This Week:

- Double-Digit Losses in Silver by the End of 2016?

- World’s Largest Derivative Holder Profits Plunge – Will they be Downgraded and Trigger a Derivative Collapse?

- What Does it Mean When the Head of NZ’s Largest Bank is Warning of Housing Collapse?

- Danish Banker Also Warns on Housing

- A Key Driver of the Rise in Gold and Silver this Year?

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1896.75 | + $6.96 | + 0.36% |

| USD Gold | $1338.35 | + $24.06 | + 1.83% |

| NZD Silver | $28.82 | + $0.96 | + 3.44% |

| USD Silver | $20.33 | + $0.95 | + 4.90% |

| NZD/USD | 0.7056 | + 0.0101 | + 1.45% |

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1824 |

| Buying Back 1kg NZ Silver 999 Purity | $883 |

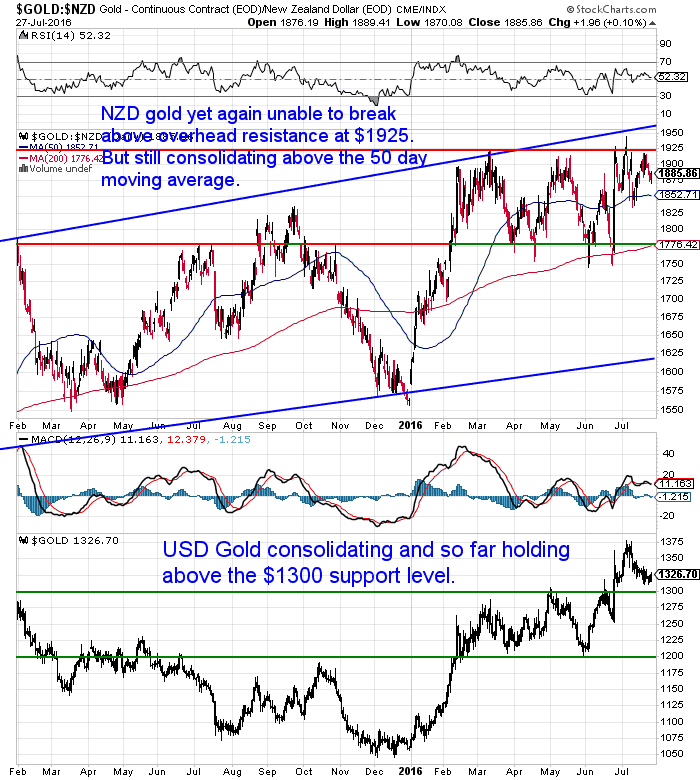

NZD gold has edged up slightly this week from last. It yet again got close to the overhead resistance at $1925 but failed to break through. It continues to consolidate above the 50 day moving average as it has done for the past month.

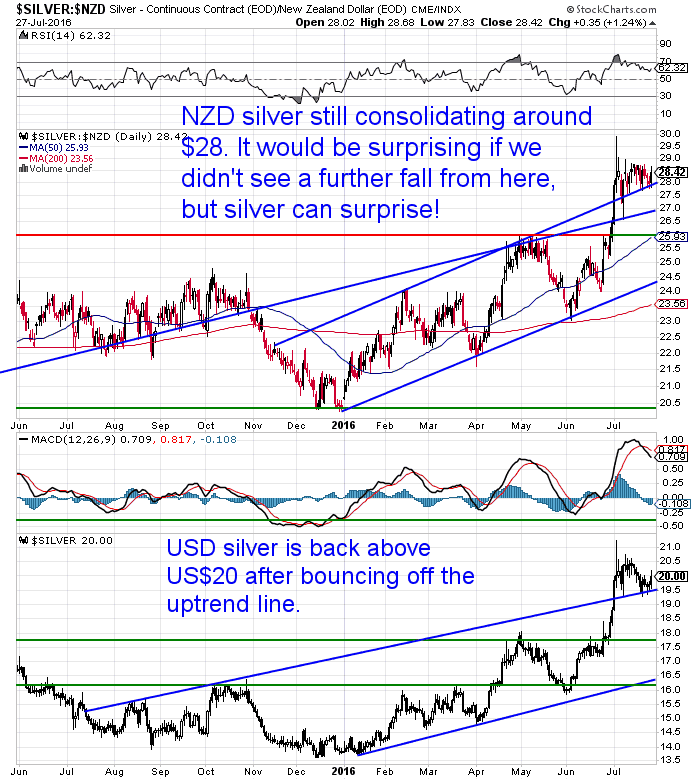

Meanwhile silver continues to surprise and is holding up above the $28 level. After such a strong surge higher it would have been expected to correct more than this by now. The Relative Strength Index (RSI) at the top of the chart has moved down from overbought levels it was at.

