Gold Survival Gold Article Updates:

Feb. 5, 2014

This Week:

- NZ Bank Failure “Bail In” Scheme

- Gold and USD both rising together

- Why is Silver Lagging Gold?

- Not Convinced of Rising Interest Rate Story Yet

Our weekly email is a day early today with Waitangi Day tomorrow. So we’ll try and keep it relatively brief too.

It’s been a volatile week to say the least. Particularly in foreign exchange markets and in most stock markets around the world too.

Although they are back up today, US shares tumbled yesterday after falling steadily for the past week or so. Likewise the kiwi dollar has been falling all week but has bounced sharply back up over a cent today to be at .8193. Probably not surprising given it was getting into oversold territory after having tumbled rapidly a few cents in a couple of weeks.

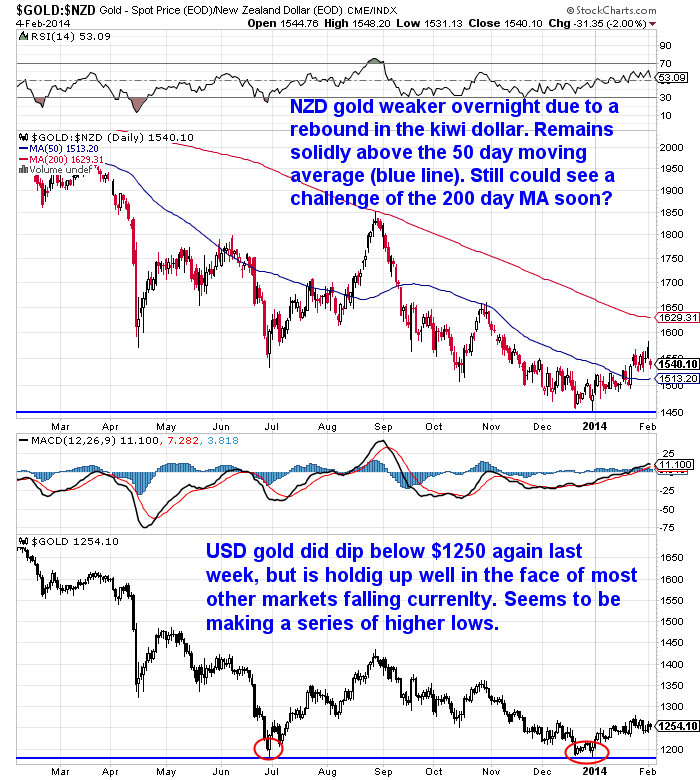

So while gold in US dollars has been holding fairly steady around $1259, the stronger kiwi dollar overnight has seen the local gold price fall $16.27 since last week or 1.05% to be at $1531.73 today.

