Mike Maloney: The April Emergency The Fed Doesn’t Want You To Know About

We thought this video was worth sharing as it covers a number of points we’ve read in the past few weeks from a number of different sources, but all in one hit.

Full video is at the end, but here’s some of what is covered along with a few thoughts of our own:

Fed Board of Governors Hold Emergency Meeting

“Using “expedited procedures” the Federal Reserve Board of Governors held an impromptu (read emergency) meeting yesterday to discuss monetary policy and interest rates. Afterwards Chairwoman Yellen visited the White House for another irregular meeting with the President. Both of these meetings were closed door and both went largely unreported by the mainstream media. [Or rather the media just reported the fluffy version of events that all is well] Unfortunately we don’t know exactly what was said in those meetings, but we do know it is highly unusual for the Fed to invoke “expedited procedures.””

Maloney postures that the fact the Federal Reserve Board of Governors are looking likely to have 8 meetings this month is highly unusual and may well be indicative that they are fighting some fires that remain hidden to the rest of us.

This latest Fed meeting under “expedited procedures” comes just as lower GDP figures were forecast in the US. The first quarter GDP forecast in the US is down from 0.4% to 0.1% growth in the last quarter.

Global Growth Continues to Fall

Maloney didn’t mention this but we also note that the IMF has just cut its global growth forecast for the fourth time in a year. It is particularly worried about the impact on emerging economies and a sharp fall in capital inflows. They say that “in the current environment of weak growth, risks to the outlook are now more pronounced.” No kidding.

“These include:

• A return of financial turmoil, impairing confidence. For instance, an additional bout of exchange rate depreciations in emerging market economies could further worsen corporate balance sheets, and a sharp decline in capital inflows could force a rapid compression of domestic demand.

• A protracted period of low oil prices could further destabilize the outlook for oil-exporting countries.

• A sharper slowdown in China than currently projected could have strong international spillovers through trade, commodity prices, and confidence, and lead to a more generalized slowdown in the global economy.

• Shocks of a noneconomic origin—related to geopolitical conflicts, political discord, terrorism, refugee flows, or global epidemics—loom over some countries and regions and, if left unchecked, could have significant spillovers on global economic activity.”

So who knows but maybe Janet & Co have been discussing some of the issues or maybe something more significant?

Stock Market: Is The Top In?

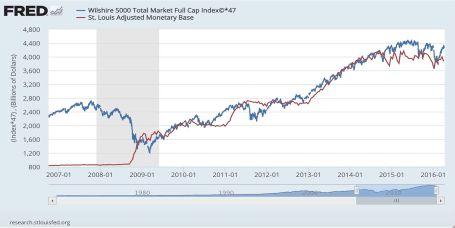

Maloney then outlines how there has been such a tight correlation between the increase in base money supply and global stock markets that it is almost impossible to be a coincidence.

Now that base money is falling (red line in chart below) it appears that global stock markets are also topping out (blue line).

He looks at various measures to value sharemarkets such as the Price/Earnings ratio and how they point to stocks currently being extremely overvalued.

The same chart also indicates how much more unstable interest rates have been since the Federal Reserve came into existence.

But it’s not only Sharemarkets that are overvalued.

The Biggest Crash in History

Maloney then looks at Robert Shillers home price index to show that real estate even after correcting sharply in the USA is now back up again and still very overvalued today.

On top of this there is also a bubble in bonds. This will likely get even worse as the Fed will buy more and more bonds and securities in reaction to a coming stock market crash.

So with so many sectors in bubble territory he believes that’s why we are heading for the biggest crash in history. This fits in with Robert Kiyosaki who’s timeline in his “Rich Dad Prophecy” also predicted the biggest crash around 2016.

Who knows if these two are correct but odds are that things can’t continue like they are forever. It is likely just a matter of time.

Why Does What Happens in US Markets Matter to NZ?

You might be wondering why what happens in the USA matters that much to us down here in New Zealand?

Well, the USA has the global reserve currency so it has the biggest impact on global money supply. Plus what the US Central Bank does, other central banks eventually also follow. So keeping an eye on what is going down in the USA, can give us some advance warning of what may be in store for us here down under eventually.

>> Read more: RBNZ on Central Bank Digital Currency and Negative Interest Rates

Pingback: 5 Reasons to Buy Silver Right Now - Gold Survival Guide - Gold Survival Guide

Pingback: Rich Dad Poor Dad Author Robert Kiyosaki Warns Australia of ‘Biggest Crash in History’: Should You Listen? - Gold Survival Guide