This Week:

- Watch out for “Quitaly”

- NZ Bank Bail-in Scheme “Most Ruthless” in the World

- Presentation: Wealth Insurance with Upside

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1780.24 | + $10.88 | + 0.61% |

| USD Gold | $1255.60 | – $11.26 | – 0.88% |

| NZD Silver | $24.83 | + $0.03 | + 0.12% |

| USD Silver | $17.51 | – $0.25 | – 1.40% |

| NZD/USD | 0.7053 | – 0.0107 | – 1.49% |

| Looking to sell your gold and silver?Visit this page for more information | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1708 |

| Buying Back 1kg NZ Silver 999 Purity | $759 |

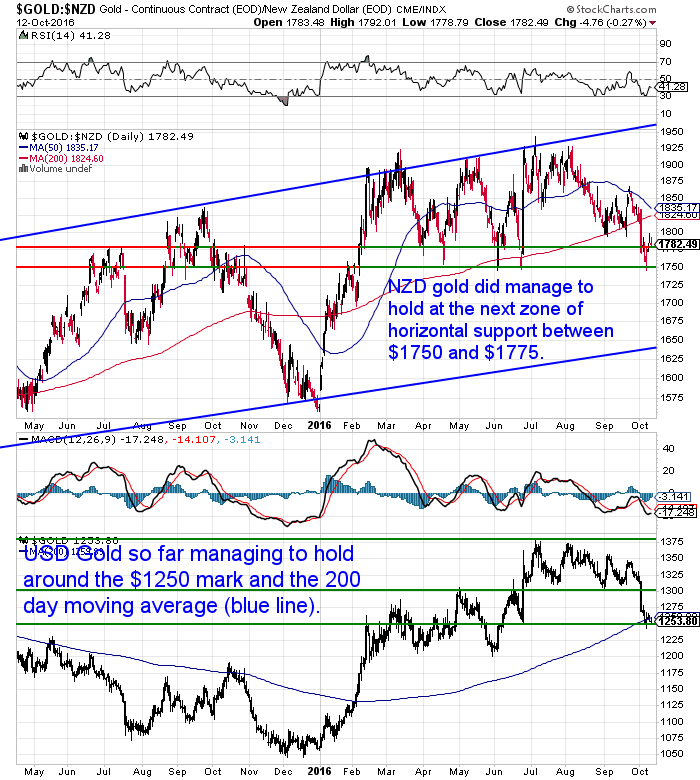

The NZ Dollar has been the main driver of local precious metals prices this past week. It dropped 1.49% against the US Dollar. So while the US prices of gold and silver fell, in NZ Dollar terms they were both higher this week.

While the NZ Dollar is getting quite oversold, it looks like it might be closing in to try and test the 200 day moving average before long.

Checking out the local gold price chart now we can see that yet again it has bounced off the $1750 support zone. It’s actually the fourth time this year. So there’s every chance that this area with prove to be a good time to be buying.

If it was to drop conclusively below this support line then it would like head to around $1650 where the lower trend line coincides with the next major level of horizontal support.

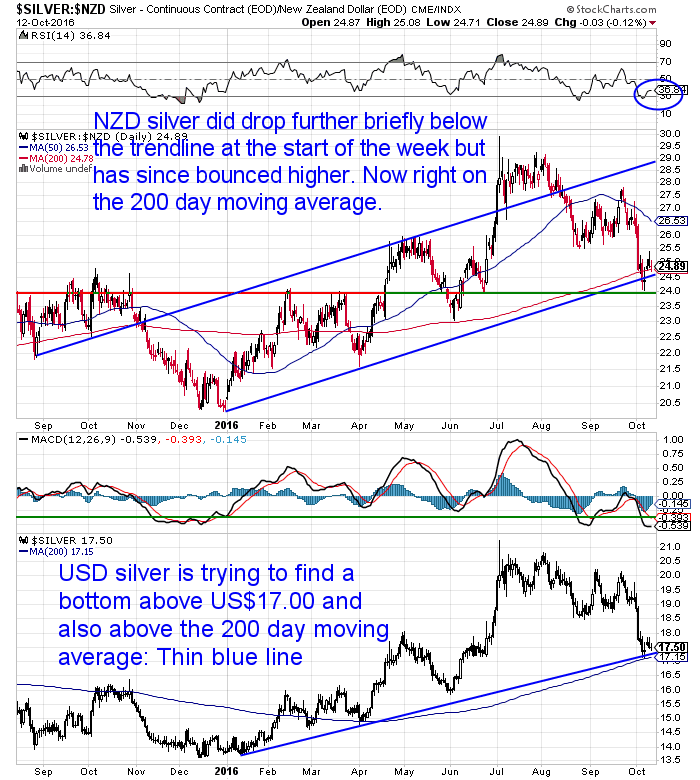

Silver did drop even lower earlier in the week, before staging a rebound. It now sits right on the 200 day moving average and just above the rising blue trendline. Silver has retraced 50% of the run up since the start of 2016. So the trend appears to be still up and that would make this merely a healthy correction in a renewed bull market.

