This Week:

- Gold Manipulated Upwards?

- Record shorts fail to push gold to new lows

- The Correction Isn’t Over, But Gold’s Headed to $20,000

- RBNZ Forward Guidance and Other Bunkum

Gold Manipulated Upwards?

A bit of a turnaround from last week with gold “stop logic” circuit breakers on the COMEX futures exchange being tripped by a large buy order overnight Tuesday – instead of the multiple large sell orders that have occurred this year. See Nanex Blog.

Just like the sell orders this one was strange in that it occurred in low volume at 8.07 New York time. Also we’d imagine buying 3000 futures contracts (300,000 ounces or about US$375 Million – wish we could say it was us!) in one second is not the way to get the lowest price. If you’re even a half sensible buyer you would stagger the orders out.

All very strange but you’d have to guess that it was someone manipulating the price up. Presumably because they wanted to get it above the important $1250 mark where other buy orders would then trigger, bumping the price rapidly higher as happened?

Gold and Silver in NZ

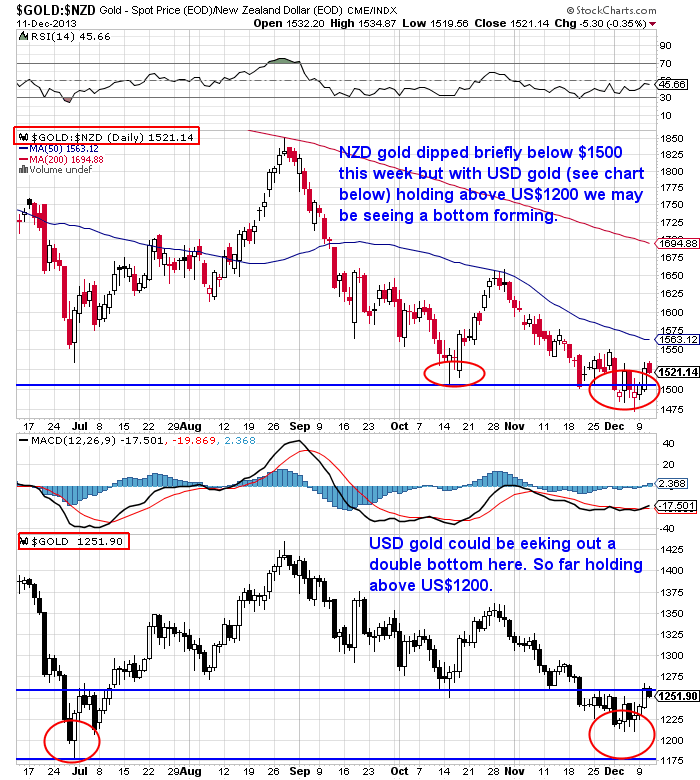

During the week gold in NZ dollars did dip briefly down below $1500 again. However with the bump above US$1250 mentioned above, NZ dollar gold is today at $1516.70 – down just $7.30 or 0.48% from last Thursday.

The kiwi dollar is up just under a cent from last week at $0.8263. So that continues to be a significant factor in holding the NZD gold price down.

