This Week:

-

Silver Technical Analysis – Here’s Hoping This Chart is Correct

-

What Could Cause the Silver Price to Break Out?

-

Updates from last week on: Indian Import Duties, Chinese Reserves, and German Repatriation

We really could cut and paste our commentary from the past few weeks in here today and head to the beach! So repetitive have the precious metals markets been. Yet again we are back near the lows of last year in gold with the price bouncing around NZ$1988 again.

Silver in NZ dollars remains comparatively stronger as it has over the past few weeks sitting at $37.57 an ounce. Both metals remain in the boring consolidation phase they have been in for a while now.

Silver Technical Analysis – Here’s Hoping This Chart is Correct

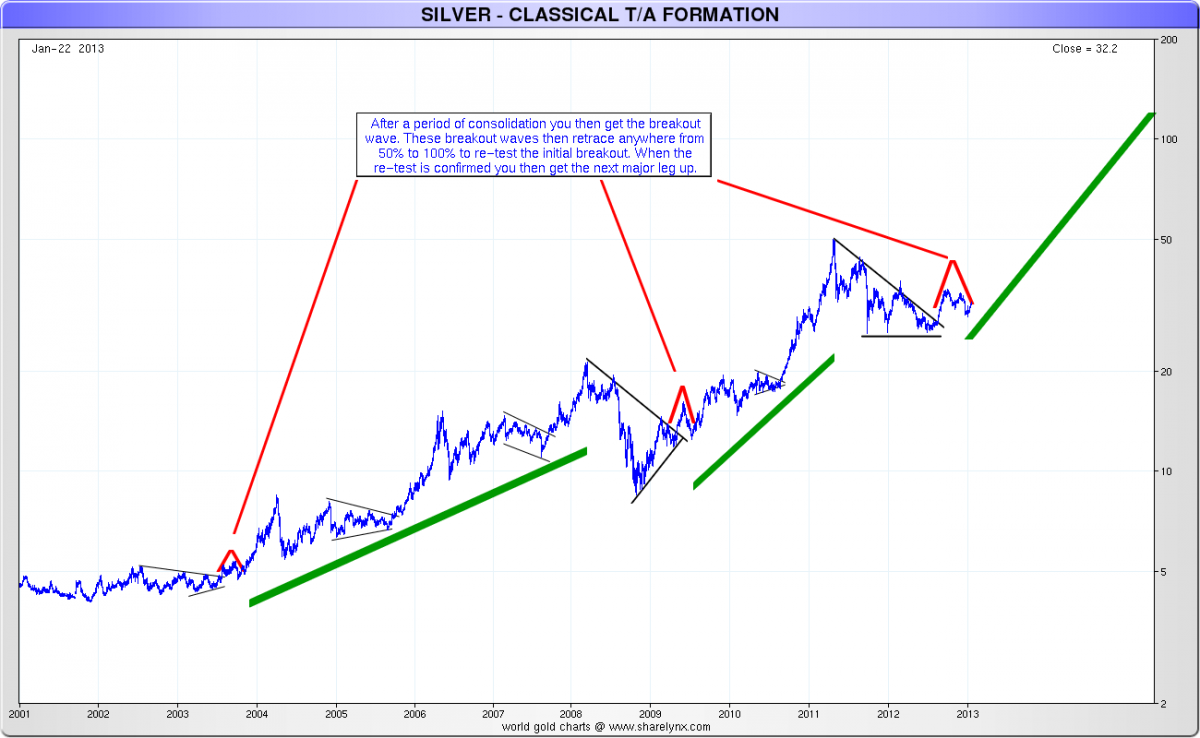

Here’s a chart from Nick Laird’s sharelynx.com site. We’ve been showing this same triangle formation for many months now in our daily price alerts. It appears again above in todays silver chart too. Granted, the below chart is in US dollars and ours are in NZ dollars, but the same pattern is playing out nonetheless.

As the explanation in the chart says after a period of consolidation, like we’ve had for the past 18 months or so, you get a breakout, like the one that started at the end of last August. You then get a retrace of anywhere from 50%-100% of the breakout move, like we are seeing at the moment, before the next major upleg.

So we will see if Nick Laird’s chart plays out. Technical analysis is as much an art as a science and you can make a chart show what you want it to to some degree. But these same patterns in the past have resulted in sizeable run ups in price as the green lines show.

What Could Cause the Silver Price to Break Out?

So what could it be that sends the price of silver higher as per Nick Laird’s Chart?

