|

Gold Survival Gold Article Updates

Oct. 30, 2014

This Week:

- Gold Down But Silver Holds Steady

- NZ Dollar Tumbles

- Gold Coverage Ratios – How Much Gold Does NZ Have?

- Petrodollar Shenanigans

We’ve got a video and 3 articles on the website this week, so scroll down to check all them out.

Gold Down But Silver Holds Steady

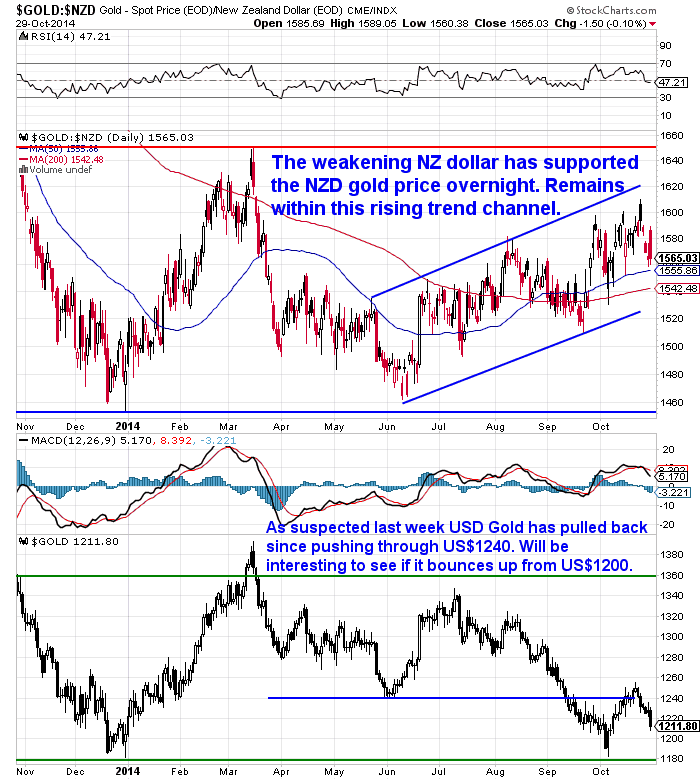

Not surprisingly gold took a dive after what we have read was a fairly “upbeat” Fed Announcement earlier this morning. As we suspected it might last week after breaking through US$1240 it has since pulled back and is closing in on US$1200 again. It will be interesting to see if it can bounce back again from there. It is down $29.36 or 2.36% from a week ago to US$1212.50

However a much weaker NZ dollar following the RBNZ announcement this morning has held the local gold price up. Gold in NZD is down just $11.92 or 0.76% from last week to $1556.08 this morning.

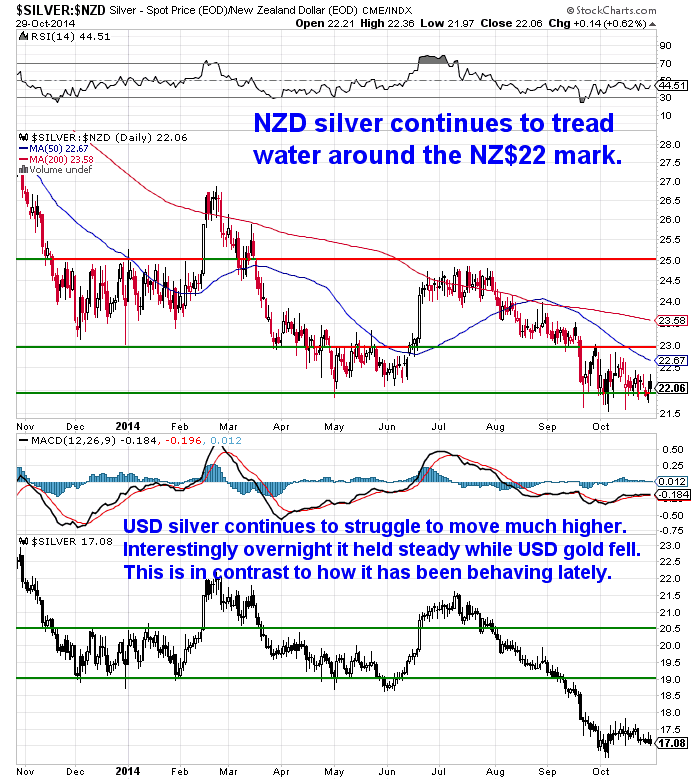

Silver in USD is down just 6 cents or 0.35% to $17.11 from last week. It was very interesting to see silver hold up well in the face of a decent fall by gold. This was in stark contrast to silvers behaviour of late, where silver has been falling more than gold and then also failing to rise as much as gold either. So it will be interesting to see if it can continue to hold above US$17.00

Again thanks to the weaker Kiwi, silver in NZD is actually up 28 cents or 1.29% to $21.96 from a week ago.

