Darryl Schoon discusses gold “price management” since the 1980’s and how today it’s likely that it’s China who doesn’t want the price to rise too fast…

THE GOLD MARKET

SEEN THROUGH A GLASS DARKLY

Gold is a leading indicator of monetary distress

No matter what confidence game is being run, confidence is the necessary pre-requisite. This is why confidence indicators are so closely monitored by central bankers. If consumers and businesses lack confidence, they will not partake of the central banker’s credit; a necessary step in the indebting of otherwise willing victims.

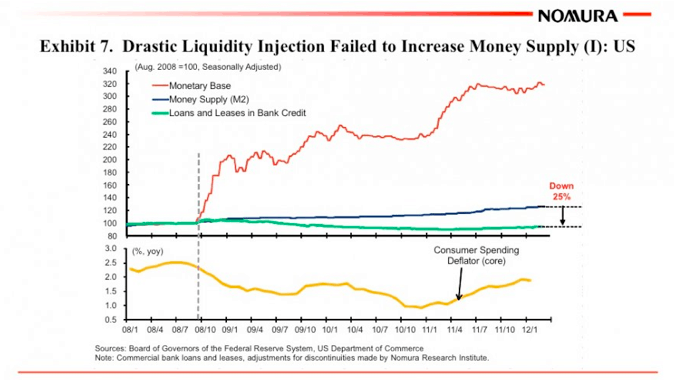

The credit trap is at the core of the bankers’ ponzi-scheme of credit and debt; and although today’s markets are awash with liquidity, bankers are increasingly loath to lend and customers are increasingly reluctant to borrow.

Central bankers are well aware of the precarious health of their illicit franchise. Credit and debt-based economies must constantly expand to pay constantly compounding debts; but now, instead of expanding, economies around the world are slowing and contracting.

This is why central bankers are concerned with a rising price of gold. After gold exploded upwards in 1980 during a virulent episode of inflation, the price of gold was understood to be an indicator of monetary distress.

The more distressed the bankers’ prey

They’re far less likely to borrow today

After gold’s explosive ascent in 1980, central bankers began seriously ‘manage’ the price of gold. A lower price of gold would indicate not only an abatement of monetary problems but investors would be less inclined to trade their paper banknotes for the safety of gold when they could more profitably leverage their paper banknotes in the bankers’ paper markets.

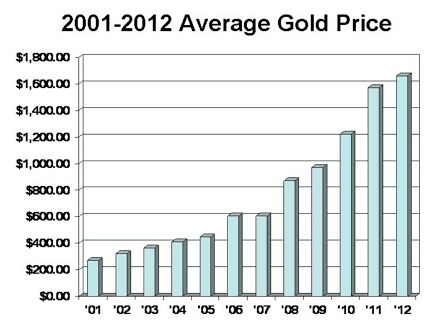

Since the early 1980s, supplies of newly mined gold have constantly fallen short of market demand for gold; but notwithstanding supply and demand fundamentals, gold prices nonetheless fell for 20 straight years. In 1980, the average price of gold was $615. By 2001, it was only $271. Clearly, the free market price of gold was being distorted by ‘outside’ forces.

This anomaly in the supply and demand dynamic that exists in free markets is explained by the research of Frank Veneroso, a little-known but very influential analyst. In my book, Time of the Vulture: How to Survive the Crisis and Prosper in the Process, I tell how Veneroso explained central banks’ collusion with ‘bullion banks’ to suppress gold.

This highly profitable collusion incentivized bullion banks to borrow large amounts of central bank gold; then sell it on the market allowing the banks to invest the funds in the interim and profitably exit the trade when the gold price was lower because of the artificial depression caused by the additional supplies of gold.

This constant downward pressure on the gold price continued from 1981 until 2001. Indications that the profitable gold-carry trade was coming to an end happened in 1999 when the Bank of England ‘inexplicably’ sold 415 tons of gold reserves at the then bottom of the market.

The sale of almost half, i.e. 40 %, of England’s gold reserves has been subsequently revealed to have been triggered by a large—probably American and probably Goldman Sachs—investment bank’s short position in the gold market.