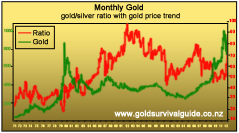

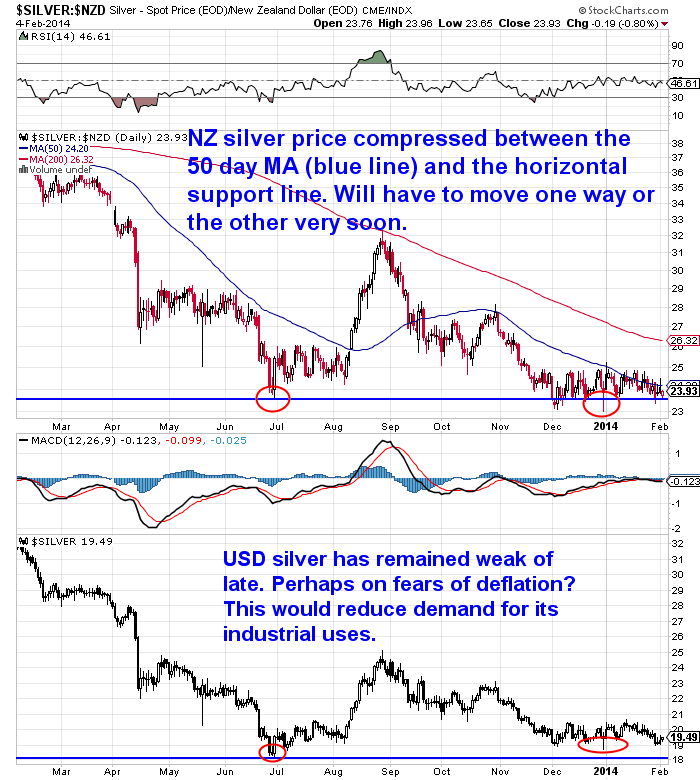

Likewise silver is down 33 cents per ounce or 1.37% to be under $24 again at $23.82. So silver whether in US dollars or NZ dollars has yet to get solidly above the 50 day moving average. Unlike gold which has clearly broken above this shorter term trend indicator. But you can see in the silver chart below that the price is being compressed between the blue 50 day moving average line and the horizontal support line. So it will have to break in one direction or the other very soon.

Why is Silver Lagging Gold?

Poor mans gold has been behaving poorly of late. While gold is starting to show signs of life, silver has just been bouncing along the bottom, trading in a pretty tight range for the past 2 months.

Why is this?

Well we could make a good argument for manipulation. But there might also be some reasons why actual real people have been going for gold rather than silver of late.

Our best guess is that it is due to silver being only partially a monetary metal in comparison to gold. Silver has a multitude of industrial uses (which we touch on in this article: Why Buy Silver). Much moreso than golds industrial uses.

So silver is more susceptible to opinions on global growth as a weakening world economy would mean less industrial silver demand. Given there appears to be a bit of doubt around currently about the global economy perhaps this is the reason for silver underperforming gold?

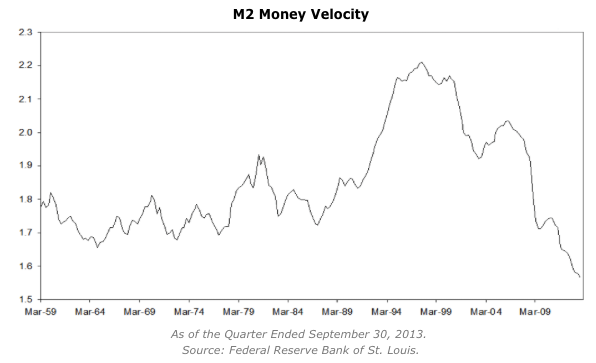

Money velocity remains low, showing all those trillions of digital money created by the US Federal reserve are yet to seriously make it into the wider economy (as we’ve discussed recently).

This would seem to portend a fear of deflation rather than inflation currently. Given gold is almost purely a monetary metal then people would be turning to it in times like these and ignoring silver. This is why we like to have a bit of both gold and silver as they don’t necessarily both move in unison.

Evidence of Fear of Deflation

This fear of deflation is also shown by the fact that so far this year, bonds are up (i.e. their interest rates are down), the USD is up, gold is up, and most stock markets are down (along with silver as mentioned already and platinum too).

Most people would be surprised to see gold and the US dollar rising at the same time, given gold is meant to be the “anti-dollar” but every now and then they both move up at the same time. This happened back in 2008/09 and it also happened towards the end of the last precious metals bull market in 1979.

It is of real interest to us in New Zealand as this is when we see the local gold price rise most sharply as the kiwi dollar weakens while the USD gold price also rises – a double shot as I think we said last week. Since the start of the year we have seen this with the local gold price in NZD rising more than in USD.

Not Convinced of Rising Interest Rate Story Yet

So for these reasons we are also not convinced that interest rates both abroad and at home will necessarily rise in a slow steady fashion as most predict. If the near to medium term risk is deflation then we would likely see a continuation of “safe haven” buying. More people buying the likes of US treasuries would mean that interest rates would stay lower too. As we have seen so far this year, it is possible that people continue buying gold at the same time.

Back here at home, deflation in the world economy would impact export demand and a weaker economy would lessen the need for the Reserve Bank to raise interest rates. As we’ve said recently we could see rate rises before then witnessing a backtrack and more rate cuts.

A deflationary scare would obviously slow up the Feds taper plans and this could be a trigger for the New Fed Head Yellen to come up with a plan to reduce the interest rate the Fed gives banks for holding their “excess reserves” with them. And there are A LOT of these reserves.

Inflation Versus Deflation

This would be the deflation first and then inflation scenario. Whereby the Fed responds to falling asset prices with the bazooka of a rate cut on the mountain of reserves banks are being paid to hold with them.

