This Week:

- SDR Bonds Sold in China – Will the Dollar Live to Die Another Day?

- When they say ‘hoarding’ instead of ‘saving’ you know you’re in trouble

- Why Gold Demand Doesn’t Necessarily Correlate with Price

- Support from Across the Ditch for our Theory on House Prices

- World’s largest money manager sees inflation ahead

- Reminder: Gold Will Rise With Interest Rates

First up in case you missed our email earlier this week…

Free Webinar: How to Increase Profits in Gold, Silver, and Foreign Currencies

With record low interest rates generating a yield today is really tough.

We’ve convinced a past client of ours who is a full time forex trader and also a forex trading coach to come along to a webinar and share some of his 12 years worth of knowledge.

Sign up to the webinar on Tuesday, 20 September 2016 at 12:00 PM NZST here.

In this webinar you will get information on technical analysis for beginners that can be used in the gold and silver futures markets. So you can increase your potential profit when timing purchases of physical gold and silver.

Come along and you can also learn about how to generate an ongoing income via foreign currency trading strategies as well as via gold and silver futures. So you can spend more time doing what you enjoy with your family and friends, and less time working.

He’s not one of the guys you hear advertising on the radio from Australia or the US. He’s an ex-dairy farmer based right here in Hamilton, New Zealand.

You’ll hear him present in a laid back, low pressure and no hype style, from a Kiwi point of view.

You won’t hear promises of get rich quick or make millions in just 10 minutes a day. You will learn how to make a steady profit over many years regardless of market conditions.

Sign up today for the webinar on Tuesday, 20 September 2016 at 12:00 PM – 1:00 PM NZST

We’re hoping to have a recording of the event to share later. So even if you can’t make it live we encourage you to sign up to be sure you don’t miss it.

We look forward to seeing you there.

Now we return to our usual broadcast…

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1808.98 | – $9.96 | – 0.54% |

| USD Gold | $1345.70 | + $29.52 | + 2.24% |

| NZD Silver | $26.64 | + $0.80 | + 3.09% |

| USD Silver | $19.82 | + $1.12 | + 5.98% |

| NZD/USD | 0.7439 | + 0.0203 | + 2.80% |

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1738 |

| Buying Back 1kg NZ Silver 999 Purity | $816 |

The realisation that the US Fed is yet again unlikely to raise interest rates in the short term seems to have set in this week. The US Dollar has been falling and so gold and silver have risen, but so has the kiwi dollar.

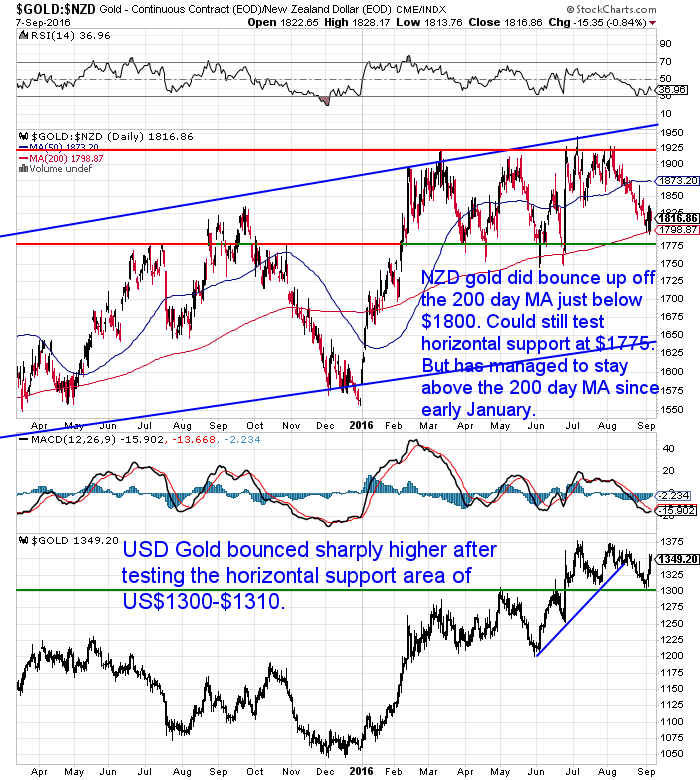

The upshot is gold in NZ dollars is down slightly on a week ago. But perhaps more importantly NZD gold actually bounced off the 200 day moving average line.

