|

Gold Survival Gold Article Updates:

Jul. 24, 2014

This Week:

- RBNZ Lifts Interest Rates – NZD Falls

- Gold & Silver Miners vs the Metals Themselves

- The TRUTH about China’s Massive Gold Hoard

We have a bit of a chart-a-pallooza for you this week. Plus a couple of good articles and another great video from Professor Fekete (see those at the end of this email as usual). So more pictures less writing this week.

NZ dollar main factor in local precious metals prices this week

This week the NZ dollar has been the main driver in local gold and silver prices.

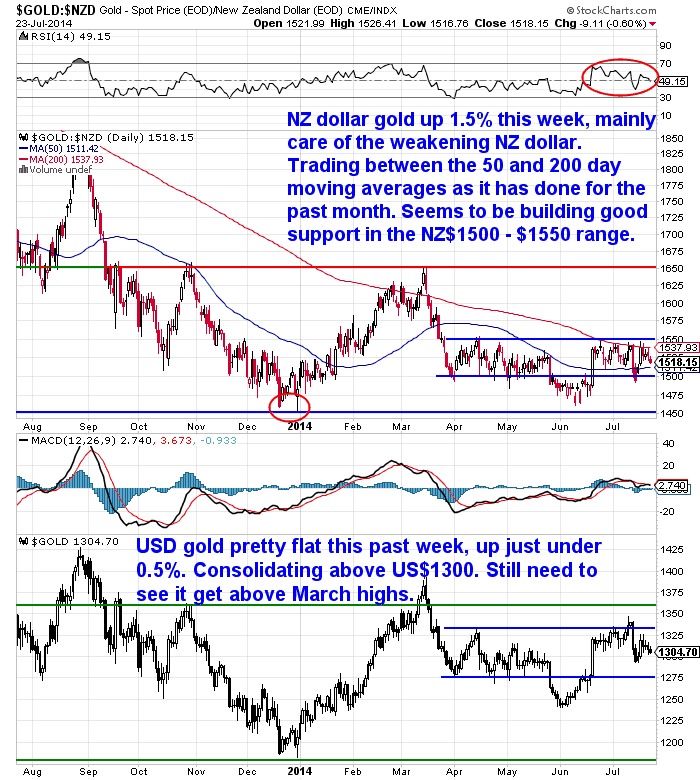

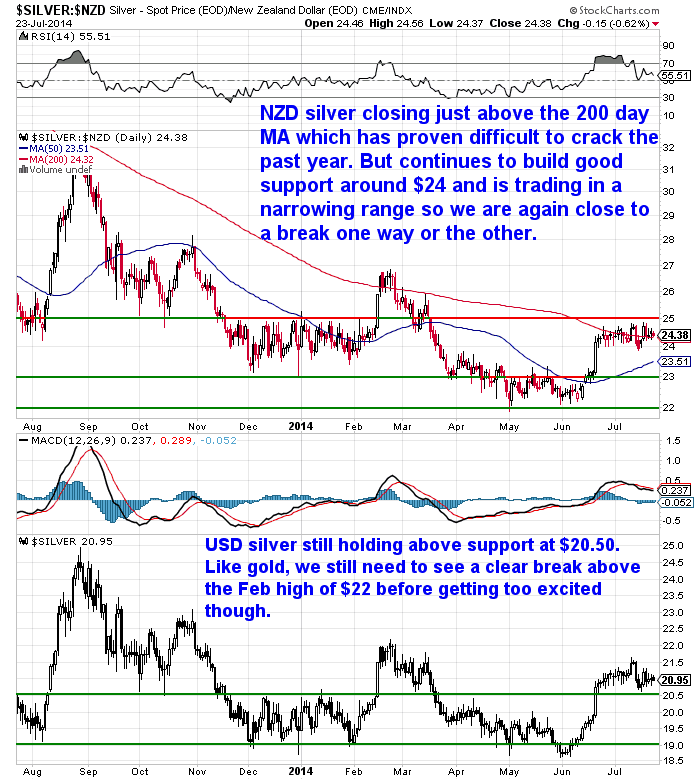

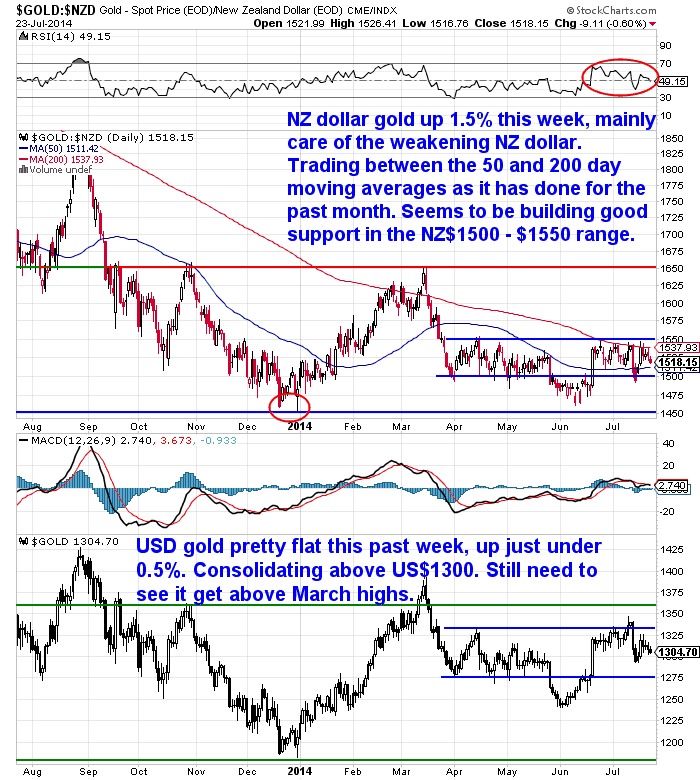

