better targeted at the risk of financial instability created when many people cannot repay their debt,” added Lees.”

Source.

—–

This still misses the point. Yet again the discussion is about how to “fix” a problem that is caused by central banking in the first place!

Central bank policies don’t help keep things “stable” but are actually the cause of instability and bubbles. Non market set, ultra low interest rates are what cause high asset prices along with Reserve Bank policy that actively encourages lending against housing more than business.

It remains very rare outside of anyone loosely in the “Austrian Economics” camp to discuss the root cause of these problems. And that those causing them should not be entrusted with trying to “fix” them!

Rant over. We promise – for this week anyway.

NZ Dollar close to all time highs

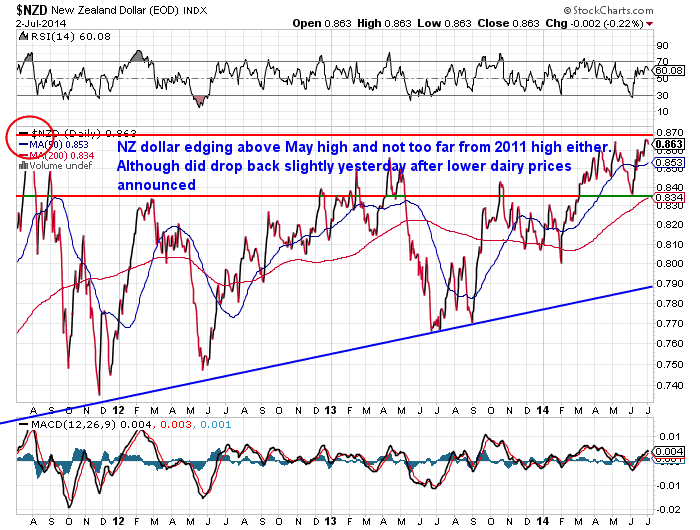

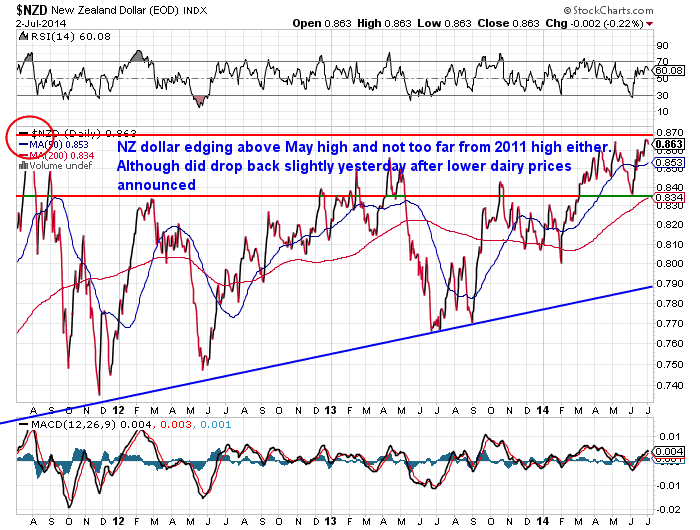

As reported by the NBR, the “New Zealand dollar declined as dairy prices fell to their lowest in 18 months at Fonterra Cooperative Group’s latest GlobalDairyTrade auction, raising concerns about the strength of the local economy. The kiwi slipped to 87.52 US cents at 5pm in Wellington, from 87.71 cents at 8am and 87.67 at 5pm yesterday.”

Source.

However as you can see in the chart below the kiwi dollar is still getting very close to its all time high from back in 2011.

So it remains to be seen whether it can break through this level in coming weeks. With most of the rest of the world remaining very sluggish, New Zealand could remain a popular destination for capital seeking higher yields and the “promise” of an appreciating currency for a bit yet.

However record highs are a good time to be hedging your bets and that is what gold and silver do. They offer protection from downside in the kiwi dollar. And also protection from the loss of purchasing power the likes of higher fuel costs that a weaker dollar will bring.

Unfortunately preparing for less sunny days is what most people don’t do. If you’re not one of them get in touch and we can help you with your financial insurance preparations.

This Weeks Articles:

|

Big move in Gold and Silver Coincides With Indicators of a Likely Bottom |

2014-06-26 01:25:02-04

Gold Survival Gold Article Updates Jun. 26, 2014 This Week: Our New Website is Live Big move in Gold and Silver More Indicators of a Likely Bottom Wealth Inequality Getting Worse in NZ – So Tax the Rich? Wealth to Income Ratio: Predictor of Market Crash? Our New Website is Live This week we’ve […] read more…

SMART MONEY, DUMB MONEY & YOUR MONEY 2014-06-26 01:25:02-04

Gold Survival Gold Article Updates Jun. 26, 2014 This Week: Our New Website is Live Big move in Gold and Silver More Indicators of a Likely Bottom Wealth Inequality Getting Worse in NZ – So Tax the Rich? Wealth to Income Ratio: Predictor of Market Crash? Our New Website is Live This week we’ve […] read more…

SMART MONEY, DUMB MONEY & YOUR MONEY |

2014-06-28 23:17:03-04

Darryl Schoon discusses various indicators that demonstrate things may not be as they seem in the current financial system. Including share trading volumes falling while prices rise, what institutional investors are doing versus private/retail investors, and bond market illiquidity… SMART MONEY, DUMB MONEY & YOUR MONEY Crime is far more common than logic. This is the refuge […] read more… 2014-06-28 23:17:03-04

Darryl Schoon discusses various indicators that demonstrate things may not be as they seem in the current financial system. Including share trading volumes falling while prices rise, what institutional investors are doing versus private/retail investors, and bond market illiquidity… SMART MONEY, DUMB MONEY & YOUR MONEY Crime is far more common than logic. This is the refuge […] read more…

|

|

2014-06-26 01:25:02-04

Gold Survival Gold Article Updates Jun. 26, 2014 This Week: Our New Website is Live Big move in Gold and Silver More Indicators of a Likely Bottom Wealth Inequality Getting Worse in NZ – So Tax the Rich? Wealth to Income Ratio: Predictor of Market Crash? Our New Website is Live This week we’ve […]

2014-06-26 01:25:02-04

Gold Survival Gold Article Updates Jun. 26, 2014 This Week: Our New Website is Live Big move in Gold and Silver More Indicators of a Likely Bottom Wealth Inequality Getting Worse in NZ – So Tax the Rich? Wealth to Income Ratio: Predictor of Market Crash? Our New Website is Live This week we’ve […]  2014-06-28 23:17:03-04

Darryl Schoon discusses various indicators that demonstrate things may not be as they seem in the current financial system. Including share trading volumes falling while prices rise, what institutional investors are doing versus private/retail investors, and bond market illiquidity… SMART MONEY, DUMB MONEY & YOUR MONEY Crime is far more common than logic. This is the refuge […]

2014-06-28 23:17:03-04

Darryl Schoon discusses various indicators that demonstrate things may not be as they seem in the current financial system. Including share trading volumes falling while prices rise, what institutional investors are doing versus private/retail investors, and bond market illiquidity… SMART MONEY, DUMB MONEY & YOUR MONEY Crime is far more common than logic. This is the refuge […]