Watch out for “Quitaly”

Italy looks like the next nation in the EU to have on our watch list. We’ve got 3 articles on the website this week looking at the goings on over there.

First up a look at the sorry state of the “Non Performing Loans” in Italy. Plus the level of government debt. It is only the record low interest rates that are keeping Italy’s head above water. But you’ll see why this is actually a double edged sword for it’s banks.

Doug Casey on “Quitaly” and the Collapse of the EU

Next up Doug Casey looks at how the troubles in Italy could be the next step in the break up of the European Union.

Here’s Where the Next Bank Deposit “Bail-In” Will Strike…

We’ve written about bail-ins many times over the past few years. The banking system problems in Italy mean the risk of depositors funds being used to recapitalise the banks is rising. And Italians seem to be realising this:

- “Italians are rightly afraid of bail-ins. That fear is leading them to withdraw their savings as cash and also to buy gold. This further drains the banks’ capital, making it more likely they’ll need to do a bail-in to remain solvent, which fuels even more withdrawals. It’s like a self-fulfilling prophecy.”

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

NZ Bank Bail-in “Most Ruthless” in the World

If you’ve been following us for the last few years you should of course be aware that New Zealand has one of the harshest policies in place when it comes to a failed or failing bank.

See these for more:

Bank Failures: Will New Zealand be Cyprussed?

Bank Failures – Could they happen in NZ? The Reserve Bank thinks so

What’s Wrong With the RBNZ’s Bank Failure Plans?

Yesterday we stumbled across an article in Australia that comments in no uncertain terms on the harshness of the Reserve Bank of New Zealand’s Bail-in system.

- New Zealand is Australia’s back door for bail-in

- “New Zealand’s bail-in system, called Open Bank Resolution (OBR), is the most ruthless and blatant deposit-stealing scheme in the world.”

- “…New Zealand has also pioneered bail- in, about which it is remarkably open, or rather, blatant. New Zealand’s Reserve Bank (RBNZ) doesn’t even attempt to disguise its intention to seize whatever deposits it deems necessary to prop up banks. In fact, it illustrates its OBR bail-in policy in full colour on its website (below). The illustration states that at the end of OBR the “unused portion of frozen money will be returned to customers”, but it doesn’t reassure customers it won’t use all of it. All that’s missing from this illustration is images of dead sheep piled at the bottom of the cliff and the odd sheep who has made it to the end of the OBR path, completely fleeced!

- To underscore how ruthless OBR is, not only is there no guarantee of deposits, but note how RBNZ classifies ordinary savers—who since primary school have been taught to put their money into a bank for safekeeping—as “investors”, in this excerpt from its 2011 “Primer on Open Bank Resolution”: “Unsecured creditors include a wide range of individuals and entities. At one end of the spectrum, there are large international nancial institutions that invest in debt is- sued by the bank (commonly referred to as wholesale funding). At the other end of the spectrum, are customers with cheque and savings accounts, and term deposits. Whilst there are differences between different classes of unsecured creditors, they all have the same legal claim on the bank. Each has freely invested in a private institution and has enjoyed a return on that investment whilst accepting the risks associated with the investment.”

- This might come as a shock to Kiwis…”

Yes indeed. We’re sure most NZers have no idea that every dollar they have in any bank is at risk.

What about bank accounts you hold elsewhere in the world?

The article also highlights the level at which a bail in will occur in various other countries:

- “In the other jurisdictions where statutory bail-in is in force, the authorities are careful to stipulate that it only applies to “uninsured deposits”, i.e. the portion of bank deposits not covered by a government guarantee. In the EU, that is €100,000; in the UK £75,000; and in the United States US$100,000 (in Australia, which doesn’t—yet—have statutory bail-in, but does have contractual bail-in, the deposit guarantee is $250,000). “

- “In December the Italian government couldn’t honour the €100,000 deposit guarantee when four small banks collapsed, and had to get some large banks to put up the money.”

- Source.

So take heed. Deposits are at risk throughout the G20 nations.

Here’s another report out of Canada also looking at global bail-in policies.

Bank Bail-Ins – Depositors’ Worst Nightmare How You Could Lose Your Money in The Bank

It concludes:

- “So, if you are receiving little economic return on your bank deposits and are now burdened with uncertain risks including liquidity, should you feel truly safe and comfortable about those deposits?……Unfortunately, the answer is NO!”