Gold in NZ Dollars is up $22.71 or 1.52% to $1516.21. You can see in the chart below that it continues to trade between the 50 day and 200 day moving averages (MA). It seems to be building good support at these levels but we have to see a break again one way or the other pretty soon.

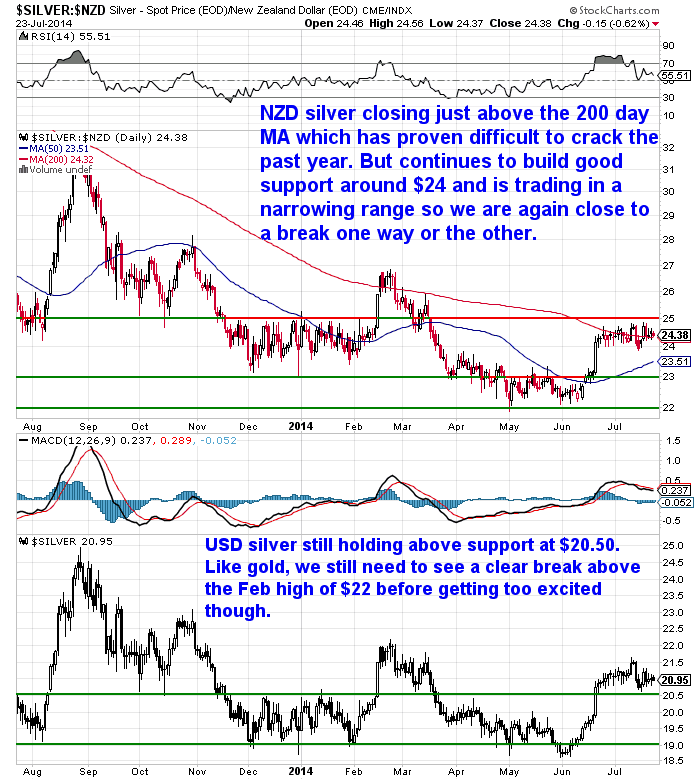

While silver in NZ Dollars has lagged gold a tad, but is still up 18 cents or 0.75% to $24.07. It has managed to poke its head above the 200 day moving average line so will be intersting to see if it can get clearly above it this time.

Much like we reported last week the globally quoted US dollar gold and silver prices are not up so much due to the continuing weakening of the Kiwi dollar which is down a cent from last week (more on that later).