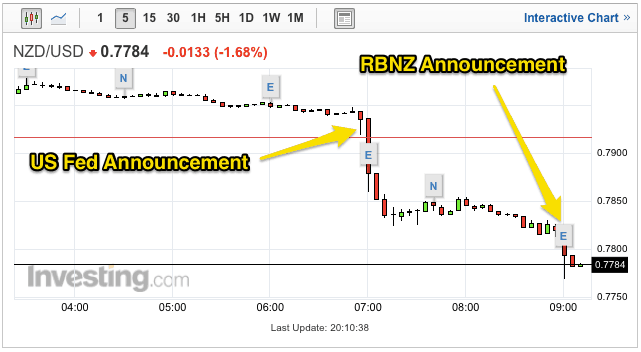

NZ Dollar Tumbles

As noted earlier the NZD took a dive overnight dropping close to 2 cents at one point. The US Federal Reserve announcement did most of the damage and then the RBNZ talking it down further also added to the pressure.

A NZ Herald report noted:

—–

“The central bank’s comments were slightly more “dovish” than many had expected, and dealers noted a key feature of the previous announcement in September – “nevertheless, we expect some further policy tightening will be necessary” – was omitted this time.

“This omission will further fuel the skeptics in the market who believe the RBNZ will not tighten any further,” Westpac said in a commentary.”

—–

As we’ve noted many times in recent months we have thought that the talk of steadily rising interest rates is premature both here and abroad. Back in April we noted:

—–

“It is noteworthy that whole milk prices have fallen 20% in the past couple of months. Inflation also seems to be slowing as opposed to rising. The RBNZ raised its inflation projection at the time of the March OCR increase from 1.5% to 1.9%. But the March quarter CPI came in much below expectations (0.3% versus 0.5%) so the need for further rate hikes could be a somewhat less than most expect.

If this plays out we might well see the NZ dollar weaken from where it is. “

—–

So far this has been the case – no further rate hikes and a weaker kiwi dollar.

We heard it mentioned on the radio this week that one of the bank economists, we think it was ANZ Chief Economist Cameron Bagrie, thinks the RBNZ’s next move could actually be to cut interest rates. This is quite an about turn from what the economists were saying only a few months ago. So the steady as she goes rates rises that everyone in the mainstream has been predicting look less and less likely.

In an ASB note we just received via email they state:

—–

“Although the RBNZ’s decision to hold the OCR at 3.5% was widely expected, markets were surprised by the dovish tone of the OCR Review statement. The subdued inflation environment has seen the RBNZ water down its tightening bias substantially. The central bank is still considering further policy adjustment this cycle, but has opened the door to the possibility that it won’t need to raise the OCR any further.

We expect two further OCR increases this cycle given our forecast of a pick-up in inflation from late 2015.”

—–

So they still expect a couple more rate rises yet. We shall see.

We think this is more evidence of deflation knocking on the doors of many nations. Even though most Central Planners continue to sing The Lego Movie song “Everything is Awesome, Everything is Cool”, it’s not all coming up roses.

This week the Swedish Central Bank actually cut their interest rate to 0% saying:

—–

“The Swedish economy is relatively strong and economic activity is continuing to improve. But inflation is too low. The Executive Board of the Riksbank has therefore decided that monetary policy needs to be even more expansionary for inflation to rise towards the target of 2 per cent. The Board is cutting the repo rate by 0.25 percentage points to zero per cent, and making a significant downward revision to the repo-rate path. Their assessment is that the repo rate needs to remain at this level until inflation clearly picks up. It is assessed as appropriate to slowly begin raising the repo rate in the middle of 2016.”

Source.

—–

So everything is awesome and cool, but we need even lower interest rates to counter the low inflation?

These unexpectedly low inflation rates seem to be popping up everywhere. Last week it was here in NZ where they came in below expectations, and we’ve had similar reports from all across Europe in recent weeks.

So the “race to debase” could be about to gain some further traction with no country wanting their currency to rise too much. However every country on earth can’t have low exchange rates all at once.

Actually hold that thought – maybe they can – against gold. We stand corrected.

Have you got yours yet?

