We’ve had a number of questions lately from new readers. Almost always these are gold and silver related. However today this one was asking our opinion on Bitcoin.

This question comes from someone who is already aware of what Bitcoin is and how it functions. So we won’t bother to explain what Bitcoin is. That is only a Google search away. Anyhow the question was:

“Whats your view on the success of the Bitcoin- especially of late and do you think it has a very promising future?

Would you recommend investing in this currency as something reliable as Gold/silver, or do you think it too would eventually get affected by the crisis?”

Here was our reply:

We’re certainly taking an interest in Bitcoin. In particular from what we’ve read the blockchain upon which it is based seems to have a lot of potential for decentralising many areas of society – not just money.

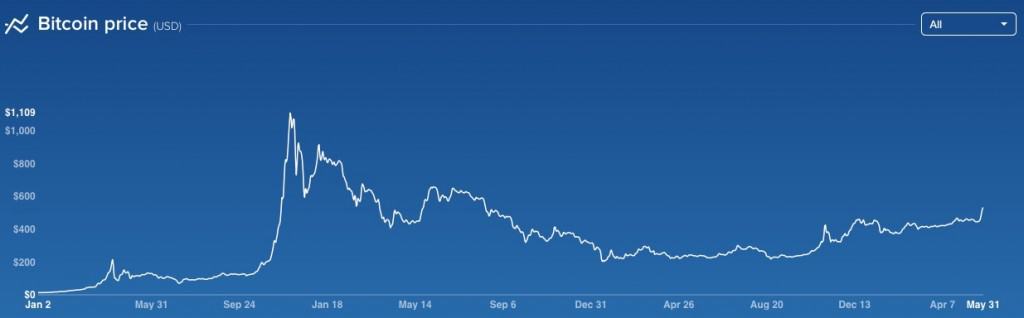

And certainly it does seem to have woken up lately (a bit like silver really) and has been rising after a long consolidation (again not unlike the precious metals).

However it does worry us that banks and central banks have been talking it up a bit of late, and looking to get involved in this space too.

Why?

Because we’d doubt they would want to keep the decentralised anonymous ledger that exists currently that records transactions and ownership of each bitcoin.

Perhaps they have more sinister plans of using it as part of what looks to be an ongoing outlawing of cash? But with a removal of the anonymous part of the blockchain system? A centralised ledger would be perfect to track transactions globally and ensure everyone paid “their fair share”.

As far as whether it is as “reliable” as gold and silver, Bitcoin has been around a few years now, whereas gold and silver perhaps a few millennia so it certainly doesn’t have much track record to go on yet.

We have written before that perhaps bitcoin or at least the blockchain technology behind it could be used along with gold and silver as an improvement on the existing monetary system.

Multiple currencies – a free market for money?

Here’s our ideal. A free market for money as we discuss in more depth here. The Gold Standard: What Do We Think About it?

In this case virtual currencies may also rise up – ala Bitcoin and others. However we think in a true free market for money it’s likely they would need some tangible backing. So perhaps gold and silver as store of value, unit of account (again goods priced in ounces not dollars), but some technological addition to aid in the means of exchange?

Just like any free market, odds are the best currency would become the most popular and rise to the top. Throughout history the best money has been gold and silver. We’re not sure that technology will necessarily change that.

And here is a recent article we shared written along similar lines.

And here is a recent article we shared written along similar lines.

Chris from Capitalist Exploits comments that we won’t see a return to a gold standard but makes an argument for why gold and Bitcoin may well work together (and rise together) in the future…

Could Gold and Bitcoin Work (and Rise) Together?

And another one talking about “hard digital currencies” from 2014:

Mt. Gox’s Downfall Shows the Power of Creative Destruction: Erik Voorhees Interview

Of course there are others like Mexican Billionaire and silver coin proponent Hugo Salinas Price who is decidedly anti – bitcoin. As he says here:

Hugo Salinas Price: When Reality Overthrows Imagination

“All imaginary digital money is imagined to exist exclusively in imaginary banks, where it is registered as supposedly the property of corporations and other imaginary institutions of all sorts, and also, as the property of flesh and blood humans. An awkward fundamental question is “How can something imaginary constitute property?”

Such is the mighty hold of imagination upon humans that even the ridiculous imaginary Bitcoin has gained the attention of some otherwise prudent humans. Governments have objected to the use of the Bitcoin because the Bitcoin, as imaginary money, invades the imaginary turf of bankers and governments and these people don’t like that. Curiously, on the Internet we can see pictures of pretty shiny Bitcoins, though none have been minted. A picture is helpful to the promotion of an imaginary coin.

On the part of some normally sound critics of fiat money the main doubts regarding the Bitcoin refer to its security and safety from falsification. Nobody is concerned that the Bitcoins are totally imaginary. Humanity appears to be quite happy in the imaginary world in which it lives.

Today, imaginary governments rule by means of distribution of imaginary money provided by imaginary banking systems controlled by imaginary central banks.”

We’re no experts on Bitcoin by any means. But sit perhaps somewhere in the middle. Not shouting about it from the rooftops, not pooh poohing, but certainly keeping a close eye on it.

We’d prefer our money to be something tangible, but at the end of the day a free market in money is what we’d prefer overall. Let people decide what they want to use. And if they did perhaps Bitcoin would play a part in this?

So odds are the price of bitcoin may continue to track upwards – it certainly looks positive at the moment. We just wouldn’t want all our eggs in that one basket.

You can now buy gold and silver with bitcoin. Check out this post to learn more about the pros and cons: How to Buy Gold and Silver with Bitcoin