This Week:

- NZD Silver Breakout!?

- RBNZ Continues to Stoke Property Prices

- Land Tax for Foreigners – Why That Wouldn’t Work

- Catherine Austin Fitts: Why Privacy is Over & Taxes Set to Increase

- A Free Market in Money

|

TODAY ONLY: LIMITED QUANTITY SILVER SPECIAL ***** 55 x 1 Kg PAMP Silver Bars 55 x 1kg Swiss PAMP silver 999 bars for $885 each Elsewhere Swiss PAMP silver is $932 x 5 = $4660 picked up Even cheaper than locally made NZ 999 silver bars currently $906 +++++++ Ph 0800 888 465 or reply to this email with your email, name, address, mobile number and amount required, delivered or picked up. Offer closes at 4pm today |

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1799.24 | + $13.28 | + 0.74% |

| USD Gold | $1244.35 | + $0.25 | + 0.02% |

| NZD Silver | $24.91 | + $0.57 | + 2.34% |

| USD Silver | $17.23 | + $0.28 | + 1.65% |

| NZD/USD | 0.6916 | – 0.0050 | – 0.71% |

NZD Silver Breakout!?

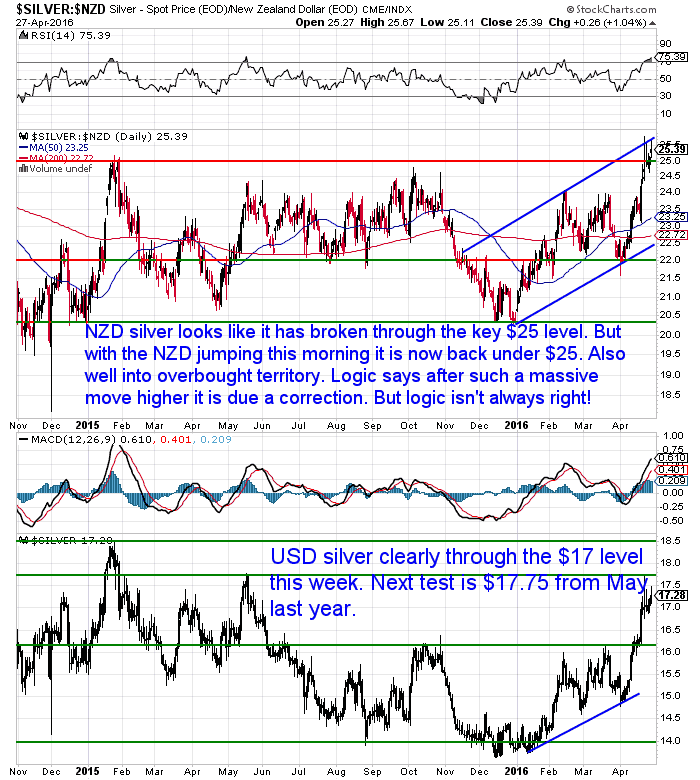

The trend of the past few weeks has continued. Silver has again outperformed gold this week. It also appears that NZD silver has broken above the key $25 level that we’ve been harping on about for months. Although this morning the RBNZ left interest rates on hold (which wasn’t really a surprise), the NZ Dollar jumped a cent higher and so silver dropped sharply below the $25 level again. This isn’t shown on the chart below.

What is shown is how sharp the run up in silver has been and that we are in overbought territory on the RSI. Logic says we should see a correction after such a strong price rise. But. Logic doesn’t always prevail in markets.

If silver has broken out of the sideways range it has been in for over 18 months, then this likely indicates even higher prices ahead.