We’d still expect that silver would be due to pull back further from these levels yet. But if there’s one thing silver can do it’s that it can surprise us!

But for now it is managing to stay above the uptrend line it broke above a month ago. Perhaps it can continue to consolidate here instead?

More on silver shortly.

The NZ dollar has moved back up this week after it’s sharp plummet when the RBNZ indicated further interest rate cuts are ahead. It’s back above the 50 day moving average and looks to be in an uptrend still to us.

Double-Digit Losses in Silver by the End of 2016?

Steve Sjuggerud reckons it’s likely silver will fall by close to 10% by the end of this year:

- “Based on the Commitment of Traders (COT) Report – a weekly report that shows the real-money bets of futures traders – bullish bets on silver are at their highest level in history.

- Not even in 2011, when silver prices nearly hit $50 an ounce, were futures traders more bullish than they are today.

- This is not a good sign. It shows that the “buy silver” trade is getting crowded today.

- Typically, when sentiment reaches an extreme like this, the opposite happens over the next three months or so.

- That’s exactly what has played out in the past in silver as well…

- You see, optimism on silver is high thanks to the precious metal’s recent gains – specifically the massive 17% gain in June.

- Now, a gain that big in just one month is rare in silver. It has only happened six other times over the last decade. And it has only happened 22 other times going all the way back to 1970.

- Importantly, these large monthly gains tend to signal that silver is getting ahead of itself… Based on history, instead of continuing higher, the metal tends to fall. Take a look…

- Silver tends to fall over the six-month period following these big monthly gains. The metal’s typical six-month return is 2.4%… But these extremes have led to losses of roughly 10%.

- Based on the historical precedent, we could see a double-digit fall in silver prices by the end of the year.

- This is a sentiment extreme. This type of extreme typically affects performance over the next one to six months.

- Looking at the bigger picture, I believe precious metals could head much higher in the coming years.”

Do we disagree?

In short, no. Silver has certainly shot higher and it would not be a surprise to see it pull back from here. If you look back at the silver chart above, in NZ dollar terms a 10% fall from current prices of $28.80 would take it back to around $26.

This would coincide with where the current run up started from and what is now the horizontal support line on the chart.

So this really wouldn’t be a surprise or even a big move. Will it play out over the next 6 months? Who knows? It could happen faster than that. There’s also the chance it may not happen at all.

The argument for the Commitment of Traders (COT) silver futures report indicating that silver is very overbought is somewhat countered by a couple of things we’ve read recently.

Alistair Macleod reasons that it could be institutions that are building non-speculative positions in gold via futures. So they may not leave in a hurry and it could be the bullion banks that are forced to cover their short positions. This would push the price sharply higher. Silver would likely follow in this case:

- “I am also detecting growing interest in gold from investing institutions. They are less likely, perhaps, to think in terms of physical gold, but are interested in building a position in a portfolio context. It should be borne in mind that physical gold is not a regulated investment, but futures are regulated. Institutional interest is therefore likely to focus, initially at least, on the paper markets.

- This brings us back to the relevance of the Managed Money category on Comex. The chart below shows how net longs have exploded to extraordinary levels in recent weeks.

- Analysts would argue that speculative positions this extreme will end in tears.

- Normally, they would be right. But what if investing institutions, and not speculating hedge funds, are using futures to maintain a strategic non-speculative portfolio position in gold? If so, then we can expect a significant and continuing positive bias to net contracts in this category.

- This opens the possibility that the bullion banks, which take the other side of Managed Money longs, could be forced to capitulate. They must be worried that open interest in both gold and silver is larger than in the past by substantial margins. It is no longer a market where persistent shorting and a bit of patience always wins out for them profitably.

- It is a bold call, but it could be “Game On” for the bulls.”

- Source.

So what to do?

