We’ve featured many articles recently on why silver looks nicely set up for a decent move higher in the future. The fact that a certain bank has been steadily adding to the hoard of silver it controls is yet another reason that bodes well for silver in the future. Here are the details. There’s also […]

Category Archives: Syndicated Articles

Here is where we also feature writing from others around the world. We don’t always agree with everything they have to say but we pick interesting commentary from the likes of James Rickards, Darryl Schoon, Stewart Thomson and many others.

Often giving our 2 cents worth on what they have to say too.

Latest Articles

If you’ve studied the history of markets, you know that sentiment can turn on a dime. Whether it is an unexpected wake-up call like the collapse of Lehman Brothers, or simply the popping of a bubble that’s blown too big, the tides can shift in a matter of hours or days. No one knows this […]

It’s a good idea to understand the history of the monetary system over the past 100 years or so. Why? Because what has happened before can give a pretty good indication of what may come to pass in the future. This article explains why another collapse is due for the dollar. It describes the errors […]

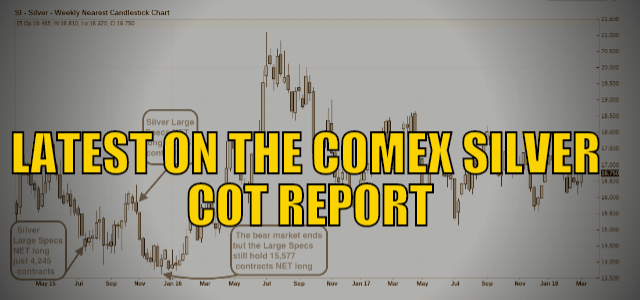

There are a number of solid indicators that often indicate silver is in a bullish set up. These include very high gold to silver ratio, extreme speculative short position levels and extremely low speculative long position levels in the silver futures market. Read more: Gold and Silver Commitment of Traders (COT) Report: A Beginners Guide When […]

Before making any financial decision it’s always a good idea to consider both sides of the story. Silver is no different. Poor man’s gold has pros and cons and there are definitely better times to buy silver. Here’s two contrary arguments with an optimists and a pessimists view on silver currently… Optimist or Pessimist […]

Here’s an interesting discussion on government backed cryptocurrencies. Including a gold backed cryptocurrency and how when cryptocurrencies become easily exchangeable for gold it’s going to help the markets for both cryptos and gold… Doug Casey on the World’s First Government-Backed Cryptocurrency Justin’s note: Venezuela just introduced its own cryptocurrency. That’s right… The country battling chronic […]

Here in New Zealand, real estate is the heavily most favoured investment class. Pretty much to the exclusion of everything else for the vast majority of the country we’d imagine. But there are many other assets to consider owning that serve different purposes. Below Dan Denning (who we’ve heard speak well at the Sydney Gold Symposium a […]

In yesterday’s feature article, The Yield Curve Recession Predictor: Impact on Gold? we outline a timeframe for the next US and global recession to potentially arrive. We explained how the next bull market in gold and silver is also likely in it’s early stages. This article we came across this week also outlines why gold is currently […]

In last weeks newsletter we explained “What is COT’s?” Here is the latest on the positioning of silver futures traders and what it might mean for the silver price. As the author states “the CoT is often a lagging indicator of future trend”. So the numbers detailed below may not mean a jump in silver […]

See why Hugo Salinas Price believes the looming trade tariffs planned by Trump will likely encourage the return of gold to central bank reserves worldwide… Bad ‘Karma’ Brings Bad Consequences for Those Who Practice It By Hugo Salinas Price – First published at plata.com.mx/ There is a lot of commentary going around the world, regarding […]