This Week:

- Deutsche Bank: The Fiat Money World May Be Coming to an End

- Golden Catalysts

- Here’s How Inflation Could Surprise Everyone

- Will the New Zealand Dollar Continue to Fall?

Prices and Charts

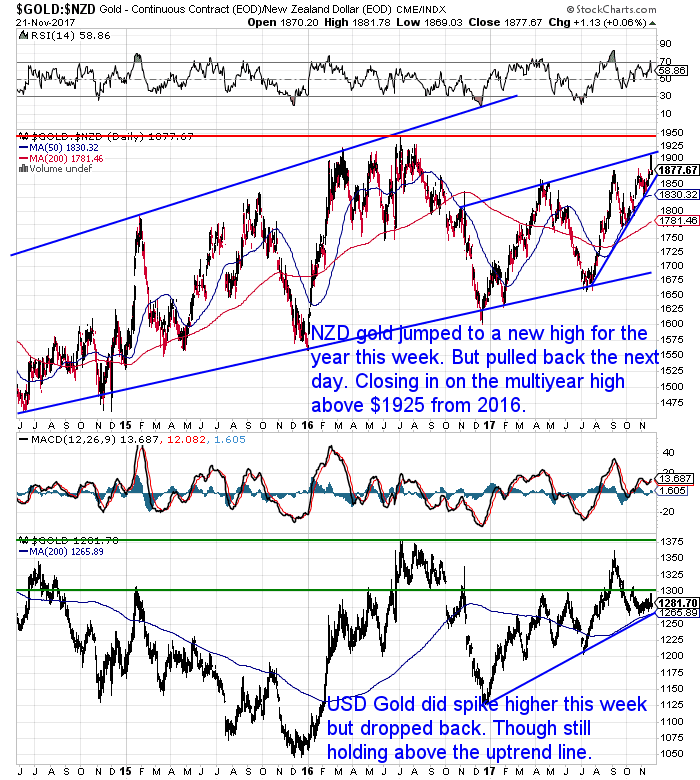

NZD Gold and Silver Breakout

Gold in NZ Dollars reached a new high for the year this week. Shooting above $1900 on Monday before pulling back yesterday. But it has edged higher again today.

Depending on how we draw the resistance line, NZD gold has either broken above it or just touched it. We’ve gone with the latter option today. But either way NZD gold continues its steady rise for 2017. Up over $200 per ounce.

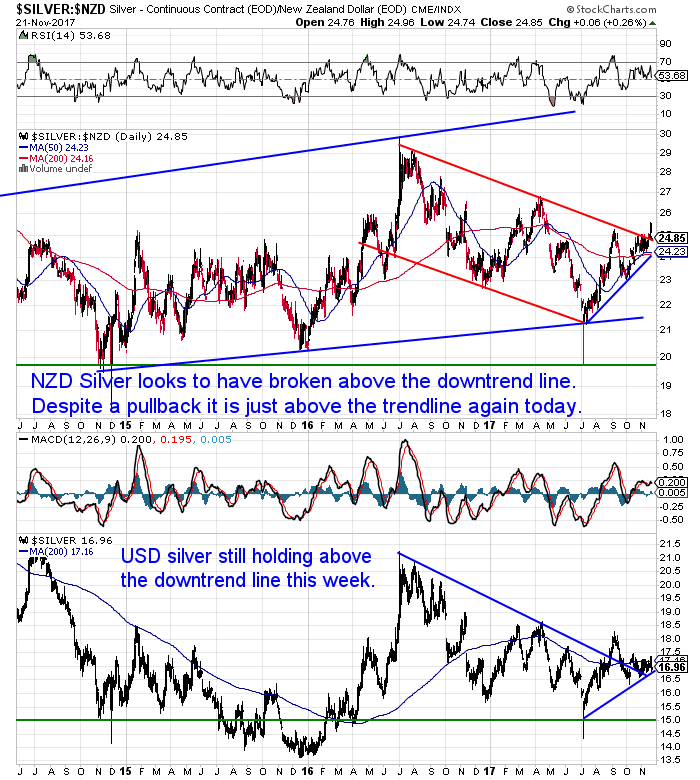

Silver also shot sharply higher on Monday. It has now broken out of the downtrend it has been in since July 2016. While it did pull back sharply yesterday, silver is today still above the downtrend line. It’s now likely that higher prices are ahead. With not a great deal of resistance until the 2016 high above $29.