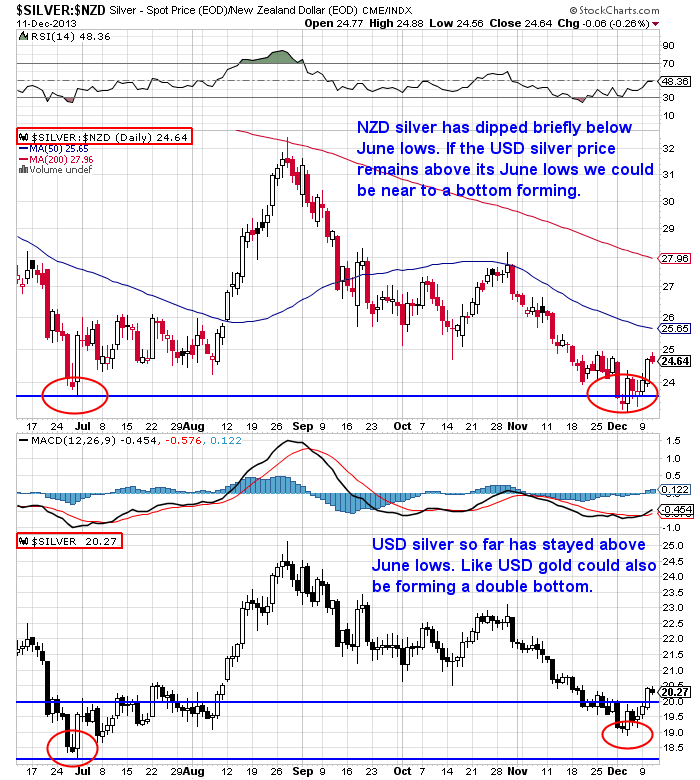

While NZ dollar silver is at $24.59 today, up $0.33 or 1.36% on a week ago. It too this month has dipped briefly below the June lows but if the USD lows of June hold we could be seeing a bottom forming here.

Record Shorts Fail to Push Gold to New Lows

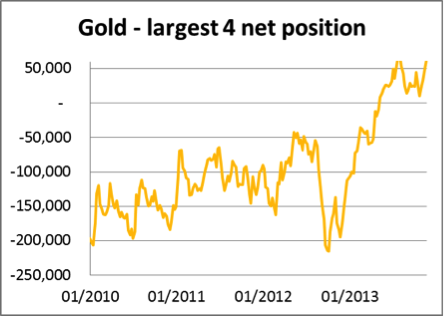

We mentioned last week that the number of futures traders betting on further falls for gold had been growing. Over the weekend Goldmoney news showed this visually with the following chart depicting how managed money short positions had very rapidly reached similar levels to that back at the USD gold/silver lows in June. What was telling was how the price managed to stay above US$1200 even in the face of this.

In contrast the (assumed to be) 4 largest bullion banks have taken record long positions.

As Alasdair Macleod said “The last time this happened was mid-2013, and bears were forced to cover when the price rallied 21% from $1180 to $1430.”

It could be we are seeing the start of such a rally now. As mentioned already, overnight Tuesday gold managed to get above what has been recent resistance at US$1250 and silver above $20. Both metals are still above these levels today too, so we could be in for a run higher from here. Of course this doesn’t mean the correction is over, but it is significant that the USD price of gold held above $1180. So it could well be a “double bottom” is playing out as noted in the chart earlier.

The Correction Isn’t Over, But Gold’s Headed to $20,000

Our feature article this week is an absolute must read interview with Professor Krassimir Petrov. A wealth of topics are covered but in particular Professor Petrov uses cyclical analysis, technical analysis, fundamental analysis, and portfolio analysis, to identify not only the likely length of the precious metals bull market, but also the possible length of the current correction.

Why take notice of what he has to say? Well, 5 years ago he made a couple of calls that so far have played out pretty close to the mark.

But if we think that manipulation/price management of precious metals is likely why is there any point in listening to someone talking cycles and technical analysis?

Our answer would be that if Chris Powell of GATA is correct and central planners are engaged in an “orderly retreat” where they let the price of gold rise but not too fast, then this type of analysis can still be valid. Perhaps that’s why this bull market is playing out in a more protracted fashion than that of the 1970’s? The London Gold Pool (more on this below and in the interview with Professor Petrov) of the 1960’s shows that manipulation can only work for a limited period of time before true value wins out.

Anyhow we think it is still worth reading. Of note is that he also has an opinion on how various countries will go in the next few years. And while New Zealand isn’t mentioned he does comment on Australia and the Asian region quite specifically. And where they go we will more than likely follow.

Anyhow we think it is still worth reading. Of note is that he also has an opinion on how various countries will go in the next few years. And while New Zealand isn’t mentioned he does comment on Australia and the Asian region quite specifically. And where they go we will more than likely follow.

The Correction Isn’t Over, But Gold’s Headed to $20,000

We mentioned above the London Gold Pool. In last weeks newsletter (see the item headed The 1960’s London Gold Pool – a Blueprint for today?), we also referred to this, excerpting a small piece from Grant Williams latest Things That Make You Go Hmmm letter on the London Gold Pool of the 1960′s. This was such an informative read that we’ve posted it onto the website as we think it’s worthy of reading in full…

We mentioned above the London Gold Pool. In last weeks newsletter (see the item headed The 1960’s London Gold Pool – a Blueprint for today?), we also referred to this, excerpting a small piece from Grant Williams latest Things That Make You Go Hmmm letter on the London Gold Pool of the 1960′s. This was such an informative read that we’ve posted it onto the website as we think it’s worthy of reading in full…

The other article this week looks at other bull markets that have occurred in the likes of oil and the NASDAQ and compares selloffs that occurred in these markets with that of gold recently. Click the link below to see if there is any historical precedent for large sell offs midway through a larger run higher.

