Gold Survival Gold Article Updates:

15 January 2015

This Week:

- NZD Gold and Silver performance for 2014

- Prognostications for 2015 – both ours and others

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1596.00 | $31.00 | 1.98% |

| USD Gold | $1231.15 | $14.21 | 1.16% |

| NZD Silver | $21.90 | $0.58 | 2.72% |

| USD Silver | $16.89 | $0.27 | 1.62% |

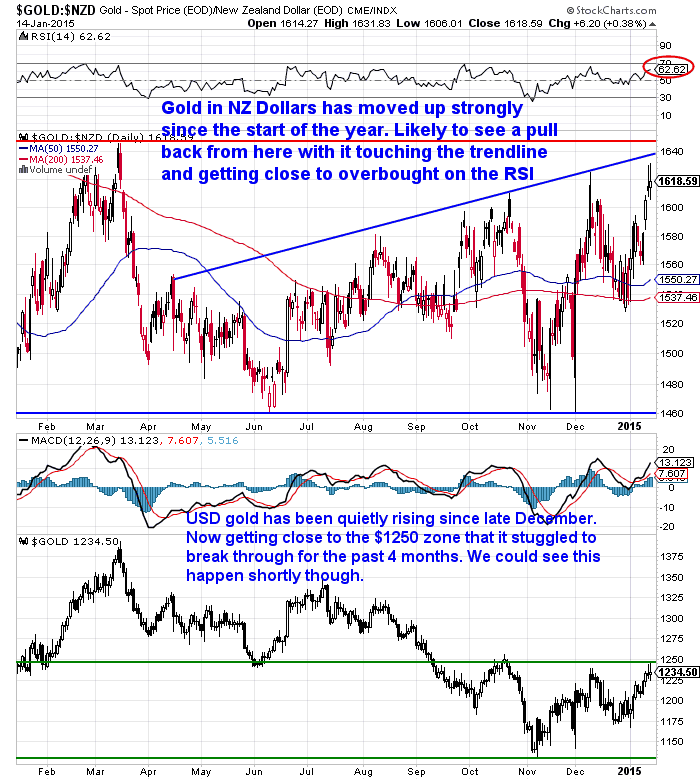

If you haven’t been paying attention (which with the weather most of NZ has been experiencing you have every right not to!), gold and silver have been steadily – but quietly – moving up since the start of the year.

For the first time we can remember in a number of years, the low volume holiday period didn’t see a sharp plunge lower for the precious metals either.

As you can see in the chart above just in the past week we’ve seen the NZD price of both move up close to 2% and 3% respectively and in the week prior we also saw a rise.

So what’s behind the surge?

Care of Bullionvault’s Adrian Ash:

—–

“Three things to watch…

#1. It’s January, and gold is making an annual habit of dashing higher after the Christmas break. The Chinese New Year now looms (the Year of the Goat starts on Feb.19), and while China’s consumer demand doesn’t push prices higher, it makes a great story for traders hunting a fast buck off a simple idea. Fact is…

#2. Those hot-money traders are making the running right now, piling into bullish futures and options contracts instead of buying physical metal. But it’s also plain that…

#3. Interest rates are falling, and falling in real terms, adjusted for inflation. Even though inflation itself is dropping. And the link between real rates and gold prices is plain.”

—–

The chart below shows the NZD gold price has actually been trending steadily upwards since the middle of last year. Making higher highs each month or 2. Right now we’re close to the trendline again so it wouldn’t be a surprise to see it pull back from here, but there does seem to be a decent looking trend in place.

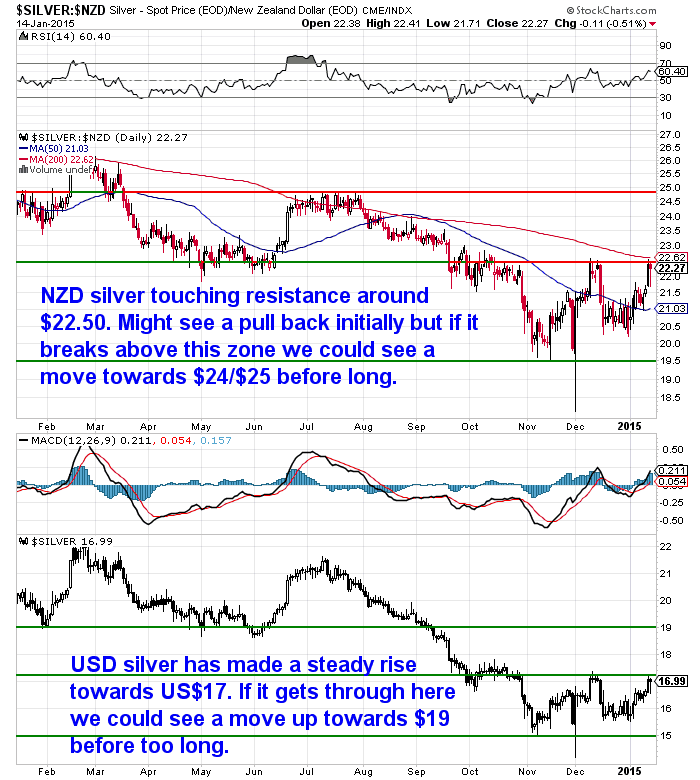

Silver seems like it might have finally woken up at last too. Edging back up towards NZ$22.50 this week. If it busts through here soon we could well see some decent gains, as there is not much resistance before the $24/$25 range.

What does the rest of 2015 have in store for gold and silver? Our Guesses…

You’ll have to head on over to our feature article this week to see what our guesses for 2015 are. (Predictions sounds like we might actually know what we’re on about so we prefer guesses or prognostications!)