As noted in the chart below NZD gold could still head lower again and test the horizontal support level at $1775. But since early January it has managed to stay above the 200 day MA apart from 2 intraday blips.

So anything close to the $1800 mark could well prove a good entry point.

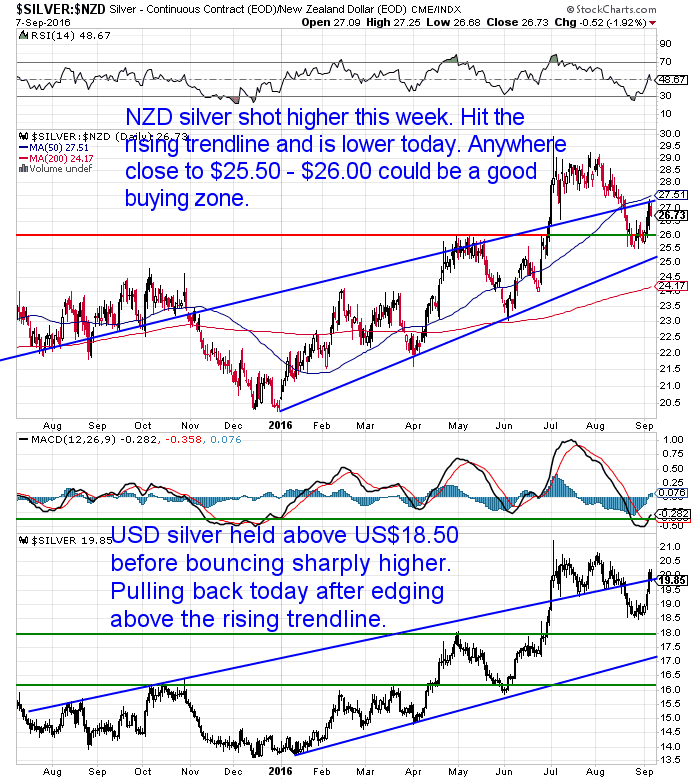

Silver too bounced higher this week. Even the stronger NZ Dollar couldn’t dent the sharpness of the rise.

NZD silver touched the rising trendline overnight and has turned lower. So any purchase around the $25.50 to $26.00 mark could be a good buying zone.

As noted the NZ dollar strengthened sharply this week. It is now above 0.74 and at a new high. But it is now close to getting overbought and outside the Bollinger Bands so a pull back is likely.

So it we may see the continuing trend of this year. Which is rising gold and silver prices, but slightly dulled by an also rising NZ dollar.

Why Gold Demand Doesn’t Necessarily Correlate with Price

The strange dichotomy in the precious metals markets continues. That is where demand doesn’t necessarily correlate with price.

During the multi year correction we’ve had, there were times of intense demand for physical metal, but the price continued to fall. Conversely currently we are seeing a drop off in demand in the 2 biggest markets in the world – China and India – yet prices have been rising.

Adrian Ash of Bullionvault explains why:

- “US stockpiles of gold registered to meet Comex futures contracts deliveries have also jumped…surging back to 3-year highs alongside the price. Total Comex warehouse stockpiles have risen above 300 tonnes, equal to some 10% of annual world mining output.

- On the other side of the world, meantime, India’s gold demand has vanished…with scrap re-sales booming…while even the most ardent follower of China’s ‘true demand’ data must admit that its world-beating appetite has sunk since January.