The other article this week looks at other bull markets that have occurred in the likes of oil and the NASDAQ and compares selloffs that occurred in these markets with that of gold recently. Click the link below to see if there is any historical precedent for large sell offs midway through a larger run higher.

Time for Goldbugs to Admit Defeat?

(Actually in a similar vein in case you didn’t read them back in July here are a couple of articles that compare the 1970’s mid cycle selloff in gold with that of today.

Telegraphing the Turnaround in Gold)

Doug Casey’s New Book: Right on the Money

Just released, Doug Casey’s new book, Right on the Money is about profiting in an upside-down economy. This follow-up to Totally Incorrect (the second in a series of “Conversations With Casey” books) includes several conversations between Doug Casey and Louis James that weren’t distributed in Casey Research’s former column by that name. In the book, Doug and Louis delve into the specifics of how to apply his contrarian philosophy to making money.

To read quotes from the book and learn more, click here.

RBNZ Still Sits on its Hands

The Reserve Bank of New Zealand (RBNZ) again left the OCR (overnight cash rate) on hold this morning. Our translation of the press release quoting Guv Wheeler was that the high dollar was giving them leeway to keep the price of money super cheap for longer. [And help to eventually inflate some real bubbles across the country].

No big surprise at all. As we’ve referred to many times over the past months we think they will keep rates low for much longer than the bank economists have been saying. We noticed that ASB said at the start of the week “We see the risks our core expectation of a March OCR increase as skewed to a later start.” Man, doesn’t economist speak just do your head in! Translation: “The OCR may rise later than we first predicted”.

RBNZ Forward Guidance and Other Bunkum

Our central bank just like most others globally has in recent times opted for “forward guidance”, “transparency” and “clear communication”. Back in the “good old days” central bankers opted for secrecy and subterfuge.

Forward guidance of course means telling us what they will be doing (or at least think they will be doing) well into the future.

A press release issued last Friday outlined the Reserve Banks rationale for this…

—–

“Reserve Bank committed to effective communication

The Reserve Bank is deeply committed to transparency and sees clear communication as vital to making its actions more effective, Deputy Governor Geoff Bascand said today.”

—–

Specifically….

—–

“Our communications support monetary policy by informing and shaping expectations about future monetary policy settings. Widespread understanding of the Reserve Bank’s policy approach makes it easier for the Bank to achieve its objectives, for example in achieving price stability, by better anchoring low inflation expectations. This, in turn, means that we are able to respond to economic shocks by adjusting interest rates less than would otherwise be the case,” he said.

—–

Translation: If we tell you that inflation will remain low then you’ll believe it and we can keep interest rates much lower than they likely should be if they were set by the free market. This way we keep asset prices high and you will keep borrowing plenty and the country will keep its head above water like everyone else. Well at least until it doesn’t anyway.

—–

“A recent study reported that the Reserve Bank of New Zealand is the second most transparent central bank in the world, just behind the Swedish central bank.”

—–

Our take: Being almost the best of a bad idea doesn’t actually make your existence a good idea.

—–

“As a financial regulator, accountability is a key reason for transparency around our regulatory conduct, with public engagement a cornerstone of our approach to prudential policy development. Transparency also gives economic benefits from enhancing the operation of financial markets and improving the public’s understanding of financial risk.

“A key message here is that the Reserve Bank’s regulatory and supervisory oversight does not represent a ‘no failure’ regime. Accordingly, investors need to carefully assess risk against expected returns. The Bank’s increased regulatory and supervisory responsibilities will demand new communication channels, new audiences and new messages,” Mr Bascand said.”

—–

Our take: The RBNZ was the first to openly discuss and formalise the “bail in” and we’ll use it if we need to. So don’t believe your money is as safe as “houses”.