We could list any number of factors, but in general terms we like what “Trader” Dan Norcini had to say over at King World News during the week. He simply thinks silver will have to go higher to meet the demand as there are not enough sellers at current prices. That is that it’s not a shortage of silver per se as there is plenty of silver hoarded around the world. But rather not enough people are willing to trade their paper dollars for silver at these prices.

He also commented on silver price breakout levels to watch (in US dollars of course).

On this topic, we’ve also had a few questions on silver supply and whether we’d seen any shortages of the metal. A reader actually sent us this link and asked if we’d seen any shortages of silver.

Now Royal Canadian Mint Rationing Silver Coin Sales

Here’s our reply in case that’s of interest to you:

“Yes we have seen the effects of the shortage in silver coins. The premiums on American Silver Eagles, Canadian Silver Maples, and Austrian Silver Philharmonics all increased when the US Mint announced the suspension of the Silver Eagles in early January.

We haven’t heard of any increases again following this announcement from the Royal Canadian Mint but it would not be surprising to see premiums rise again.

So it’s not that you can’t get any but that it will be with a higher premium than a couple months ago. That could change of course as existing stocks run down of Eagles.

Our main local silver supplier is also backed up a bit but that seems to be more a case of refining and production capacity and catching up on the christmas rush from Jewelers than a lack of actual raw metal itself. They are catching up too, with delays down to a few weeks from a couple months that it was at the start of the year.

Interestingly things have been quiet locally in terms of buyers this month. It was very busy in Nov and Dec though.

Maybe a contrarian indicator of the price about to rise perhaps? We shall see I guess.”

Since we wrote this it has been announced that “The US Mint has resumed sales of American Silver Eagles on ALLOCATION ONLY” so premiums on Silver Eagles and Canadian Maples have actually come down slightly now. Of course allocation only means limited supplies so the silver market remains tight.

Updates from last week on: Indian Import Duties, Chinese Reserves, and German Repatriation

Indian Gold Import Duties

Last week we mentioned how India had increased it’s gold import duties by 50% and wondered if it would have a long term impact. This CNBC article interviews an Indian Jeweler who doubts it will have a lasting effect on buyers:

Is India Fighting a Losing Battle Against Gold Bugs?

“Prashant Tejnani, owner of a jewelry store in India’s financial capital Mumbai, said news of the government’s latest tax hike on gold imports sent an initial wave of panic through vendors in the city’s bustling Zaveri Bazaar, or jewelry market – but he expects the impact on demand to be fleeting.

“Gold will always retain its shine in India. An increment of 2 percent will curb demand initially, for one or two months, but once people get used to it, they won’t mind paying the extra,” Tejnani, whose family has been in the jewelry business for 50 years, told CNBC”.

Chinese Gold Reserves

Another item we mentioned last week, was we’d read somewhere that Jim Rickards thought China might announce a substantial increase in their gold reserves later in 2013 or 2014. (It was actually in Casey Research’s latest Big Gold report we’ve now remembered). This week he stated the same thing on Yahoo Finance with Lauren Lyster and also commented that the German Gold repatriation is “World Historical”. So see below if you want to hear it straight from the horses mouth.

Also on the topic of China’s Gold Reserves, we saw that this week Steven Leeb on KWN reckons China may already be at number 2 in size for gold reserves

“China could (already) have the second largest gold reserves in the world, even ahead of Germany. What is confirmed by everything you can see is they are importing as much (gold) as they can without trying to disturb the price of gold. You won’t believe what’s going to happen (with the price of gold). I’m telling you in 3 years people will not believe the price of gold. They will not believe the gift that Basel and the West gave everybody that wanted to accumulate gold.”

German Gold Repatriation

The major news story of the moment in precious metals land remains Germany’s repatriation of gold. We’ve read a lot about this lately and below are 2 of the best articles we’ve seen on the topic this week.

The first is from Mike Maloney’s WealthCycles.com and is a great overview of the whole topic, listing all the other countries where there are murmurrings of following the Venezuelan and German lead.

The other article which we only read earlier this morning, (and intend to put on the website but haven’t got there yet), is from Professor Fekete, who we’ve featured many times before.

He postulates the interesting theory that it is America that wants Germany to take it’s gold back so that it can be used to “feed” the futures market, and keep it intact, so that American gold doesn’t have to. An interesting concept and well worth the read.

American Bases in Germany and the Gold Basis

Latest Angle on the Debt Ceiling:

Last week we noted that the US Debt Ceiling was looking like getting a 3 month reprieve. Well that did happen but James Turk on King World News had a different take on it to most, comparing it to Nixons “temporary” suspension of the dollar’s convertibility into gold in 1971:

“The mainstream media reported that the House has now extended the debt ceiling to May 19th. But that is not accurate. What the House actually did is suspend it. Bloomberg accurately reported that the House acted to “temporarily suspend” the debt ceiling.