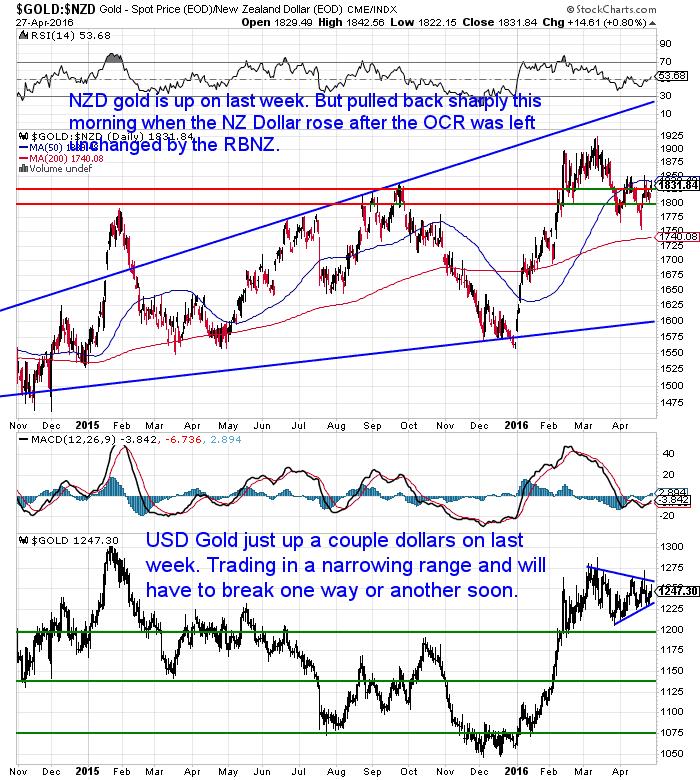

Conversely NZD Gold is only up slightly on last week. It continues to consolidate around the $1800 level.

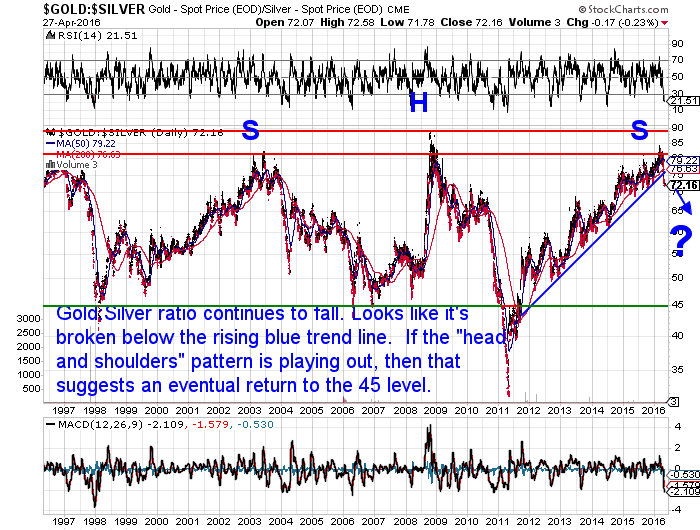

This outperformance of silver versus gold is reflected in the gold silver ratio falling further this week. Now at 72. It certainly looks like it has broken below the uptrend line from 2011.

If the head and shoulders pattern plays out then this suggests a return of the ratio to 45. At the current price of NZ$1800 this would equate to NZ$40 silver.

Of course if we have indeed seen a return to a precious metals bull market, then gold will likely also be higher than the current price. So silver could be even higher than NZ$40 in this case.

NZ Interest Rates Held at Record Lows

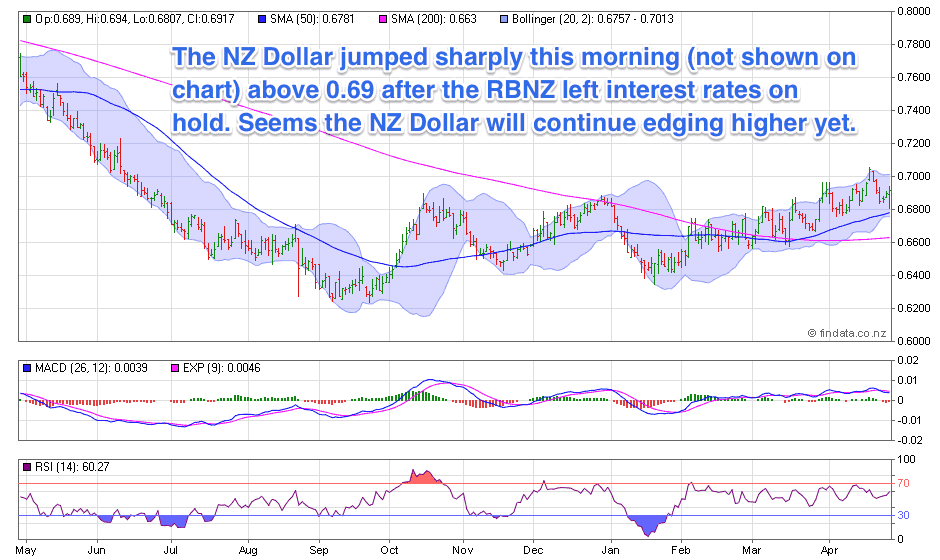

As noted already the RBNZ held the overnight cash rate (OCR) at 2.25% this morning. In response the NZ Dollar rose a cent. (Although this is not shown on the chart below as the closing price came before the OCR announcement).