- Deliveries out of the Shanghai Gold Exchange dropped for the first 7 months in a row from the same periods a year ago, only to hit a new 2016 low in August.

- How come? Same reason that metal is piling up in ETF trust-fund accounts, pouring into London vaults, and piling up in Comex warehouses.

- Price decides where gold is wanted and delivered. So far in 2016, that has been into Western investment hands…a huge reversal of the price-crash switch starting 2013.

- There is no shortage. Anyone telling you gold prices must rise…because there isn’t enough to meet demand right now…is half wrong at best.”

This sentiment from Adrian Ash is echoed in an article on the website from Stewart Thomson.

- “Even though Indian demand is currently soft, gold is very well supported by institutional money managers. At this point in time, it could be persuasively argued that neither the love trade nor the fear trade are the prime movers of the gold price.

- Instead, gold is being supported by the “competitive cost of carry” trade. Low rates and negative rates on most fiat currencies make gold very attractive as a currency.”

Thomson also argues that because of this a big spike in the gold price up or down is not likely in the short to medium term.

Gold And Silver: Good Times Are Here

Support from Across the Ditch for our Theory on House Prices

Earlier this year we wrote a couple of articles on our theories on the state of house prices in New Zealand. See:

Rising Auckland House Prices: Shortage or Cantillon Effect?

And:

Our solution to rising house prices

Seems our “crazy” house prices are not going unnoticed by our neighbours across the ditch. Port Phillip Publishings Kris Sayce wrote about Auckland house prices on Tuesday and has a theory similar to ours:

- “Barfoot & Thompson managing director, Peter Thompson says:

- ‘While prices continue to rise, for the past 5 months buyers have not been prepared to pay more than they believe is the market price.

- ‘The same trend can be seen with the median price, which at $850,000 for August is up 1.2 percent on July’s, and up 2.5 percent for the average for the previous 3 months.’

- In Aussie dollar terms, the Auckland median house price is $816,000. That’s $36,000 above the Sydney median house price.

- Is Auckland that much more desirable than Sydney? We won’t pass judgement.

- Sydney is fine, but we’ve never been to Auckland.

- But, in truth, it doesn’t matter whether Auckland is nice or not. ‘Niceness’ isn’t a factor. There is only one factor, and that’s interest rates.

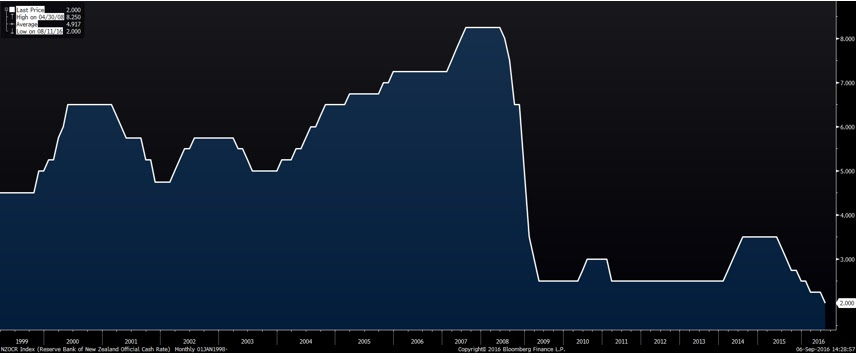

- …To make our point on the importance of interest rates, consider this chart. It’s of the Reserve Bank of New Zealand Official Cash Rate:

- Source: Bloomberg

- Click to enlarge

- As in Australia, New Zealand’s interest rates are at a record low. It’s no wonder, then, that Auckland house prices are at a record high.

- There is a tendency in the financial profession to overcomplicate things. If a financial professional can make something seem complicated, they feel it will increase the demand for their services.

- In reality, financial markets aren’t as complex as most pros will have you believe.

- In finance, there are just a few simple relationships. The most simple of all is interest rates. Interest rates influence everything.