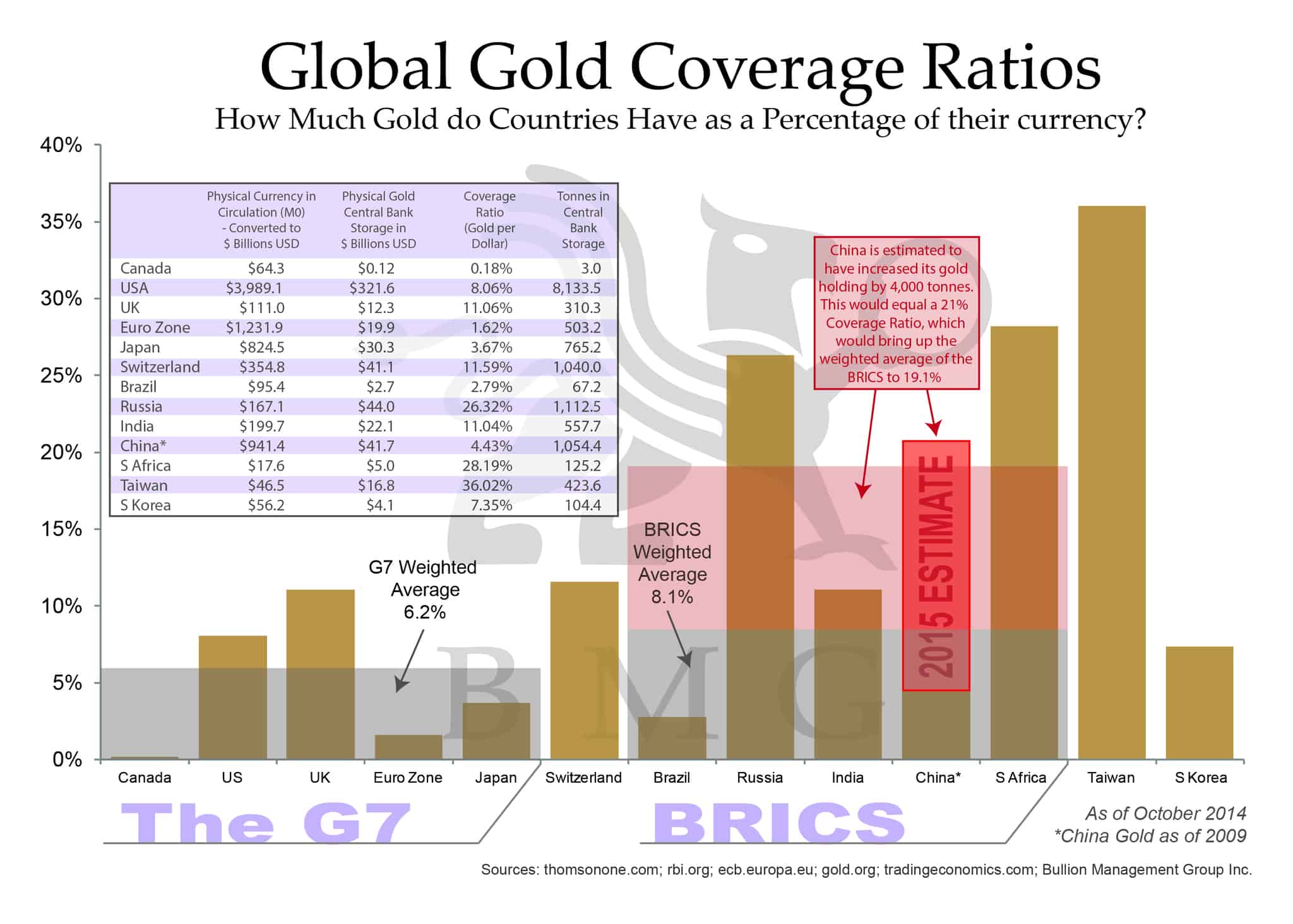

Gold Coverage Ratios – How Much Gold Does NZ Have?

Don’t rely on our National Gold Reserves to protect you though. As the graphic below care of BMG shows (and as we’ve written many years ago) New Zealand doesn’t have any gold reserves to speak of. So our coverage ratio is 0% (i.e. how much gold we have as a percentage of our currency).

It’s interesting to see a visual comparison like this. Of course this topic has gained a bit of press lately care of the Swiss Gold Referendum. Which if voted in favour of, and polls reflect it being pretty tight, would require the Swiss National Bank to buy about 1,593.94 tonnes of gold over the next three years to bring its gold holdings up to 20% of reserves. That’s a fair bit of gold to buy, given that annual gold production is just over 3,000 tonnes.

So if you don’t have any it could be a good idea to get in before the Swiss do!

Yet again silver is sitting right on its lows, so a monster box of 500 Canadian Silver Maple 1oz coins again makes good buying today at $13320 fully insured and delivered to your door.

Scroll down for more details on this and other products.

|

Pingback: Gold & Silver Plunge Again - Gold Prices | Gold Investing Guide