We recently received a comment from a reader that said:

“I have gone through your Gold survival course, and most of what you say makes very good sense.

But I have one thing that seriously puzzles me, and nobody can give me a plausible answer:

Logically when the currencies are printed to the levels they have been over the last 5 years, without any asset backing, you would assume the metals like Gold should progressively be in huge demand and therefore the prices of gold should rise significantly.

Why then have the prices of gold been progressively falling over the last 5 years. Gold is almost at the price it was 5 years ago.

Why are people not rushing out to buy Gold to hedge their bets against the so called Fiat currencies, and why is the demand for gold progressively declining with its price?

It definitely is an anomaly, but nobody can explain the reason for this to me yet.

Your view on this anomaly would be appreciated.”

It’s a great question so we thought we’d have a crack at an answer and share it with everyone who might be interested.

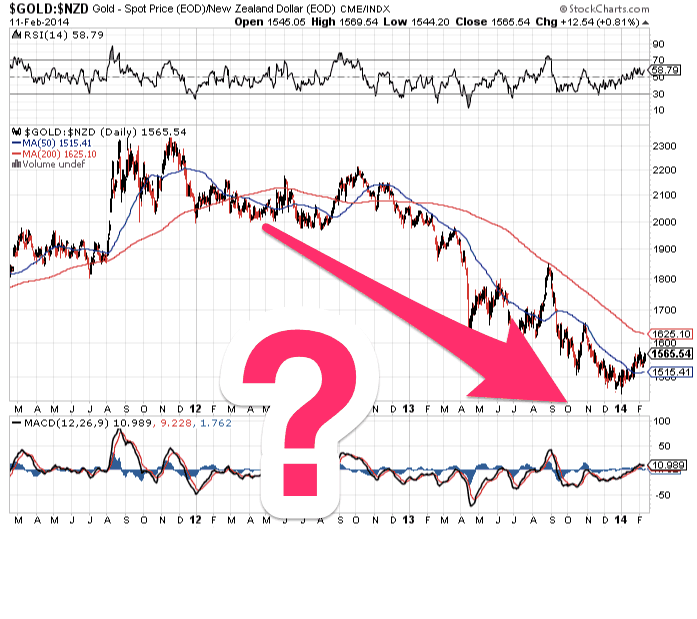

First up we wouldn’t agree that gold has been progressively falling over the past 5 years. It may have been for the past 2 and a bit years. But prior to that the trend was most definitely consistently up (or rather the trend for virtually all national currencies was down).

However it is accurate to say we are close to levels of 5 years ago (in New Zealand dollars at least), as the past 2 and a bit years of falling prices has negated the prior 2 to 3 years of rising prices. So we are back not too far above the same level as almost 5 years previous.

Some of this care of a strengthening New Zealand dollar.

Why is this?

Well of course no one really knows, but we can hazard a few well educated guesses.

Manipulation

Physical versus paper markets

Manipulation or Price Management

If you’ve been following the precious metals sector for any length of time, you will have been doing well to avoid coming across some discussion of manipulation of gold and silver markets.

The US financial regulators the CFTC, even conducted a multi year investigation into price manipulation in silver, which ended with a statement that “Based upon the law and evidence as they exist at this time, there is not a viable basis to bring an enforcement action with respect to any firm or its employees related to our investigation of silver markets.”

“The Gold Anti-Trust Action Committee, an advocacy group that believes the Federal Reserve and banks are colluding to keep gold and silver prices artificially low, said it was not surprised by the CFTC decision.

“We believe that the U.S. government is part of the trading operation. In essence, you are not going to have the CFTC turns against its own government,” GATA Chairman Bill Murphy said.

“We are not even slightly surprised and had expected this.”

When we first started writing on gold and silver back in 2009, GATA was definitely seen as a conspiracy organisation but it is testament to their efforts that the existence of manipulation in the gold and silver markets seems to have become quite widely accepted by many in the precious metals community now.