- If all roads lead to Rome, then all financial booms and busts lead back to interest rates. We can’t be any clearer about it than that.

- In 2008, across most of the world, asset prices collapsed. There were a few exceptions. House prices in Australia and Canada didn’t collapse. Most everywhere else, they did.

- But Australia didn’t escape completely. ‘Trophy homes’ in places like the Gold Coast took a beating. As did homes in Perth, which had previously shot up in value as a result of the mining boom.

- The Aussie stock market fell by half. That was due to the collapse of mining stocks and the worldwide banking crisis.

- As a result, central banks slashed interest rates. You can see how that played out in New Zealand in the chart above.

- Prior to the crash, the RBNZ Cash Rate was 8.25%. A year later it was 2.5%. Today, it’s 2%. And according to the futures market, there’s a 58.8% chance of the RBNZ cutting rates to 1.75% at its November meeting.

- Just when will the era of low interest rates end?

- On the current evidence, here in Australia, in New Zealand, and in the US, it doesn’t seem as though it will end any time soon.

- So, get used to it.”

Bill Bonner had a few thoughts on US interest rates this week after Yellen’s speech at the recent central banker gathering in Jackson Hole:

“Yellen said the case for raising rates had “strengthened in recent months.” She cited the “continued solid performance of the labor market” as a reason for optimism. She didn’t mention that the “labor market picture” she’s looking at – based on the government’s own figures – are heavily photoshopped, screening out the long-term unemployed and adding in fictitious jobs based on various theories and models.

And what happens to those nice (though largely fictitious) jobs numbers after you raise rates?

Isn’t that the real problem?

Having created a world where businesses and consumers barely have their heads above water… even with the EZ-iest borrowing costs in history, what will happen to them when rates rise?

She certainly wasn’t going to bring that up!”

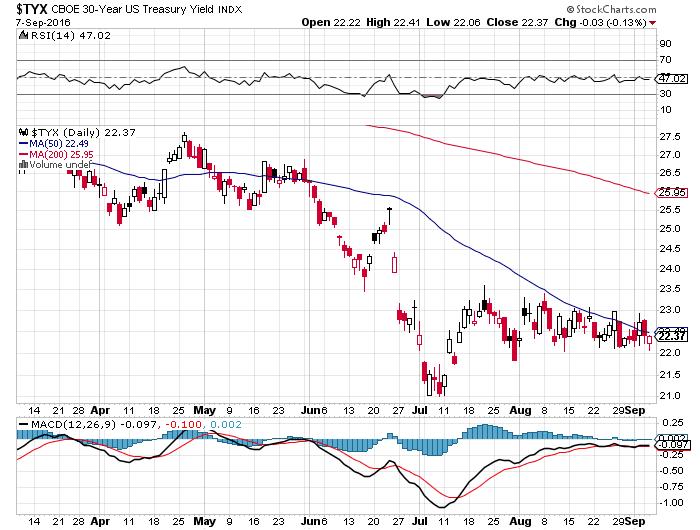

At some point rates will rise. Likely when pretty much no expects it’s even possible. In terms of US treasury Bonds we may even be in the early stages of such a rise now.

The chart below shows US 30 Year Treasury Bond yields appear to have bottomed out back in July.

Rising interest rates will likely come hand in hand with rising inflation. Something else that most people probably don’t have on their horizon currently either.

But the world’s largest money manager does…

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have 4 weeks emergency food supply.

For just $190 you can have 4 weeks emergency food supply.

World’s largest money manager sees inflation ahead

Kris Sayce notes via a Bloomberg report:

- ‘BlackRock Inc. is shunning long-term Treasuries following a surge in 2016 in a bet the Federal Reserve will allow a pickup in inflation.

- ‘“We think the Fed is likely to allow inflation to run hotter than its target for a while,” Rick Rieder, the chief investment officer of global fixed income in New York, wrote in a report Sept. 2. “While we have believed that there was more value in longer-end interest rates over the past year or so, we are more comfortable holding shorter, or belly, interest rate exposure.” BlackRock is the world’s biggest money manager with $4.6 trillion in assets.’