You’ll have to head on over to our feature article this week to see what our guesses for 2015 are. (Predictions sounds like we might actually know what we’re on about so we prefer guesses or prognostications!)

We also review the performance of both metals last year which you may find surprising.

Gold & Silver in NZ Dollars: 2014 in Review & Some Prognostications for 2015

Recap: Our Most Popular Articles from 2014

If you missed it last week we featured our most read articles of 2014.

If you missed it last week we featured our most read articles of 2014.

So if you’ve joined us in just the past year it might be worth checking them out to see what you’ve missed.

Other Predictions for 2015

We’ve read a few predictions from others in the last week. One was from someone we hadn’t heard of before introduced to us by way of John Mauldin. Jawad S. Mian, who writes STRAY REFLECTIONS. (We actually note one of his points about an unexpected relationship between rising interest rates and the USD in our prognostications article mentioned above).

But he also had some well balanced points about gold…

—–

“[W]hat to do about gold?

Gold peaked in 2011 and has since dropped more than 40%. Is the powerful bull market since 2001 still alive or is gold entering a multi-year decline?

The catalysts for higher prices, which were present for much of the last decade, have clearly diminished: real interest rates around the world are no longer negative, although they will remain low for some time; and central bank policy is not as expansionary, even though competitive devaluations are still in vogue. As the world “looks better,” the price of gold has adjusted down to reduced tail risk across the global macro spectrum. Gold tends to perform quite poorly when real yields are rising, Fed tightening is brought forward, economic surprises are positive, and the equity risk premium is shrinking. Should we see a sharp rise in volatility and fall in asset prices, all of these forces are prone to reverse, and gold should prove to be an effective hedge in that environment. Even if you are worried about the Fed hiking rates next year, keep in mind that gold rallied from 2004 to 2006, even as the Fed funds rate increased.

Anyone interested in a safe haven, or has systemic risk reached a secular crescendo?

The price of gold already appears to have stabilized, despite weak inflation readings and lackluster broad money growth. From a technical perspective, gold is sitting on trend-line support that extends from the November 2001 pivot, with momentum at positive divergence on both a weekly and monthly time frame. We find market extremes in both sentiment and positioning and believe liquidation of gold ETF holdings will soon reach an inflection point. The only factor that has given a reliable signal for gold prices is the US dollar. Based on our discussion so far, we believe the reversal in the dollar will lead gold to recapture some of its lost glitter.

The “no” vote for the “Save Our Swiss Gold” campaign did not come as a shock to us. The proposal, which called for ‘protecting the country’s wealth by investing in gold,” was rejected by 78% of the voters. After a three-year bear market, the Swiss can be forgiven for falling out of love with gold. The Swiss National Bank is particularly relieved, as it would otherwise have had to hold at least 20% of its balance sheet in gold reserves, which would make its monetary machinations far more cumbersome. But we really can’t help but wonder whether this decision will be remembered along with the infamous “Brown’s Bottom,” when Britain’s Gordon Brown, then Chancellor of the Exchequer, decided to unload half of the UK’s gold reserves in a series of auctions, at an average gold price of $275 over a span of three years. Will the Swiss eventually look back in anger at possibly passing on a golden opportunity?

The price of gold is up 7% since the vote.”

—–

Bill Bonner is always a fun read, plus he does seem to get the big once in a decade trend changes right.

So here are few discontinuities, forecasts and trends Bill suggests could surprise you in 2015:

—–

- “Stocks could go down. Why not? They’ve gone up for six years in a row. They’ve got to go down sometime. Bonds could also go down. There’s been a bull market in bonds since 1982. That has to end sometime too

- Oil could go up. The Fed’s bubble in the oil market has burst. Now output should be falling, as the Fed still holds its key rate near zero… and central banks in Japan, China and Europe are still pumping

- Inflation could surprise us. We’ve gotten used to falling inflation rates and everyday low prices. The Consumer Price Index has been going down for 33 years. There’s no law that says it has to keep going down

- And when price increases go back above 2%, what major central bank will have the courage to tighten?

“Those are just the most obvious and inevitable trend changes. There are also wars, crashes and natural disasters that we can’t foresee but that could be devastating to millions of people.”

—–

No doubt we will be surprised at some point with a trend change or two. But in the meantime the era of the central bankers continues. Ours was the best in the world last year according to some outfit called “Central Banking Publications”. They sound like a barrell of laughs.

So while the central planner lovefest continues perhaps the good times can keep rolling for a while longer yet.

And with them so too the debt levels. A Fitch report shows that NZ household debt has risen to 156% of disposable income from 152% in 2011 and is “high.”

“Fitch does not foresee a significant improvement in this ratio in 2015. In fact, there is a risk that household debt could continue to increase if property prices continue to rise on credit supply,” Fitch says.

“A significant correction in house prices and a sharp increase in the Official Cash Rate could pose a risk for the banks’ household exposures.”

While precious metals prices are trending up at the moment they remain at decent levels for a hedge against rising debt levels.

Free delivery anywhere in New Zealand and Australia

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $13,120 and delivery is now about 7-10 business days.

This Weeks Articles:

|

|

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| Today’s Spot PricesSpot Gold | |

|

NZ $ 1596 / oz |

US $ 1231.15 / oz |

| Spot Silver | |

|

NZ $ 21.90 / oz NZ $ 704.00 / kg |

US $ 16.89 / oz US $ 543.07 / kg |

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuideToday’s Prices to Buy |

|

Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

|

Our Mission

|

|

We look forward to hearing from you soon. Have a golden week! David (and Glenn) Ph: 0800 888 465 From outside NZ: +64 9 281 3898 |

|

|

|

The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

|

Copyright © 2013 Gold Survival Guide. All Rights Reserved. |

Pingback: Gold in NZD breaks out! - Gold Prices | Gold Investing Guide