The bank, expecting to profit from the continually falling price of gold, had made a large bet that gold prices would continue to fall; but, prices had stopped falling. This exposed the bank to losses so large that the bankers’ prevailed upon the Bank of England to sell 410 tons of its gold to force gold prices lower.

Cropped photo of Bank of England gold vault

The photo of the Bank of England’s gold reserves is intended to bolster the confidence of investors as to the supplies of gold held by central banks. In truth, the photo is cropped to make it appear that the bank’s gold supplies are larger than they actually are.

Photoshop version of perhaps the more likely size of Bank of England gold vault

The empty space to the left of the rows of gold bullion were once filled with rows of gold bars sold in 1999 to insure that bullion banks could exit their gold trades without taking massive losses. A photo of gold vaults at Fort Knox—and/or the New York Fed—would show an even greater erosion of gold stocks and similarly vacant storage space.

In 1949, US gold reserves totaled 21,775 tons. In 1971 when the US was forced to end the convertibility of US dollars to gold because of diminishing supplies, US gold reserves had declined to only 7,000 – 8,000 tons; the loss of America’s gold was due solely to the post-war US global military presence and to the overseas expansion of US corporations.

2001: GOLD BEGINS MOVING UP

Even the sale of 415 tons of England’s gold in 1999 was unable to contain the growing demand for gold. This demand was exacerbated by the collapse of the US dot.com bubble in 2000. In the next few years, central bankers responded by selling 1300 tons of gold owned by the Swiss National Bank to suppress the now rising price of gold but to no avail—gold continued to rise.

2012: GOLD ENCOUNTERS RESISTANCE AT $1800

Gold is a leading indicator of monetary distress

The price of gold has risen for 10 years as systemic monetary stress has increased. In July 2011, because of EU monetary disarray, the price of gold rose from $1500 to $1900 in only two months, an almost vertical 27% rise.

Since September 2011, however, gold has been in an extended trough. This is not due, however, to an abatement of systemic stress. It is due to measures central bankers put in place to prevent a wholesale flight to gold from developing at that time.

What happened in July and August 2011 is what central bankers had feared, an almost vertical ascent in the price of gold that could cause investors to exit the bankers’ paper markets and turn to gold in a lemming-like rush for the safety of gold bullion.

This would be the death knell in the bankers’ confidence game. In my article, Gold: Stage Three Up Down Up Down Up (October 22, 2012), I explained how the bankers moved to prevent this feared event from coming true. It worked—for awhile

In December 2012, it is clear the bankers drew a ‘line in the sand’ in September 2011 to prevent another rapid ascent in the price of gold. To some, this ‘line in the sand’ presents a major barrier to gold’s advance. But, in reality, the bankers’ line in the sand represents the bankers’ desperate last ditch attempt to prevent the inevitable from happening.

The systemic distress that drove gold’s 27 % rise between July and September to $1900 has not abated although the lower price of gold would imply otherwise. The present price of gold below $1800 is due solely to central bank emergency measures to contain the price of gold and China’s reluctance to let gold rise too far too fast before China can buy as much gold as possible before the next economic crisis.

2013: GOLD WAITS FOR THE END OF THE BANKERS’ CONFIDENCE GAME

Speculation abounds as to the trigger event that will set off gold’s vertical ascent. It could be the collapse of the global derivatives market or a credit event such as Credit-Anstalt’s collapse in 1931, the Austrian bank owned by the Rothschilds or perhaps Japan’s inevitable descent into the deflationary conflagration it has resisted since 1990.

It could be any number of events or causes. It could be triggered by a black swan event, a geopolitical crisis or a natural disaster on the level of the earthquake that struck off the coast of Japan in March 2011. Whatever the trigger, in the end the banker’s 300 hundred year-old con game will collapse from a simple lack of confidence.

In my current youtube video, The Collapse and the Better World to Come, I explain why I’m so optimistic about what is about to happen.

Buy gold, buy silver, have faith.

Darryl Robert Schoon