As we referenced in last weeks article on gold backwardation and negative Gold Forward Offered Rates, there has been plenty of talk around the interwebs of “high demand for physical gold and that this is backed up by falling COMEX inventories”. There have been arguments made that these falling inventories are signalling a soon to […]

Category Archives: Gold and Silver Market

Here we cover the basics of the gold and silver markets. But also the not so basic as well. Such as physical versus paper markets, and how war affects the gold and silver price.

Plus our yearly reviews and prognostications for the precious metals markets.

If you like what you read here, then stay informed by joining our weekly gold and silver updates and you’ll also get a free download “19 Nuggets of Knowledge”.

Must read articles about the Gold and Silver Market

What Does Gold Spot Price (Or Silver Spot Price) Mean?

Learn about spot prices, gold and silver futures, retail prices and how they are all set.

How Might War With North Korea Affect the Gold and Silver Price?

Does war cause gold and silver to rise? See what has happen during previous wars and what a war with the likes of North Korea could mean for gold and silver.

Why Does Gold Demand Remain Strong in the East?

Historically gold has been popular in the eastern hemisphere. See why the likes of China and Russia have been buying and what this might mean for us in the future.

Gold Purity and Silver Purity – A Complete Guide

When buying precious metals, it is important to have an understanding of the gold purity or silver purity of the bars or coins. Why? Because a small difference in gold or silver purity can have an impact upon the overall value of the gold or silver contained in a coin or bar. And therefore the price you pay.

What is a Troy Ounce? Troy Ounce vs Standard Ounce

Here’s everything you need to know about the unit of measure for gold and silver – the troy ounce.

Latest Articles

You may have heard the term backwardation discussed in the gold market recently. We’ve posted a number of articles on this topic in the past few years ourselves with the likes of: Antal Fekete: Gold Backwardation and the Collapse of the Tacoma BridgeProf Fekete Interviewed by Max Keiser on Gold BackwardationGold Backwardation Now Permanent This […]

Well it has been a week or so of action to say the least. The plummeting prices have bought plenty of people out of the woodwork the world over it seems and New Zealand has been no exception. We’ve had the busiest week ever in terms of the actual number of people placing orders so […]

Well another year bites the dust and as we have done for the past couple, it’s time to review the performance of Gold and Silver in New Zealand Dollars for 2012. By now you’ve no doubt read that gold (when priced in US dollars) extended its run of positive year end results to 12 years […]

Headline news on Monday was the approval by the Department of Conservation of an extension of Oceana Gold’s Reefton mine by “34 rugby fields” as we heard one news story put it so kiwiana-ishly. Our (likely controversial) take is that the Greens should actually be embracing gold. Why? Because gold would likely have a dramatic […]

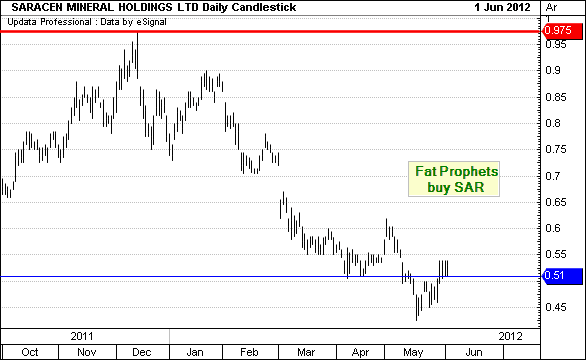

With gold mining shares having bounced up significantly in the last week or so, this latest free gold mining stock report from Fat Prophets we have for you this week could be timely. This features an Australian listed junior gold mining stock Saracen Mineral Holdings. If you’re looking at gold mining shares in Australia, then […]

Following on from the first free Aussie gold mining stock pick we featured a couple of weeks ago we have another free report this week from Fat Prophets. Founded by New Zealand born Angus Geddes in 2000, Fat Prophets is an Australian based stock market research house providing insightful reports, recommendations, and investment / wealth management services. They […]

In our subscriber survey a couple months ago a number of readers mentioned how some information on NZ and Australian gold mining shares/stocks would be useful. So in response we’ve managed to negotiate some exclusive free reports from Fat Prophets. Founded by New Zealand born Angus Geddes in 2000, Fat Prophets is an Australian based stock […]

With another year past it’s time to reflect on the performance of gold and silver in New Zealand dollar terms. You may have read recently about how gold has again ended the year higher than it began. No big deal except for the fact it is the 11th year in a row that gold has […]

Much of the talk, both mainstream and “underground” on the internet is currently centred on what the next “black swan” will be. Will it be a Greece default? More middle eastern riots and government overthrows? A break up of the Euro-zone, or the (comical) US debt ceiling not being raised, that causes gold to lurch […]