What do Buzz Lightyear from Toy Story and Ben Bernanke have in common?

“To Infinity and Beyond” is their shared catch phrase it seems.

With the US Federal Reserve’s Chairman’s announcement last week of open ended quantitative easing (QE), Jim Sinclair’s (of JSmineset.com) long time call of QE to infinity seems to now be in play.

Or as we saw written cleverly somewhere QEternity!

So consider getting yourself a Ben Bernanke “To Infinity and Beyond!” T-shirt or mousepad like these from Cafepress to commemorate the sad occasion.

But besides finding T-shirts what else have we been up to?

Well, considering what impact all this quantitative easing (QE) will have on little old New Zealand of course? Actually let’s call it what it is though – money printing plain and simple.

What Exactly is QE3?

Firstly what exactly is Bernanke doing? Well, each month he’ll create money out of thin air to buy $40 billion dollars worth of mortgage backed bonds with a view to somehow bringing down the US unemployment rate. This is on top of the $45 billion per month of longer maturity bonds they are already buying for Operation Twist. And importantly he’ll keep doing it until the US labour market improves. Never mind that the previous two versions of money printing did little to improve the US unemployment levels. So it beats us how it will work but here’s Bernanke theory for what it’s worth:

“Our tools involve – I mean, the tools we have involve affecting financial asset prices, and that’s – those are the tools of monetary policy.

There are a number of different channels – mortgage rates, I mentioned other interest rates, corporate bond rates, but also the prices of various assets, like, for example, the prices of homes. To the extent that home prices begin to rise, consumers will feel wealthier, they’ll feel more – more disposed to spend. If house prices are rising, people may be more willing to buy homes because they think that they’ll, you know, make a better return on that purchase. So house prices is one vehicle.

Stock prices – many people own stocks directly or indirectly. The issue here is whether or not improving asset prices generally will make people more willing to spend.

One of the main concerns that firms have is there’s not enough demand. There are not enough people coming and demanding their products. And if people feel that their financial situation is better because their 401(k) looks better or for whatever reason – their house is worth more – they’re more willing to go out and spend, and that’s going to provide the demand that firms need in order to be willing to hire and to invest.”

So seems he’s going to make the US feel richer and therefore become richer?!?!

Of course Bernanke’s real role is to support the banking system and giving them virtually free money which they can then lend back to US treasury and pocket the difference. A pretty good business model if you can get it.

So How’s All This Extra Money Going to Affect the Planet and Us in NZ?

Well, let’s look to history to be our guide. Thousands of years of debasement have shown it to never work out well in the end. Initially people feel richer but before very long prices rise across the board, so the extra money you think you have because of rising asset prices is actually totally cancelled out by your everyday living costs going up. And this time round we have the reserve currency of the planet, the US dollar, being debased. Every other currency being tied to it and no (golden) anchor. Plus we have the majority of major nations following the reserve currency holders lead and printing up a storm. So in the long run, likely affects = very bad. But in the meantime, we have no way of knowing how long the long run is.

Impact of QE3 on the NZ Dollar

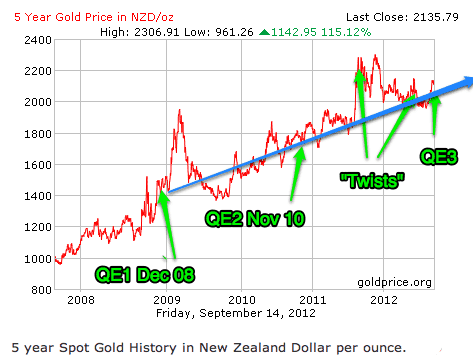

So how about closer to home and in the slightly shorter term, we’re talking in the coming months and not so many years ahead? Again having no crystal ball we only have history to be our guide. So we’ve got a chart of the NZ dollar/ US dollar exchange rate for the past 5 years. On it we’ve marked the dates of the previous money prints so we can see the impact of these on the exchange rate.

You’ll not be hugely surprised to see that since QE1 the US dollar has lost a lot of value compared to the NZ dollar. The chart actually shows it from our perspective in NZ, with the cross rate moving from about .55 to .83 currently. Unless you’ve been under a rock you’ll have heard about this trend no doubt.

(Note: If you want a full description of the different forms of manipulation that the Fed has undertaken since 2008 we’ll cheat and reprint from wikipedia below:

Quantitative Easing 1 (QE1, Dec 2008 to Mar 2010)

“On November 25, 2008, the Federal Reserve announced that it would purchase up to $600 billion inagency mortgage-backed securities (MBS) and agency debt. On December 1, Chairman Bernanke provided further details in a speech. On December 16, the program was formally launched by the FOMC. On March 18, 2009, the FOMC announced that the program would be expanded by an additional $750 billion in purchases of agency MBS and agency debt and $300 billion in purchases of Treasury securities.