We stick to our same old boring advice of if you’re unsure consider breaking the funds you desire to turn into gold or silver into a number of tranches. Consider taking a position now but then keeping some cash in hand in case the correction does eventuate.

World’s Largest Derivative Holder Profits Plunge – Will they be Downgraded and Trigger a Derivative Collapse?

Deutsche Bank, the world’s largest derivative holder today announced their profits had plunged by 98%. A Zerohedge report commented that:

- “…the biggest problem for DB remains its massive balance sheet. Morgan Stanley analysts calculated that Deutsche Bank has a €9 billion capital hole to fill by 2018, and that’s not including damage caused by future litigation costs, which considering DB’s record of pervasive capital rigging, are sure to rise.”

- Source.

But what may really be the biggest issue is that as Bix Weir pointed out there is likely to be a credit rating downgrade on Deutsche Bank to below investment grade in the coming weeks.

Why does that matter?

Because most derivatives “that are written by the issuing company have a triggering requirement of maintaining an investment grade rating.”

So could Deutsche Bank set off a derivative domino before too long?

If you have trouble getting your head around the concept of derivatives check out our beginner’s guide to derivatives.

Derivatives – a Beginner’s Guide to “Financial Weapons of Mass Destruction”

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have 4 weeks emergency food supply.

What Does it Mean When the Head of NZ’s Largest Bank is Warning of Housing Collapse?

Financial advisor and author Martin Hawes shared our sentiments after reading an opinion piece from the head of ANZ last week:

- “This week, David Hisco, CEO of ANZ, wrote the most extraordinary opinion piece I have seen in my many years in finance.

- Hisco detailed the manifold difficulties that face New Zealand: an overvalued exchange rate, the economic trouble of our biggest trading partner and widespread political instability are worry enough, but at the top of Hisco’s list is the housing market.

- Hisco sees storm clouds gathering and does not write “if” they will break but “when” they will break. I have never before seen a senior banker talk down his own book like this.

- Clearly, it is time to take shelter.”

- Source.

We admit to scratching our head about this. As Hawes says it is indeed a strange thing to see the head of a bank “talking down his own book”.

So why is he?

To save face maybe? If this comes to pass he can say “it wasn’t our fault, we tried to tell you” perhaps? We’ll have to keep mulling that over. Please let us know if you have a theory?

Danish Banker Also Warns on Housing

A Danish banker had a very similar sounding warning to the ANZ head this week too:

- “Denmark’s biggest mortgage bank is warning there’s a risk the housing market may get “out of control,” especially around cities, as long-term negative interest rates make borrowers complacent.

- “To be concrete, there is a danger that Danes go blind to the risk of rates ever rising again,” Tore Stramer, chief analyst at Nykredit in Copenhagen, said in an e-mail. “That raises the risk of a major housing price decline, when rates at some point or other start to rise again.”

- Source.

The article goes on to say that apartment prices in Denmark are 5% above their 2006 highs.

So does Denmark have a “housing shortage” too?

Or is excess money, low interest rates and the “Cantillon effect” more likely at play?

Denmark has had negative interest rates longer than anywhere else – 4 years now. So perhaps the fact that the housing market has surged higher should not be a surprise.

We continue to be dubious of the housing shortage theory here in Auckland.

A Key Driver of the Rise in Gold and Silver this Year?

Speaking of negative interest rates. These really are starting to become all pervading.

10 of 23 developed nation’s 5 year government bonds now have negative yields. Meaning you pay the government for the privilege of lending them your money! If you’ve got kids try explaining how that works to them!

This is perhaps a key driver of the rise in gold and silver that we’ve seen this year.

And it’s not just government bonds with negative rates:

- “Natwest has become the first [UK] bank to warn business customers it may charge them negative interest rates on money held in current accounts.

- In what is believed to be a UK first, the bank has signalled its intention to force account holders to either pay to hold money or move funds elsewhere.

- Although current plans for negative rates are restricted to business customers, fears are mounting that “pay to save” rates could soon become a reality for millions of consumers, if other banks follow suit.

- The outgoing pensions minister, Ros Altmann, warned negative interest rates on current and savings accounts pose a threat to the financial security of older savers, who often rely on their savings to provide a retirement income.”

- Source.

No s**t Sherlock. It’s definitely not a good time to be trying to earn a yield on anything. We doubt they needed a government committee to work that one out!