We won’t attempt to summarise the evidence that they have gathered here. But there is plenty. We’d recommend you go through the written transcript of the speech that GATA secretary Chris Powell gave here in Auckland last year. This documents and has links to various pieces of evidence that GATA has gathered over the years.

Including from the likes of the “Central Bank for Central Banks”, the Bank for International Settlements (BIS) and the (International Monetary Fund) IMF. So while we are yet to see a Central Banker stand up publicly and say “Yes I did it”, there is a good deal of evidence pointing to what some might prefer to call interference, or price management in the precious metals markets…

Chris Powell in Auckland: Gold price suppression – why, how, and how long?

In the speech Chris covered:

- Why do Western central banks rig the gold market?

- How do Western central banks and particularly the U.S. government rig the gold market?

- How Western central bank market rigging goes far beyond gold.

- How there are many official admissions of gold market rigging.

- How then there is the evidence of the market itself.

- Why does all this matter? How and when will it end?

More recently the German Financial regulator has also announced an investigation into the London Gold Fix. Who knows whether this will actually amount to anything or if it is just being down to appease the “stirrers” in Germany?

But the old saying regarding smoke and fire springs to mind.

But how exactly might Central Bankers or major banks in general intervene in gold markets?

This recent article (Now is the Time to Buy Gold) and an earlier short video linked below by Bud Conrad, chief economist at Casey Research outlines how quite nicely.

An excerpt from the article states:

“Why Has Gold Fallen $700 Since 2011?

In our distorted world of debt-ridden governments and demand from Asia, gold should continue rising.

What’s going on?

The gold price quoted all day long comes from the futures exchanges. These exchanges provide leverage, so modest amounts can be used to make big profits. Big players can move markets—and the biggest player by far is JPMorgan (JPM).

For the first 11 months of 2013, JPM and its customers delivered 60% of all gold to the COMEX futures market exchange; that, surely, is a dominant position that could affect the market. By supplying so much gold, they are able to keep the price lower than it would otherwise be.

A key question is why a big bank would take positions that could drive gold lower. Answer: Banks gain by borrowing at zero rates. But the Federal Reserve can only continue its large quantitative easing programs that bring rates to zero if gold is not soaring, which would indicate weakness in the dollar and the need to tighten monetary policy. Voilà—we have a motive. Also, suppressing the price of gold supports the dollar as a reserve currency.”

Here is the video: Evidence on Why Gold Is Falling on the Verge of a Dollar Implosion

Back in April last year after the price of gold plunged $200 an ounce in just a few days Bud also wrote a well reasoned piece on the hows and whys of gold being manipulated (Physical Gold vs Paper Gold: The Ultimate Disconnect). Including some thoughts on why someone would sell 400 tonnes of paper gold in one hit. They obviously weren’t trying to get the best price, so more likely they were trying to move the price lower and trip “stop losses” of other traders. They succeeded and the price fell rapidly lower.

But if gold’s manipulated why has it still risen then?

A common retort is that if the gold price is manipulated then how has it risen from US$250 in 1999 to as high as US$1895 a few of years ago?

Chris Powell of GATA states that the Central Banks have been staging an “orderly retreat”. Without their intervention it would have been many multiples higher he believes. They have merely managed to dull it’s rise, until more recently when they have managed to actually send it lower.

Of course most of these articles we’ve quoted only deal with the price fall since April of last year. With suspicious large sales of paper gold happening on multiple occasions in 2013, it would seem the intervention in the gold market became much more blatant.

Read more: If Precious Metals Prices Are Manipulated, Why Does the Price Rise at All?

Then why was the gold price also falling prior to 2013?

Well most of these manipulation arguments could also be applied to the previous couple of years.

But there is also the consideration that gold had gotten a bit too widely followed and popular in the lead up to it hitting the peak of US$1895 in 2011.