Gold in US dollars is up only $5.66 per ounce or 0.43% to $1305.15.

While silver in US dollars is actually down 7 cents per ounce or 0.33% to $20.72. So not a great deal of change since last week.

Both metals seem to be just quietly building a base at these levels which should bode well for the future we reckon.

RBNZ Lifts Interest Rates – NZD Falls

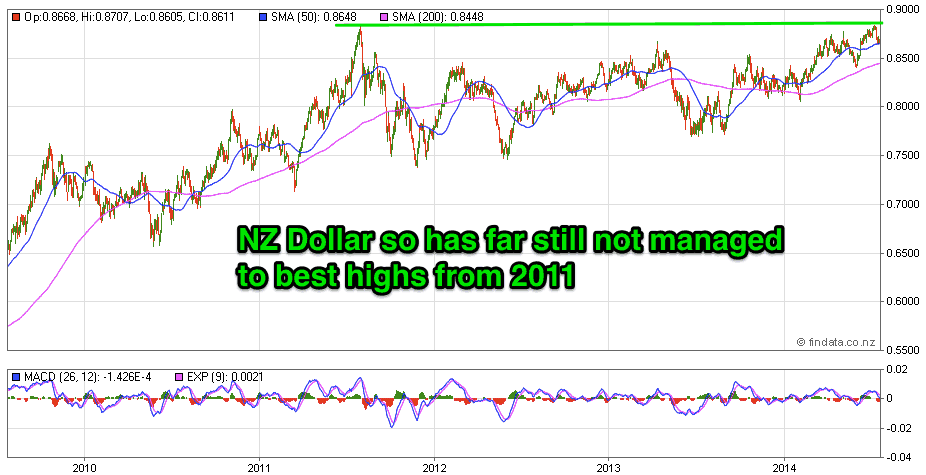

The RBNZ raised interest rates again by 0.25 to 3.50% this morning as expected. However the accompanying statement seems to have surprised a few judging by the kiwi dollars reaction…

The dollar was edging up prior to the announcement at 9am but plunged around 1 cent upon its release. We’ll avoid boring you with central banker mumbo jumbo too much but the likely reason for the fall was the statement that it is “prudent that there now be a period of assessment before interest rates adjust further.”

As we have been saying for some time, we are not so sure that the path for interest rates is necessarily a steady climb upwards as most seem to have expected. And it now looks like rates may be on hold here for a while now.

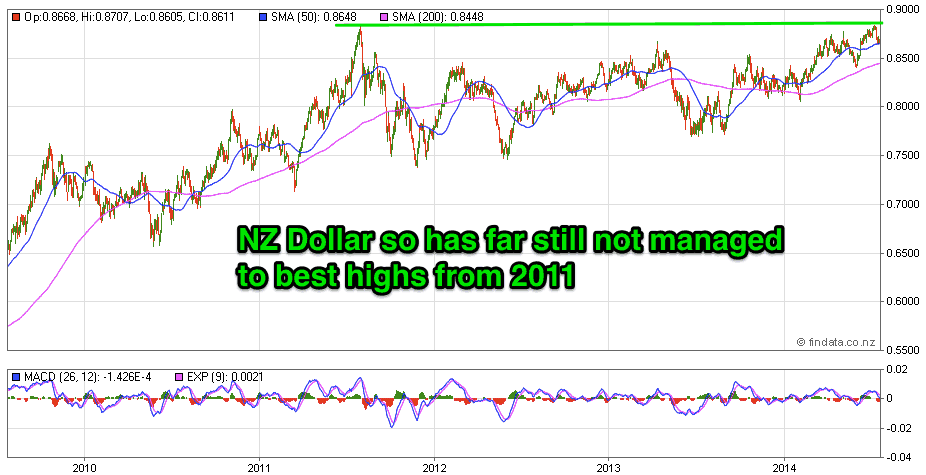

So the dollar may have some headwinds in trying to get above the 2011 high now.

This article of ours from back in March posed the question: Could These Currency Charts Indicate an Asia-Pacific Slow Down? – How Would This Affect New Zealand?

So perhaps we are seeing the effects of this starting to show?