This inflation / deflation battle is shown brilliantly in Ronald Stoeferles latest chart book. A bit of which we featured last month.

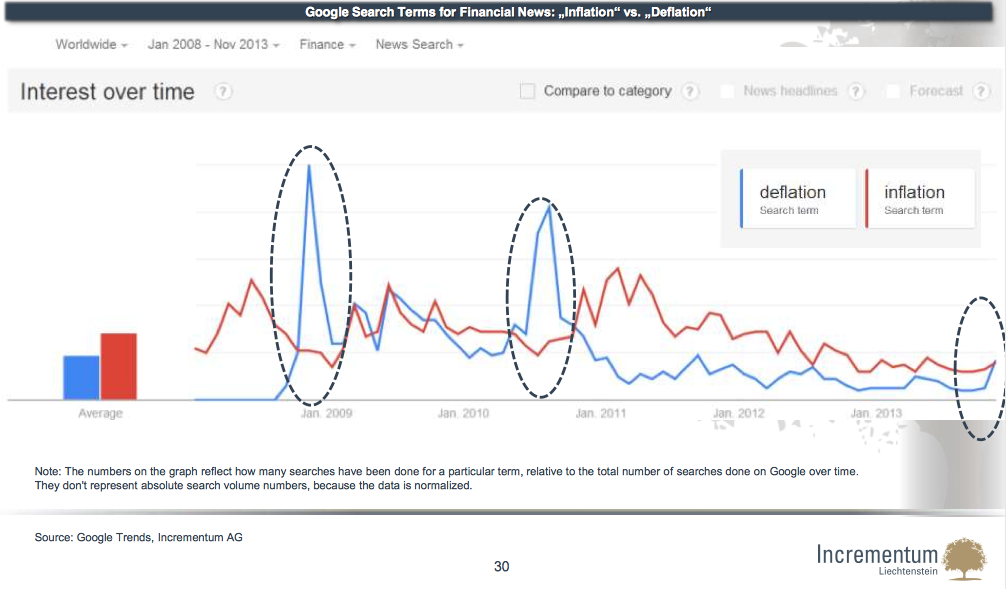

The chart below of Google Trends shows the numbers of searches for deflation have taken a recent uptick. Still along way from the volume in 2008/09 and in 2010 but it is pointing up.

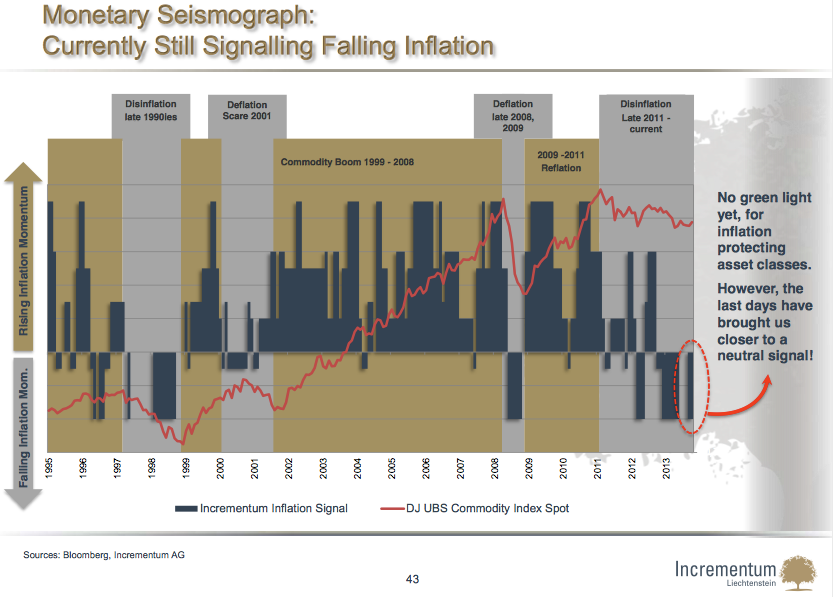

Also from Ronnies Chartbook is this chart of Incrementums “Monetary Seismograph”.