Who knows why this happened since it wasn’t a great surprise that they held the rate where it was. The expectation is another cut will come in June.

But it seems the Kiwi dollar is in an uptrend. And while the RBNZ tries to talk it lower, they aren’t having much luck.

But it seems the Kiwi dollar is in an uptrend. And while the RBNZ tries to talk it lower, they aren’t having much luck.

NOTE: In case you missed it last week check out our thoughts on what a rising NZ Dollar may mean for gold and silver in NZ:

NZ Dollar Outlook + Impact on NZ Gold & Silver Prices

RBNZ Continues to Stoke Property Prices

Of course these record low interest rates are a key driver in continuing to push house prices higher. Even while the RBNZ voices concern over them!

Bank economists think the RBNZ will have to come up with some other “prudential tools” to temper this since a further rate likely will exacerbate the problem of rising house prices.

Land Tax for Foreigners – Why That Wouldn’t Work

Meanwhile John Key is floating other ideas like a land tax for foreign buyers.

Gareth Morgan makes some good points about why this wouldn’t work.

Morgan has other ideas to “fix” things though:

By not taxing the effective income every owner-occupier enjoys from owning property we have created the biggest tax loophole available. This enables New Zealanders to get rich from the flood of buyers into that market – no matter whether they’re foreign or local. If you really want to keep the price of property within reach of everyday New Zealanders you need to actually close the loophole. Just barring foreigners from playing this game simply opens up great arbitrage opportunities for some of us to exploit.”

Basically he advocates taxing all effective income from capital. This would include the rise in price in houses whether you live in it, rent it out or just sit on it.

However we have our doubts about this too. Why?

Well, just look elsewhere in the world.

Other countries have capital gains taxes, stamp duties and a myriad of other taxes. But taxes don’t stop prices rising for them either. Sure they may have some impact.

But other countries that do have such taxes like the USA and Australia have also had (and still have) house price bubbles.

We still stand behind what we wrote back in 2012:

We still stand behind what we wrote back in 2012:

Housing Un-affordability: It’s Not Supply, It’s the Debt Stupid!

It is the global monetary system that is the key factor in the bubbles appearing across the planet. Many factors that are said to be the cause are actually just symptoms of this system.

What is the solution?

Well it is a free market in money. What’s that? We’ll come back to it soon. But suffice to say we don’t think that is very likely in the near future.

So probably the solution to high prices are… even higher house prices!

Say what!

Well contrary to popular belief, they can’t keep rising forever. Eventually the prices will get too high for anyone else to buy them. When the easy capital gains cease odds are many will sell and cause an oversupply on the market. Result: Lower prices.

Of course this seems impossible to most currently and the calls are for the government to “do something”.

But today we saw that property investment veteran Olly Newland was warning of just this very thing.

“[T]he veteran property investor and author, who is also a director of property advisory and management company Newland Burling, said the current residential property market had the same smell about it as previous booms, before they turned into busts.

“The warning bells are well and truly ringing but no one is listening,” he said.

…Newland said although residential property prices were continuing to increase, particularly in Auckland, the days of rising prices would eventually come to an end and that would be a day of reckoning for many investors.

“At the moment they are all giggly. They all go around giggling about the money they are making,” he said.

But when prices stopped going up investors would be left with the chores of having to collect rents, maintain their properties and deal with changes in tenants, without the benefit of capital gains, and many would decide to lock in the capital gains that had already been made and cash up.

That could see thousands of properties coming on to the market at the same time, with a shrinking pool of buyers.

Newland said the sale statistics he had, showed that investors were buying 80% of the properties sold in South Auckland and 41% of sales across the whole of Auckland.

“First home buyers haven’t got a look in because investors are buying everything that’s coming up.

“It’s not healthy,” he said.