- Two things. ‘Belly interest rate exposure’ means medium-term maturity bonds.

- Second, the fact that BlackRock has US$4.6 trillion in assets under management tells you that asset price inflation, and inflation in general, is already completely out of control.

- To put that in perspective, that almost matches the combined market capitalisation of the Aussie and UK stock exchanges.

- But that’s by the by. BlackRock is basically saying that it’s too risky to hold long-term bonds. At the moment, a 30-year US bond yields 2.226%. In order to achieve a positive outcome, an investor needs inflation to be below that level.

- An inflation rate above 2.226% means an investor receives a negative yield on their investment.

- For a long term bond investor, that creates a problem. If inflation spikes, the investor has a choice. They can ride it out, hoping for lower inflation, knowing they will at least get their principle investment back on maturity.

- Or they can sell out of the bond now, likely at a loss if inflation and interest rates have risen, hoping they can reinvest in higher-yielding assets.

- That brings us full circle. If inflation increases further, then interest rates will rise, whatever the US Federal Reserve does with short-term rates.

- With higher inflation, investors would likely demand higher returns.”

This morning we read something else that backs up the CIO of BlackRock’s theory on inflation.

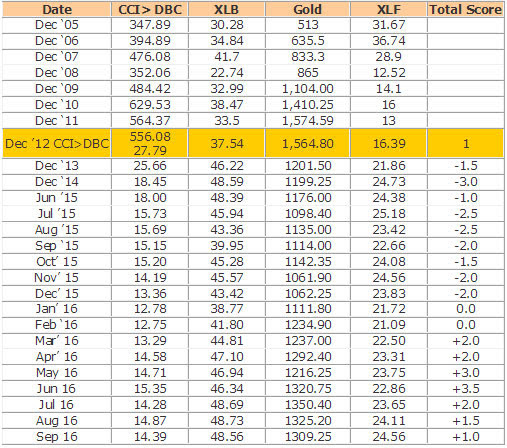

In the latest monthly report from trading teacher Van Tharp, his inflation-deflation model indicates that a trend of rising inflation might be beginning:

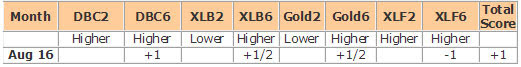

- “Part III: Our Four Star Inflation-Deflation Model

- In the simplest terms, inflation means that stuff gets more expensive, and deflation means that stuff gets cheaper. There’s a correlation between the inflation rate and market behaviour so understanding inflation and deflation can help traders understand some important big-picture processes.

- See the tracking table below.

- Here are the model components and how the prices looked at the end of February [Editor’s Note: We think that should read August, not February] compared with two months back and six months back.

- So we have had five straight inflationary months now through August. This indicates a clear new trend and indicates that the value of your money is going down while things like gold and commodities are going up. We are clearly seeing a major change in the economy from what we’ve had over the last several years.

- Source.

Reminder: Gold Will Rise With Interest Rates

A reminder that even though the talk always reverts to how gold will be hit when the Fed raises interest rates, the exact opposite happened with the first tiny rate rise late last year. This kicked off a corresponding rise in gold and silver.

Here’s an article that delves into the reasons why gold will actually rise when interest rates rise. Much like it did in the 1970’s.

3 Reasons Why Gold Doesn’t Have to Fall when Interest Rates Rise

Read more: Interest Rates and Gold: If Interest Rates Rise What Happens to Gold?

Rickards on changes coming this month to the global monetary system

There’s a lot going on in the next month or so with respect to the international monetary system. Jim Rickards gave a good summary of the action to come.