NZ Dollar at New Low for 2017

The weaker New Zealand dollar has been a big factor in the higher NZD gold and silver prices of late. This week the Kiwi Dollar set a new 17 month low as it dipped below the horizontal support line at 0.6825.

Will the NZ Dollar fall further yet? Check out this weeks feature article where we look at this question in detail.

Unsure About Any Terms We Use When Discussing the Charts?

Remember to check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

3 Theories on Why Inflation May Surprise Us

This week the idea that inflation may surprise is the common theme.

First we have a surprising article from a Deutsche Bank analyst. He is worried that the deflationary factors of the past couple of decades may be coming to an end, and once it does, central banks won’t be able to use their usual tricks. And if that happens, the age of fiat money will be in trouble.

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Do you have all the essentials on hand if you need to leave home in a hurry?

Get Your Own Emergency Survival Kit

Now Available. In Stock. Ready to Ship.

Grab Your Own Grab ‘n’ Go Bag NOW….

—–

Interestingly another Analyst from a different bank had similar thoughts recently. Adrian Ash notes:

“In the 1970s and 80s,” writes currency strategist Steven Barrow at ICBC Standard Bank…also pondering the real meaning of Salvator Mundi today [referring to the record price for a Da Vinci painting]…”the inflation unleashed by rampant liquidity growth was primarily in goods and services prices, not asset prices.

“Globalisation has [now] managed to suppress inflationary pressure in those countries that have conducted QE, and everywhere else for that matter.

“[So] all the inflation these days is in asset prices.”

This could change, Barrow warns. First because asset bubbles always pop in the end. But second, moves to roll back globalization…such as Trump’s protectionist policies, or the UK vote for Brexit…”will eventually cause goods and services inflation to reassert itself in a more significant way.”

Gold, silver and especially platinum have so far sat out this latest round in the world’s multi-decade asset-price bubble.

Precious metals could well offer some kind of salvation amid a financial crash or surge of inflation.”

Then finally the advisory board at Incrementum discussed how inflation could surprise people in depth including:

► Quantitative Tightening is deflationary in theory, but will be inflationary in practice

► The narrative around inflation is about to change, which in turn will

lead to higher inflation

► It’s the market narrative that’s important, not the underlying reality of markets

We summarise the pain points below or you can watch the video highlights if you prefer…

Download Our New Android App

If you’re on an Android phone then be sure to check out our new Gold Survival Guide App (Apple version coming soon too).

Tell Jim Rickards – Gold Has Already Broken Out

We also posted an article from Jim Rickards looking at a number of catalysts for gold.

Golden Catalysts

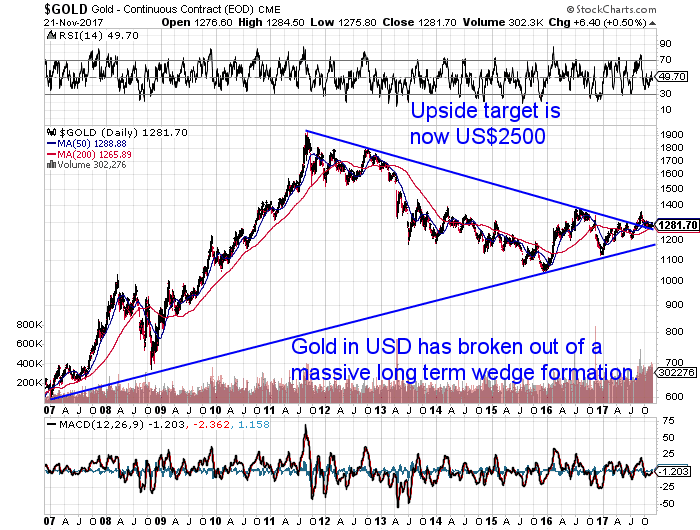

One of the points Rickards makes is that gold is trading in a multi-year wedge formation. A formation he notes it will have to break out of soon.

But to us it looks like Rickards needs to update his chart. As this breakout has already happened in recent months. We just are yet to see much of a move higher in US Dollar gold.

Your Questions Wanted

Finally Remember, if you’ve got specific question, be sure to send it in to be in the running for a 1oz silver coin.

Call David to discuss any of today’s deals on 0800 888 465. Or just reply to this email.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

—–

|