And many of the investors that came to Newland Burling for advice had paid so much for their properties that they were having to keep shovelling money into them to keep them afloat, because the rental income wasn’t sufficient to cover the outgoing like rates, insurance and maintenance.

“That’s all very nice when capital gains keep making you feel better but when capital gain stops it will become a real pain,” he said.”

Our theory remains, prices will keep rising – until they don’t!

Make sure you’ve got an “alternative asset class” when that happens. (Do we have to spell out what that asset class might be?)

Free delivery anywhere in New Zealand

Free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $14,875 and delivery is now about 7-10 business days.

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have 4 weeks emergency food supply.

Learn More.

—–

Catherine Austin Fitts: Why Privacy is Over & Taxes Set to Increase

“Top official at the country’s space agency reveals plans for mission to the red planet … Mission chief spoke … about plans for Mars and moon missions … The agency is planning to launch a mission to reach Mars by 2021 It also plans to establish a lunar research base and explore the moon.”

Austin Fitts believes China will try to address its debt problems by a combination of growing its way out of its problems but also also by printing a lot of RMB and then exporting them outside the country, much like how the US has done for decades with exporting massive amounts of Dollars.

She also believes China is copying the US militarily with the expansion of its Navy.

Catherine Austin Fitts: Why Privacy is Over & Taxes Set to Increase

The Daily Bell this week interestingly covered a number similar points to those raised by Catherine Austin Fitts:

“When it comes to economics, space exploration, leadership or military control, the Chinese approach seems similar to that of large Western countries and especially the US.

As we’ve pointed out before the Chinese economic system and the behavior of its tops economists align with Western Keynesian orthodoxy. Its space program and military strategies resemble Western ones as well in that they are quite significant in terms of size and cost but still operate under civilian control.

Parallels between Chinese sociopolitical and economic structures and the West’s are increasingly evident. In some ways, China resembles an authoritarian version of the United States, though in some ways, parts of the Chinese economy may actually be freer than the US’s.

But given the way that China is evolving – all of Asia, really – one cannot expect that the system will present significant variances from Western ones. The world is growing smaller but it is also growing more homogenized.

Conclusion: Increasingly, the world’s power centers offer the same solutions, the same structures, the same overwhelming sovereign and consumer debt and societal manipulations. If you want to create a life that is not increasingly controlled by mercantilist strategies, you’ll have to do it on your own.”

Indeed we seem to be trending towards even more centralised control and less freedom. Here’s the complete opposite and what we continue to try to educate people about and hope for…

A Free Market in Money

Back to the theory of a “free market” in money we alluded to earlier. What does this mean?

Well, step one is that it shouldn’t be the government or earnest central bankers gathered around a table that sets the price of money i.e. interest rates. The market should decide what these are. Get rid of the central banks!

But we’d take it a step further than that. Get rid of government money altogether. Huh?

Let people decide what they want to pay with in exchange for goods and services.

Crazy concept huh?

This weeks feature article explores this concept further and looks at how gold and bitcoin might work together in a future of monetary freedom. We can but dream and hope that this comes about, rather than the even more centrally planned world that Austin Fitts and the Daily Bell referred to above…

This weeks feature article explores this concept further and looks at how gold and bitcoin might work together in a future of monetary freedom. We can but dream and hope that this comes about, rather than the even more centrally planned world that Austin Fitts and the Daily Bell referred to above…

Could Gold and Bitcoin Work (and Rise) Together?

[New] Credit Card Knife (2 pack)

Check out this cool new survival gadget.

This amazing little knife in just seconds transforms from an unassuming card in your wallet into a fully functional knife.

The Insta-Knife folds down to the same size as a credit card. And at just 2 mm thin it is 1/10th the thickness of your standard utility knife!

FREE Shipping – Shop Now

This Weeks Articles: |

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

|

Today’s Spot Prices

Spot Gold |

|

|

NZ $ 1799.24 / oz

|

US $ 1244.35 / oz

|

|

Spot Silver

|

|

|

NZ $ 24.91 / oz

NZ $ 800.85 / kg |

US $ 17.23 / oz

US $ 553.87 / kg |

|

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy |

|

Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

|

Our Mission

|

|

We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

Gold Survival Guide

PO Box 74437

Greenlane Auckland 1546

New Zealand

| Copyright © 2016 Gold Survival Guide. All Rights Reserved. |