They explain the measure like this:

“Price inflation is a monetary phenomenon. Due to the fractional reserve banking system and the dynamics of ‘monetary tectonics’, inflationary and deflationary phases may alternate.

To measure how much monetary inflation is spilling into the markets, we utilize a number of market-based indicators, which are combined in a proprietary signal. This method of measurement can be compared to a monetary seismograph.

The measurement results in the “Incrementum-Inflation Signal”, indicating the current momentum of inflation.

From our point of view, it is not the absolute level of inflation but rather the change of inflation that matters. According to the respective signal we position ourselves for rising, neutral or falling inflation trends.”

(By the way, the full Chart Book can be found here.)

So Incrementums measure shows we have been in “disinflation” since late 2011, but could be getting close to a change in inflation levels.

Ronnie explains in more detail some content from his latest chartbook in a post on King World News that we’d recommend you check out. Ronald Stoeferle on King World News

NZ Bank Failure “Bail In” Scheme

If you’ve been keeping an eye on us for a while you will no doubt have read about the NZ Reserve Banks “Open Bank Resolution (OBR). Basically a means of avoiding a taxpayer bailout of a failed bank by instead using customers deposits.

If you’ve been keeping an eye on us for a while you will no doubt have read about the NZ Reserve Banks “Open Bank Resolution (OBR). Basically a means of avoiding a taxpayer bailout of a failed bank by instead using customers deposits.

A question as to whether we knew of any videos on the subject from a reader/client, prompted us to throw one together. So if you have yet to learn about the risks facing your money in NZ banks then be sure to check that out. It also contains links to the previous articles we’ve written on the subject.

RBNZ Bank “Bail In” Scheme for Bank Failures: The Open Bank Resolution (OBR)

A must read article on the site this week is from Bud Conrad who we have a soft spot for since it was a dinner he was speaking at that led to our meeting and the idea of goldsurvivalguide.co.nz being hatched back in 2008. Bud lays out clearly just why he thinks now is the time to again be buying gold. He covers most of the happenings in the gold space of late, including China buying, COMEX and ETF inventories dwindling, the reasons why gold fell and how there is a crisis brewing in the gold market. Definitely our must read of the week

A must read article on the site this week is from Bud Conrad who we have a soft spot for since it was a dinner he was speaking at that led to our meeting and the idea of goldsurvivalguide.co.nz being hatched back in 2008. Bud lays out clearly just why he thinks now is the time to again be buying gold. He covers most of the happenings in the gold space of late, including China buying, COMEX and ETF inventories dwindling, the reasons why gold fell and how there is a crisis brewing in the gold market. Definitely our must read of the week

Finally is a piece on Junior Gold Stocks, who have quietly started the year as the best performing asset of the past month. Not something many would have expected. History shows there can be a mountain of upside in these when they turn.

Finally is a piece on Junior Gold Stocks, who have quietly started the year as the best performing asset of the past month. Not something many would have expected. History shows there can be a mountain of upside in these when they turn.

A Turning Point in Junior Gold Stocks?

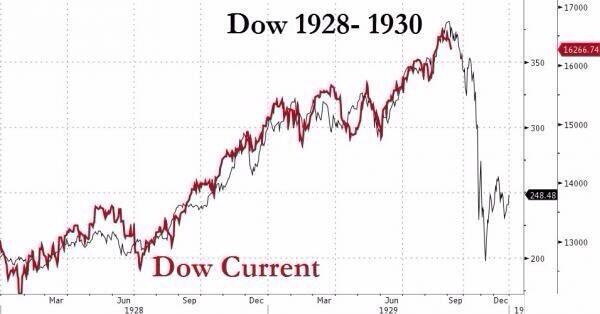

Could we be seeing something of a similarity to the 1930’s when during a period of deflation gold stocks were just about the only group that rose in the stock market?

Speaking of the 1930’s, here’s a chart that we have seen a few times this past week showing the US DOW index is tracking a similar pattern to that of 1928-1930 before the big plummet.

Dow Current v Dow 1928-1930

Monday 3 Feb 2014, Dow dropped 326.05 points, or 2.1 percent, to close at 15,372.80, its biggest decline since June 20, 2013.

An interesting chart, but it wouldn’t surprise us to see them manage to keep things going for a while yet.

Gold can also offer protection from an occurrence like this as the performance of the gold miners back then shows.

