|

Gold Survival Gold Article Updates

Dec. 4, 2014

This Week:

- A Golden Bank Run?

- GOFO Negative Again – So What?

- Prof. A. Fekete: War and Peace – Episode 11/17

- Ben Davies Makes Bold Call

Prices and Charts

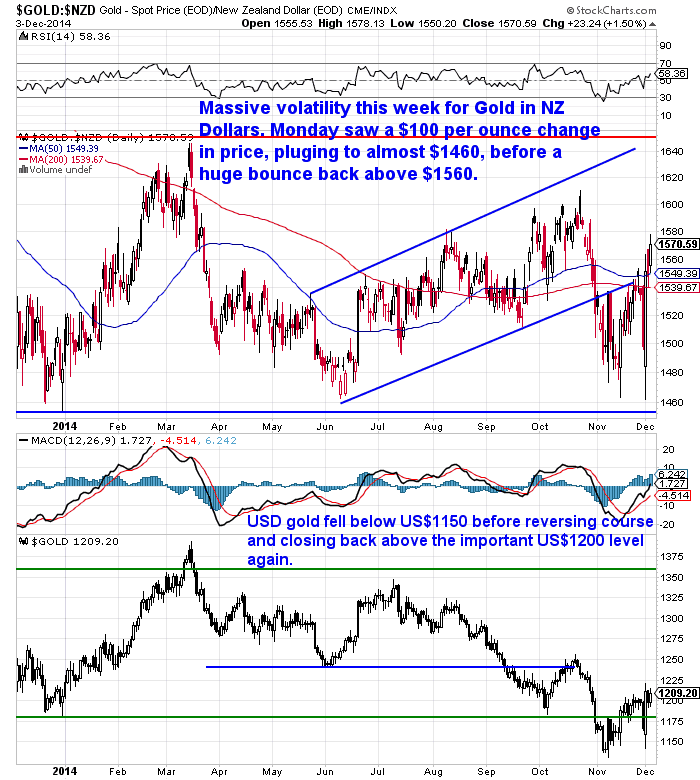

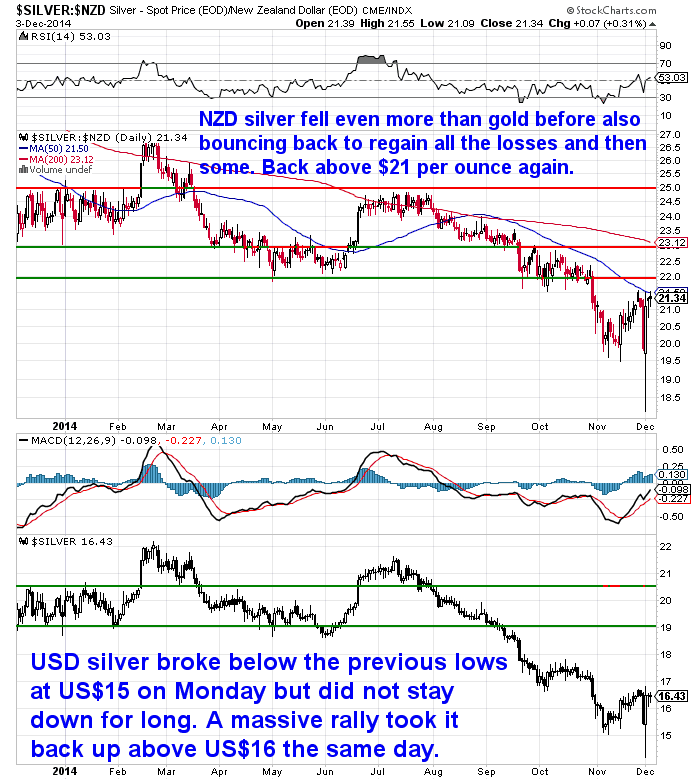

In case you hadn’t been paying attention that was quite a week in precious metals land. Huge intraday volatility on Friday US time and Monday NZ Time. We saw a massive plunge in price in both metals but an almost instant rebound back above previous levels. You can clearly see the range in the charts below. There was a brief window on Monday where a couple of clients managed to grab some silver when the price dipped below US$15 an ounce.