Interestingly along with the dollar dropping bond yields also fell. In fact the benchmark 10-year bond fell to its lowest level since May 2013. Likely reflecting a change in interest rate expectations longer term.

This ties in with US Treasury bond rates also continuing to fall despite the ongoing talk of higher rates over there too. The chart below shows they have been trending down all year. Could they surprise everyone and head down further to test the 2.5% low from 2012?

If so then the NZ Government Bond will likely also follow the US yields lower.

There is one thing we know for sure….We certainly wouldn’t want to lend either of them money for 10 or 30 years at those miniscule rates!

Gold & Silver Miners vs the Metals Themselves

We’ve featured some short term charts of metals versus miners over the past few months. So today we thought we’d look at how they have compared year to date.

Since the start of the year gold miners have led gold itself higher. While gold has been relatively flat since April the miners have risen back close to the March highs. So either they are due for a pullback or perhaps more likely they are indicating gold is due to rise again?

Likewise the silver miners led silver higher at the start of the year. Of note when silver fell in June to new lows for the year, the miners did not follow and held up above the January lows.

So the precious metals miners are looking positive with their indexes being up over 25% year to date.

If we had to put money on it, we’d hazard a guess that the lows are in for gold and silver and that now will be a good long term entry point.

That said we won’t get too excited until we see the highs from February and March taken out. That would be higher highs to go with the higher lows we have seen in recent months. If you agree with our summation and want to add to your metallic insurance hoard (or begin it) then get in touch via the methods below.

And don’t forget to check out this weeks articles.

This Weeks Articles:

| Dairy prices plunge – NZ dollar follows |

2014-07-17 00:48:36-04Gold Survival Gold Article Updates: Jul 16, 2014 This Week: Dairy Prices Plunge – NZ Dollar Follows Reader Question: “Why Bother With Technical Analysis if Gold & Silver are Manipulated?” Gold and Silver Technical Indicators Flash “Buy” Prof. Antal Fekete: The Banking System – Episode 01/17 Important: Want to make sure you continue to receive […]read more…

MH17: For Bankers, Every Crisis and Tragedy is an Opportunity to Manufacture Profits 2014-07-17 00:48:36-04Gold Survival Gold Article Updates: Jul 16, 2014 This Week: Dairy Prices Plunge – NZ Dollar Follows Reader Question: “Why Bother With Technical Analysis if Gold & Silver are Manipulated?” Gold and Silver Technical Indicators Flash “Buy” Prof. Antal Fekete: The Banking System – Episode 01/17 Important: Want to make sure you continue to receive […]read more…

MH17: For Bankers, Every Crisis and Tragedy is an Opportunity to Manufacture Profits |

2014-07-23 03:44:51-04There’s been plenty of discussion over the past year in particular on the topic of manipulation of the gold and silver markets. Almost always this is with regard to price seeing manipulated lower. This interesting article from JS Kim looks at how the recent tragedy of MH17 being shot down may well have seen gold and silver manipulated higher for […]read more…

The TRUTH about China’s Massive Gold Hoard 2014-07-23 03:44:51-04There’s been plenty of discussion over the past year in particular on the topic of manipulation of the gold and silver markets. Almost always this is with regard to price seeing manipulated lower. This interesting article from JS Kim looks at how the recent tragedy of MH17 being shot down may well have seen gold and silver manipulated higher for […]read more…

The TRUTH about China’s Massive Gold Hoard |

2014-07-23 07:12:28-04Back in May we noted the report that Chinese gold imports via Hong Kong had fallen but that this coincided with the opening of official gold imports through Beijing–the first time foreign bullion sales will be allowed directly through the capital. So the speculation was that China has allowed this to make their gold imports […]read more…