You can see in the chart that New Zealand is a fair way from negative rates yet.

But as more and more other countries go “full retard” on their interest rates, there’s no reason to expect ours not to continue to fall too.

As we say in the intro to one of the articles this week (see link below) who’s to say in such a crazy world that it can’t happen here eventually too?

Here’s What Happens When the World Overdoses on Debt

With the trend in interest rates continuing to be done and the longer term trends in gold and silver looking like being up, it makes sense to take out some financial insurance.

Wanting some small denomination silver?

We have free shipping on boxes of 500 x 1oz Canadian 9999 purity Silver Maples delivered to your door via UPS, fully insured until you sign for them.

Price today is $16,790.

Delivery in approx 7-10 business days.

We wouldn’t be surprised to see the wait times increase for these soon and quite likely the premiums too.

** Urgent Message for All Car Owners **A compact, revolutionary tool can save your life.

We believe everyone who drives or rides in a vehicle must carry this tool.

The Keychain Car Escape Tool can save lives.

For less than the price of 2 movie tickets you can get 2 of these.

One for each car in your family or give one to someone you care about.

—–

This Weeks Articles:

How to Profit From These Massive, Brexit-Induced TrendsWed, 27 Jul 2016 2:57 PM NZST  Yesterday, Casey Research founder Doug Casey shared his thoughts on the Brexit. Today, in part two, he lays out the major trends the Brexit will accelerate…and explains how you can set yourself up to profit from them… Weekend Edition: How to Profit From These Massive, Brexit-Induced Trends By Doug Casey This has the makings […] Yesterday, Casey Research founder Doug Casey shared his thoughts on the Brexit. Today, in part two, he lays out the major trends the Brexit will accelerate…and explains how you can set yourself up to profit from them… Weekend Edition: How to Profit From These Massive, Brexit-Induced Trends By Doug Casey This has the makings […]

|

Doug Casey on “Brexit”Wed, 27 Jul 2016 2:40 PM NZST  It’s been a month since “Brexit”…the historic event that wiped out more than $3 trillion from the global stock market in two days. But what happens now? Today, Casey Research founder Doug Casey breaks down what the decision means for Britain…and how it foreshadows some big changes in the world at large… Weekend Edition: Doug […] It’s been a month since “Brexit”…the historic event that wiped out more than $3 trillion from the global stock market in two days. But what happens now? Today, Casey Research founder Doug Casey breaks down what the decision means for Britain…and how it foreshadows some big changes in the world at large… Weekend Edition: Doug […]

|

Here’s What Happens When the World Overdoses on DebtWed, 27 Jul 2016 2:27 PM NZST  There seems to be just more and more news items on negative interest rates lately. We seem to be a long way from these here in New Zealand, but for now the trend in interest rates seems to be down still. So who says negative interest rates can’t happen here too? It’s crazy they exist […] There seems to be just more and more news items on negative interest rates lately. We seem to be a long way from these here in New Zealand, but for now the trend in interest rates seems to be down still. So who says negative interest rates can’t happen here too? It’s crazy they exist […]

|

RBNZ: First they taketh and then they giveth backTue, 26 Jul 2016 2:24 PM NZST  This Week: How to Sell Gold and Silver Bullion RBNZ: First they taketh and then they giveth back The Rising Danger Of A Bidless Market How to Survive the Deep State Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1889.70 + $34.29 + 1.85% USD Gold $1314.29 […] This Week: How to Sell Gold and Silver Bullion RBNZ: First they taketh and then they giveth back The Rising Danger Of A Bidless Market How to Survive the Deep State Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1889.70 + $34.29 + 1.85% USD Gold $1314.29 […]

|

The Serious Warning No One’s Talking AboutFri, 22 Jul 2016 1:26 PM NZST  Is “helicopter money” coming to Japan? This article makes a very good argument as to why Japan might be the first major nation to try very soon. This followed a visit to Japan from someone that was previously the world’s most powerful central banker… The Serious Warning No One’s Talking About By Justin Spittler […] Is “helicopter money” coming to Japan? This article makes a very good argument as to why Japan might be the first major nation to try very soon. This followed a visit to Japan from someone that was previously the world’s most powerful central banker… The Serious Warning No One’s Talking About By Justin Spittler […]

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

|