(Actually one of these clients had a standing order in with us to get back to him if we saw close to US$15 silver. So just drop us an email if you’d like us to keep an eye out for a specific price to buy at for gold or silver).

After all that massive movement the end result is that Gold in US dollars is up $11 or 0.91% to $1209.50 from a week ago.

The kiwi dollar fell by 1.24c during the week care of a 7.1% fall in Whole Milk Powder auction prices on Wednesday. So gold in NZ dollars is up $38.57 or a hefty 2.53% to $1561.05. As we’ve said before we’d like to see it above the march high of $1640 before getting too excited.

Last week silver in US dollars was $16.60. After the plunge and rebound we are now down 21 cents to $16.39, or in percentage terms down 1.26% from then.

While silver in NZ dollars is up 6 cents or 0.28% to $21.15.

There has been a fair bit going on this week precious metals wise and we’ve had trouble keeping up. Here’s a quick summary of just a few:

India Surprisingly Axes 80:20 rule

Given there had been talk of the Indian government actually toughening up on gold imports it was quite a surprise to have them completely axe what is know as the 80;20 rule. Meaning anyone who imports gold must re-export 20% of it. No real reason given for why this was done but heading into festival season this will likely see an even greater pick up in demand for gold in India. Source.

Swiss Gold Referendum Fails Big Time

Really not a complete surprise as this would have opened the floodgates if it had passed. With Netherlands repatriating a good pile of their gold reserves and possible French president in waiting Marine Le Pen writing an open letter to their Central Bank calling for the French to do the same and buy more, a passing of the referendum could have really set a match under a number of other nations too.

But the fact that the referendum required that the Swiss National Bank never sell any of their gold meant it was going to be a pretty tall order. Perhaps they should have set their sights a little lower at just a 20% gold backing only? Although for the reasons set out above, we don’t think the powers that be were going to let it pass.

GOFO (Gold Forward Offered Rate) goes Negative Again

At the same time as gold was plunging and rebounding the GOFO rate or lease rate on gold was again going negative.

What was the significance of this?

A blog by one of the fund managers for Bakers Steel (who we’ve seen a number of times at the Gold Symposium in Sydney) broke this down as simply as we’ve seen it anywhere. Interestingly he has worked for the Reserve Bank of Australia (RBA) as a senior Bank Analyst and studied the sale and leasing of RBA’s gold reserves. So he has some first hand insight on the topic:

—–

A Golden Bank Run

…I’ve been studying lease rates and GOFO for years, and I think real panic is brewing within certain gold depositors. Whether it’s been all the talk about gold repatriation, high and rising physical premiums in China and India, falling registered COMEX gold levels, technical default by several European banks who elected to close gold accounts and pay-out in cash only, retail rationing at global mints or more likely first hand experience of a bullion bank pushing back on requests to return their gold deposit.

This is one reason why I can’t understand why wealthy investors would turn themselves into bank depositors – why would they trust bullion banks to store and manage their gold for them when the whole case for gold holdings is to completely eradicate any form of third party credit risk. It’s always the depositors that fare worst and have the most to lose.

From the bullion banks perspective (remember they are the ones setting the GOFO rate) negative GOFO means instead of accepting gold deposits, posting $ in return and charging the depositor the GOFO “yield” they are now so desperate for gold deposits that they are advertising to accept gold, post $ in return PLUS pay for the privilege (0.6% annualised for rolling 1 month agreements).

Think about it again. The bullion bank is accepting an asset that has no intrinsic return, has expenses to insure and store, and in return is posting $ that it could otherwise invest in the markets, $ that it otherwise has to raise via it’s individual cost of capital. For this exchange, they themselves are coming up with a negative charge!

Now the question to ask is why? Like any fractional bank, the bullion bank is mismatched between deposits and loans. What is happening is that they are being hit from both sides. Depositors are lining up demanding return of their bullion and at the same time their borrowers (mining companies) are struggling with their own default probabilities (see CDS on gold miners – its on the rise as gold prices near the cost of production).

Also bullion banks do not simply keep the gold on account. They mobilise it in their own investment books, they rehypothecate it, they register it on exchanges for futures contracts delivery, in summary they can’t always get it back.