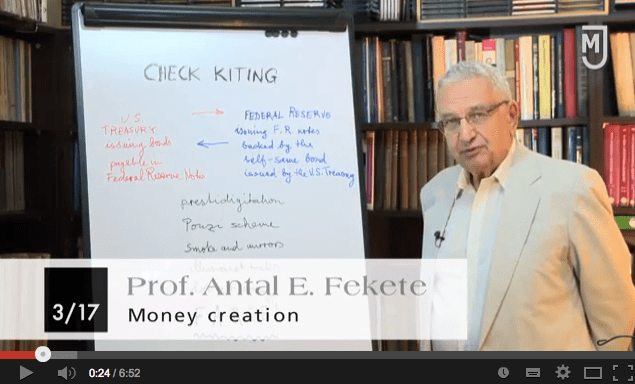

Prof. Antal Fekete: Money creation – Episode 03/17 2014-07-23 07:12:28-04Back in May we noted the report that Chinese gold imports via Hong Kong had fallen but that this coincided with the opening of official gold imports through Beijing–the first time foreign bullion sales will be allowed directly through the capital. So the speculation was that China has allowed this to make their gold imports […]read more…

Prof. Antal Fekete: Money creation – Episode 03/17 |

2014-07-23 18:51:37-0403/17 Prof. A. Fekete: Money creation This is the third video (just under 7 minutes long) from Professor Fekete in a series of 17 short videos. We left the 2nd video out as was mainly about the early years of the Professor growing up in Hungary. (Here is the link to the 1st video: Prof. Antal […]read more… 2014-07-23 18:51:37-0403/17 Prof. A. Fekete: Money creation This is the third video (just under 7 minutes long) from Professor Fekete in a series of 17 short videos. We left the 2nd video out as was mainly about the early years of the Professor growing up in Hungary. (Here is the link to the 1st video: Prof. Antal […]read more…

|

|

2014-07-17 00:48:36-04Gold Survival Gold Article Updates: Jul 16, 2014 This Week: Dairy Prices Plunge – NZ Dollar Follows Reader Question: “Why Bother With Technical Analysis if Gold & Silver are Manipulated?” Gold and Silver Technical Indicators Flash “Buy” Prof. Antal Fekete: The Banking System – Episode 01/17 Important: Want to make sure you continue to receive […]

2014-07-17 00:48:36-04Gold Survival Gold Article Updates: Jul 16, 2014 This Week: Dairy Prices Plunge – NZ Dollar Follows Reader Question: “Why Bother With Technical Analysis if Gold & Silver are Manipulated?” Gold and Silver Technical Indicators Flash “Buy” Prof. Antal Fekete: The Banking System – Episode 01/17 Important: Want to make sure you continue to receive […] 2014-07-23 03:44:51-04There’s been plenty of discussion over the past year in particular on the topic of manipulation of the gold and silver markets. Almost always this is with regard to price seeing manipulated lower. This interesting article from JS Kim looks at how the recent tragedy of MH17 being shot down may well have seen gold and silver manipulated higher for […]

2014-07-23 03:44:51-04There’s been plenty of discussion over the past year in particular on the topic of manipulation of the gold and silver markets. Almost always this is with regard to price seeing manipulated lower. This interesting article from JS Kim looks at how the recent tragedy of MH17 being shot down may well have seen gold and silver manipulated higher for […] 2014-07-23 07:12:28-04Back in May we noted the report that Chinese gold imports via Hong Kong had fallen but that this coincided with the opening of official gold imports through Beijing–the first time foreign bullion sales will be allowed directly through the capital. So the speculation was that China has allowed this to make their gold imports […]

2014-07-23 07:12:28-04Back in May we noted the report that Chinese gold imports via Hong Kong had fallen but that this coincided with the opening of official gold imports through Beijing–the first time foreign bullion sales will be allowed directly through the capital. So the speculation was that China has allowed this to make their gold imports […] 2014-07-23 18:51:37-0403/17 Prof. A. Fekete: Money creation This is the third video (just under 7 minutes long) from Professor Fekete in a series of 17 short videos. We left the 2nd video out as was mainly about the early years of the Professor growing up in Hungary. (Here is the link to the 1st video: Prof. Antal […]

2014-07-23 18:51:37-0403/17 Prof. A. Fekete: Money creation This is the third video (just under 7 minutes long) from Professor Fekete in a series of 17 short videos. We left the 2nd video out as was mainly about the early years of the Professor growing up in Hungary. (Here is the link to the 1st video: Prof. Antal […]