Earlier this week, we shared a post looking at the very unusual set up in the silver futures market. That is, where the large silver speculators have their first net short position in memory. Meaning they are betting the price of silver will go lower. Now this post shows that the “commercials” (who are the […]

Category Archives: Syndicated Articles

Here is where we also feature writing from others around the world. We don’t always agree with everything they have to say but we pick interesting commentary from the likes of James Rickards, Darryl Schoon, Stewart Thomson and many others.

Often giving our 2 cents worth on what they have to say too.

Latest Articles

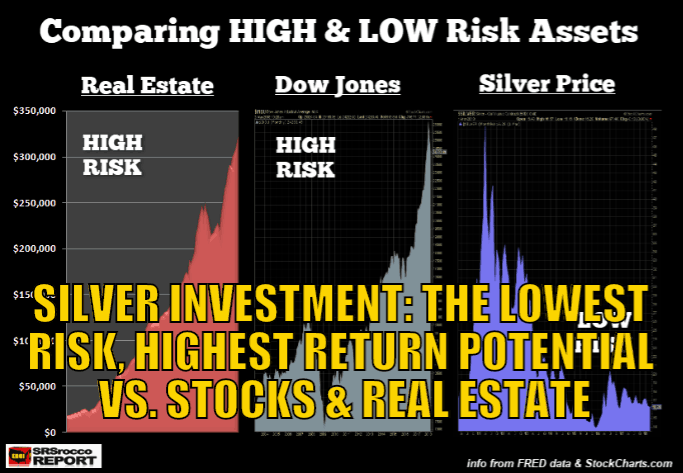

Sorry we can’t stop publishing posts outlining why silver is likely such a good buy currently. In recent weeks we’ve had, Silver: Black Swans, 2018 and Beyond and Why Silver May Not Be “Off the Radar” For Much Longer. We have another post this week from technical analyst Clive Maund. He takes a close look […]

Here’s an excellent summary of what could be in store for silver in 2018 and into the following few years. Including a look back at past silver cycles and what that might mean for the next cycle. What some objections to this outcome might be. Plus what some possible “black swan” events could do to […]

We’ve been “banging the drum” on silver lately. Pointing out in our weekly newsletter for the last couple of weeks here and here, that silver is currently very cheap compared to gold. But that may not last too much longer if the technical analysis in this post proves to be correct. While silver may have had no […]

With the emergence of cryptocurrencies in recent years, it is interesting to ponder, what might money look like in the future. Nathan Lewis, author of the book, Gold: the Once and Future Money, gives a simple account of what really creates stable money. No surprise, his view is that it it isn’t central bank policies […]

Doug Casey makes some fairly bold claims in this interview such as how by the end of 2018 “gold will hit $2,000” in this new bull market for gold. We too believe gold could make some good gains this year, even if US$2000 seems a long way off yet. One thing we do agree on […]

We sometimes find Bill Holter’s work at JSmineset.com a bit over the top. However this article gives a good summary of the implications of changes in interbank lending, rising interest rates, inflation and velocity of money. It also ties in nicely with an article we published earlier on the same topics: Gold: The Ultimate Iron Lady […]

In late 2017 we reported: Here’s How Inflation Could Surprise Everyone. Just lately we are starting to see a few more warnings of a possible rise in inflation. Zerohedge recently published a great post on how the velocity of money may be bottoming out. Monetary velocity is a key factor in rising inflation levels. Stewart Thomson […]

Here’s a few reasons from our favourite newsletter writer Chris Weber as to why silver is lagging gold: “First is that gold has a strong monetary reserve place in the vaults of the central banks the way silver does not have. Further, wealthy people, whose distance from normal people is far larger today than it […]

At the end of January we reported the following: “Russian gold reserves hit historic high, stockpiling record 223 tons last year. Meanwhile the “Central Bank of Russia (CBR) added 300,000 ounces (9.3 tons) of gold to its reserves in December, bringing the total yearly holdings to a record 1,838.211 tons, worth over $76 billion in […]