It states the alternatives are keeping cash under the mattress, accepting negative yields on government bonds or:

- “Negative interest rates make a strong case to hold gold, as it has kept pace with inflation since 1972 with a 44-year average annual compound rate of appreciation of 8.3% risk free. Gold has been used as currency (i.e. money) for over 3,000 years and is used as money by the central banks. Gold is highly liquid. According to the London Bullion Market Association (LBMA) statistics, the net daily turnover of gold is $23 billion.”

- Source.

Remember it’s too late get get insurance after your home burns down. It’s also too late to get financial insurance after your bank deposits have been bailed-in! The lower levels of gold and silver currently offer a lower risk entry point.

Just reply to this email for a quote or phone David on 0800 888 465 if you have any questions.

Presentation – Gold & Silver: Wealth Insurance with Upside

Speaking of financial insurance we’ve just posted as we “go to print” a recording of a presentation we made earlier this week entitled: Gold & Silver: Wealth Insurance with Upside.

We cover a lot of ground so click through and check out what’s included in that…

** Urgent Message for All Car Owners **A compact, revolutionary tool can save your life.

We believe everyone who drives or rides in a vehicle must carry this tool.

The Keychain Car Escape Tool can save lives.

The Keychain Car Escape Tool can save lives.

For less than the price of 2 movie tickets you can get 2 of these.

One for each car in your family or give one to someone you care about.

—–

This Weeks Articles:

Presentation – Gold & Silver: Wealth Insurance with UpsideThu, 13 Oct 2016 2:34 PM NZST  Earlier this week we returned the favour to Forex Trading Coach Andrew Mitchem and made a webinar presentation for his clients. (If you missed the webinar Andrew did for our clients you can still see the link to it here: Forex Trading – How You Can Benefit). The topic of our presentation to his clients […] Earlier this week we returned the favour to Forex Trading Coach Andrew Mitchem and made a webinar presentation for his clients. (If you missed the webinar Andrew did for our clients you can still see the link to it here: Forex Trading – How You Can Benefit). The topic of our presentation to his clients […]

|

A Mile-High House of CardsWed, 12 Oct 2016 4:38 PM NZST  Italy looks like it might be the next domino to fall. See just how bad it has gotten in terms of non performing loans at banks and also the massive level of government debt. It looks like it is only record low interest rates that is keeping Italy’s head above water currently… A Mile-High House of […] Italy looks like it might be the next domino to fall. See just how bad it has gotten in terms of non performing loans at banks and also the massive level of government debt. It looks like it is only record low interest rates that is keeping Italy’s head above water currently… A Mile-High House of […]

|

Doug Casey on “Quitaly” and the Collapse of the EUWed, 12 Oct 2016 1:44 PM NZST  Now that a Brexit is in the process of happening, there is actually a potentially occurrence that will have a much more dramatic impact on the European Union. That is if a certain party gains power in Italy and ushers in an exit from the EU. See how this might play out… Doug Casey on […] Now that a Brexit is in the process of happening, there is actually a potentially occurrence that will have a much more dramatic impact on the European Union. That is if a certain party gains power in Italy and ushers in an exit from the EU. See how this might play out… Doug Casey on […]

|

Here’s Where the Next Bank Deposit “Bail-In” Will Strike…Wed, 12 Oct 2016 12:12 PM NZST  2013 saw the first very widely publicised bank deposit “Bail In” in Cyprus. We wrote about that situation back then and how it compares to what exists here in New Zealand in this article: Bank Failures: Will New Zealand be Cyprussed? But there is now a very real risk of this happening again in another […] 2013 saw the first very widely publicised bank deposit “Bail In” in Cyprus. We wrote about that situation back then and how it compares to what exists here in New Zealand in this article: Bank Failures: Will New Zealand be Cyprussed? But there is now a very real risk of this happening again in another […]

|

Gold & Silver Smack Down – 2013 Redu or Buying Opportunity?Thu, 6 Oct 2016 7:03 PM NZST  This Week: Another Smack Down in Gold & Silver 2013 Redu or Buying Opportunity? World Gold Council: Price drop likely to spur demand This Maths Show Why Negative Interest Rates are Very Likely in the USA Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1769.36 – $48.34 […] This Week: Another Smack Down in Gold & Silver 2013 Redu or Buying Opportunity? World Gold Council: Price drop likely to spur demand This Maths Show Why Negative Interest Rates are Very Likely in the USA Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1769.36 – $48.34 […]

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9amClick here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2016 Gold Survival Guide. All Rights Reserved. |