Gold is getting noticed a bit more of late. Here’s an excerpt from a recent New Zealand herald article by Andrew Gawith, the executive director of Gareth Morgan Investments…

Does all this mean the US dollar is about to lose its status as the world’s reserve currency? It’s unlikely.

There is no obvious alternative: the euro is tortured by sovereign debt problems and a complex political support structure; the yen and the Japanese economy are in no fit state to take on reserve currency status; and the Chinese yuan is a long way from being a freely traded and transparent world currency.

There’s also been talk of some sort of composite currency becoming the reserve currency – appealing in theory but difficult to see working in practice. So it’s going to be the US dollar for a while yet despite its declining value.

Worries about the value of the world’s leading currencies have encouraged people to invest in gold (and silver) on the basis that it is the only currency with integrity. Given that the US in particular is probably comfortable to see its currency depreciate to make it more competitive and to possibly help inflate away some of its mounting pile of debt, going for gold seems pretty rational.

Full article: http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10722946

It is heartening to see someone in the mainstream investment community actually speaking about gold and the factors driving increased demand for it. However read on and the overarching theme does not seem particularly pro gold. Later in the same article Mr Gawith states:

The question is whether economies are slowly being forced to return to some sort of gold standard that would mean paper money was explicitly backed by gold to shore up its integrity. The rush to gold certainly suggests people are looking for greater assurance of the purchasing power of their money or wealth. But perhaps the rise in the price of gold is simply part of the general rise in commodity prices and that linking its rise to lack of integrity of currencies and inflation fears is simply spurious.

The past three years have seen some extraordinary measures required to prevent a financial meltdown and nurse economies back to some semblance of growth. The Fed is effectively targeting higher inflation – they have been trying to avoid a deflationary cycle taking hold.

Once growth is firmly established interest rates will rise thus restoring some confidence in the dollar and making gold a less attractive asset to hold.

The status quo will have been restored.

Personally I believe Mr Gawith’s view seems a bit hopeful and optimistic that “Once growth is firmly established interest rates will rise thus restoring some confidence in the dollar and making gold a less attractive asset to hold. The status quo will have been restored.”

His statement also makes some large assumptions and I believe gives the Fed too much credit! How will growth be established? Will it be more of the artificial kind we’ve had over the past 18 months, through more “quantitative easing” or more truthfully money printing and currency debasement?

No government including our own here in New Zealand seems interested in doing anything about the major problem which is the significant debt they virtually all hold.

Mr Gawith suggests that gold could possibly just be rising with all commodities in general. Not rising due to a “lack of integrity of currencies and inflation fears”. So the question to then ask is why are commodities in general rising? Isn’t it likely that commodities in general are all rising simply due to more paper dollars chasing a fixed amount of goods – which is the very definition of monetary inflation? His statement is also an over simplification of the subject.

He may be right that interest rates will have to rise eventually. Although this in itself poses massive problems for the US as well as many other governments as their debts are now so huge that any increase in rates translates into a massive increase in the interest bill to be paid. This is a key difference from 1980 when the US debt was miniscule comparatively to today. So the argument that the US can simply raise interest rates to head off inflation like Paul Volker did in late 1979 onwards, is somewhat complicated by this mountain of debt they will have to service. But, that is a whole other story.

Anyway, back to rising interest rates. It is a common misconception that gold performs poorly when interest rates rise. The key number to look at is the “real” rate of interest. That is the interest rate after inflation is taken into account. Currently real interest rates remain negative meaning the rate of inflation is higher than interest rates, so savers are losers. However interest rates can rise and a “savers” real return can actually still remain negative. We can look back to the last bull market in gold to see a demonstration of this concept.

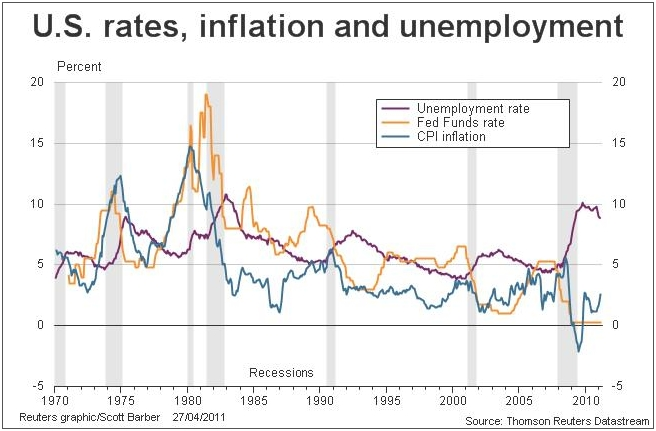

The chart below shows interest rates rising dramatically (yellow line) from about 1977 through to the early 1980’s. However you can see that the inflation rate (blue line) was just as high as the interest rate until 1980. Gold actually also rose dramatically during this period, until 1980. So even though interest rates were rising for 3 years this did not dampen the gold price until real rates were finally higher than the inflation rate.

You can this see clearly in the next chart which plots the real interest rate versus gold since 1966. The gold price didn’t drop until real interest rates were firmly positive.  So you see, central banks may raise interest rates (as some already are), but with the significant monetary inflation that has gone on to date they may be trying to catch up with, but still not actually manage to get ahead of, the inflation.

So you see, central banks may raise interest rates (as some already are), but with the significant monetary inflation that has gone on to date they may be trying to catch up with, but still not actually manage to get ahead of, the inflation.

Thus even though they tweak rates up, Joe Saver still receives a rate of interest that is less than the actual inflation rate. While this continues, the cost to “carry” or hold gold is negated and so gold (and silver) will remain attractive as little else is likely to maintain purchasing power.

My guess is this will be much longer than Mr Gawith thinks. I would also have major doubts about the “status quo” being “restored”. My bet is that the international currency “playing field” will look vastly different a decade from now. Not just the players but the rules and the game itself are likely to be vastly different.

—–

Want to know when it’s time to sell gold? Read this article for a number of indicators to keep an eye on: When will you know it’s time to sell gold?

If you’d like to know the exact process for selling gold and silver see: Sell Gold & Silver Bullion, Bars or Coins

Pingback: Why Gareth Morgan Investments and the mainstream are wrong about gold - Part 2: A counter to GMI’s senior economist | Gold Prices | Gold Investing Guide

Pingback: Why Gareth Morgan Investments and the mainstream are wrong about gold - Part 2: A counter to GMI’s senior economist -