|

|||

2014-02-27 16:05:23-05Doug Casey: “There’s going to be a bubble in gold stocks” By Doug Casey The following video is an excerpt from “Upturn Millionaires—How to Play the Turning Tides in the Precious Metals Market.” In it, natural-resource legends Doug Casey and Rick Rule discuss the deeply undervalued junior mining sector and the rare opportunity for spectacular […]read more… 2014-02-27 16:05:23-05Doug Casey: “There’s going to be a bubble in gold stocks” By Doug Casey The following video is an excerpt from “Upturn Millionaires—How to Play the Turning Tides in the Precious Metals Market.” In it, natural-resource legends Doug Casey and Rick Rule discuss the deeply undervalued junior mining sector and the rare opportunity for spectacular […]read more…

|

|||

2014-03-04 20:35:56-05While this piece doesn’t directly cover precious metals, it does look at the impacts of quantitative easing and the risks that currently exist in the market place. Given these risks it offers some advice on how to best mitigate them. It will be of particular interest to anyone nearing retirement age and trying to make […]read more… 2014-03-04 20:35:56-05While this piece doesn’t directly cover precious metals, it does look at the impacts of quantitative easing and the risks that currently exist in the market place. Given these risks it offers some advice on how to best mitigate them. It will be of particular interest to anyone nearing retirement age and trying to make […]read more…

Studying Gold & Silver’s Past Gives Us a Glimpse of Where We’re Heading in the Future |

|||

2014-03-05 15:32:34-05J.S. Kim looks back to the similarities between now and 2006 when most of the mainstream were dispensing the idea that gold was over and about to head much lower. There’s also an interesting video contained within the piece… By JS Kim, Founder & Chief Investment Strategist of SmartKnowledgeU Yesterday morning, we released this article on our […]read more… 2014-03-05 15:32:34-05J.S. Kim looks back to the similarities between now and 2006 when most of the mainstream were dispensing the idea that gold was over and about to head much lower. There’s also an interesting video contained within the piece… By JS Kim, Founder & Chief Investment Strategist of SmartKnowledgeU Yesterday morning, we released this article on our […]read more… |

Privacy: Do purchases of gold and silver in NZ have to be reported?

We recently had a question from a reader on the topic of what reporting occurs with regard to gold and silver in New Zealand…

—–

“I would like to buy gold and silver but it loses appeal if government can take it back in tough times. Are gold and silver registered at time of purchase or can what you buy with your legitimately earned money be your business only?”

—–

Here’s our thoughts on the subject:

Currently there is no legal requirement to register purchases of pure gold and silver with any government entity.

When/if you sell it back to a dealer under second hand dealer laws they must collect your details and ID and hold the bullion for 2 weeks – purely as protection in case of stolen goods. Just as any second hand dealer must do with any goods they buy off the public.

But there is no requirement to collect details when you initially buy.

Odds are this will change in coming years as there are plans to include precious metals dealers into existing anti money laundering (AML) regulations. This would require bullion dealers such as ourselves to collect customer details as part of the “know your customer” requirements of the AML Law. Just as banks and other financial institutions must do currently, but this is still likely a couple of years away.

Here’s some details from the Ministry of Justice website (emphasis added ours)….

—–

Anti-money laundering and countering financing of terrorism

The Ministry of Justice is responsible for leading the development of New Zealand’s anti-money laundering and countering financing of terrorism (AML/CFT) policy.

The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 (external link) seeks to detect and deter money laundering and the financing of terrorism, contribute to public confidence in the financial system and improve New Zealand’s compliance with international laws and best practices.

The Act introduces obligations for various businesses and industries, described in the legislation as ‘reporting entities’. Reporting entities include financial institutions, casinos, certain trust and company service providers and certain financial advisers.

Three government agencies – the Financial Markets Authority, the Reserve Bank and the Department of Internal Affairs – are responsible for supervising the reporting entities.

The Act comes into full force on 30 June 2013.

A second phase will consider introducing AML/CFT obligations for other businesses and professions, such as lawyers, accountants, conveyancing practitioners, real estate agents and businesses that deal in high-value goods, such as auctioneers and bullion dealers. Timing for that phase is yet to be determined.

—–

Who knows exactly what this will mean? In Australia we believe it is a $5000 limit for providing identification when purchasing bullion. So perhaps something similar with occur here?

Of course we don’t condone money laundering by criminals but we believe purchasing bullion should remain as private as possible to reduce the risk of theft – and not just from the government! If bullion dealers have to maintain lists of customers that would incentivise law breaking types to get their hands on them and have a “shopping list” of targets who have bought precious metals in the past.

So it could be a case of get in while privacy still exists for bullion buyers. Odds are this won’t last for too much longer, so consider yourself forewarned!

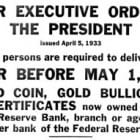

On the topic of government confiscation, we think the odds of this are probably lower than many would think. We’d say government would take other steps prior to this.

On the topic of government confiscation, we think the odds of this are probably lower than many would think. We’d say government would take other steps prior to this.

We’ve actually written on this topic before. Check out these articles for more…

Gold Confiscation – Could it happen in New Zealand?