Quantitative Easing 2 (QE2, Nov 2010 to Jun 2011 )

In November, 03,2010, the Fed announced that it would purchase $600bn of longer dated treasuries, at a rate of $75bn per month. That program, popularly known as “QE2”, concluded in June 2011

Operation Twist (2011)

The Federal Open Market Committee concluded its September 21, 2011 Meeting at about 2:15PM EDT by announcing the implementation of Operation Twist. This is a plan to purchase $400 billion of bonds with maturities of 6 to 30 years and to sell bonds with maturities less than 3 years, thereby extending the average maturity of the Fed’s own portfolio.[3] This is an attempt to do what Quantitative Easing (QE) tries to do, without printing more money and without expanding the Fed’s balance sheet, therefore hopefully avoiding the inflationary pressure associated with QE.[4] This announcement brought a bout of risk aversion in the equity markets and strengthened the US Dollar, whereas QE I had weakened the USD and supported the equity markets. Further, on 20 June 2012 the Federal Open Market Committee announced an extension to the Twist programme by adding additionally $267 bn thereby extending it throughout 2012.

http://en.wikipedia.org/wiki/History_of_Federal_Open_Market_Committee_actions)

Anyway, you can see from the chart the biggest move was from QE1 in December 2008 through to the announcement of QE2 almost 2 years later. Since then the change in the NZ/US exchange rate has not been nearly as great. So while past performance is no guarantee of future and all that, it seems likely the kiwi could continue to strengthen versus the USD for a bit yet. Of course, that is barring some “black swan” event that could send punters rushing back to the USD like in 2008. Can you say derivatives perhaps?

How about gold in NZ?

What Will QE3 Mean for Purchasers of Gold in New Zealand Dollars?

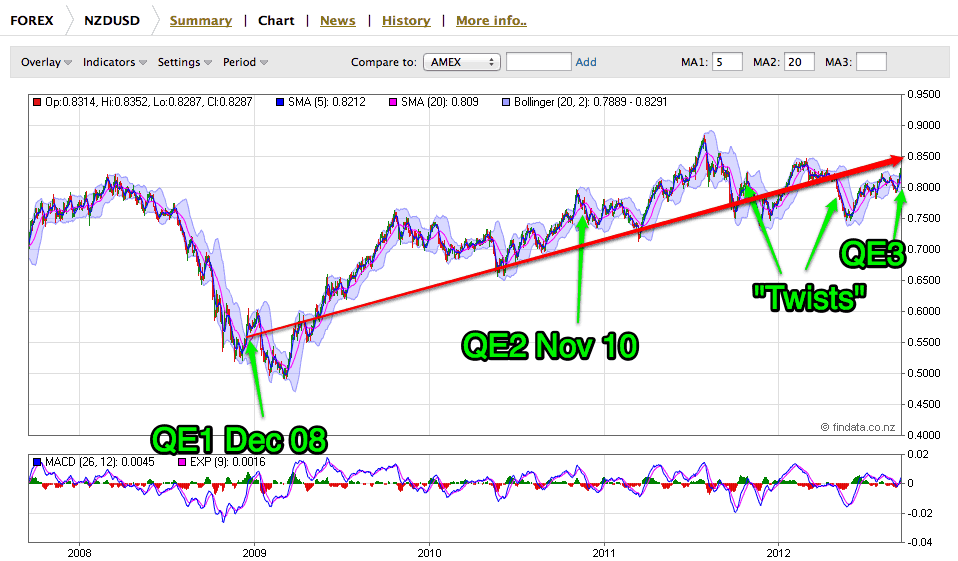

Some people do argue there’s no point buying gold here down under, because our strengthening NZ dollar just cancels out all the “gains” seen in US dollar gold. Again guided by the hand of history, how has NZD gold fared under earlier money printing by the US Fed? The below chart indicates when previous episodes of money printing occurred over the past 5 years.

As can be seen in the chart, and more specifically in the table below, we’ve gone from NZ$1475 per ounce at the announcement of QE1, through to NZ$1725 when QE2 was announced. And now with the announcement of the latest print-a-thon we sit at NZ$2135. An increase of almost 45% even in the face of a stronger FX cross rate. So seems a pretty safe bet that $85 billion per month will take gold higher. And even though the NZD may continue to strengthen against the USD, when measured against gold, odds favour the NZD continuing to weaken. Perhaps quite significantly.

| Date | NZD Gold | NZD Silver | NZD/USD | |

| QE1 | 16-Dec-08 | $1,476.21 | $19.60 | 0.5513 |

| QE2 | 03-Nov-10 | $1,725.90 | $31.44 | 0.7685 |

| Twist 1 | 21-Sep-11 | $2,213.58 | $49.61 | 0.8221 |

| Twist 2 | 20-Jun-12 | $2,028.93 | $35.63 | 0.7946 |

| QEternity a.k.a. QE3 | 14-Sep-12 | $2,135.79 | $41.70 | 0.8230 |

How About Silver in NZ and QE3?