In other words, the House is proposing to eliminate the debt ceiling, meaning that there will be no limit on what the federal government can spend until May 19th when the debt ceiling must again be considered.

But here’s the really important point: These two words used by Bloomberg in reporting this event – temporarily suspend – are chilling, Eric. These are the exact same two words that Nixon used in his August 15, 1971 speech announcing that he was breaking the dollar’s link to gold.

His temporary suspension has now lasted 42 years, which is the key point I am making here. This suspension of the debt ceiling is not going to be temporary. Each time it comes up for consideration, the politicians will just keep extending the suspension again and again. They will always take the soft political option.”

We thought they might come up with something to remove the need for the debt ceiling increases and this would be a cunning way of doing that. We’ll see what happens on May 19th!

This Weeks Articles:

This weeks articles on the website are listed below. We have 3 that are all worth a read this week, but especially check out our favourite billionaire, Hugo Salinas Price commenting on The Telegraphs Ambrose Evans-Pritchard recent return to a gold standard article.

We can’t put our finger on it but we get the feeling that something is brewing in the gold and silver markets. All this news that should be precious metals positive and they continue to creep sideways. It can’t last forever and will no doubt take most by surprise when the next move higher comes. Will it be you?

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

goldsurvivalguide.co.nz

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| Latest on Real Interest Rates in NZ and Their Relationship to Gold |

2013-01-22 22:05:18-05This week: Why the Consolidation in Gold and Silver Markets is a Good Thing Chinese Appetite for Gold Continues Latest on Real Interest Rates in New Zealand Well Known NZ Fund Manager Talks up Gold and Platinum Why the Consolidation in Gold and Silver Markets is a Good Thing Well not a massive change from […] 2013-01-22 22:05:18-05This week: Why the Consolidation in Gold and Silver Markets is a Good Thing Chinese Appetite for Gold Continues Latest on Real Interest Rates in New Zealand Well Known NZ Fund Manager Talks up Gold and Platinum Why the Consolidation in Gold and Silver Markets is a Good Thing Well not a massive change from […]read more… |

| SOOTHSAYERS, NAYSAYERS AND OSTRICHES |

2013-01-24 19:41:22-05We’ve mentioned former central banker John Exter and his inverse pyramid (with gold at the bottom) before. Recently we told how Dan Denning, one of the speakers at the 2012 Gold Symposium covered the inverse pyramid in some depth, but as far as we can recall we haven’t listed Exters full history before. This article by […] 2013-01-24 19:41:22-05We’ve mentioned former central banker John Exter and his inverse pyramid (with gold at the bottom) before. Recently we told how Dan Denning, one of the speakers at the 2012 Gold Symposium covered the inverse pyramid in some depth, but as far as we can recall we haven’t listed Exters full history before. This article by […]read more… |

| Ambrose Evans–Pritchard Beats About the Bush |

2013-01-24 20:51:55-05In case you missed it, a week or so ago there was a widely publicised article by Ambrose Evans-Pritchard in the UK Daily Telegraph entitled “A new Gold Standard is being born“. (Read that first if you haven’t). While an interesting piece, when we read it we noted a few points that we didn’t agree on. […] 2013-01-24 20:51:55-05In case you missed it, a week or so ago there was a widely publicised article by Ambrose Evans-Pritchard in the UK Daily Telegraph entitled “A new Gold Standard is being born“. (Read that first if you haven’t). While an interesting piece, when we read it we noted a few points that we didn’t agree on. […]read more… |

| Confessions of a Gold Analyst: “It’s All My Fault” |

2013-01-28 17:43:53-05In the past couple of weeks we’ve seen Citigroup, Morgan Stanley and HSBC all cut their gold price forecasts for 2013. The below article shows just how poor the “top” analysts at the big investment houses have been with their gold price projections for the past 7 years. So perhaps we can take these recent price […] 2013-01-28 17:43:53-05In the past couple of weeks we’ve seen Citigroup, Morgan Stanley and HSBC all cut their gold price forecasts for 2013. The below article shows just how poor the “top” analysts at the big investment houses have been with their gold price projections for the past 7 years. So perhaps we can take these recent price […]read more… |

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Pingback: Silver Technical Analysis | Gold Survival Guide

Pingback: RBNZ Jawboning But May Follow Through | Gold Prices | Gold Investing Guide