Windfall Tax on Gold – a New Zealand Perspective

So if you want to beat the likely coming clamp down on privacy and also buy when the price looks to have bottomed out then get in touch.

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

| Today’s Spot Prices |

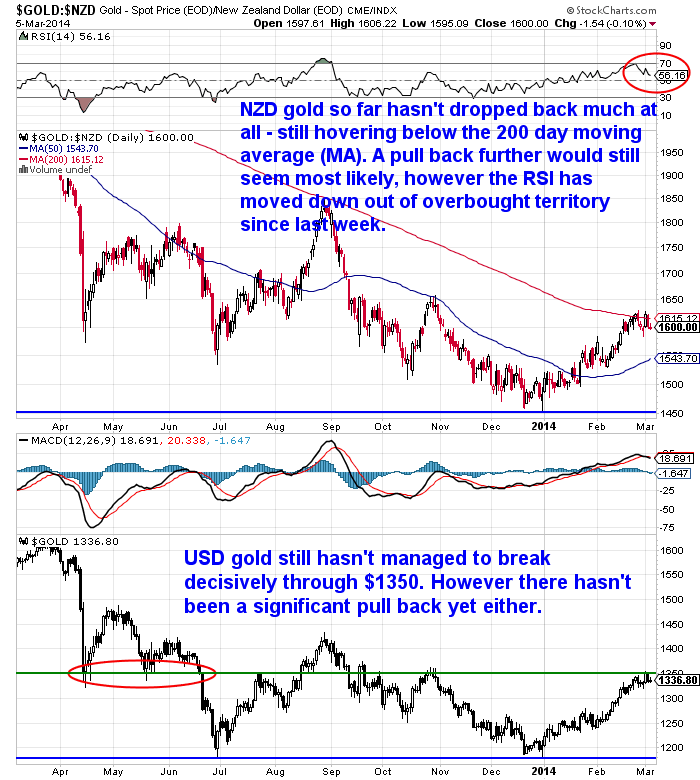

Spot GoldNZ $ 1591 / oz

US $ 1337.55 / oz

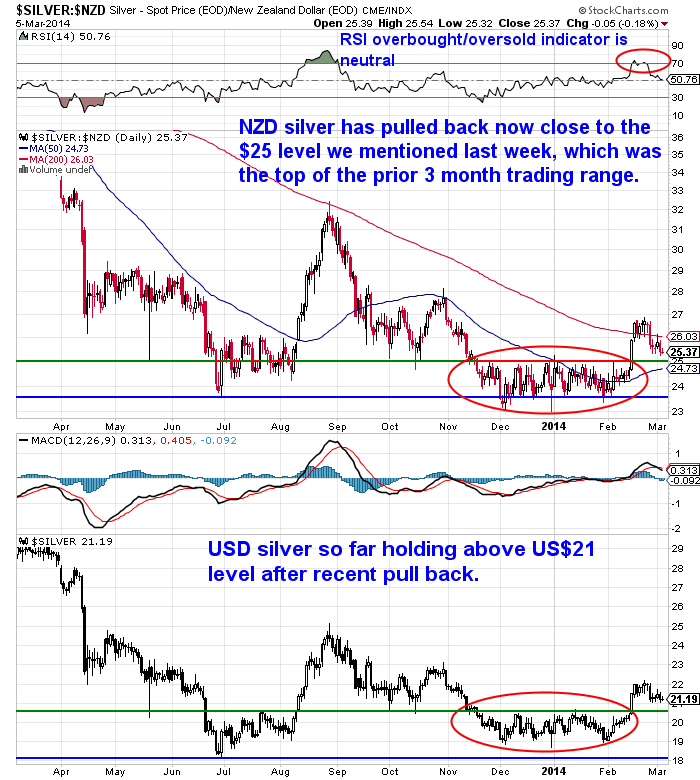

Spot SilverNZ $ 25.20 / oz

NZ $ 810.35 / kgUS $ 21.19 / oz

US $ 681.26 / kg

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

$880.87

(price is per kilo only for orders of 5 kgs or more)

(Fully insured and delivered)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

To demystify the concept of protecting and increasing ones wealth

through owning gold and silver in the current turbulent economic

environment.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

| We look forward to hearing from you soon. Have a golden week! |

David (and Glenn)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

|

2014-02-27 00:41:07-05

2014-02-27 00:41:07-05

Pingback: Gold breaks out | Gold Prices | Gold Investing Guide

Pingback: Gold Prices | Gold Investing Guide Currency Charts Indicate an Asia-Pacific Slow Down

Pingback: Foreign Real Estate Is the New Swiss Bank Account - Gold Prices | Gold Investing Guide

Pingback: Prove You’re Not a Terrorist - The War on Cash - Gold Prices | Gold Investing Guide

Pingback: Capital Gains Tax on Precious Metals in New Zealand - Is There Any? - Gold Prices | Gold Investing Guide

Pingback: They’re Bringing Back Feudalism… and Nobody Seems to Notice - Gold Survival Guide

Pingback: Do You Have to Document Your Precious Metals Purchase?