However all this “forward guidance” and “transparency” may not be working as in the same speech the Deputy Guv said…

—–

“Public not listening to us: RBNZ

The Reserve Bank says although it is trying to be more open about what it is doing and its views on future interest rates many people aren’t listening.” Source.

—–

If only this were true. Unfortunately it seems we are still a long way from enough awakening to the total lack of need for Central Banks.

All the talk about the loan-to-value (LVR) restrictions introduced in October and what else the RBNZ should or shouldn’t be doing proves this. And now this week the exemption on lending for new construction has everyone offering suggestions on how to “solve” the housing “shortage”.

We wish no one at all were listening to them! Perhaps it will take at least one more big bubble and collapse? Although last time – 2008 – showed that this actually led to more centralisation of power not less. We can but hope that more and more are steadily awakened to the fact that most of todays problems originate at the hands of the governmental/elite monopoly on money. Spread the word – here’s to a free market in money.

In the meantime preparation for another bursting bubble seems like a wise thing to do. Especially with the price of financial insurance at 3-4 year lows and a possible double bottom forming in gold and silver. Let us know if you have any questions on how to buy.

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| Money Manager: Risks Facing the NZ Dollar |

2013-12-05 02:56:11-05Gold Survival Gold Article Updates Dec. 5, 2013 This week: Short Squeeze in Both Metals Negative interest rates, cashless societies and Bitcoin Money Manager: Risks Facing the NZ Dollar The 1960’s London Gold Pool – a Blueprint for today? Short Squeeze in Both Metals Well, things continue to be very hard to read […]read more… 2013-12-05 02:56:11-05Gold Survival Gold Article Updates Dec. 5, 2013 This week: Short Squeeze in Both Metals Negative interest rates, cashless societies and Bitcoin Money Manager: Risks Facing the NZ Dollar The 1960’s London Gold Pool – a Blueprint for today? Short Squeeze in Both Metals Well, things continue to be very hard to read […]read more… |

| Time for Goldbugs to Admit Defeat? |

2013-12-05 23:17:05-05Gold has really plummeted over the past couple of years. There are multitudes of opinions ringing out proclaiming that its run is well and truly over. But is there any precedent for a fall as large as this has been to occur during a longer term bull market? Read on to find out… Time for Goldbugs […]read more… 2013-12-05 23:17:05-05Gold has really plummeted over the past couple of years. There are multitudes of opinions ringing out proclaiming that its run is well and truly over. But is there any precedent for a fall as large as this has been to occur during a longer term bull market? Read on to find out… Time for Goldbugs […]read more… |

| Twisted (By The Pool) |

2013-12-10 16:46:57-05In last weeks newsletter (The 1960’s London Gold Pool – a Blueprint for today?), we excerpted a small piece from Grant Williams latest Things That Make You Go Hmmm letter on the London Gold Pool of the 1960′s. However this letter was a very informative read and so we’ve posted it here as we think […]read more… 2013-12-10 16:46:57-05In last weeks newsletter (The 1960’s London Gold Pool – a Blueprint for today?), we excerpted a small piece from Grant Williams latest Things That Make You Go Hmmm letter on the London Gold Pool of the 1960′s. However this letter was a very informative read and so we’ve posted it here as we think […]read more… |

| The Correction Isn’t Over, But Gold’s Headed to $20,000 |

2013-12-10 18:02:37-05This is one of the most comprehensive interviews on gold that we have read for sometime. There is no other way to put it other than it is an absolute must read. Luckily it is available for you to read now too as it was previously only for subscribers of Casey Research’s flagship letter the […]read more… 2013-12-10 18:02:37-05This is one of the most comprehensive interviews on gold that we have read for sometime. There is no other way to put it other than it is an absolute must read. Luckily it is available for you to read now too as it was previously only for subscribers of Casey Research’s flagship letter the […]read more… |

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1516.70 / oz | US $1253.25/ oz |

| Spot Silver | |

| NZ $24.59/ ozNZ $790.43/ kg | US $20.31/ ozUS $653.13/ kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

(price is per kilo for orders of 1-4 kgs)

$859.56

(price is per kilo only for orders of 5 kgs or more)

(Fully insured and delivered)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

Copyright © 2011 Gold Survival Guide. All Rights Reserved.

Pingback: The (mini) taper finally occurs | Gold Prices | Gold Investing Guide