Being hit from both sides like this makes a default progressively likely. The most aggressive gold depositors will be best placed, as in any bank run. First in, best dressed. As the panic spreads gold’s physical premium (convenience yield) will shoot higher, and overnight gold will go bid only. I would recommend you get your physical requirements in order well before that moment.

Source.

—–

It’s fair to say this is a fairly complex topic. But the previous times backwardation and negative GOFO have occurred have preceded important bottoms in gold, so we think this is a topic worth getting your head around.

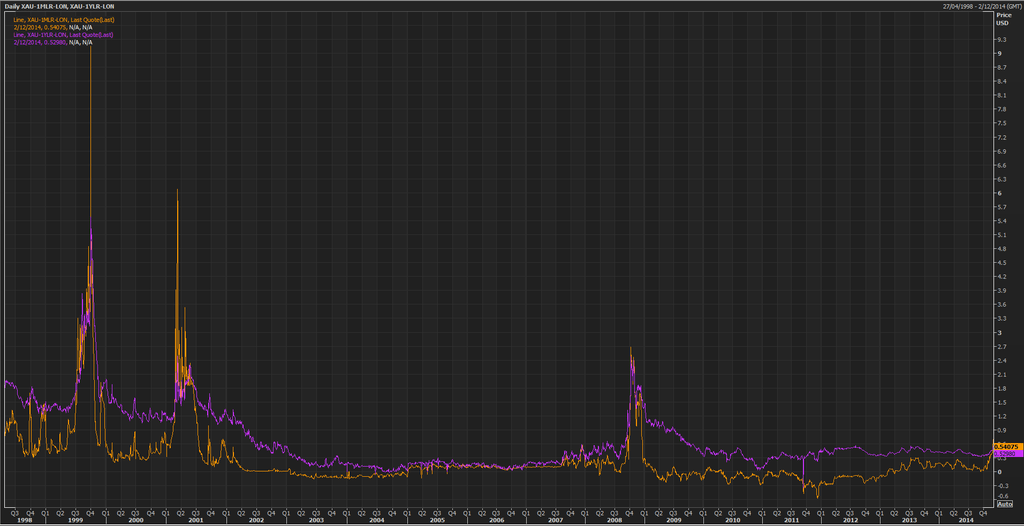

Although Bron Suchecki (of the Perth Mint) who we learnt about the above blog from, did share the following chart on his personal blog showing that we are still someway off the historical lease rates of 1999, 2001 and 2008 yet.

However this is still another straw in the wind indicating not all is completely hunky dory in the paper gold markets.

We had a crack at this topic ourselves last year, so if you’d like to understand more about this we’ve included two previous articles below. In the first we look at various opinions on the these 2 topics and then give our own conclusions at the end. We had a crack at this topic ourselves last year, so if you’d like to understand more about this we’ve included two previous articles below. In the first we look at various opinions on the these 2 topics and then give our own conclusions at the end.

Hopefully we’ve broken them down enough for someone new to precious metals to understand, but it should offer plenty of thoughts also for those who have already read a bit on these topics.

Gold Backwardation and Negative GOFO – What does it all mean?

Sandeep Jaitly Discusses GOFO and Backwardation

Ben Davies Makes Bold Call

It’s fair to say King World News is known for fairly over the top headlines and opinion pieces by various “gold gurus”. Some of which have come to pass others not so much. Someone who hasn’t been on for a while is Ben Davies from England, so he hasn’t been calling bottoms for the past 18 months like some others have. (We saw an interesting presentation by him at the Gold Symposium a couple years back, so we’ve always kept an eye on what he has to say. )

He’s made what is a pretty bold statement that he thinks the action on Monday in gold and silver is indicative of a “sea change” in these markets. He also reckons that we’ll see US stock markets back at October lows before Christmas so it’s time to sell stocks and buy gold and silver. So we’ll see if he’s right in due course or if he ends up with egg on his face like a number of others have making bold calls. We still wonder if stock markets won’t head higher yet as there is not the universal bullishness on them that is usually seen at market tops.

So if you think Ben Davies is correct or that negative gold lease rates are indicative of troubles brewing in the paper gold markets, then you might want to get some physical gold or silver at what remain very low prices.

Free delivery anywhere in New Zealand and Australia

A box of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, with free delivery fully insured anywhere in NZ or Australia is $12,750 and delivery is now about 7-10 business days away. |