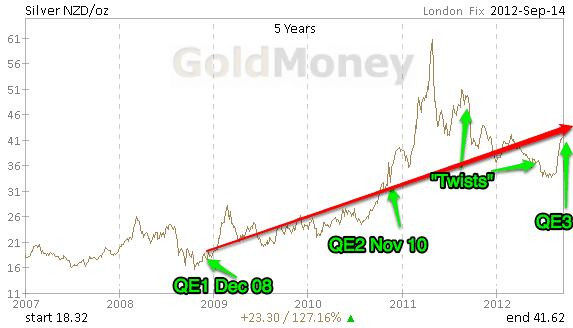

Let’s look at silver now – same style of chart below showing the different QE’s and impact on silver price in NZ dollars. Like gold you can see the red trend line clearly heading up and to the right through each date QE was announced. Silver has outperformed gold over this time, rising from about NZ$19 to about $41 currently. So an increase of 115%, compared to gold in NZ dollars 45% rise.

So again it would seem a decent bet that this trend of a rising NZ silver price will continue on the back of more fiat money sloshing about the world. But more so, the outperformance of silver over gold could also continue with “QEternity”.

Of course as you can see from the charts above these trends won’t be in a straight line. We’ll no doubt have some major ups and downs along the way.

Here in New Zealand the odds are we’ll also see higher fuel and food costs in the not too distant future and quite likely housing will continue to be fuelled by more waaaay too cheap money. So rising nominal house prices could continue for a while yet.

QE3 and the “Crack Up Boom”

It seems we are in the midst of what Austrian Economist Ludwig von Mises termed the “crack up boom”.

The credit boom is built on the sands of banknotes and deposits. It must collapse… If the credit expansion is not stopped in time, the boom turns into the crack-up boom; the flight into real values begins, and the whole monetary system founders.

Ludwig von Mises, Human Action, 1949

And of course none of the above considers the seemingly outlandish proposition of QE by the Reserve Bank of New Zealand (RBNZ). If that were to occur we would see even bigger “gains” for gold and silver in New Zealand. But the RBNZ would never do that would they?

Well, we’ll lay out a scenario just for fun. Okay fun might not be the right word, just for the sake of it rather.

Say the kiwi dollar continues to strengthen which will continue to hurt retailers, manufacturers and tourism. The calls grow louder and louder for the RBNZ to “do something” (as per this article in todays herald they already exist: NZ’s financial stability ‘very worrying’ – JB Were). So the RBNZ intervenes in the currency markets as they did in 2007/2008. But with almost every other central bank already doing the same, they don’t have sufficient kiwi dollar reserves to buy enough of the USD to make an impact so they are forced to print more kiwi dollars to do this.

Here’s another possibility, consider that China stumbles and buys less of Australia’s minerals (our major trade partner). Australia struggles and buys less of our produce. So we sell less of everything, the economy starts to slip into recession and the RBNZ cuts interest rates all the way to almost zero. But most other countries are already there, including the US, Europe, UK, Japan, and China. So the RBNZ are forced to follow suit and print to try and devalue the kiwi dollar and boost our exports again.

The currency wars are likely only just getting started is our guess. Hopefully history doesn’t repeat too closely because as Jim Rickards outlines in his book Currency Wars, the past shows that unfortunately currency wars lead to trade wars, which lead to world wars.

Thinking of buying gold or silver? Head over to our bullion order page to check the latest prices to buy.

Pingback: Price Targets in NZ Dollars for Next Move Up in Gold and Silver | Gold Prices | Gold Investing Guide

The argument about the FX rate is really not an issue particularly for the newcomers because it means that Gold/silver is cheaper even with it moving up. Eventually the NZ$ will devalue and hence more gains.So if you are buying regularly then a high exchange rate is advantageous.

Thanks for the comment Steve. Yes we have to agree that is the way to look at it too. All paper currencies are going down, just at different rates. And at the moment the NZ dollar is not falling as fast as others. But as you say no guarantee that this will be the case for ever and at some stage we could see it make up for lost time falling further. i.e. the NZD gold price rises faster.

Pingback: Why the Greens Are Wrong About Money Printing | Gold Prices | Gold Investing Guide

Pingback: Housing Un-affordability: It’s Not Supply, It’s the Debt Stupid! | Gold Prices | Gold Investing Guide

You know, as a matter of consequence, Printing money is never the answer, because that only leads to HyperInflation. It doesnt resolve the problem. The Federal Reserve entities are renowned for it. Buying Gold or Silver is simply a means to protect your investments because paper money is nothing without it, regardless of its cost. It is a well known fact that if the greenback and yen goes down, we go down. NZ’ers should watch the US to understand what will eventually happen to us.

Hi Ruth,

Thanks for taking the time to comment. Indeed all currencies are falling in relation to precious metals. And while the kiwi dollar is spoken of as being strong it is merely the best of a bad bunch!

Thanks again.