- “What will happen in the next five weeks is just as significant as any of the monetary earthquakes mentioned above. There are three major events happening in rapid sequence. Here’s the list:

- On Sept. 4, the G20 leaders meet in Hangzhou, China

- On Sept. 30, the yuan officially joins the SDR basket of currencies

- On Oct. 7, the IMF holds its annual meeting in Washington, D.C.

- You might be tempted to dismiss this calendar as “business as usual.” G20 leaders’ meetings happen every year. The SDR basket has been changed many times in the past. The IMF has global meetings twice a year (spring and fall). But it’s not business as usual. This time is different.

- The hidden agenda involves the formal transition from a dollar standard to an SDR standard in world monetary affairs. It won’t happen overnight, but the elite decisions and seal of approval will take place at these meetings.

- The SDR is a source of potentially unlimited global liquidity. That’s why SDRs were invented in 1969 (when the world was seeking alternatives to the dollar), and that’s why they will be used in the imminent future.

- SDRs were issued in several tranches during the monetary turmoil between 1971 and 1981 before they were put back on the shelf. In 2009 (also in a time of financial crisis). A new issue of SDRs was distributed to IMF members to provide liquidity after the panic of 2008.

- The 2009 issuance was a case of the IMF “testing the plumbing” of the system to make sure it worked properly. With no issuance of SDRs for 28 years, from 1981–2009, the IMF wanted to rehearse the governance, computational and legal processes for issuing SDRs.

- The purpose was partly to alleviate liquidity concerns at the time, but also partly to make sure the system works in case a large new issuance was needed on short notice. The 2009 experience showed the system worked fine.

- Since 2009, the IMF has proceeded in slow steps to create a platform for massive new issuances of SDRs and the creation of a deep liquid pool of SDR-denominated assets.

- On Jan. 7, 2011, the IMF issued a master plan for replacing the dollar with SDRs. This included the creation of an SDR bond market, SDR dealers, and ancillary facilities such as repos, derivatives, settlement and clearance channels, and the entire apparatus of a liquid bond market.

- In November 2015, the Executive Committee of the IMF formally voted to admit the Chinese yuan into the basket of currencies into which an SDR is convertible.

- In July 2016, the IMF issued a paper calling for the creation of a private SDR bond market. These bonds are called “M-SDRs” (for market SDRs) in contrast to “O-SDRs” (for official SDRs).

- In August 2016, the World Bank announced that it would issue SDR-denominated bonds to private purchasers. Industrial and Commercial Bank of China (ICBC), the largest bank in China, will be the lead underwriter on the deal. Other private SDR bond issues are expected soon.

- On Sept. 4, 2016, the G20 leaders will meet in Hangzhou, China, under the leadership of G20 President Xi Jinping, who is also the general secretary of the Communist Party of China. In this meeting, other world leaders will metaphorically kowtow to the new Chinese emperor and recognize China as the co-head of the global monetary system alongside the U.S.

- On Sept. 30, 2016, at the close of business, the inclusion of the Chinese yuan in the SDR basket goes live.

- On Oct. 7, 2016, the IMF will hold its annual meeting in Washington, D.C., to consider additional steps to expand the role of SDRs and make China an integral part of the new world money order.

- Over the next several years, we will see the issuance of SDRs to transnational organizations, such as the U.N. and World Bank, to be spent on climate change infrastructure and other elite pet projects outside the supervision of any democratically elected bodies. (I call this the New Blueprint for Worldwide Inflation.)

- Thereafter, the international monetary elite will await the next global liquidity crisis. When that crisis arrives, there will be massive issuances of SDRs to return liquidity to the world and cause global inflation. The result will be the end of the dollar as the leading global reserve currency.

- Based on past practice, we can expect that the dollar will be devalued by 50–80% in the coming years.

- A devaluation of this magnitude will wipe out the value of your life’s savings. You’ll still have just as many dollars, but they won’t be worth nearly as much.

- The time to start preparing is now.”

- Source.

If you agree with Rickards advice that the time to start preparing is now, then get in touch for a quote.