This involved many hedge funds and momentum players entering the market – known as the “speculators” in the COMEX Futures Commitment of Traders reports. They are trend followers and not so likely to be holders of physical gold but rather of futures contracts or ETFs. So they can leave just as quickly as they arrived, which they have certainly done.

It is in the paper markets where the price is set. These are leveraged anywhere from 5 to 100 times (depending on whose numbers you take) more than the actual physical metal available. So while we have seen phenomenal physical demand across the globe, from China to India and even western mints such as the US, Canadian and Perth Mint, it is the paper markets where the price remains set (well perhaps at least for now).

So while our reader stated…..

“Why are people not rushing out to buy Gold to hedge their bets against the so called Fiat currencies, and why is the demand for gold progressively declining with its price?”

In the east people have been rushing out to buy. And even in the west there have still been record sales of physical gold in the past year.

(Refer to this recent article on gold demand from around the globe over the past year.)

So these numbers wouldn’t seem to indicate that demand for physical gold has been progressively declining.

However we have noticed less people buying in the past couple of months, which we think may be another indicator of the market bottoming out.

So this increase in physical demand while the price keeps falling would seem to indicate that it is what futures traders on COMEX and in the London OTC (Over the Counter) markets do that seems to move the price most. And overall of late they have been selling for the most part.

At some point we reckon this will change and given how low “registered” gold stocks available for delivery have gotten in the last couple of months, we might have already seen this change. (See this article if you’d like to know more about registered versus eligible gold inventories on the COMEX).

Ronald Stoeferle in his presentation in Auckland last year also gave a list of reasons as to why gold has been falling. He touched on a number of reasons that have affected the sentiment towards it:

Ronald’s Reasons Why Gold Has Been Falling

– Disinflation – the money supply has decreased in the Eurozone and the UK

– the outlook of QE being tapered and eventually exited

– rising real interest rates

– partly declining money supply (especially ECB)

– record high short positions

– backwardation since April 5, which has intensified

– rising opportunity cost of owning gold due to the rally in stocks

– ETFs: the majority of the outflows were from the SPDR gold trust, and thus probably mainly initiated by US investment managers who are turning away from gold in order to switch into the rallying stock market

– tightening credit spreads

– cascading sell orders by trend-following systems, CTAs, managed futures accounts, etc., as the technical support level of $1,530 was violated

– increasingly negative analyst opinions (among others, Goldman Sachs, Credit Suisse, Societe Generale,…)

So the short answer to why the gold price has been falling?

Perhaps a mix of intervention in the paper market, along with some damage to the sentiment towards gold. The financial system is based upon confidence and for the past few years rightly or not, most people believe things have gotten better and will continue to do so. So they have not seen much need for financial insurance in the form of physical gold bullion. Well, in the West at least.

China has continued to buy up large over 2013 (in excess of 1100 tonnes), which seems to have made up for the reduction in demand caused in India by the government intervention in the form of large import tariffs and restrictions on gold.

So far this physical demand seems to have not been enough to impact the paper price. However in recent weeks that appears to be changing with the price now looking likely to have set a bottom in late December.

At some point in the future we reckon it’s likely these trillions created by Central Banks over the last 5 years will find their way into the wider global economy. Perhaps by the Federal Reserve reducing the interest rate they charge commercial banks for holding their “excess reserves” with the Fed? When this happens we will possibly see a more dramatic impact on the gold price.

But perhaps the best answer as to why after all the trillions that have been printed gold hasn’t gone to the moon is that given by veteran financial newsletter writer Richard Russell: “Gold always does what it should do … it just never does it when we think it should.”

So it could happen at a rather unexpected time too.

Why do you think the gold price has fallen over the past couple of years? Do you agree with our reasons? Show us you’re alive and leave a comment below.

Pingback: Gold Continues to Quietly Rise | Gold Prices | Gold Investing Guide

Pingback: Paper Gold Ain’t as Good as the Real Thing | Gold Prices | Gold Investing Guide

Pingback: What’ s driving the gold & silver price up now? | Gold Prices | Gold Investing Guide