Anyway, we reckon Bud Conrad’s article we mentioned earlier makes a pretty good case as why now is likely a decent time to be buying again. Coupled with the fact that interest remains incredibly low from what we are seeing. Buying today you will be in the minority for sure. So If you agree with Bud and also want to go against the grain and begin or add to your stack then get in touch:

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| 2014 Bad News (is Finally) Good News For Gold |

2014-01-29 22:36:59-05Gold Survival Gold Article Updates: Jan. 30, 2014 This Week: Bad News (is Finally) Good News For Gold Money Still Record Cheap Here in NZ Lessons (And a First Hand Report) From Japan US Debt Ceiling – Forgotten But Not Gone Bad News (is Finally) Good News For Gold This morning we’ve seen […] 2014-01-29 22:36:59-05Gold Survival Gold Article Updates: Jan. 30, 2014 This Week: Bad News (is Finally) Good News For Gold Money Still Record Cheap Here in NZ Lessons (And a First Hand Report) From Japan US Debt Ceiling – Forgotten But Not Gone Bad News (is Finally) Good News For Gold This morning we’ve seen […]

|

| A Turning Point in Junior Gold Stocks? |

2014-02-03 04:56:04-05The folks at Casey Research seem fairly convinced that we are witnessing a turnaround in the precious metals sector currently. Here’s why they think the junior gold stocks are the place to be as the turn around begins… A Turning Point in Junior Gold Stocks? By Doug Hornig, Senior Editor It’s not exactly news that […] 2014-02-03 04:56:04-05The folks at Casey Research seem fairly convinced that we are witnessing a turnaround in the precious metals sector currently. Here’s why they think the junior gold stocks are the place to be as the turn around begins… A Turning Point in Junior Gold Stocks? By Doug Hornig, Senior Editor It’s not exactly news that […]

|

| Now Is the Time to Buy Gold |

2014-02-03 15:48:48-05As we’ve mentioned before, a presentation here in Auckland by Bud Conrad, Casey Research’s chief economist, was where we first met and where the idea of goldsurvivalguide.co.nz was first born. So partly for this reason we always pay attention to what Bud has to say. However more importantly he always gives a logical and analytical […] 2014-02-03 15:48:48-05As we’ve mentioned before, a presentation here in Auckland by Bud Conrad, Casey Research’s chief economist, was where we first met and where the idea of goldsurvivalguide.co.nz was first born. So partly for this reason we always pay attention to what Bud has to say. However more importantly he always gives a logical and analytical […]

|

| RBNZ Bank “Bail In” Scheme for Bank Failures: The Open Bank Resolution (OBR) |

2014-02-04 15:32:16-05Here’s a quick video summary of the Reserve Bank Of New Zealand’s Open Bank Resolution (OBR) scheme. Implemented in June 2013 as an alternative to a government (i.e. tax payer) bail out of any failed bank in New Zealand, this rather innocuous sounding name actually means a Cyprus like bank “bail in” or depositor “Hair […] 2014-02-04 15:32:16-05Here’s a quick video summary of the Reserve Bank Of New Zealand’s Open Bank Resolution (OBR) scheme. Implemented in June 2013 as an alternative to a government (i.e. tax payer) bail out of any failed bank in New Zealand, this rather innocuous sounding name actually means a Cyprus like bank “bail in” or depositor “Hair […]

|

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1531.73/ oz | US $1254.95/ oz |

| Spot Silver | |

| NZ $23.82/ ozNZ $765.89/ kg | US $19.52/ ozUS $627.49/ kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

(price is per kilo for orders of 1-4 kgs)

$833.30

(price is per kilo only for orders of 5 kgs or more)

(Fully insured and delivered)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

Copyright © 2011 Gold Survival Guide. All Rights Reserved.

Pingback: QUANTITATIVE EASING: THE KILLER SOLUTION | Gold Prices | Gold Investing Guide

Pingback: What’ s driving the gold & silver price up now? | Gold Prices | Gold Investing Guide

Pingback: Gold breaks out | Gold Prices | Gold Investing Guide

Pingback: Silver continues to under-perform gold | Gold Prices | Gold Investing Guide

Pingback: Gold Prices | Gold Investing Guide Gold Continues to Quietly Rise