If you’d like to hear more on the SDR we’ve posted a video from Max Keiser where he and Stacy Herbert discuss this new m-SDR and cover Rickards theory too.

SDR Bonds Sold in China – Will the Dollar Live to Die Another Day?

Lastly, don’t forget to check out the other articles posted on the site this week linked below.

** Urgent Message for All Car Owners **A compact, revolutionary tool can save your life.

We believe everyone who drives or rides in a vehicle must carry this tool.

The Keychain Car Escape Tool can save lives.

The Keychain Car Escape Tool can save lives.

For less than the price of 2 movie tickets you can get 2 of these.

One for each car in your family or give one to someone you care about.

—–

This Weeks Articles:

SDR Bonds Sold in China – Will the Dollar Live to Die Another Day?Thu, 8 Sep 2016 10:31 AM NZST  Last week as part of an article we discussed Jim Rickards theory as to how the changes to the global monetary system may play out. This week Stacy Herbert and Max Keiser discussed the recent issuance of IMF Special Drawing Right (SDR) bonds for the first time in 35 years sold to Chinese Investors. They […] Last week as part of an article we discussed Jim Rickards theory as to how the changes to the global monetary system may play out. This week Stacy Herbert and Max Keiser discussed the recent issuance of IMF Special Drawing Right (SDR) bonds for the first time in 35 years sold to Chinese Investors. They […]

|

The Biggest Threat to the Banking System Is “Here to Stay”Wed, 7 Sep 2016 2:54 PM NZST  It’s not just a huge overhang of debt, a lack of confidence, or a bank run that poses a risk to the banking system. Read on to discover what perhaps the biggest ongoing threat is to the banking system… The Biggest Threat to the Banking System Is “Here to Stay” By Justin Spittler The banking […] It’s not just a huge overhang of debt, a lack of confidence, or a bank run that poses a risk to the banking system. Read on to discover what perhaps the biggest ongoing threat is to the banking system… The Biggest Threat to the Banking System Is “Here to Stay” By Justin Spittler The banking […]

|

Gold And Silver: Good Times Are HereWed, 7 Sep 2016 12:41 PM NZST  Stewart Thomson was on the ball with his recent call that gold could likely find a bottom following the latest US jobs numbers announcement. That is exactly what happened with gold bouncing higher from just above US$1300 last week. So let’s check back in on what his latest thoughts are. He has some interesting thoughts on […] Stewart Thomson was on the ball with his recent call that gold could likely find a bottom following the latest US jobs numbers announcement. That is exactly what happened with gold bouncing higher from just above US$1300 last week. So let’s check back in on what his latest thoughts are. He has some interesting thoughts on […]

|

When they say ‘hoarding’ instead of ‘saving’ you know you’re in troubleWed, 7 Sep 2016 9:43 AM NZST  How do you know that the world financial system has gone completely screwy? How about when an investing system that has provided safe steady returns for 29 years is now proving to be very risky and likely to get even riskier if the central planners and busy-bodies have their way. The following article outlines how […] How do you know that the world financial system has gone completely screwy? How about when an investing system that has provided safe steady returns for 29 years is now proving to be very risky and likely to get even riskier if the central planners and busy-bodies have their way. The following article outlines how […]

|

What “unconventional monetary policy” in NZ may look likeThu, 1 Sep 2016 6:18 PM NZST  This Week: What “unconventional monetary policy” may look like in New Zealand How Will the Global Monetary System Change Take Place? The Night That Is Upon Us and the Dawn of a New Era Dollar – The Greatest Pyramid Scheme Of All Time Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly […] This Week: What “unconventional monetary policy” may look like in New Zealand How Will the Global Monetary System Change Take Place? The Night That Is Upon Us and the Dawn of a New Era Dollar – The Greatest Pyramid Scheme Of All Time Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly […]

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2016 Gold Survival Guide. All Rights Reserved. |

|

|

…